Context

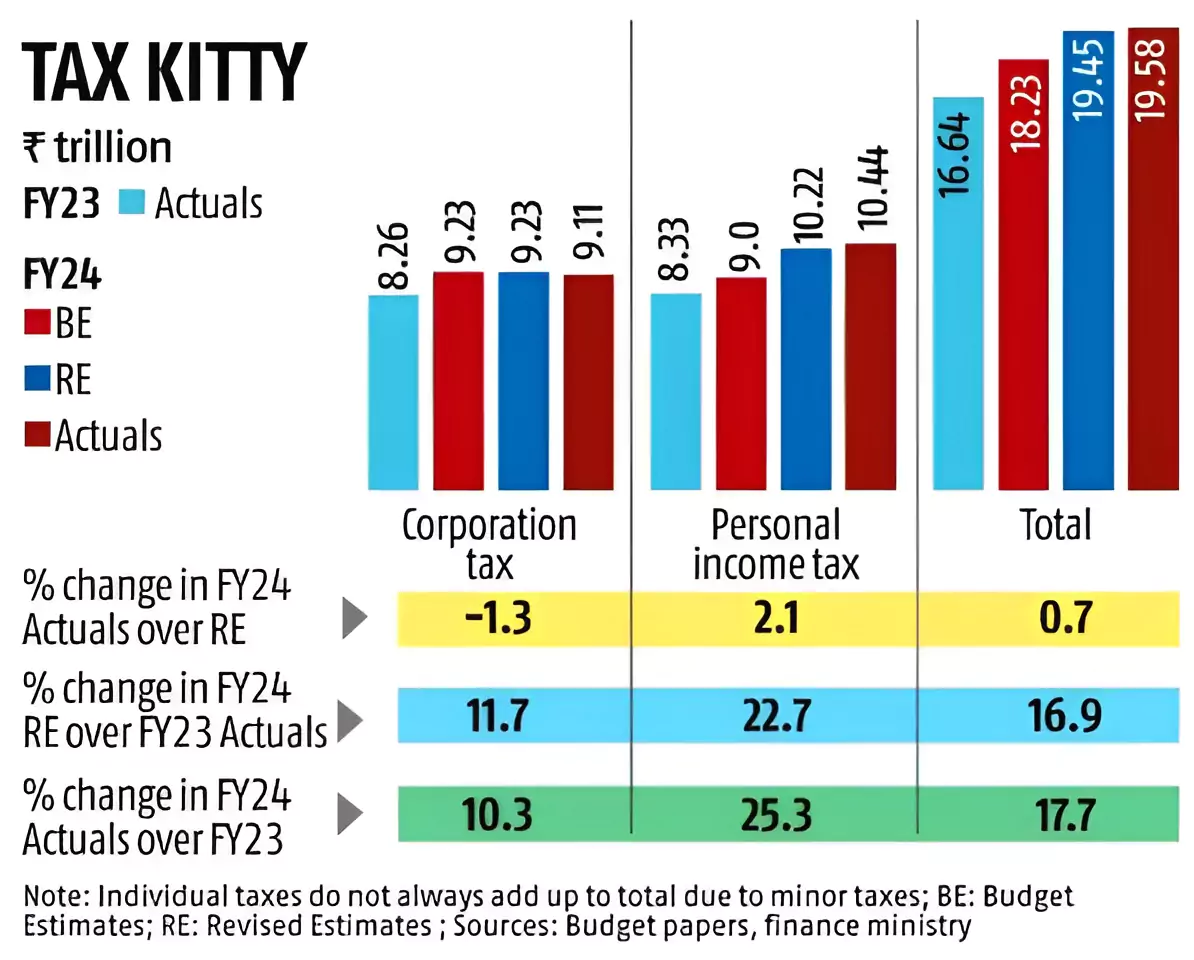

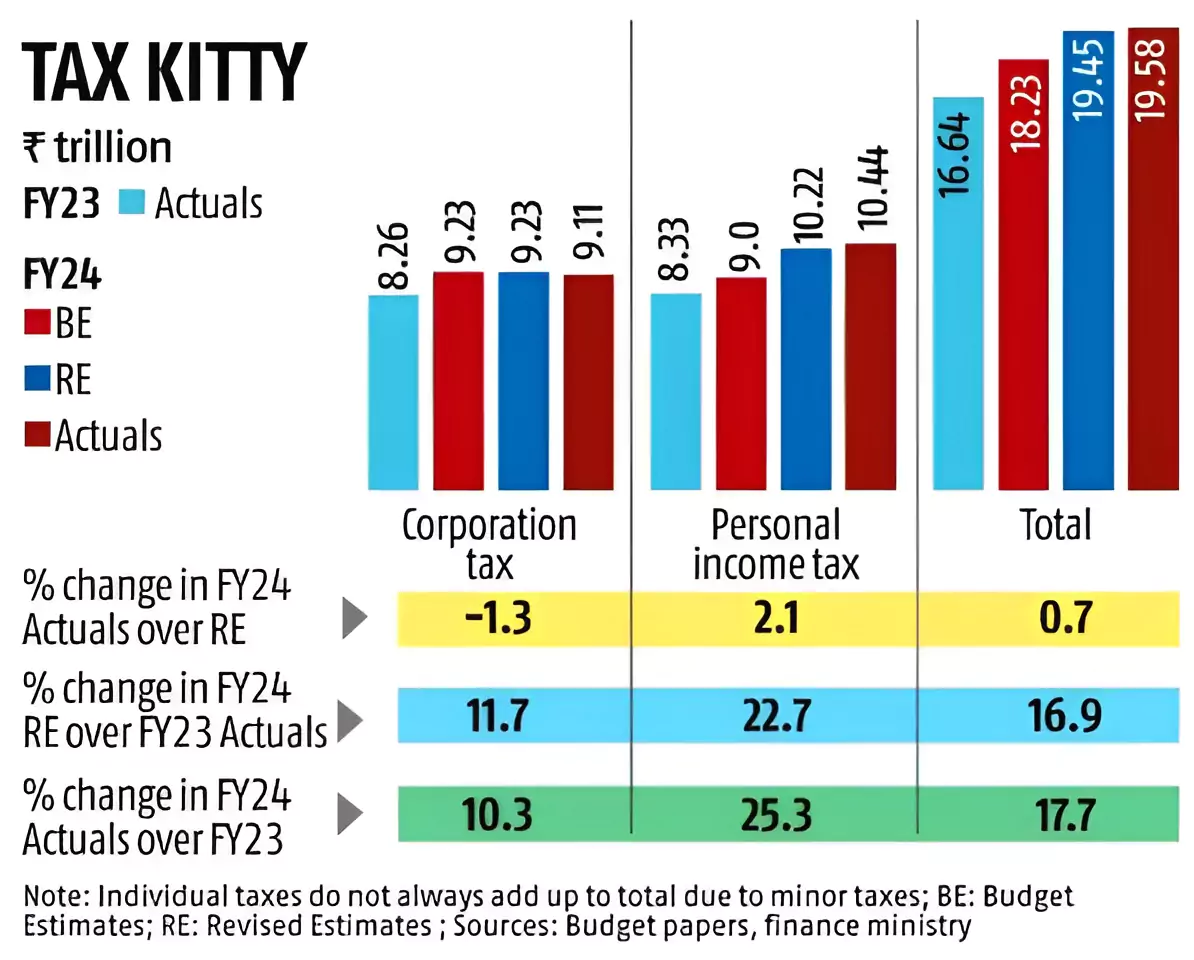

The net direct tax collections for the fiscal year 2023-24 reached ₹19.58 trillion, marking a 17.7% increase from the previous fiscal year 2022-23.

Direct Tax Collections in FY23-24

- Exceeding Budget Estimates: This figure surpassed the initial budget estimate by ₹1.35 trillion and the revised estimate (RE) mentioned in the interim budget by ₹13,000 crore.

- If refunds are added to the collection, the resultant gross direct tax collection grew 18.5 per cent to Rs 23.37 trillion during FY24 from Rs 19.72 trillion during FY23.

- Refunds of Rs 3.79 trillion were issued during 2023-24, showing an increase of 22.7 per cent over Rs 3.09 trillion issued the previous year.

- Rise in Personal Income Tax Collection: In FY24, the actual growth in personal income tax collection exceeded expectations, reaching 25.3% compared to the 22.7% projected in the Revised Estimates (RE) over the FY23 collection.

- Significance of Increased Income Tax Collections: Net income tax collections surged by 25.2%. This is significant for two reasons:

- The higher tax payments suggest increased earnings, indicating prosperity among taxpayers.

- It may indicate an expansion of the tax base.

- Lower than Anticipated Corporation Tax Growth: The growth in corporation tax was lower than anticipated, standing at 10.3% instead of the 11.7% forecasted in the RE.

- The government reduced the corporation tax rate to 22% (25.17% including cess and surcharge) from the previous 30% starting from FY20 for companies that do not utilize any exemptions or incentives.

- The tax rate was lowered to 15% for newly established domestic companies incorporated on or after October 1, 2019, engaged in fresh investments in manufacturing until March 31, 2023.

- This deadline was subsequently extended until March 31, 2024.

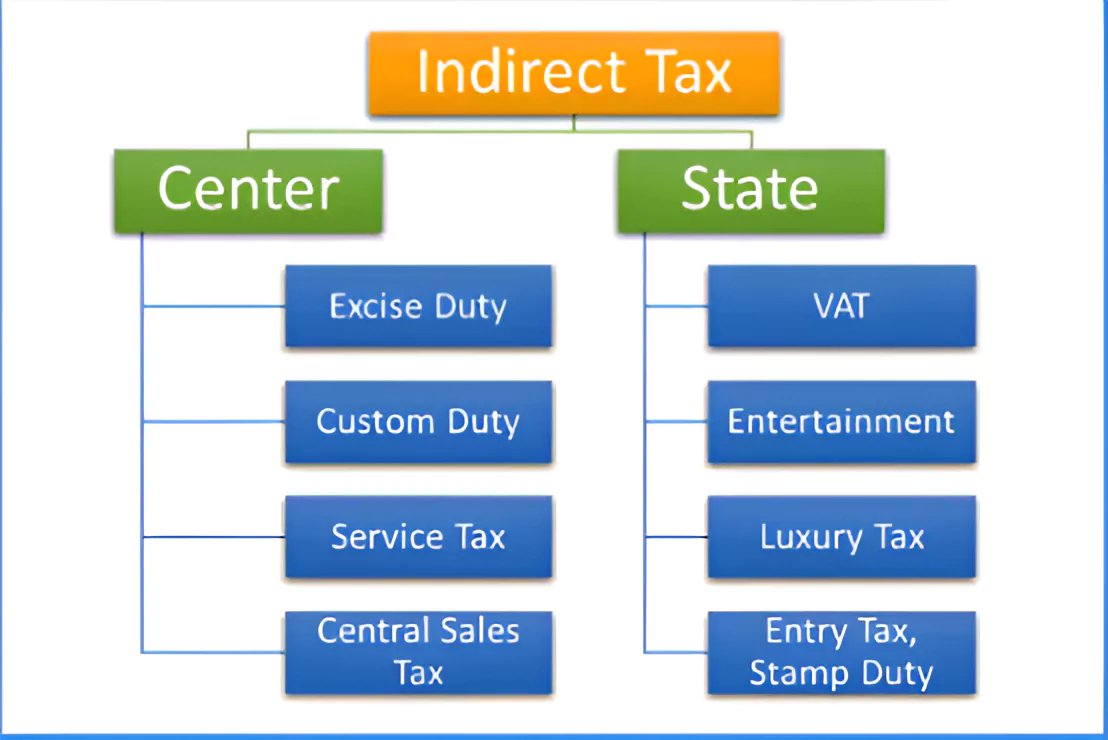

- Trend in Indirect Tax Collection: As indirect tax collection exceeded the RE for FY24, it is anticipated that the total tax revenue will surpass the RE.

- The indirect tax collection for FY24 surpassed the RE of Rs 14.84 trillion by a considerable margin, primarily due to record GST collection.

Enroll now for UPSC Online Course

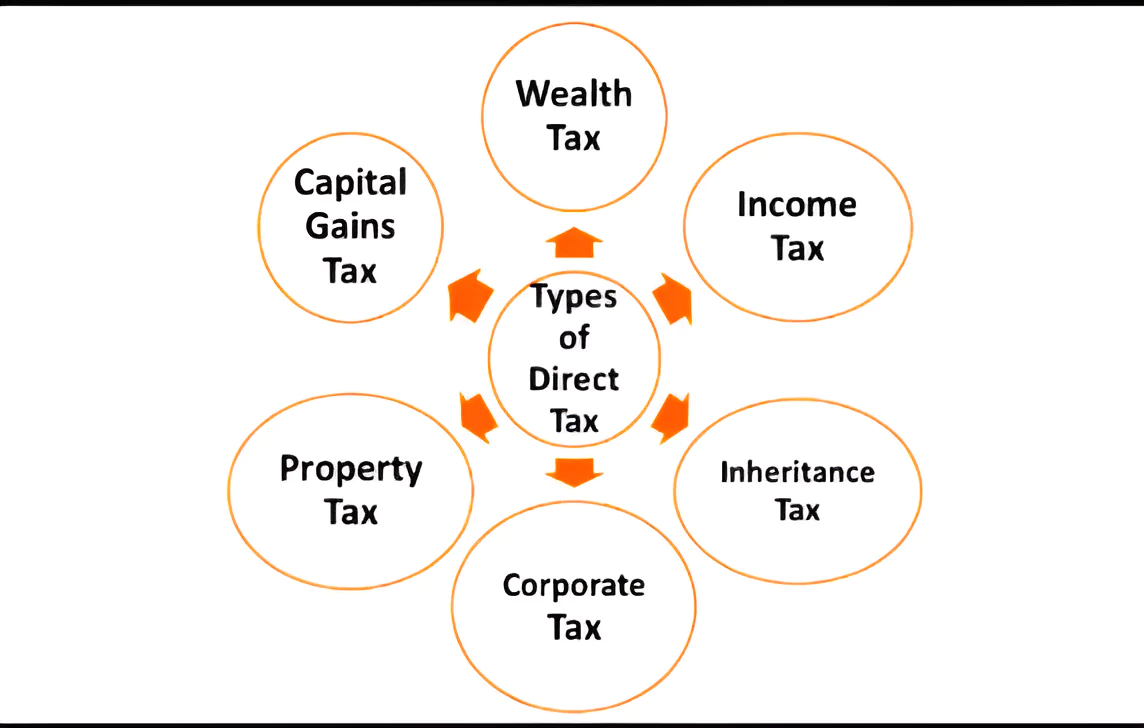

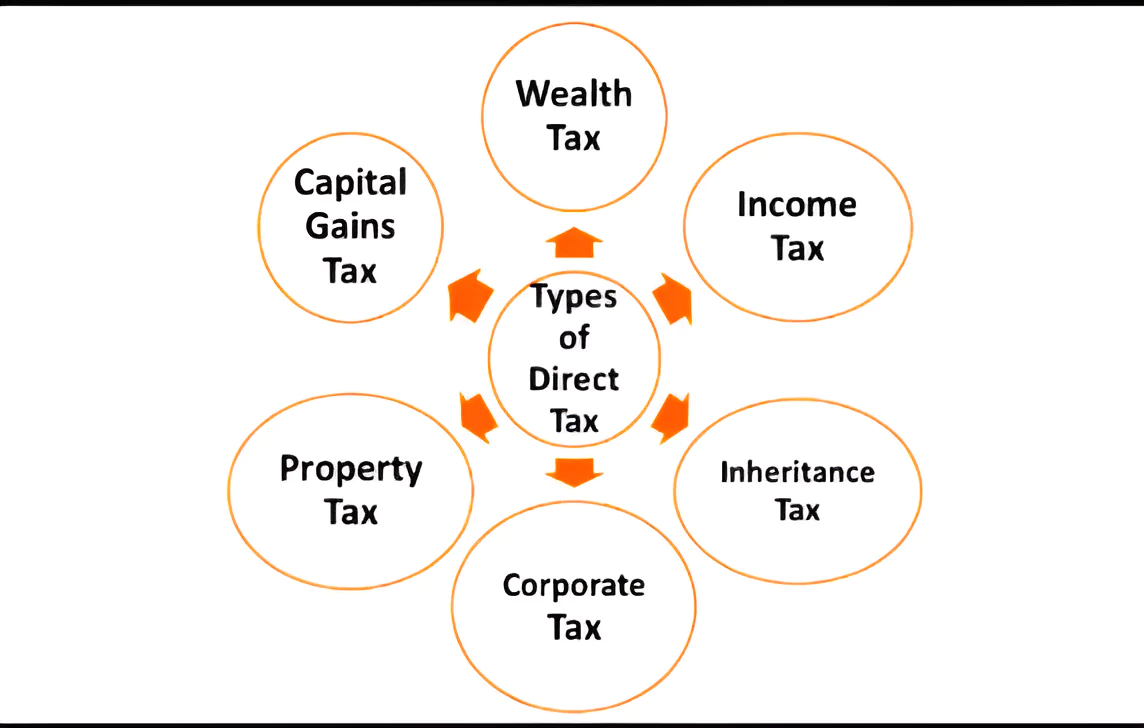

About Direct Tax

- About: It is a type of tax that is levied directly on the income, wealth, or property of individuals or organizations.

- Unlike indirect taxes, which are levied on goods and services and are paid indirectly by consumers (such as sales tax or VAT), direct taxes are paid directly to the government by the taxpayer.

- Significance: The tax rate increases as income or wealth increases which promotes a sense of fair distribution of the tax burden based on ability to pay.

- Income Tax: Imposed on individual, liable to pay the tax directly to the Government and bear the burden of the tax himself.

- Corporation Tax: Levied on the profit of corporations and companies.

Government Initiatives to Improve Direct Taxes

- Faceless E-assessment Scheme (2019) & Faceless Appeals(2020): It removes direct interaction between taxpayers and assessing officers/ appellate authorities fostering transparency and reducing bias.

- Document Identification Number (DIN): A unique DIN is assigned to every communication related to tax matters, facilitating easy tracking and verification.

- Advance Pricing Agreements (APAs): It allows taxpayers and tax authorities to pre-agree on how to price international transactions, minimizing future disputes and fostering certainty.

Vivad se Vishwas Act, 2020: It provides a window for settling pending direct tax disputes, offering reduced penalties and fees for timely resolution.

Vivad se Vishwas Act, 2020: It provides a window for settling pending direct tax disputes, offering reduced penalties and fees for timely resolution.

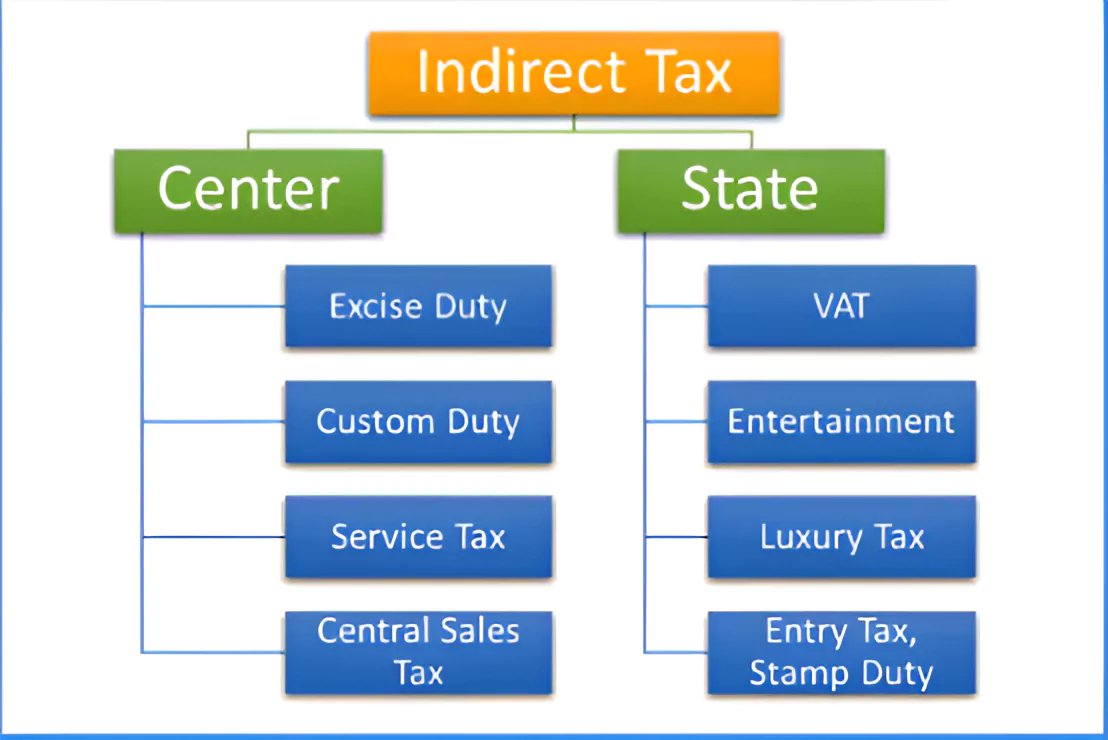

About Indirect Tax

It is the tax levied on the consumption of goods and services. It is not directly levied on the income of a person.

- Indirect tax is generally imposed on suppliers or manufacturers who pass it on to the final consumer.

Also Read: Taxation Systems In India: Classification & Types

![]() 22 Apr 2024

22 Apr 2024

Vivad se Vishwas Act, 2020: It provides a window for settling pending direct tax disputes, offering reduced penalties and fees for timely resolution.

Vivad se Vishwas Act, 2020: It provides a window for settling pending direct tax disputes, offering reduced penalties and fees for timely resolution.