Recently, the Supreme Court said it would consider a submission to set up a Constitution bench to hear pleas challenging the validity of the passage of laws passed as ‘money bills’ allegedly to bypass the Upper House of the Parliament.

| Relevancy for Prelims: Article 110, Consolidated Fund of India, Article 109, Aadhaar Act, 2016, etc.

Relevancy for Mains: Classification of bills as Money Bills, Constitutional provisions regarding Money Bills, etc. |

What is a Money Bill?

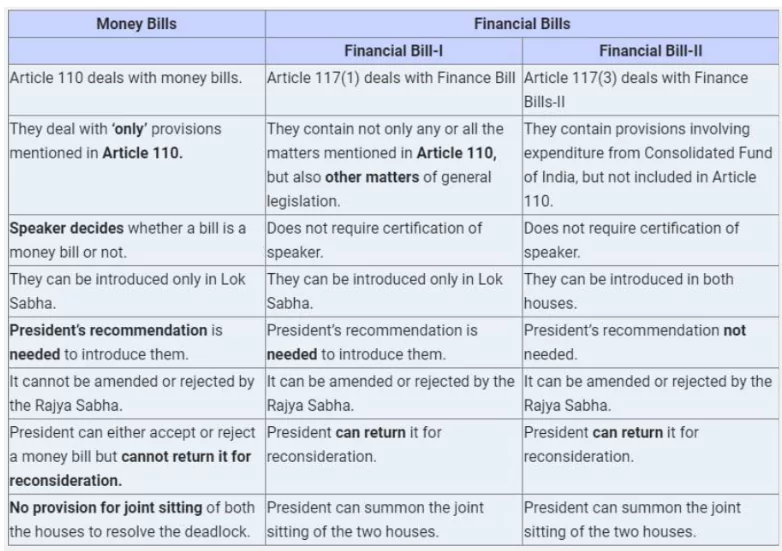

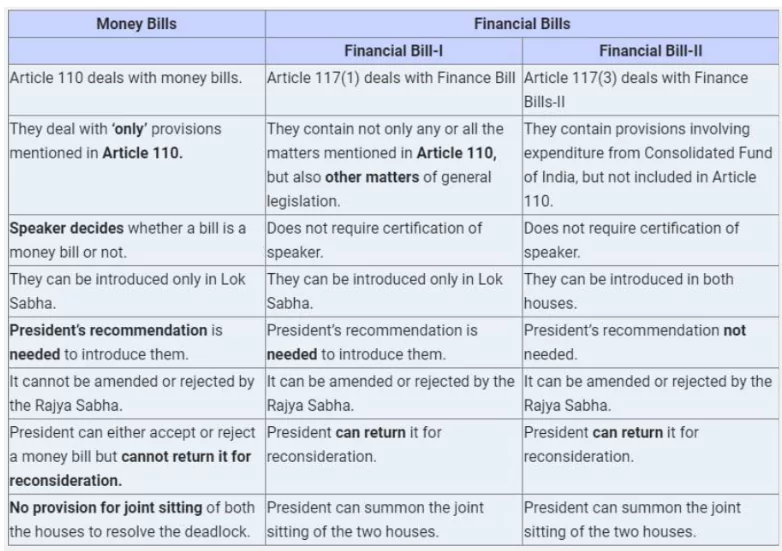

- According to Article 110 of the Constitution, a Bill can be designated as a money Bill if it exclusively deals with certain subjects. Article 110 of the Constitution deals with the definition of money bills.

- It states that a bills deemed to be a money bill if it contains ‘only’ provisions dealing with all or any of the following matters:

- The imposition, abolition, remission, alteration or regulation of any tax.

- The Regulation Of The Borrowing Of Money by the Union government

- The custody of the Consolidated Fund of India or the contingency fund of India, the payment of money into or the withdrawal of money from any such fund

- The appropriation of money out of the Consolidated Fund of India

- Declaration of any expenditure charged on the Consolidated Fund of India or increasing the amount of any such expenditure

- The receipt of money on account of the Consolidated Fund of India or the public account of India or the custody or issue of such money, or the audit of the accounts of the Union or of a state

- Any matter incidental to any of the matters specified above.

Enroll now for UPSC Online Course

Issue With Respect to Money Bill

- Ambiguity in Scope and Definition:

-

- Ambiguity in Article 110: The definition of what constitutes a Money Bill under Article 110 of the Constitution is somewhat ambiguous, leading to differing interpretations and potential misuse.

- Broad Classification: Bills that include non-financial provisions are sometimes classified as Money Bills, which can lead to disputes over their validity.

- Bypassing the Rajya Sabha: Under Article 109, however, a Bill introduced as a money Bill only requires assent from the Lok Sabha and the Rajya Sabha merely has 14 days to consider the Bill and return it with recommendations. The Lok Sabha may either accept or reject these recommendations and enact the money Bill into law.

-

- Potential for Misuse: Governments may classify controversial bills as Money Bills to raising concerns about transparency and democratic process.

- Limited Scope for Review: The Speaker’s decision to classify a bill as a Money Bill is considered final and cannot be questioned in court, limiting judicial review and accountability.

- Lack of Debate and Scrutiny: Classifying complex and multifaceted bills as Money Bills can limit parliamentary debate and scrutiny, reducing transparency and accountability.

- Public Trust: The perceived misuse of Money Bill provisions can lead to a loss of public trust in the legislative process and the integrity of the parliamentary system.

Cases Challenged Concerning the Passage Of Bills As Money Bills

- Aadhaar Act, 2016:

- Legality of Aadhar Act as a Money Bill. The Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016, was passed as a Money Bill.

- Challenged in SC: This classification was challenged in the Supreme Court, arguing that the Act contained provisions beyond the scope of a Money Bill as defined in Article 110 of the Indian Constitution.

- Judgment: The Supreme Court upheld the constitutionality of the Aadhaar Act, 2016, by a 4:1 majority stating that no illegality was committed by passing the Aadhaar Bill as a Money Bill in the Parliament.

- Government argued that legislation aimed at extending benefits in the nature of aid, grant, or subsidy to the marginalised sections of society with the support of the Consolidated Fund of India.

- Hence, the Act fell within the ambit of Article 110 and was validly passed as a Money Bill.

- Prevention of Money Laundering Act (PMLA) Amendments:

- The Finance Acts passed in 2015, 2016, 2018 and 2019, brought in crucial amendments to the PMLA.

- Finance Bills passed during the budget are introduced as money bills under Article 110 of the Constitution.

- These amendments granted the Enforcement Directorate extensive powers, including the authority to make arrests and conduct raids.

- The Court upheld the PMLA and the vast powers of the ED.

- However, the bench had left the validity of amendments to the PMLA through the Money Bill route open for a larger Constitution bench to hear.

- Tribunal Reform:

- In Roger Matthew Vs Union of India, the Supreme Court heard the challenge against tweaks in the service conditions of tribunal members which was also introduced as a money bill in the Finance Act, 2017.

- The government argued that since salaries of members of Tribunals flow from the Consolidated Fund of India, the amendments were introduced as a Money Bill.

- A five-judge bench of the Supreme Court struck down the Appellate Tribunal Rules of 2017 as unconstitutional.

- The Supreme Court pointed out that the Money Bill issue in the Puttaswamy judgement was ‘not convincingly reasoned’ and could lead to a potential conflict in interpretation.

- The Bench asked for the question to be put before a larger bench of the Supreme Court since it was similar in strength to the Puttaswamy Bench.

Check Out UPSC Modules From PW Store

Conclusion

The Supreme Court should clarify the constituents of the money bill for the legislative efficiency and proper functioning of the democracy.

![]() 18 Jul 2024

18 Jul 2024