![]() 1 Dec 2023

1 Dec 2023

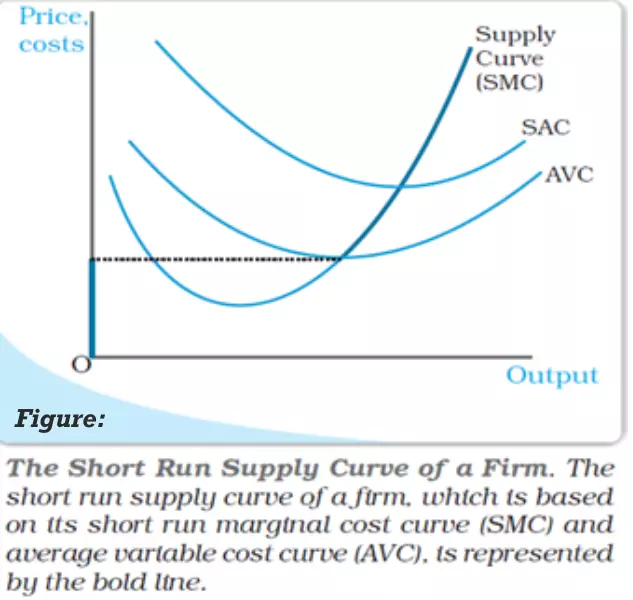

A firm supply refers to the quantity it opts to sell at a specified price, given the technology and the prices of production factors.

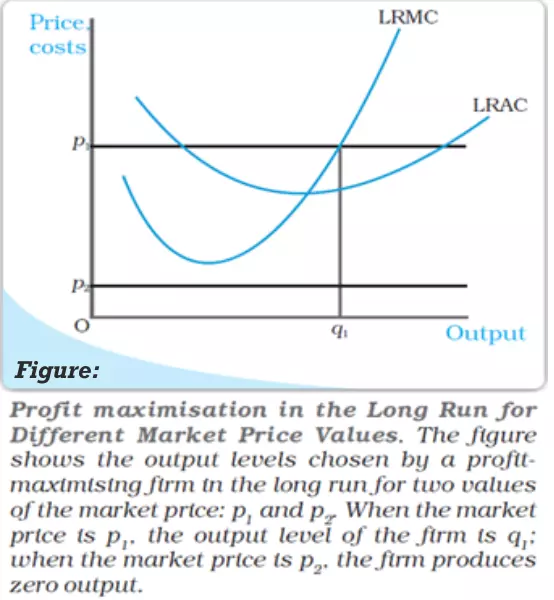

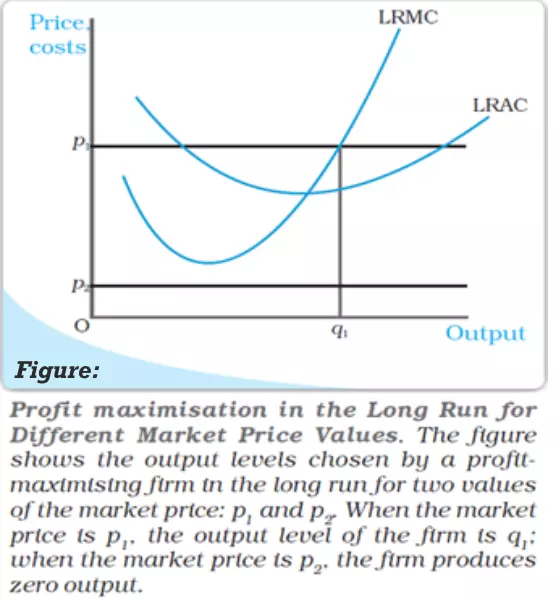

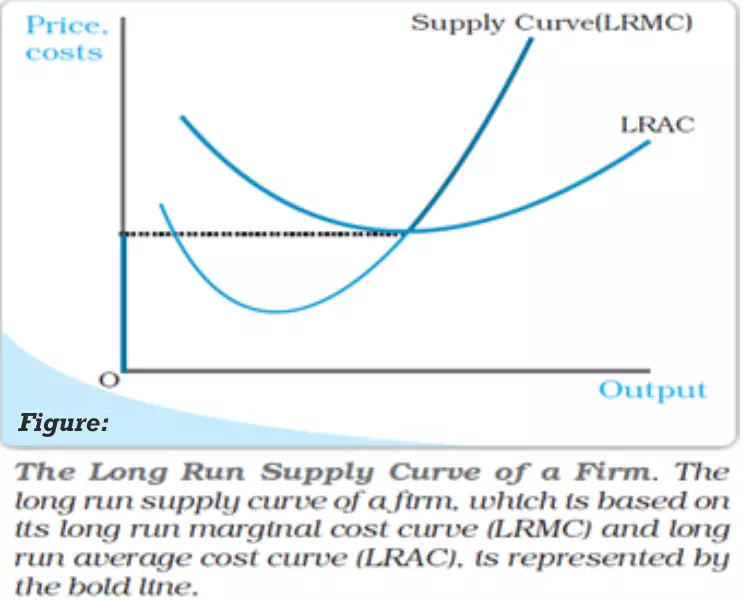

The derivation of a firm’s long-run supply curve is illustrated in Figure and is dissected into two scenarios based on the relationship between the market price and the minimum Long Run Average Cost (LRAC).

In this scenario, the market price, denoted as p1, is greater than or equal to the minimum LRAC.

In this scenario, the market price, denoted as p2, is less than the minimum Long Run Average Cost (LRAC).

Integrating the insights from both cases leads to a significant conclusion regarding the firm’s long-run supply curve.

The concept of the shutdown point is crucial in understanding a firm’s decision to continue production or halt it based on the prevailing market price and cost condition.

<div class="new-fform">

</div>