As India is aiming toward Internationalizing the Indian Rupee, The Chinese Yuan has emerged as a significant challenger to India’s ambition.

About Internationalisation of Rupee

- Internationalisation of a currency is a process that involves the use of a currency for more and more cross-border transactions.

- For the rupee, it means that more and more international payments start taking place in the Indian currency.

- Meaning: Internationalisation of the Indian rupee does not mean the use of Indian currency to make payments and buy things in a foreign country rather it means to use the currency mainly to conduct international trade and cross-border payments like The USA Dollar is used for transaction not only with USA but other countries also.

- Reserve Currencies: Presently, the US dollar, the Euro, the Japanese yen and the pound sterling are the leading reserve currencies in the world.

Enroll now for UPSC Online Course

Requirements for Internationalisation of Rupee

- Use for Trade Invoicing: As per the Economic Survey 2023, Rupees increasing use for trade invoicing is a prerequisite for it to be considered as an international currency.

- The Rupee’s turnover has to rise or equal the share of non-US, non-Euro currencies in global forex turnover ie. 4 percent, for it to be regarded as an international currency.

- The US dollar accounts for 88 percent of global forex turnover, and is the dominant vehicle currency, while the Rupee accounts for just 1.6 per cent as per The BIS Triennial Central Bank Survey 2022.

- Opening up: An opening up of the currency settlement and a strong currency swap and forex market involving promoting the rupee for current account transactions and foreign trade between resident and non-resident Indians.

- Full Convertibility of Currency: To make the rupee more international, it will also have to open it for capital accounts too fully and have a restriction-free cross-border transfer of funds

- The rupee is fully convertible in the current account, but partially in the capital account.

Benefits of Internationalisation of Rupee

- Protect against currency volatility: Increasing use of Rupee in international trade transactions will reduce the currency risk of Indian businesses by protecting them against currency volatility.

- Strengthen the Indian Rupee: As more and more transactions are happening with Indian Rupees, The demand of Rupees will increase, appreciating its value and help to lower currency conversion costs.

- Maintaining Forex Reserve: It will reduce India’s need to hold huge foreign currency reserves which is at a record high of $642.63 billion as of March 2024 making India more insulated from external shocks.

- Bargaining voice: More is the usage of Rupee in international transactions more will be India’s bargaining power in international markets

Check Out UPSC CSE Books From PW Store

Progress in Internationalisation of Rupee

- Allow trade settlement for all Asian Currency Union (ACU) countries: The facilitation of rupee settlement for all Asian Currency Union (ACU) countries with regard to all transactions in compliance with RBI directions.

- Previously the regulations permitted receipt or payment in rupees for all cross border transactions (current and capital) for all non-ACU countries whereas such receipts or payments were not allowed for some ACU countries such as Bangladesh, Myanmar, Pakistan and Maldives.

- Rupee Vostro Accounts: The RBI has allowed 20 banks, operating in India, to open 92 Special Rupee Vostro Accounts (SRVAs) with partner banks from 22 countries to promote bilateral trade in a local currency in effect to make the rupee more acceptable in global trade

- Bilateral Trade settlement in Local Currency:

- UAE: India made its first-ever Rupee payment to the United Arab Emirates to buy crude oil which was historically Dollar based.

- India pays for its imports of gold from the UAE in rupees and the UAE, in turn, is using rupees to pay for gems and jewellery from India

- The Reserve Bank of India (RBI) has allowed banks from 18 countries to settle payments in the rupee including names like Sri Lanka, Israel, Russia, Germany, Singapore and the United Kingdom.

- Apart from this, 64 other countries have expressed their intent to trade with India in rupee.

Challenges in Internationalisation of Rupee

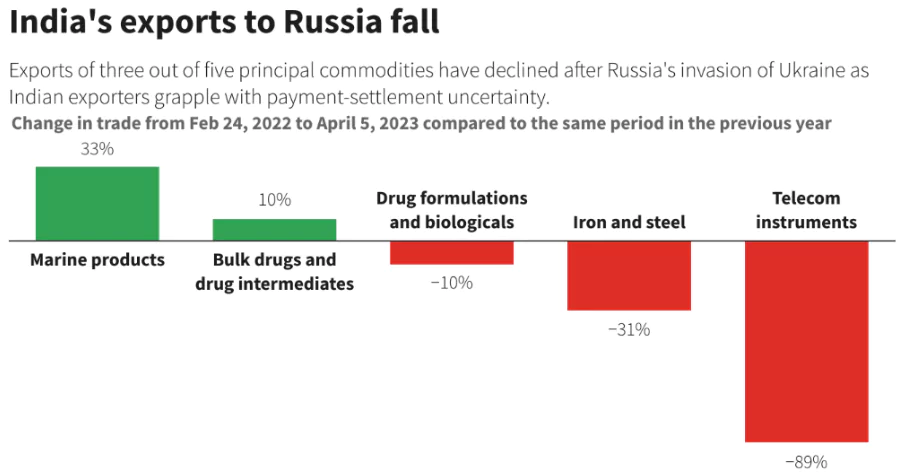

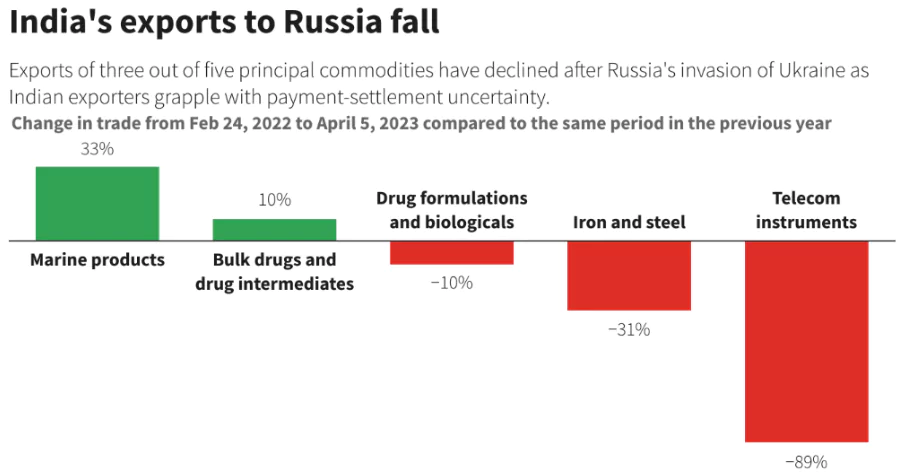

- Payment Settlement Uncertainty with Russia: With a high trade gap in favor of Russia ( $57 billion trade deficit in the $66 billion bilateral trade in FY2024) because of Indian imports of cheap crude rising to $51.3 billion from $10.6 bln previous year (12 times).

- Reason:

- Fear of Rupee Accumulation: For Moscow Rupee accumulation in the form of agreeing to the Rupee Settlement Mechanism is not desirable as it may end up with an annual rupee surplus of over $40 billion without a plan for India to leverage the Russian Market.

- Sanction Scare: Indian private banks are reluctant to facilitate trade with Russia due to fears of Western sanctions as they do have significant branch strength in the west.

- NO SOPs: Indian exporters are also facing difficulties using the rupee settlement mechanism while trading with Russia as they were unable to use it due to the absence of a Standard Operating Procedure (SOP) for banks.

- Currency Volatility: Moreover, the ruble and rupee, unlike the yuan, have experienced considerable volatility, complicating trade in domestic currency.

- Minute share in Global Trade: India’s share of global exports of goods is just about 2% and also the rupee is not fully convertible which reduces the appetite and necessity for other countries to hold rupees.

- The Yuan Challenge: The RBI’s working group has said that the most obvious challenger to the US dollar is the Chinese renminbi with China on its way to match the USA on the parameters of (size of the economy, the reach of its financial networks and the depth and liquidity of its financial markets)

- Example: As the trade graph between Russia and China is more balanced resulting 95 per cent of the trade occurring in domestic currency ie. the Chinese Yuan making yuan the most sought-after currency in the Russian stock market.

- Russian oil exports are therefore requesting payments from Indian refineries in Chinese currency, or some third party mechanism such as UAE dirham while the use of the rupee has remained largely restricted.

Enroll now for UPSC Online Classes

Measures in Pipeline to Boost Internationalization Efforts

- To Liberalize the Regulations relating to INR accounts for Non-Residents: The Foreign Exchange Management (Deposit) Regulations concerning rupee accounts for non-residents are being reviewed in consultation to let,

- Persons Resident Outside India (PROIs) to open rupee accounts outside the country,

- Facilitate Rupee lending by Indian banks to PROIs

- Enable foreign direct investment and foreign portfolio investment through special non-resident rupee and special rupee vostro accounts.

- Extension of the domestic Structured Financial Messaging System (SFMS): India will extend its SFMS through a global SFMS hub to other countries for cross-border payment messaging in local currencies.

- It will help India in reducing dependence on other major trading currencies and may help in foreign exchange management.

- GIFT city push: RBI said that it would encourage the trading of FCY (foreign currency)-INR pairs for different international currencies.

- Other Measures Include : A review of the IFSC (International Financial Services Centre) regulations under the Foreign Exchange Management Act (FEMA), a review of compounding proceedings rules under the FEMA, ratio rationalization of the Liberalised Remittance Scheme and rationalization of inward remittance schemes

- Inward remittance schemes include the Money Transfer Service Scheme and the Rupee Drawing Arrangement.

|

![]() 15 Jul 2024

15 Jul 2024