![]() 10 Feb 2024

10 Feb 2024

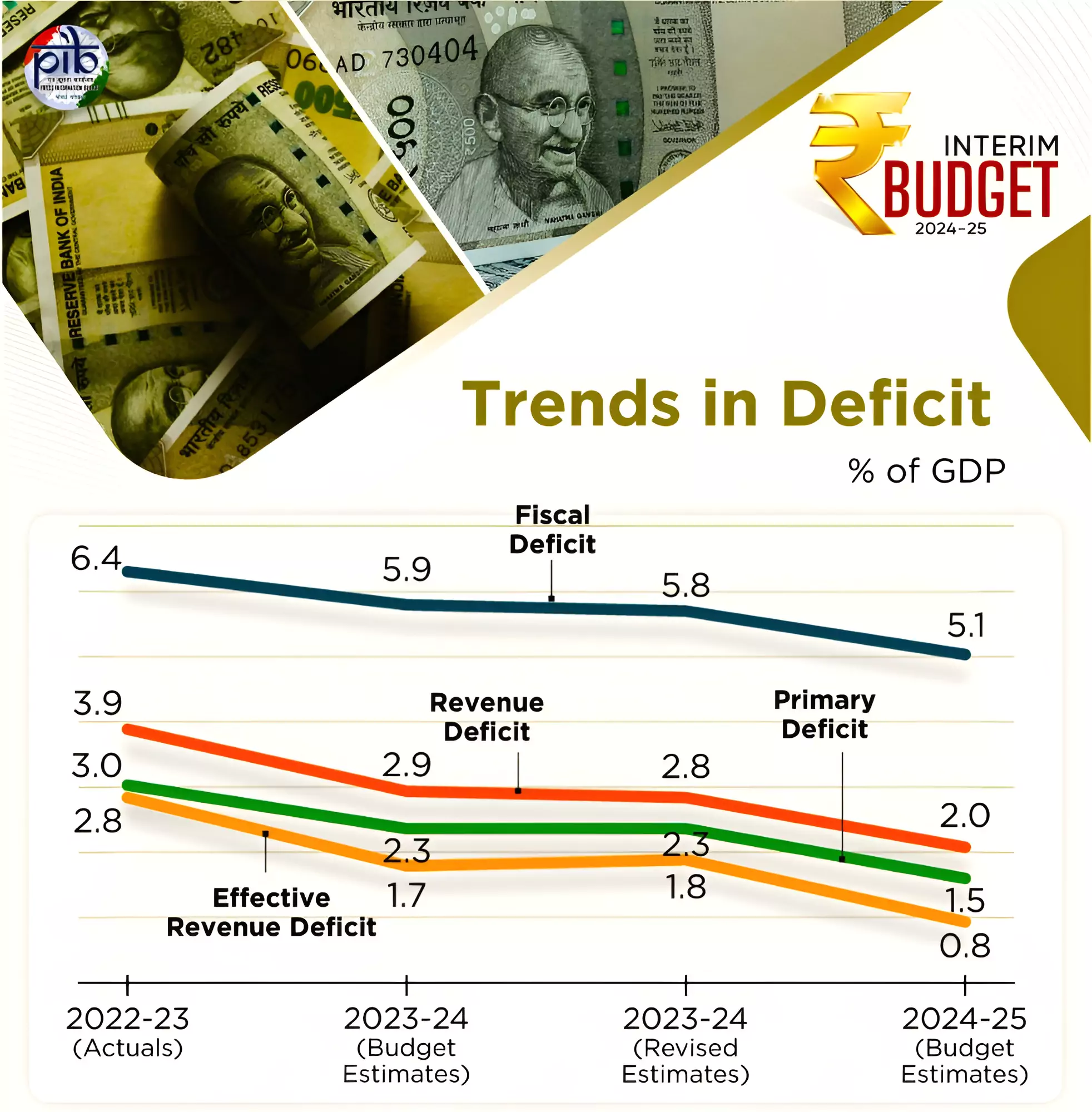

In her interim budget 2024-25 speech Finance Minister Nirmala Sitharaman announced that the centre would reduce its fiscal deficit to 5.1% of GDP in 2024-25.

Positive Aspect of Fiscal Deficit |

Negative Aspect of Fiscal Deficit |

|

|

Legislation Related to Fiscal Management in India

|

|---|

Fiscal consolidation measures can involve tough policy choices and may have short-term economic costs including reduced public spending but it underscores the importance of structural reforms to enhance productivity and competitiveness.

Also Read:

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>