Recently, NITI Aayog announced that the government has monetised assets worth Rs 3.85 lakh crore in the first three years of the National Monetisation Pipeline (2021-22 to 2024-25).

Govt monetised assets worth Rs 3.85 lakh crore under National Monetisation Pipeline in three years

- In the first two years (2021-22 and 2022-23), the NMP targeted Rs. 2.5 lakh crore and achieved approximately Rs. 2.30 lakh crore.

- In 2023-24, with a target of Rs. 1.8 lakh crore, the achievement was about Rs. 1.56 lakh crore, marking a 159% increase over the achievement in 2021-22.

- In 2023-24, all ministries attained 70% of their monetization targets, with the Ministry of Road Transport and Highways and the Ministry of Coal leading the way, achieving a total of Rs. 97,000 crore.

Asset Monetisation

- About: Asset monetization involves making public infrastructure available to the private sector or institutional investors through structured vehicles and mechanisms.

- This approach differs from ‘privatisation’ or ‘structured partnerships’ with the private sector, as it operates within defined contractual frameworks.

- Origin: In India, the idea of asset monetisation was first suggested by a committee led by economist Vijay Kelkar in 20121 on the roadmap for fiscal consolidation.

- The committee had recommended that the government should start monetisation to raise resources for further development and financing infrastructure needs.

- Objectives: Unlocking value from public investment in infrastructure.

- Leveraging private sector efficiencies.

- Generating new revenue sources by unlocking the value of previously unutilized or underutilised public assets.

- Unlocking Idle Capital: This involves the temporary transfer of Brownfield Infrastructure Assets (where investments have already been made but the assets are underutilised, languishing, or not fully monetized) to unlock “idle” capital.

- Alignment: The Union Budget 2021-22 identified Asset Monetization as one of the three key pillars for boosting sustainable infrastructure financing in the country.

- Consequently, the National Monetisation Pipeline (NMP) has been aligned with the National Infrastructure Pipeline (NIP) announced in 2019.

Enroll now for UPSC Online Course

About National Monetisation Pipeline (NMP)

National Monetisation Pipeline was launched in 2021 to finance the National Infrastructure Pipeline (NIP) by unlocking the value of underutilised or unutilized public assets.

- Objective: Developed by NITI Aayog in consultation with infrastructure ministries, the strategic objective is to unlock brownfield public sector asset value, leveraging institutional and long-term capital.

- Timeline: This monetization initiative spans four years, from FY 2021-22 to FY 2024-25, aligning with the NIP’s timeline.

- Aim: To establish a unified framework for monetizing core assets, distinct from disinvestment and the monetization of non-core assets, which are not covered under its scope.

- Core assets are integral to an entity’s business goals and are utilised for delivering infrastructure services to the public or users.

- Non-core assets typically consist of land parcels and buildings.

- The end goal is collaborative infrastructure creation through monetization, enhancing socio-economic growth and citizens’ quality of life.

Streamlining: To streamline operations, the monetization of non-core assets such as land, real estate, and infrastructure is being shifted from the Department of Investment and Public Asset Management (DIPAM) to the Department of Public Enterprises (DPE) under the Ministry of Finance.

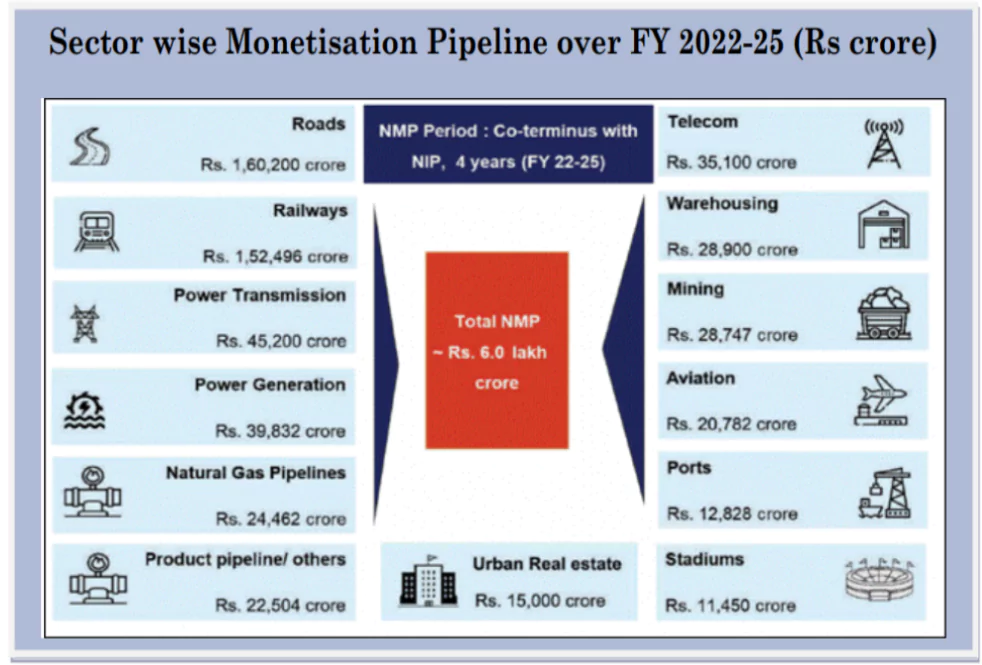

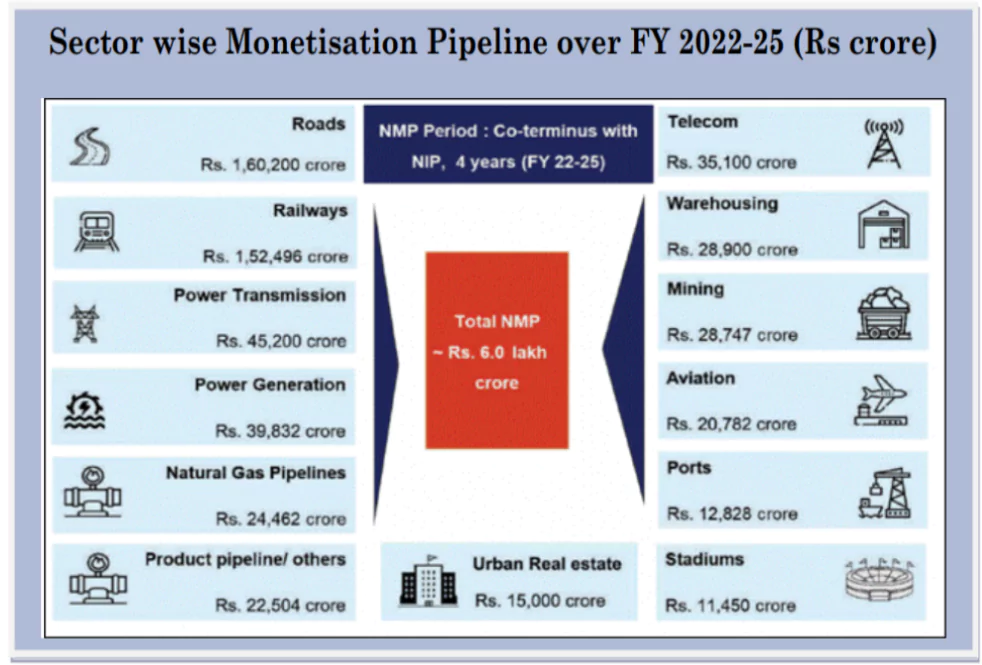

Streamlining: To streamline operations, the monetization of non-core assets such as land, real estate, and infrastructure is being shifted from the Department of Investment and Public Asset Management (DIPAM) to the Department of Public Enterprises (DPE) under the Ministry of Finance.- Features: Key features of the NMP include estimating a monetization potential of ` 6.0 lakh crores from core assets of the Central Government and Central Public Sector Enterprises.

- Coverage: Sectors covered under NMP comprise roads, ports, airports, railways, warehousing, gas & product pipelines, power generation and transmission, mining, telecom, stadiums, hospitality, and housing.

- Funding: Around 14% of the Central Government’s National Infrastructure Pipeline outlay will be funded through NMP, amounting to ` 43 lakh crores.

- Monetization Modalities: The monetization modality involves structured contractual agreements (PPP agreements/concessions) and the use of Infrastructure Investment Trusts (InvITs), with assets reverting to the government at the contract’s end.

- Core Asset Monetization Framework:

- Non-ownership Monetization: Emphasizes monetizing rights rather than ownership, requiring assets to be returned at the end of the transaction life.

- Brownfield Assets with Stable Revenue: Focuses on de-risked assets with stable revenue streams that are crucial for infrastructure.

- Structured Partnerships and Transparent Bidding: Involves structured partnerships within clear contractual frameworks and transparent competitive bidding processes. Contractual partners must adhere to Key Performance Indicators (KPIs) and performance standards.

Types of projects

- Greenfield Project: Investment in manufacturing, office, or other physical company-related structures in an area lacking previous facilities.

- Brownfield Project: Projects involving modified or upgraded existing facilities are referred to as brownfield projects.

|

Significance of National Monetisation Pipeline

- Resource Mobilization: Asset monetisation is critical to attract the required quantum of capital into the infrastructure sector.

- Fiscal Prudence: The revenue accrued by leasing out these assets will help fund new capital expenditure without pressuring government finances.

- Mobilizing Private Capital: Resource and capital efficiencies of the private sector along with the ability to dynamically adapt to the evolving global and economic reality will foster value creation in Infrastructure.

- Resource Efficiency: Through optimum utilization of government assets.

- Investment Avenues: Creates an enabling environment for participation of long-term institutional investors in infrastructure asset management.

- Cooperative Federalism: To encourage states to pursue monetisation, the Central government has already set aside R$5,000 crore as incentive.

- Promoting Public-Private Partnership: Collaboration of the public and private sector, each excelling in their core areas of competence, helps in delivering socio economic growth and quality of life to the country’s citizens.

- Integration: NMP aligns with PM Gati Shakti to enhance India’s infrastructure comprehensively, while leveraging existing assets to raise funds for new projects.

Check Out UPSC CSE Books From PW Store

![]() 21 Jun 2024

21 Jun 2024

Streamlining: To streamline operations, the monetization of non-core assets such as land, real estate, and infrastructure is being shifted from the Department of Investment and Public Asset Management (DIPAM) to the Department of Public Enterprises (DPE) under the Ministry of Finance.

Streamlining: To streamline operations, the monetization of non-core assets such as land, real estate, and infrastructure is being shifted from the Department of Investment and Public Asset Management (DIPAM) to the Department of Public Enterprises (DPE) under the Ministry of Finance.