![]() 22 May 2024

22 May 2024

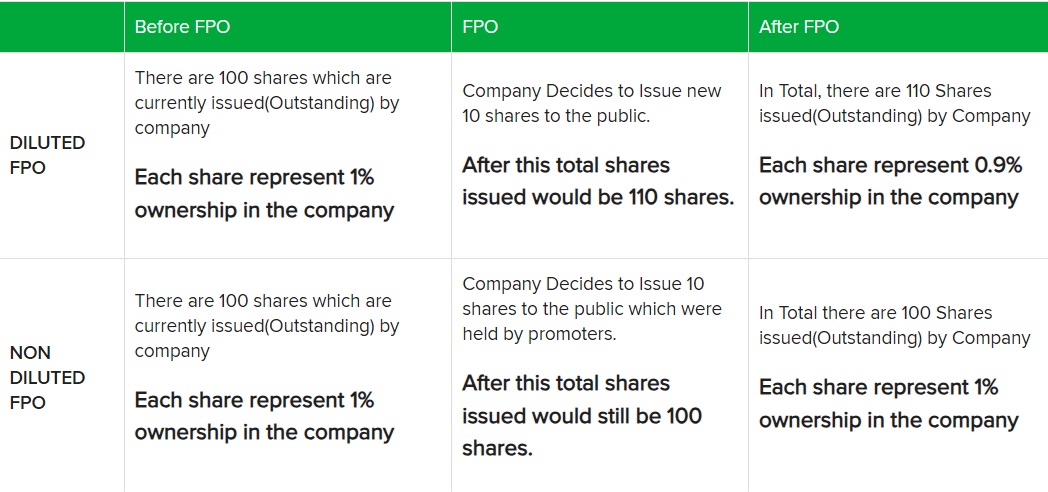

Indian Renewable Energy Development Agency (IREDA) is planning to launch a follow-on public offering (FPO) amid rising financing opportunities in the energy transition space and to bolster the company’s growth.

Difference between Follow on Public Offering (FPO) and Initial Public Offering (IPO):

|

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>