Context

This Article is based on the news “Unstable platforms” which was published in the Business Standard. A recent survey conducted across multiple Indian cities, titled “Prisoners on Wheels”, sheds light on the challenges faced by over 10,000 cab drivers and delivery persons.

Survey on the Gig Economy in India

- Conducted by: The study is jointly conducted by the University of Pennsylvania and Indian Federation of App-based Transport Workers.

- Survey Participation: Overall, 5302 cab drivers and 5028 delivery persons across eight cities — Delhi, Hyderabad, Bengaluru, Mumbai, Lucknow, Kolkata, Jaipur, and Indore — participated in a 50-question survey.

- 78% of the respondents were in the age group of 21 to 40 years.

- Challenges in India’s Growing Gig Economy: The gig economy in India is experiencing rapid growth, yet individuals employed at the bottom of the pyramid face challenging conditions.

- The survey revealed a picture of overwork, financial struggle, caste discrimination, and arbitrary work cultures.

Key Findings of the Survey on the Gig Economy in India

-

Low Pay, Long Hours:

- Over 43% of participants in the study earn less than ₹500 a day or ₹15,000 a month, after deducting all their costs.

- They pointed out that despite working more than 10 hours a day, drivers and delivery persons cannot get full-time employee status or job security.

-

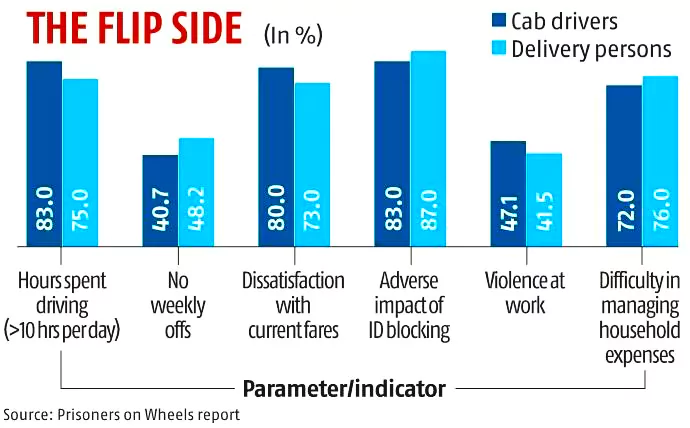

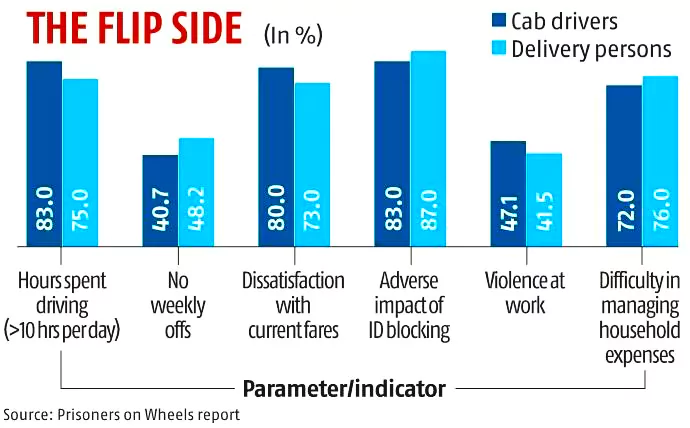

No Weekly Off:

- also appears to be a 24×7 problem for most, wherein 41% of the drivers and 48% of delivery persons reported that they are unable to take even a single day off in a week.

- This lack of work-life balance translates into limited time spent with family (67% for cab drivers and 65% for delivery personnel).

-

Dissatisfaction with Fares:

- The major reasons for low earnings are unfair fares, commission rates and arbitrary deductions by the aggregator companies.

- Nearly a third of the respondents reported that companies are deducting between 31 and 40 per cent of commission rate per ride, while the officially claimed figure by the companies themselves is 20 percent.

-

Expenses Exceed Earnings:

- 68% of cab drivers’ responses show that their overall expenses exceed their earnings.

-

Social Disparities:

- Social disparities make the situation worse, with over 60 per cent of drivers from Scheduled Castes and Scheduled Tribes work over 16 hours a day, compared to 16 per cent in the unreserved category.

- These income disparities further exacerbate the already existing social inequalities and perpetuate cycles of poverty and distress within these communities.

-

Physical Exhaustion and Road Safety Risks:

- The study found that drivers are physically exhausted due to the demanding work hours, and exposed to an increased risk of road traffic accidents.

- This is especially due to the ‘10-minute delivery at the doorstep’ policy of certain e-commerce platforms which is completely unacceptable to around 86 per cent of delivery personnels.

-

Deteriorating Health:

- The lack of time off has been leading to burnout and negatively impacts the mental and physical well-being of these workers, as 99.3 per cent drivers reported one or more forms of physical health issues like knee pain, leg pain, foot pain and back pain.

- 98.5 percent respondents reported one or more mental health issues as a result of this work, including anxiety, stress, panic, irritability, short-temperedness and panic attacks.

-

Violence at Work:

-

- Nearly half of the cab drivers (47.1%) and over 41% of delivery personnel reported experiencing violence at work.

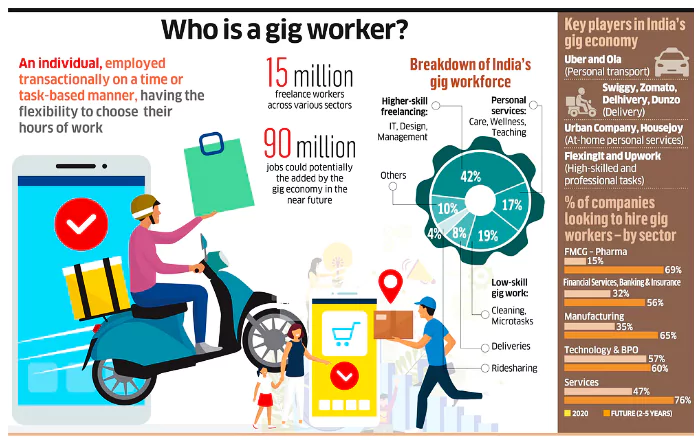

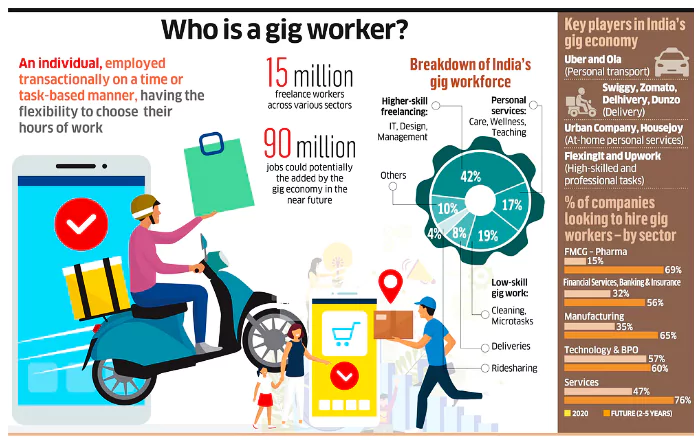

About Gig Economy

- A gig economy is a labor market that relies on independent contractors and freelancers rather than full-time permanent employees.

- In recent years, the global job market has witnessed a transformative shift with the rise of ‘gigification’ or adoption of the gig model – reshaping how we work. They include the following:

- freelancers who get paid per task;

- independent contractors who perform work and get paid on a contract-to-contract basis;

- project-based workers who get paid by the project;

- temporary hires who are employed for a fixed amount of time; and

- part-time workers who work less than full-time hours.

Classification of Gig Economy:

- Platform-Based: They use online apps or digital platforms to find and perform work, such as ride-hailing, food delivery, e-commerce, online freelancing, etc.

- Non-platform-based gig workers: They work outside the traditional employer-employee relationship, such as casual wage workers and own-account workers in sectors like construction, domestic work, agriculture, etc.

Benefits of Gig Economy:

- For Workers: Gig economy can provide more flexibility, autonomy, income opportunities, skill development, and inclusion.

- For Employers: It can enable access to a large and diverse pool of talent, lower fixed costs, higher scalability, and better customer satisfaction.

- For Customers: It can offer more choice, convenience, quality, and affordability.

Gig Economy in India

- Current Status of Gig Workers in India: According to the NITI Aayog, 77 lakh (7.7 million) workers were engaged in the gig economy in 2020-21 and the workforce is expected to “expand to 2.35 crore (23.5 million) workers by 2029-30”.

- About 47 percent of the gig work is in medium-skilled jobs, about 22 percent in high skilled, and about 31 percent in low-skilled jobs

- CAGR: The Associated Chambers of Commerce and Industry (ASSOCHAM) reports that India’s gig economy is growing at a Compound annual growth rate (CAGR) of 17 per cent annually.

- Growth Prospects: India’s vast talent pool of over 100 million unemployed individuals offers a compelling opportunity as businesses seek cost optimisation and enhanced productivity.

- Significance in Realisation of Demographic Dividend: With the world’s second-largest working-age population, the Indian workforce will continue to grow in size until 2049.

- It can help in realising the demographic dividend with 960 million potential workers.

- Examples in India: Online platforms like Ola, Uber, Swiggy, Zomato, etc.

Global Comparison of Gig Workers Rights

- UK: Supreme Court in a landmark ruling in 2021 ruled that Uber drivers are ‘workers’, and not ‘independent contractors’.

- Germany: Temporary Employment Act provides for equal pay and equal treatment of gig workers.

- California, US: In California, Proposition 22, which exempts gig platforms like Uber, Lyft, and DoorDash from classifying their gig workers as employees was upheld in March 2023, marking a victory for gig companies.

|

Gig Economy Regulatory Framework in India

-

Central Legislation:

- Code on Wages, 2019: A universal minimum wage and floor wage should be provided to all organized and unorganized sectors, including gig workers.

- Code on Social Security 2020: Under this, the gig workers are provided with recognition as a new occupational category.

- It has not been implemented as the government has yet to frame the rules.

- Dedicated Social Security Fund: It extends social Security benefits to gig workers.

- Motor Vehicle Aggregator Guidelines, 2020: Under this, gig workers are entitled to get a term insurance of Rs 15 lakh, and health insurance of Rs 10 lakh, with 2020-21 as the base year and with an increase of 5% each year.

- To curb excessive working hours of gig workers, the guidelines recommended that each driver should not be logged in for more than 12 hours in a calendar day including all aggregators apps they are integrated with.

- A break of 10 hours was mandatory if workers are logged in for 12 hours.

-

Rajasthan Platform Based Gig Workers (Registration and Welfare) Act 2023:

-

- It proposes to set up a social security fund by imposing a welfare tax of 1%-2% on every transaction made by a customer on apps that fall within its ambit, like food delivery and ride sharing.

- State government grants and contributions by gig workers will also be pooled into the fund.

-

Karnataka Gig Workers (Conditions of Service and Welfare) Bill, 2024:

- The draft is modelled on Rajasthan’s legislation, but it has more provisions for the safety and welfare of workers.

- It identified certain gaps in Rajasthan Platform Based Gig Workers (Registration and Welfare) Act 2023 such as ensuring income security, imposing penalties on aggregators, and making aggregators accountable for the occupational safety and health of workers, among others.

- It is planning to have a provision for charging aggregators gig workers’ welfare fee, which will be a percentage of the pay of the gig worker per transaction.

Concerns Associated with Gig Economy in India

- Increase in Voluntary Unemployment: It has led to an increase in voluntary unemployment as some workers prefer the flexibility and autonomy of gig work over traditional employment.

- Disrupting Work-Life Balance: Flexibility of working gigs can actually disrupt the work-life balance, sleep patterns, and activities of daily life.

- It often means that workers have to make themselves available any time gigs come up, regardless of their other needs, and must always be on the hunt for the next gig.

- Job Insecurity: Gig workers in India often lack job security, as they are typically engaged on a project or assignment basis, rather than as permanent employees.

- Lack of Formalization: Many gig workers in India operate in the informal sector, which can limit their ability to access credit, government support programs, and other resources.

- Lack of Legal Protection & Social Security: Gig workers in India are not covered under India’s labor laws and do not have legal protection in case of workplace harassment, discrimination, or unfair termination.

- Gig workers in India do not have access to social security benefits such as health insurance, retirement benefits, and paid leave.

- Unequal Bargaining Power: Gig workers in India may lack the bargaining power to negotiate fair compensation and working conditions, particularly when they are competing against a large pool of other workers on digital platforms.

- Training and Upskilling: Many gig workers in India lack the necessary skills to perform their work effectively. Gig workers often have limited opportunities for upskilling and career advancement.

- Social Stigma: Gig work is still viewed by some in India as a temporary or low-paying option, which can result in social stigma and lack of recognition for the work done by gig workers.

- Payments, Incentives, and Growth Models: Absence of a minimum wage guarantee makes workers susceptible to financial vagaries during crises/disasters.

Way Forward Suggested by the Survey On

-

Overtime Payment Beyond Regular Hours:

- Considering the physically intense nature of this work, the number of hours that are ‘regular’ hours needs to be stipulated beyond which the platform must pay overtime.

-

Payment of Minimum Wages to Platform workers:

- The gig and platform workers need to be treated as employees.

- They must be given daily assured earnings equivalent to the state minimum wage, insurance, and security benefits, apart from putting a cap on their working hours and the mandatory registration of the workers in government records.

-

Preserving Flexibility of Work for Gig Workers in India:

- The design of social security for gig workers must seek to preserve the flexibility of work.

- The choice of participating in social security should be voluntary for gig workers. They should be able to decide if their work is a short-term or long-term commitment, and whether or not to sign up for social security.

- Paid time-off or “unpaid” leave options shouldnt affect the eligibility of these workers. They should be allowed to adjust schedules within parameters to accommodate personal needs. This fosters well-being and avoids burnout.

-

Stronger Social Security for App-based Workers:

- The government needs to exercise oversight on the fairness of algorithms and mechanisms used by platforms to monitor such workers.

- It is important that the apps function transparently in terms of algorithms, incentive systems, and payment mechanisms.

- Aggregators are required to take responsibility for their gig workers and portability of benefits like social security, health insurance of these informal workers should be ensured.

- According to The Code on Social Security 2020, an aggregator means a digital intermediary or a market place for a buyer or user of a service to connect with the seller or the service provider.

-

Welfare Board for Gig Workers in India:

- It needs to be set up for the welfare of gig workers and it should be mandatory for aggregators to provide details of all registered gig workers to the board.

- The provision for auto-registration of workers with the board is important as workers often don’t know about it.

-

Addressing Occupational Health Hazards:

-

- Giving essential safety training, especially for roles with inherent risks, and safety equipment and resources can go a long way in encouraging temporary workers.

Best Practices by State:

- Namma Yatri for the Bangalore Auto Drivers Union: It places the driver’s experience at the center of the service app, eliminates the middleman and allows payments directly to the drivers.

- Rezoy App: It was rolled out by the Kerela Hotels and Restaurants Association during the Covid-19 pandemic, as a supply side innovation to protect the interest of small and medium size restaurants in Kochi.

- At that time, the restaurant businesses were frustrated by the high commissions charged by the Swiggy-Zomato duopoly.

|

-

- Sharing information on work-related injury can boost morale.

-

Addressing Mental Health:

- Companies should offer access to wellness articles, mental health information, and employee assistance programmes (EAPs).

- Partnering with relevant organisations can help them give discounted services to gig workers.

- Leaders should also encourage open and honest conversations about mental health and support seeking, and normalise the importance of work-life balance and taking breaks.

NITI Aayog Recommendations On Gig Workers in India

- Proper Estimation of Gig Workers in India: Have separate enumeration exercises to estimate the size of the gig economy and characteristic features of gig workers.

- This can be done by collecting information during official enumerations (PLFS, NSS or otherwise).

- Catalyse Platformization: Introduce Platform India initiative (similar to Startup India), built on the pillars of Accelerating Platformization by Simplification and Handholding, Funding Support and Incentives, Skill Development, and Social Financial Inclusion.

- This platform can help self-employed individuals to sell their produce to wider markets in towns and cities; Ferrying of passengers for hire etc.

- Accelerate Financial Inclusion: Enhance access to institutional credit through financial products specifically designed for platform workers and those interested to set-up their own platforms.

|

Conclusion

As the debate on gig workers in India’ welfare intensifies, governments must craft a robust framework that imposes conditions to access social security, while retaining the hallmarks of the gig economy— flexibility and choice.

Also Read: Female Labour Force Participation In India

![]() 18 Mar 2024

18 Mar 2024