Context:

Small States in India continue to rely heavily on the Union government for their revenue.States being discussed as small states are: Arunachal Pradesh, Sikkim, Manipur, Mizoram, Meghalaya, Nagaland, Tripura, Himachal Pradesh and Goa.

Highlights:

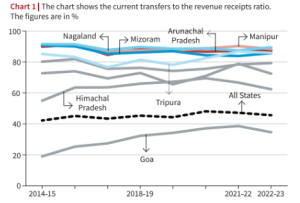

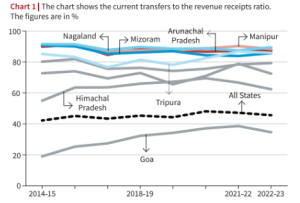

- High Reliance on Union Government: Share of Union transfers in the revenue receipts of all States combined hovers between 40% and 50%.

-

- However, Union’s share in all the other small States’ revenue receipts is more than 60% (2022-23 Budget Estimates) except in Goa.

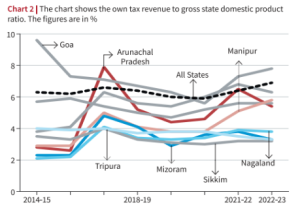

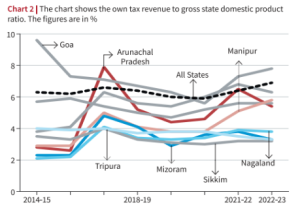

- Limited capacity of small States to raise their own taxes: Distinctive characteristics of smaller states like border state, lack of industrial development and poor access to ports etc, restrict economic activity and consequently make it challenging to generate tax revenue.

- It results in a heavy dependence on the Union government, exposing the States as well as the Union Government to various vulnerabilities.

- States rely on the Union governments’ political goodwill. A sudden decline in Union transfers can adversely affect the States’ expenditures.

- Increasing disagreements concerning resource sharing (for example, GST compensation) between the Union and the States.

- Lack of Flexibility: High dependence on the Union might imply less fiscal freedom for the States.

- A significant portion of the funds transferred by the Union is tied to specific purposes, limiting the States’ flexibility.

- Lack of Delivery: Lack of their own revenues can lead to weakened State capacity, affecting the delivery of social, economic, and general services.

- This situation becomes even more critical as many small States share international borders.

- The developmental concerns in these States can have implications for national security.

Way Forward

- Exploring New Avenues: States must prioritize identifying new sources of tax revenue or explore ways to leverage existing ones more effectively.

- Ex: Manipur liquor prohibition policies have led to substantial revenue losses without significantly reducing the negative consequences of drinking.

- Improve the tax administration in the States: States can boost their collection of non-tax revenues by revising the existing charges and rates for various services and enhancing administrative revenue collection efficiency.

- States must consider revitalizing and corporatising loss making enterprises to improve their revenue performance.

- Some States such as Mizoram have closed down loss-making public sector enterprises, recognising that these entities are a liability.

- It could lead to higher resource mobilisation and reduce the deviation of actual from budgeted tax revenues.

Sources of revenue receipts for a State

- Transfers from the Union government: State’s share in Union taxes including income tax, corporation tax, and grants.

- State’s Own Revenues

- Tax Sources: The State can raise its own taxes (own tax revenue or OTR) from professions, property, commodities, etc.

- Non-Tax Sources: It can mobilise non-tax revenue (own non-tax revenue or ONTR) from social and economic services, profits, dividends, etc.

India Constitution Provision for Transfer of Funds

- Finance Commission under Article-280: It is a constitutional body formed every five years to give suggestions on centre-state financial relations.

- Article 275: Grants from the Union to certain States

- Article 282: Centre upon its own discretion can grant aid to certain States for the public purpose.

|

News Source: The Hindu

![]() 20 Jul 2023

20 Jul 2023