![]() 5 Dec 2023

5 Dec 2023

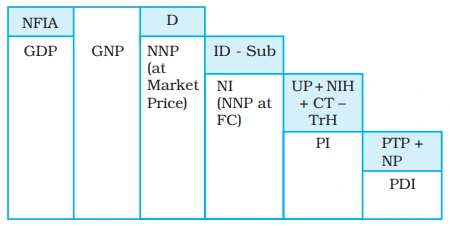

There are various macroeconomic identities and concepts related to national income measurement, including Gross National Product (GNP), Net National Product (NNP), National Income (NI), Personal Income (PI), and Personal Disposable Income (PDI).

These identities help in understanding how income is distributed within an economy and how it is affected by various factors like depreciation, taxes, subsidies, and transfers.

GNP = GDP + Net Factor Income from Abroad

NNP = GNP – Depreciation

NI = NNP at Market Prices – Net Indirect Taxes (Indirect Taxes – Subsidies)

Note

|

|---|

|

National Disposable Income = Net National Product at market prices + Other current transfers from the rest of the world The idea behind National Disposable Income is that it gives an idea of what is the maximum amount of goods and services the domestic economy has at its disposal. Current transfers from the rest of the world include items such as gifts, aids, etc. Private Income = Factor income from net domestic product accruing to the private sector + National debt interest + Net factor income from abroad + Current transfers from government + Other net transfers from the rest of the world. |

|---|

Personal Income (PI): PI is the income received by households from NI.

| PI = NI – Undistributed Profits – Net Interest Payments Made by Households – Corporate Tax + Transfer Payments to Households |

|---|

Personal Disposable Income (PDI): PDI is the income available to households after deducting personal tax payments (such as income tax) and non-tax payments (like fines) from PI.

PDI = PI – Personal Tax Payments – Non-Tax Payments

Diagrammatic representation of the relations between these major macroeconomic variables

|

|---|

Real GDP = (Nominal GDP / GDP Deflator) * 100

GDP Deflator = (Nominal GDP / Real GDP) * 100

Consumer Price Index (CPI): Tracking Consumer Inflation Trends

CPI = (Cost of Basket in Current Year / Cost of Basket in Base Year) * 100

Wholesale Price Index (WPI): Analyzing Wholesale Price Shifts in Production

|

CPI |

GDP Deflator |

|

|

|

|

|

|

<div class="new-fform">

</div>