The Income-Tax Bill, 2025, introduces a new ‘Tax Year’ concept, replacing the existing Assessment Year, aiming to simplify tax reporting.

About Income-Tax Bill, 2025

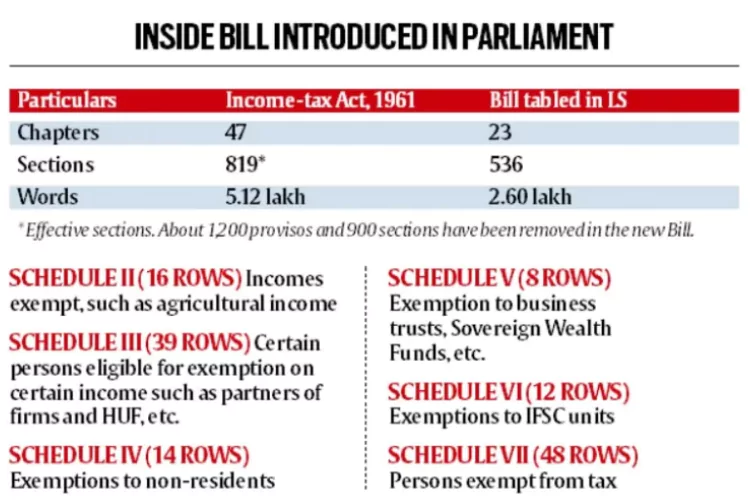

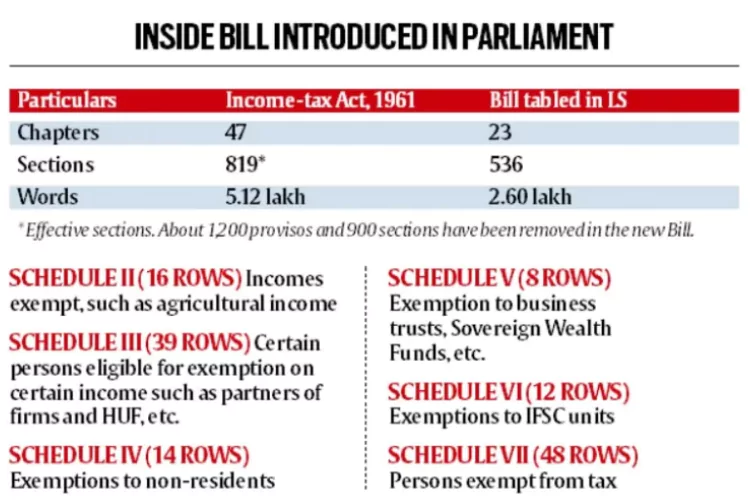

- Simplification: Streamline the 1961 Income-tax Act by removing obsolete provisions, redundant clauses, and complex legal jargon.

- Modernization: Reflect evolving economic realities (e.g., digital assets, new income sources).

Key Features of the Bill

- Tax Year: A 12-month period starting from April 1, during which income will be assessed and taxed in the same financial year.

- No change in the Financial Year (FY): It will continue to start on April 1 and end on March 31.

- Calendar Year Not Adopted: The new bill does not align with the calendar year for taxation purposes.

Existing System (Income-tax Act, 1961)

- Two concepts: Financial Year (FY) and Assessment Year (AY)

- Assessment Year (AY): The year following the financial year in which income is earned.

- Example: For FY 2024-25, the AY is 2025-26.

- Issue: Many taxpayers confuse FY and AY, leading to incorrect tax filings, delays in refunds, and procedural hassles.

|

- Inclusion of Virtual Digital Assets (VDAs) as Capital Assets:

- Cryptocurrencies, NFTs, and other digital assets are now formally recognized as capital assets.

- Taxation: Treated similarly to traditional assets like land, buildings, shares, securities, bullion, jewelry, and artwork.

- Implications: Ensures clarity on taxation of digital assets, aligning with global trends and addressing the growing digital economy.

- Expanded Definition of “Virtual Digital Space”: Taxpayers under investigation must provide access to their digital records, including email servers, social media accounts, online investments, trading and banking accounts, cloud servers, and digital platforms.

- Current Practice: Tax authorities already demand access to laptops, hard drives, and emails during surveys, searches, and seizures.

- Capital Gain Exemptions: Section 54E of the Act, which details exemptions for capital gains on transfer of capital assets prior to April 1992 has been removed in the Bill.

- Deductions have been streamlined, and outdated exemptions removed.

- Dispute Resolution:

- Dispute Resolution Panel (DRP): Clearer guidelines for issuing decisions, reducing ambiguity and potential litigation.

- Income and Tax Rates:

- Expands the definition of income to encompass emerging sources.

- Provides detailed tables for exempt income, conditions for claiming exemptions, deductions, TDS, and TCS in separate schedules for enhanced clarity.

- New Tax Regime: Slabs provided in tables; old regime rates omitted, signaling a shift toward promoting the new regime.

- Continuity: No major changes in tax structure, penalties, or compliance rules.

Key Implications

- Reduced Litigation: Simplified language and consolidated provisions may minimize interpretational disputes.

- Ease of Compliance: Tables and streamlined sections enhance taxpayer understanding.

- Digital Economy Integration: Recognition of VDAs and digital income sources aligns tax laws with modern economic trends.

- Stability: Maintains existing tax structure to avoid disruption while modernizing procedural aspects.

Criticisms/Challenges

- Lack of Penalty Reforms: No major updates to penalty or compliance mechanisms, potentially missing an opportunity to improve enforcement.

- Old Tax Regime Ambiguity: Exclusion of old regime slabs from the Bill raises questions about its future.

- Privacy & Surveillance: Possible infringement on individuals’ digital privacy.

- Need for Safeguards: Clear guidelines required to protect taxpayer rights from excessive scrutiny.

- Administrative Efficiency: Aims to streamline tax collection and reduce legal disputes.

Legislative Process

- Parliamentary Review: Bill referred to a Parliamentary Committee; amendments likely before implementation.

- Effective Date: Likely April 1, 2026, post-presidential assent.

Historical Context

- Past Reforms:

- Direct Taxes Code (DTC), 2010: Lapsed with the 15th Lok Sabha.

- 2018 Task Force: Drafted a new law but not implemented.

- Philosophical Shift: Aligns with “Nyaya” (justice) ethos, similar to recent criminal code reforms.

![]() 14 Feb 2025

14 Feb 2025