Context: Government Urges Financial Institutions to register with the Citizen Financial Cyber Fraud Reporting and Management System (CFCFRMS) platform, developed by the Indian Cyber Crime Coordination Centre (I4C).

Unregistered FIs Urged to Prioritize Registration with Cyber Fraud Prevention System

- Strengthen Fraud Management and Due Diligence: FIs have received a directive from the central government to strengthen their fraud management systems and enhance due diligence.

- The move is aimed at improving cybersecurity in the financial sector.

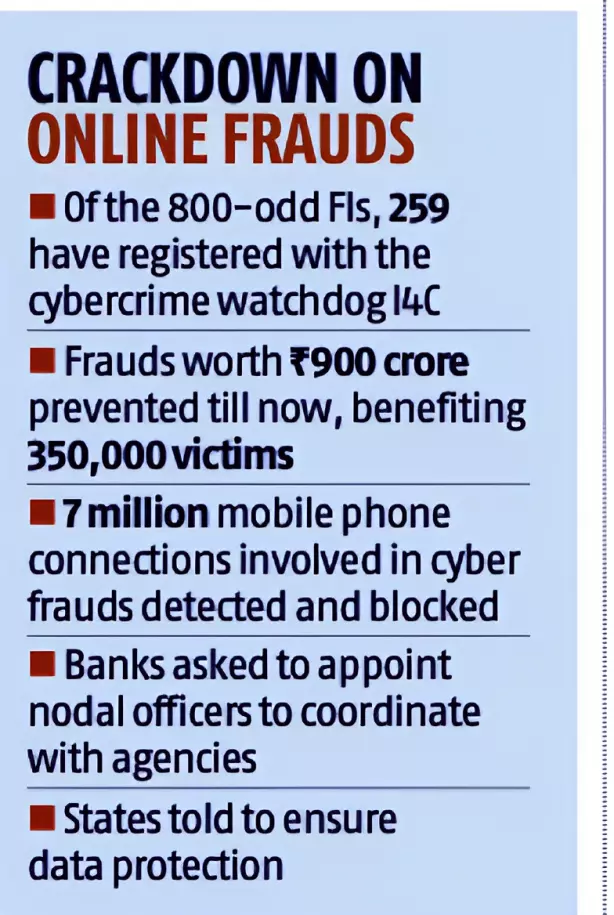

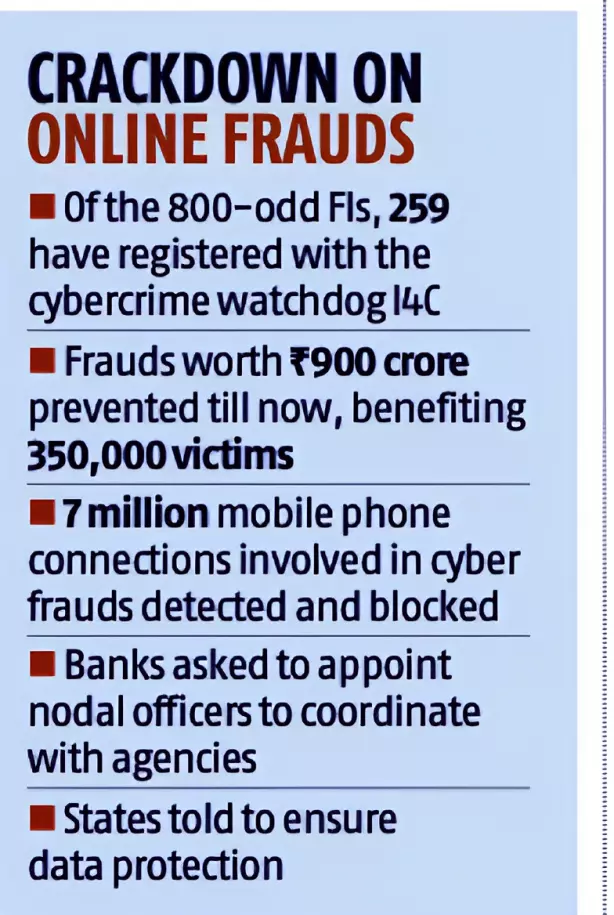

Registration Status: Currently, out of 800 FIs, only 259 have registered with I4C. The remaining institutions are requested to expedite the registration process.

About the Indian Cyber Crime Coordination Centre (I4C):

- It is an initiative of the Ministry of Home Affairs to deal with cybercrime in the country in a coordinated and comprehensive manner.

- It was approved in October 2018.

|

About Financial Institution (FI)

- A financial institution (FI) is a company that deals with financial and monetary transactions.

- The FIs consist of retail and commercial banks, internet banks, credit unions, savings and loan associations, investment banks and companies, brokerage firms, insurance companies, and mortgage companies.

|

Objectives of I4C:

- To act as a nodal point to curb Cybercrime in the country.

- To strengthen the fight against Cybercrime committed against women and children.

- Facilitate easy filing of cybercrime-related complaints and identify Cybercrime trends and patterns.

- To act as an early warning system for Law Enforcement Agencies for proactive Cybercrime prevention and detection.

- Create awareness among the public about preventing cybercrime.

- Assist States/UTs in capacity building of Police Officers, Public Prosecutors and Judicial Officers in the area of cyber forensics, investigation, cyber hygiene, cyber-criminology, etc.

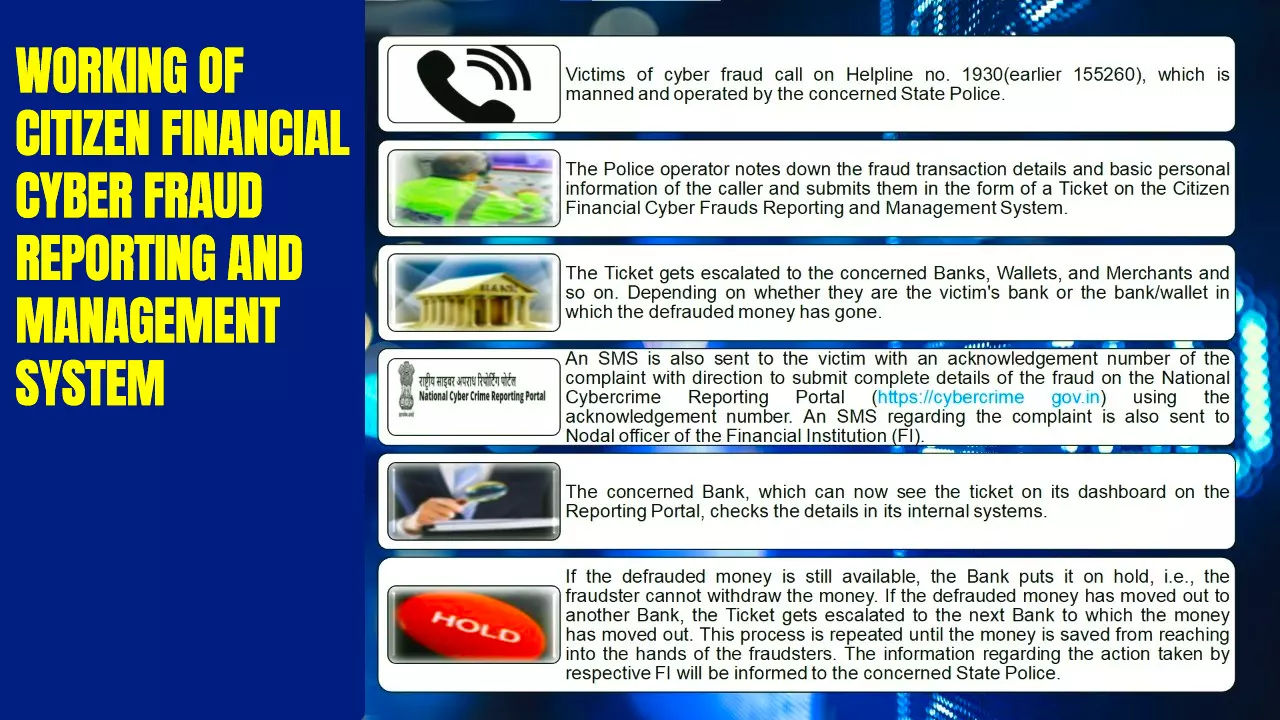

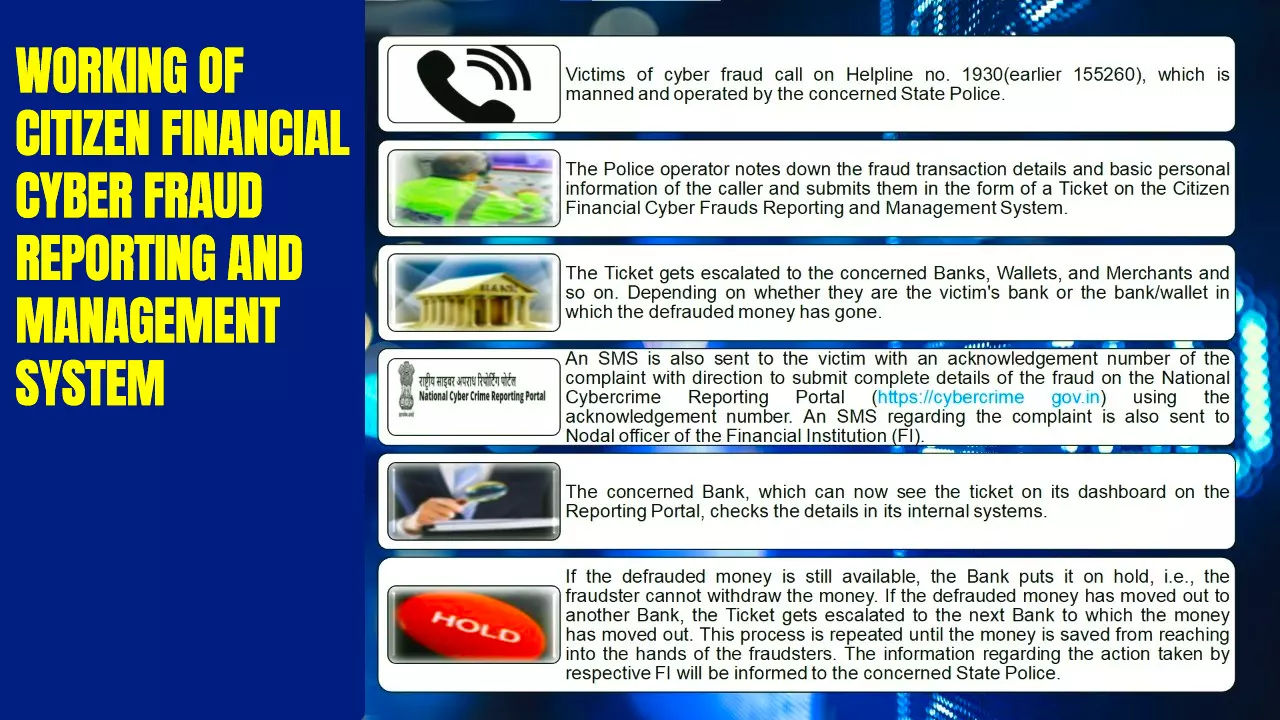

| Citizen Financial Cyber Frauds Reporting and Management System has been developed for quick reporting of financial cyber frauds and monetary losses suffered due to the use of digital banking/credit/debit cards, payment intermediaries, UPI, etc. |

It has seven components:

- National Cyber Crime Threat Analytics Unit

- National Cyber Crime Reporting Portal

- National Cyber Crime Training Centre

- Cyber Crime Ecosystem Management Unit

- National Cyber Crime Research and Innovation Centre

- National Cyber Crime Forensic Laboratory Ecosystem

- Platform for Joint Cyber Crime Investigation Team.

Also Read: Cyber Security And Rising Incidence Of Cyber Crime

News Source: Business Standard

![]() 30 Nov 2023

30 Nov 2023