Context:

This article is based on the news “When can a bill be designated as a ‘money bill’: SC to hear challenge” which was published in the Indian Express. In the backdrop of the recent judgement of the Supreme Court on the Electoral bond scheme, Money bills have recently become subject to a constitutional challenge.

Background:

- The Centre is allegedly using the Money Bill route to pass critical legislation.

- However, there is an unresolved question about what exactly qualifies as a Money Bill.

- This matter is currently under consideration by the Supreme Court’s Seven-judge Constitution Bench.

About Money Bills

-

Constitutional Provisions:

- Articles 109 and 198 deal with Special procedures in respect of Money Bills.

- Articles 110 and 199 deal with the definition of Money Bill.

-

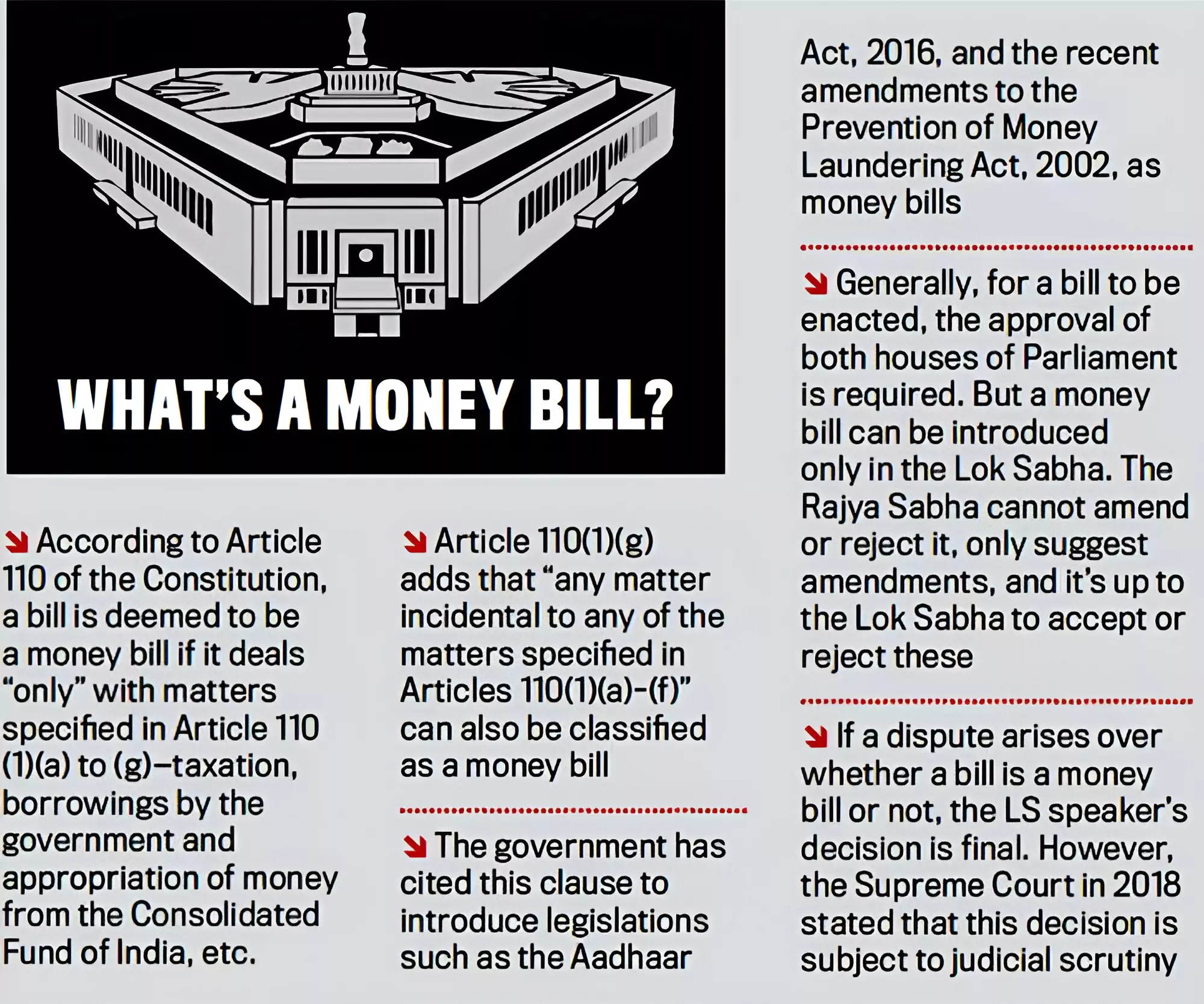

Money Bill Definition:

- A bill is deemed to be a money bill if it contains ‘only’ provisions dealing with following matters:

- Imposition, abolition, remission, alteration or regulation of any tax;

- Regulation of the borrowing of money by the Union government;

- Appropriation of Money, payments and withdrawals from the Consolidated Fund of India or the contingency fund of India,

- Receipt, custody, audit of money on account of the Consolidated Fund of India or the public account of India.

- Any matter incidental to any of the matters specified above.

-

What is not a Money Bill?

A bill is not to be deemed to be a money bill by reason only that it provides for

-

- Imposition of fines or other pecuniary penalties, or

- Demand for payment of fees for licences or fees for services rendered; or

- Imposition, abolition, remission, alteration or regulation of any tax by any local authority or body for local purposes.

Role of Different Institutions With Respect to Money Bills

-

Lok Sabha Speaker:

- The Speaker of the Lok Sabha has to certify that a bill being introduced in the house is a Money Bill.

- However, the Supreme Court in 2018 while delivering the judgement upholding the Aadhaar Act stated that the Speaker’s decision will be subject to judicial scrutiny.

- His decision in this regard cannot be questioned in any court of law or in either the House of Parliament or even the president.

- When a money bill is transmitted to the Rajya Sabha for recommendation and presented to the president for assent, the Speaker endorses it as a money bill.

-

Rajya Sabha:

-

- Money bills cannot be amended or rejected by the Rajya Sabha.

- Rajya Sabha should return the bill with or without recommendations, which may be accepted or rejected by the Lok Sabha.

- It can be detained by the Rajya Sabha for a maximum period of 14 days only.

- President: It can be rejected or approved but cannot be returned for reconsideration by him.

- Joint Sitting: No provision of joint sitting of both the Houses.

Significance of Money Bills

-

Deals With Financial Matters:

-

- They are specifically designed to address financial matters such as taxation, government expenditure, and related financial issues.

- Crucial for the effective functioning of the government and the implementation of its budgetary proposals.

-

- The passage of Money Bills is considered a de facto vote of confidence in the government.

- Its defeat in the Lok Sabha leads to the government’s resignation.

- The Lok Sabha can convey its dissatisfaction with the government by refusing to pass a Money Bill, indicating a lack of confidence.

-

Constitutional Safeguard:

- The Constitution provides broad guidelines regarding what constitutes a Money Bill.

- This ensures that it pertains exclusively to financial matters.

- It prevents the misuse of Money Bills for non-financial legislation.

-

Time-Bound Process:

- Money Bills must be disposed of within a specific time frame.

- Prevents unnecessary delays in financial decision-making.

- Ensures the government can efficiently carry out its financial responsibilities without prolonged legislative debates.

Issue With Respect to Money Bill

-

Alleged Misuse of Money Bill Route:

-

Limits Rajya Sabha’s Role in Lawmaking:

-

- A money bill can be introduced only in the Lok Sabha.

- The Rajya Sabha cannot amend a money bill passed by the Lok Sabha and can only make recommendations that the Lok Sabha can accept or reject.

- Money bill route bypasses the Rajya Sabha’s scrutiny, neglecting valuable input.

- It can lead to parliamentary oversight without scrutiny from the Rajya Sabha.

-

Anything can be passed as a Money Bill:

-

- Arguing that the main provisions align with the scope of Article 110 and passing other provisions under the garb of Money Bill will lead to the passing of any bill as a Money Bill.

-

- Money Bills provide a fast-tracked option for the enactment of laws by Parliament.

Cases Were Challenged Related Money Bill In the Supreme Court

-

Aadhaar Act, 2016: Legality of Aadhar Act as a Money Bill

- The Supreme Court upheld the constitutionality of the Aadhaar Act, 2016, by a 4:1 majority stating that no illegality was committed by passing the Aadhaar Bill as a Money Bill in the Parliament.

- Government argued that legislation aimed at extending benefits in the nature of aid, grant, or subsidy to the marginalised sections of society with the support of the Consolidated Fund of India.

- Hence, the Act fell within the ambit of Article 110 and was validly passed as a Money Bill.

-

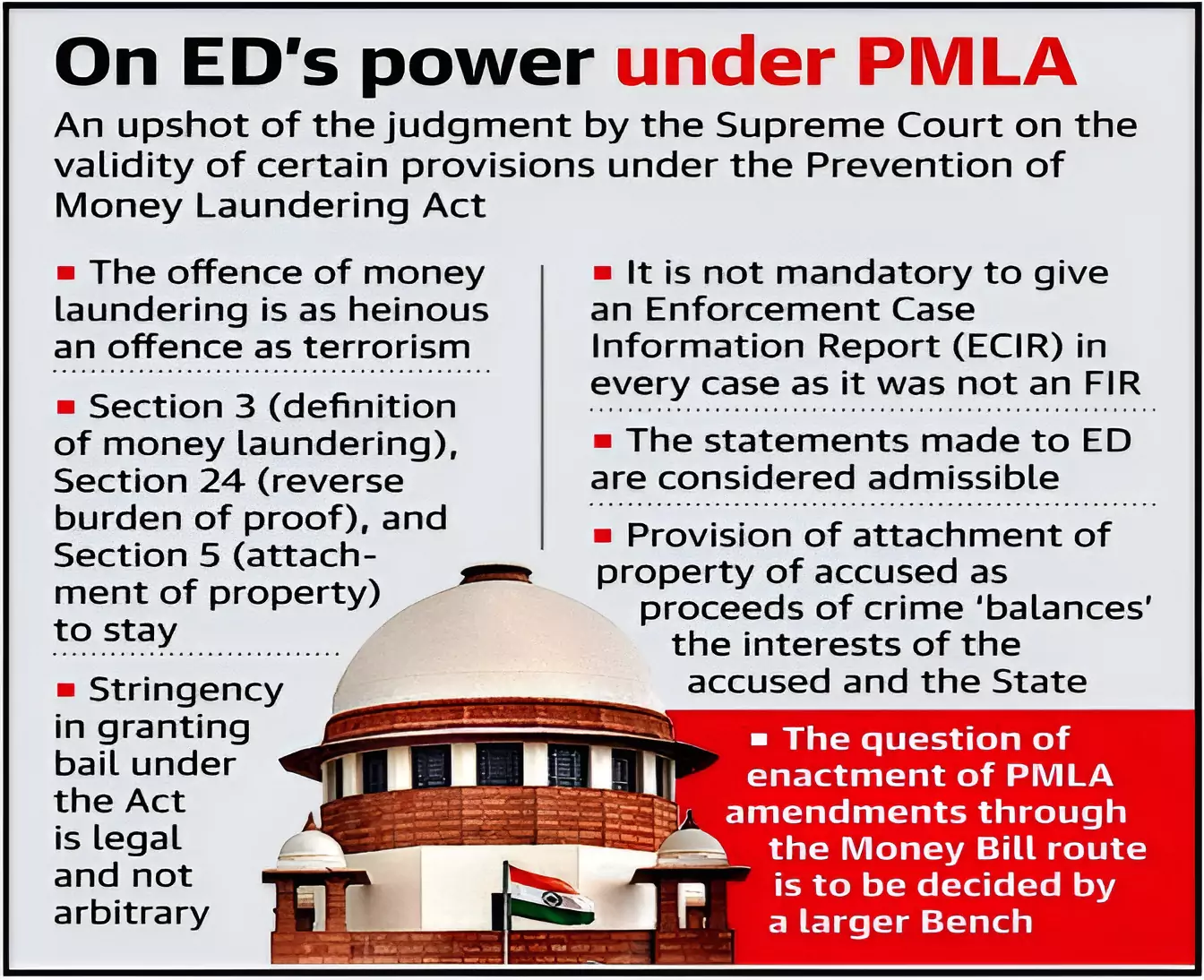

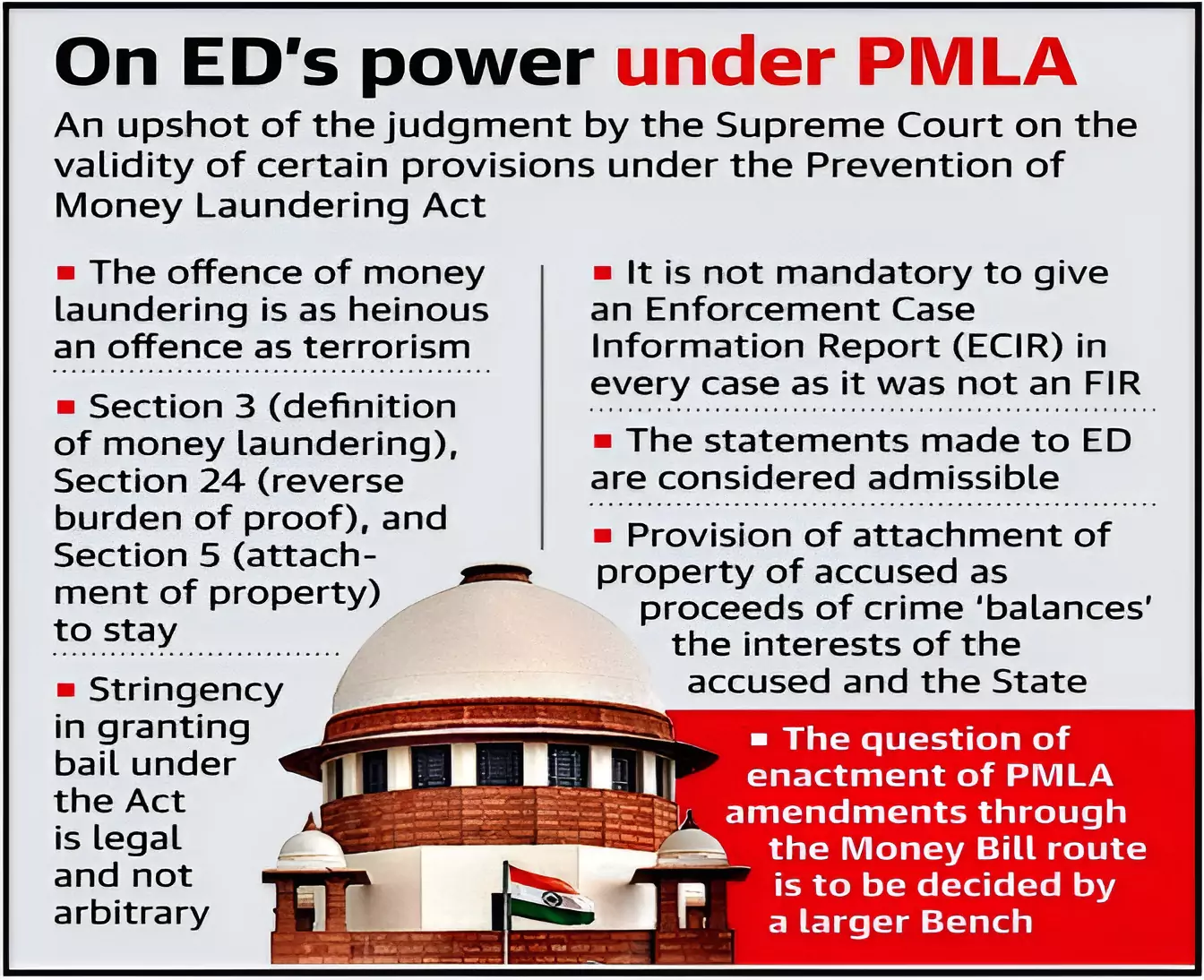

Prevention of Money Laundering Act (PMLA) Amendments:

- The Finance Acts passed in 2015, 2016, 2018 and 2019, brought in crucial amendments to the PMLA.

- Finance Bills passed during the budget are introduced as money bills under Article 110 of the Constitution.

- These amendments granted the Enforcement Directorate extensive powers, including the authority to make arrests and conduct raids.

- The Court upheld the PMLA and the vast powers of the ED.

- However, the bench had left the validity of amendments to the PMLA through the Money Bill route open for a larger Constitution bench to hear.

-

Tribunal Reform:

- In Roger Matthew Vs Union of India, the Supreme Court heard the challenge against tweaks in the service conditions of tribunal members which was also introduced as a money bill in the Finance Act, 2017.

- The government argued that since salaries of members of Tribunals flow from the Consolidated Fund of India, the amendments were introduced as a Money Bill.

- A five-judge bench of the Supreme Court struck down the Appellate Tribunal Rules of 2017 as unconstitutional.

- The Supreme Court pointed out that the Money Bill issue in the Puttaswamy judgement was ‘not convincingly reasoned’ and could lead to a potential conflict in interpretation.

- The Bench asked for the question to be put before a larger bench of the Supreme Court since it was similar in strength to the Puttaswamy Bench.

- Finance Act, 2017: To prepare the ground for the Electoral Bonds Scheme, The Finance Act, 2017 changed provisions of India’s election law, the Companies Act, and the Income-tax law.

Government’s Stance on Money Bill

- The government asserts that while determining the classification of a Bill as a Money Bill, the Supreme Court should assess whether its primary provisions align with the scope of Article 110(1)(a) to (f).

- Extra provisions, even if not strictly related, can take on the main characteristics and be passed alongside the Money Bill.

- So, all the provisions should be viewed together, avoiding a step-by-step analysis.

Conclusion

The Supreme Court should clarify the constituents of the money bill for the legislative efficiency and proper functioning of the democracy.

Also Read: Interim Budget 2024-2025: A Comprehensive Analysis

| Prelims PYQ (2023):

With reference to Finance Bill and Money Bill in the Indian Parliament consider the following statements:

1. When the Lok Sabha transmits Finance Bill to the Rajya Sabha, it can amend or reject the Bill.

2. When the Lok Sabha transmits Money Bill to the Rajya Sabha, it cannot amend or reject the Bill, it can only make recommendations.

3. In the case of disagreement between the Lok Sabha and the Rajya Sabha, there is no joint sitting for Money Bill, but a joint sitting becomes necessary for Finance Bill.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

Ans: (a) |

![]() 22 Feb 2024

22 Feb 2024