Modinomics are the set of economic policies announced and led by the Prime Minister Narendra Modi since 2014 till now.

- The main principle: Modinomics aims to encourage investment to “Make in India”. To transform India into a global hub of manufacturing, innovation and creating a market based economy for development.

The Status of Private Investment in India

As per the latest data from investment tracking firm Projects Today,

- Fresh Private sector investment plans: It fell by 15.3% in 2023-24

- Manufacturing sector: The proposed outlays dropped an alarming 40% from ₹19.85 lakh crore in 2022-23 to under ₹11.9 lakh crore in 2023-24

- Foreign investment: The proposed outlays fell 31.7% or ₹1.5 lakh crore to a little more than ₹3.23 lakh crore in 2023-24.

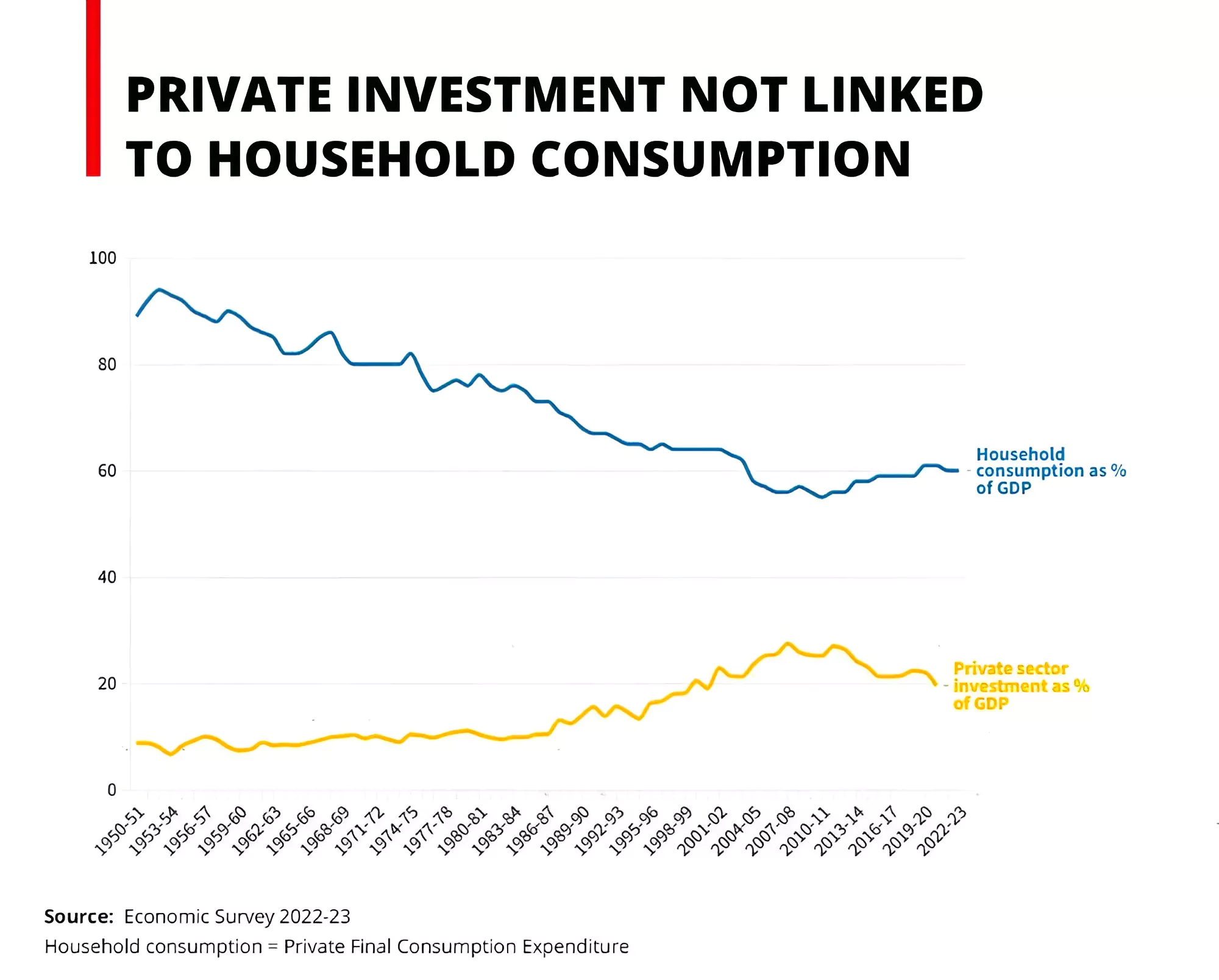

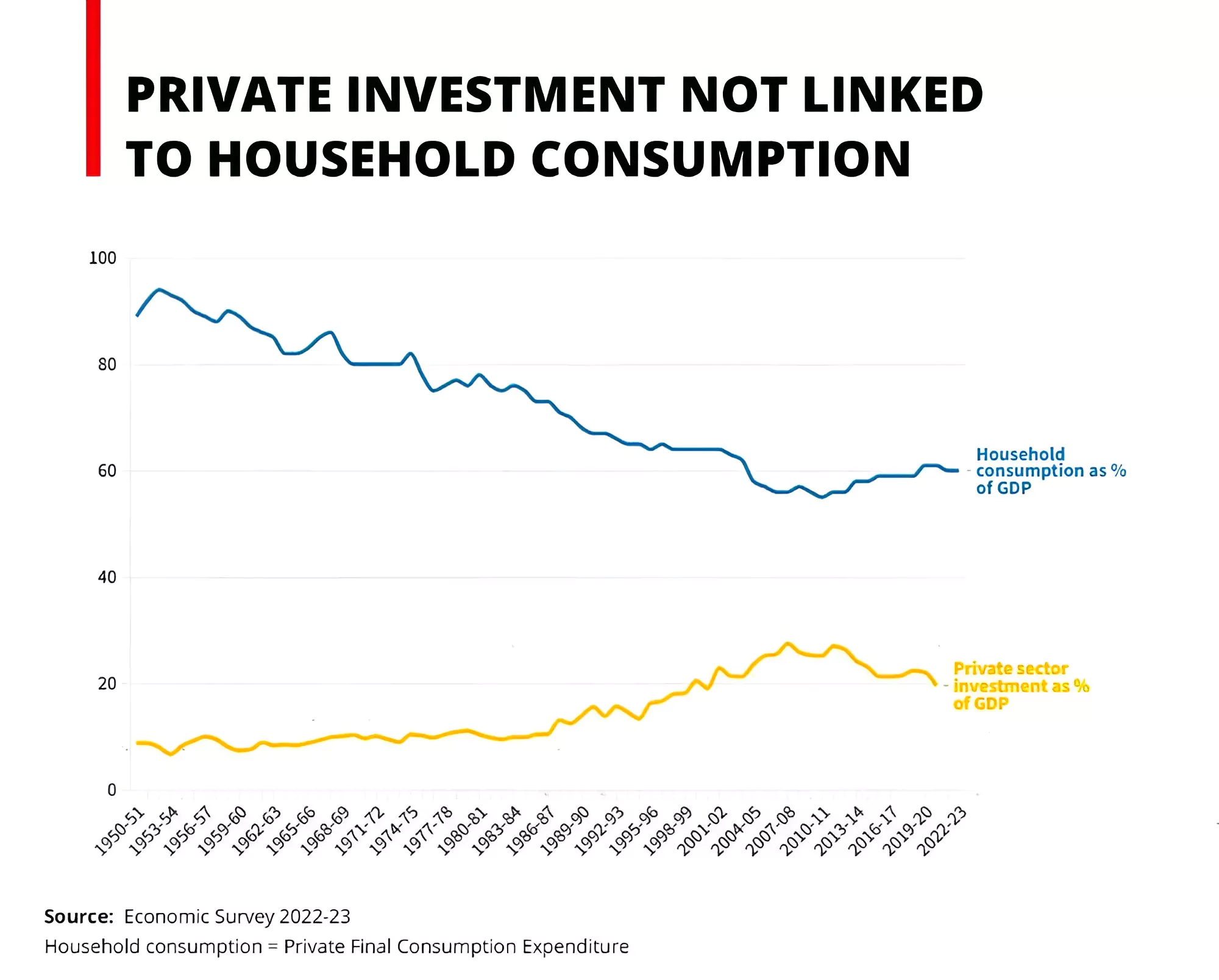

- Economic Survey 2022-2023: Private sector investment in India has been falling as a proportion of Gross Domestic Product (GDP) since 2012

- FY 2020-21: Private sector investment as a percentage of GDP had fallen to 19.6 per cent.

Enroll now for UPSC Online Classes

The Private sector Investment

- It is the Investment made in the economy by all for-profit businesses not owned or operated by the government.

- Determinants: There are 5 determinants of of private sector investment ie.

- Consumer Demand: Private Final Consumption Expenditure (PFCE), which is the amount households spend on consumption, as a percentage of GDP fell 61 per cent by 2019 from 89 per cent in 1950-51.

- Access to credit: Since 2016, while bank credit to the private sector has increased, albeit at a marginal rate, private sector investment has dipped.

- Corporate profitability: Listed corporate profits (measured by profit after taxes, PAT) have been stable at 4.0-4.5 per cent of GDP during the past nine quarters and almost doubled from the pre-Covid period (FY18-FY20) average of 2.1 per cent of GDP.

- But it is only an anemic view of the economy as the profitability of about 45 per cent of the economy ie. informal sector businesses is not being measured.

- Capacity utilisation: It is basically a measure of the extent to which the installed capacity in a company or economy is being utilised to produce the output. The higher the capacity utilisation, the more likely are fresh investments being made

- It is an indication of not just current demand, but also a company’s confidence in future demand.

- Overall business confidence: Reforms, certainty and stability in the tax and labour laws of the country driving investor confidence.

Government Measures to encourage private investment

- Ensuring Macroeconomics stability: To restore macroeconomic stability by introducing an inflation targeting regime and fiscal deficit targeting regime.

- The IBC framework: The government tried to reduce risks for banks by providing them with legal recourse via the IBC in case the loans went wrong.Also providing investors with easy exit option.

- Increased investment in Capital Expenditure: and boosting infrastructure linkages in the form of investment in transportation; electricity; irrigation; food processing etc

- Reduction of the corporate tax rate: In September 2019, the government announced a cut in base corporate tax for then existing companies to 22 per cent from 30 per cent; and for new manufacturing firms, to 15 per cent from 25 per cent.

- Production subsidies and Incentives schemes: Generous production subsidies have been made available through schemes like Production linked Incentive scheme or the RoDTEP scheme etc.

- Atmanirbhar Bharat: Tariffs have been imposed to provide protection to domestic producers, with schemes such as Make in India; stand up India; encouraging domestic production.

- Ease of Doing Business: India ranks 63rd in the World Bank’s Doing Business Report (DBR), 2020

Reason for stagnant private investment

- Overlooking The Risk component of Investment: Most of the measures are catering to a common goal ie. Increasing the returns to investment by reducing costs, increase revenues, and others to enhance after-tax profits while ignoring the risk mitigation component.

- Reversibility and Scalability of Investments: Investments in Manufacturing sectors are large, indivisible, and difficult to reverse ie. involving a greater risk factor with it which calls for a careful consideration of the risks of any investment before approving any significant project.

- Uncertain and unstable laws: Frequent changes in laws and rules related to tax (example: GST) and labour laws leads to uncertainty bringing down investment risk appetite.

Check Out UPSC NCERT Textbooks From PW Store

Investment Risk

Risks emanate from three types of state action that favor competitors, are directly coercive, or jeopardize the supply chain from an investor’s perspective,

- National champions risk: The abrupt changes in the policy framework to favor certain national champions in a case of stigmatized capitalism has deterred other domestic firms from investing out of fear that their irreversible investment has to account for the risk of discretionary policy changes.

- Example: It has materialized in online and physical retail, airports, cement, ports, telecoms, and media.

- Direct and coercive state action: Risk perception of investors deteriorates sharply when there is a climate of Tax Terrorism with selective raids by ED or tax authorities, arbitrary verdicts by regulatory agencies, or pure extortionary actions (electoral bonds saga) resulting in destroying lakhs of crores of investment.

- Example: Invoking bilateral investment treaties to challenge the government’s retrospective imposition of taxes by Cairn/Vedanta and Vodafone.

- Supply chain risk: Discretionary and abrupt changes in the tariff structure of raw materials and components or worse product bans imposed by the government decreases the risk perception among investors about access to low-cost supplies.

- For Make in India to succeed, manufacturing firms need to be assured about the access to raw materials and inputs from anywhere in the world.

- Example: Vietnam has sought to mitigate supply chain risks by signing FTAs with all the major trading powers, thereby assuring investors that they can count on having access to supplies, both now and in the future.

![]() 3 Jul 2024

3 Jul 2024