![]() 23 Jan 2024

23 Jan 2024

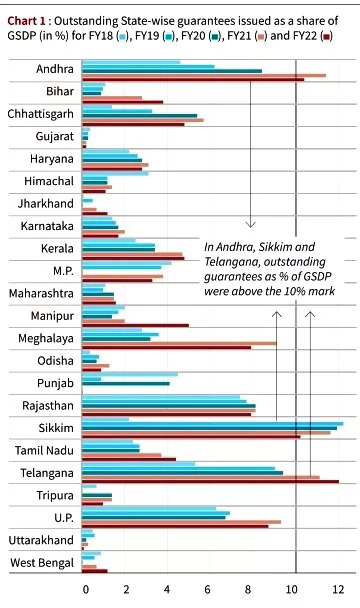

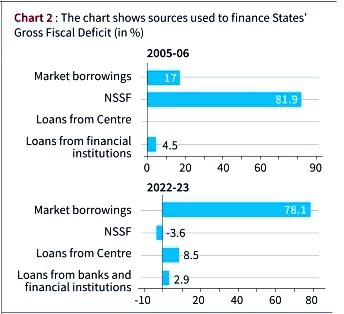

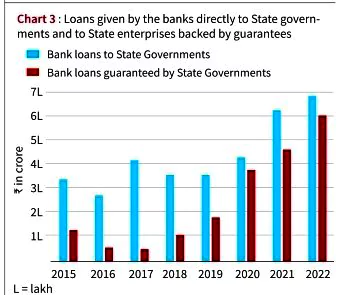

Recently, RBI’ report of the Working Group on State Government Guarantees has been published.

News Source: The Hindu

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>