Context:

The private credit alternative investment fund (AIF) space is witnessing heightened action this financial year (2023-24), with the change in taxation of debt mutual funds (MFs).

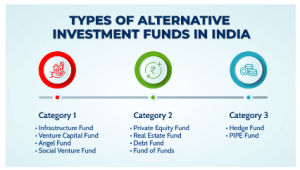

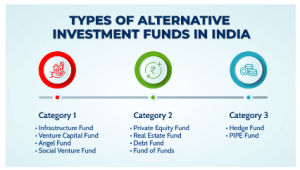

About Alternative Investment Fund (AIF):

- It refers to the collection of pooled investment funds that infuse in hedge funds, private equity, venture capital, and other investment types.

- They are defined under the Securities and Exchange Board of India (Alternative Investment Funds) Regulations 2 (1) (b), 2012 set up by the SEBI.

- It can be established through a company or a Limited Liability Partnership (LLP).

Benefits of Investing in AIFs:

- High Return Potential: AIFs generally have a higher return potential than other investment options.

- Low Volatility: AIFs are not directly related to stock markets. Volatility in these funds is less, particularly when compared with traditional equity investments.

- Diversification: These funds allow much-needed diversification in an investment portfolio. They act as a cushion at the time of financial crisis or market volatility.

News Source: Business Standard

![]() 21 Aug 2023

21 Aug 2023