![]() 3 Jan 2024

3 Jan 2024

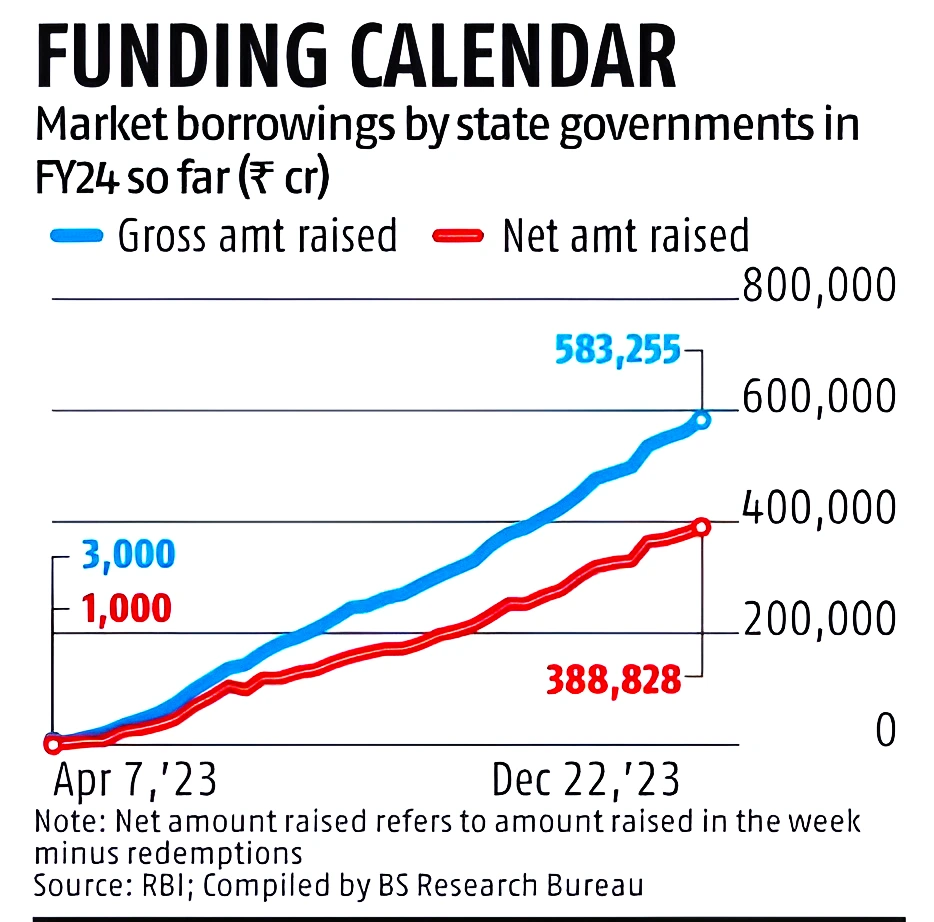

Context: The spread between yields on the 10-year state development loans (SDL) and the Centre’s G-sec (government securities) widened to a two-year high.

About Bonds

|

|---|

Source: Indian Express

|

Must Read |

|

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

<div class="new-fform">

</div>