Context:

- The Prime Minister recently remarked that state-provided freebies may yield political results in the short term, but it will lead to a great social and economic price in the long term with the poor paying a heavy price.

More about the news:

- Webinar against freebies: A webinar titled ‘Freebies Culture and its Impact on Indian Politics & Democracy’ was organised by the Association for Democratic Reforms (ADR) in view of a public interest litigation (PIL) challenging freebies.

National Pension System (NPS) vs Old Pension System (OPS):

- Under the OPS:Retired government employees get 50% of their last-drawn salary as a monthly pension.The amount keeps rising with hikes in the dearness allowance rates.

- In contrast, NPS is a defined contribution scheme wherein the subscriber contributes to his account, there is no defined benefit that would be available at the time of exit from the system

|

-

- ADR is a non-partisan, non-governmental organization that aims to improve governance and strengthen democracy in the area of electoral and political reforms.

- OPS as a populist move: The choice of certain states to revert to the old pension scheme (OPS) has been criticised as a populist measure to attract government employees.

- Five states – Rajasthan, Chhattisgarh, Jharkhand, Punjab and Himachal Pradesh have decided to go back to the OPS.

- Rise of Populist policies: Political parties in states preparing for assembly elections have begun pledging freebies, which include cash transfers and supplementary income initiatives.

- Assembly elections are scheduled to be held in Telangana, Rajasthan, Madhya Pradesh, Chhattisgarh, and Mizoram in late November and early December.

Freebies:

- The Reserve Bank of India (RBI) in a bulletin in June 2022 defined ‘freebies’ as “a public welfare measure that is provided free of charge.

- It includes provisions like free electricity, water, public transportation, the waiver of outstanding utility bills, and farm loan waivers.

Welfare Measures:

- It is a public policy intervention deriving sanctity from directive principles of the Constitution having long-term impacts on production and productivity.

- Welfare schemes like mid-day meals, PDS, MGNREGA, health insurance schemes have played a crucial role in the improvement of lives of both the rural and urban poor in the country

Difference between freebies and welfare measures:

| Welfare Measures |

Freebies |

- These are essential for maintaining the basic dignity of life-healthcare, education, social protection.

- These are crucial for accelerating human development and in turn contribute to the country’s growth.

|

- The mass distribution of non-merit goods can drain government revenue.

- They undermine the credit culture, distort pricing through cross-subsidization, and reduce incentives for work at prevailing wage rates.

|

| Example: Public distribution system, State support for education and health |

Example: Distribution of laptops, two-wheelers, etc. |

Concerns associated with excessive use of freebies:

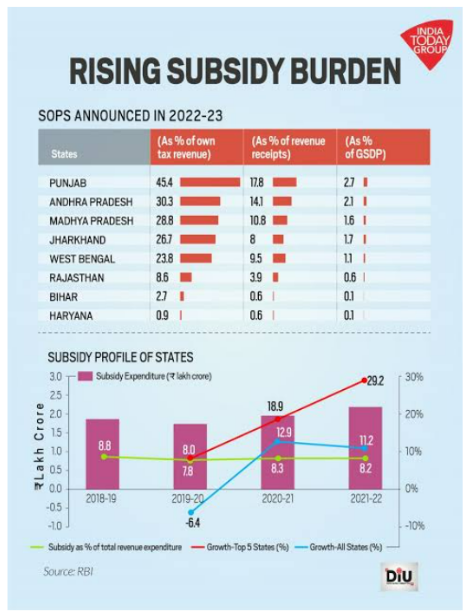

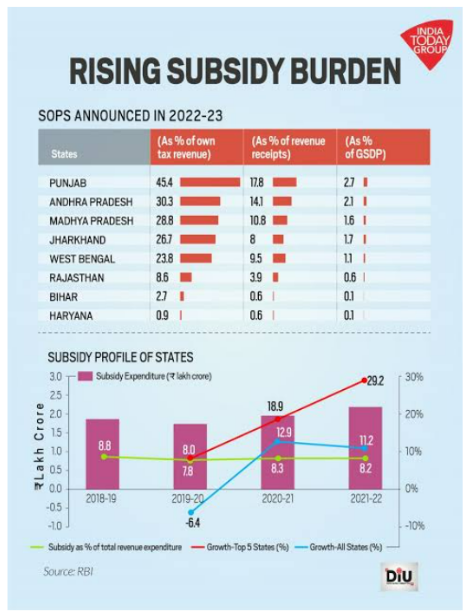

- Heavy Tax Burden on States: Many states are burdened with substantial debts, limiting their capacity to invest in more significant welfare programs.

- Punjab’s electricity subsidy constitutes over 16 percent of its total revenues.

State Finance: A Risk Analysis’, a report released by the RBI in June 2022, stated that the slowdown in state revenues and increasing subsidy burden have added to the state government’s debt.

State Finance: A Risk Analysis’, a report released by the RBI in June 2022, stated that the slowdown in state revenues and increasing subsidy burden have added to the state government’s debt. - New sources of risks have emerged in the form of rising expenditure on non-merit freebies, expanding contingent liabilities, and the ballooning overdue of DISCOMs.

- Against Constitutional Principles: Making promises when the states lack money to guarantee fundamental rights and implement directive principles is against constitutional principles.

- Shrinkage of fiscal space: The subsidy burden needs to be to be funded through debt, which will result in mounting deficits.

- It will lead to breach of Fiscal Responsibility and Budget Management (FRBM) rules and the states ending up in a debt trap.

- The report also reveals that the debt-GSDP ratio is the highest in Punjab, Rajasthan, Kerala, West Bengal, Bihar, Andhra Pradesh, Jharkhand, Madhya Pradesh, Uttar Pradesh, and Haryana.

- Debt-to-gross state domestic product ratio(Debt-GSDP): It is a measure of how much the liabilities are as a proportion of the size of the state’s economy.

- Violation of the principle of a level-playing field: Freebies gives the political parties undue advantage by making promises to provide private goods for only a section of voters.

- For instance, promising cycles for girl students or laptops for college students, or grinders for housewives, etc.

- Opportunity Cost: States offering loan waivers often have to cut spending on crucial infrastructure such as roadways development and skill development.

- Social Impact: Despite receiving more resources, the RBI’s study reveals a decline in social sector spending by states, particularly in vital areas like health and education.

- The share of subsidies in the total revenue expenditure of states has increased from 7.8 per cent in 2019-20 to 8.2 per cent in 2021-22.

- States like Punjab and Chhattisgarh are on top as they spend 10 percent of their revenue expenditure on subsidies.

- Environmental concerns: States offer free electricity to farmers, leading to overuse of groundwater and the continuation of traditional crop patterns.

- In Punjab and Haryana, the ground water extraction stands at 161 % and 134 % against the national average of 61 % due to highly subsidised electricity.

Role of ECI:

- Article 324 of the Constitution empowers the Election Commission of India (ECI)to oversee free and fair elections.

- It possesses the authority to suspend or withdraw the recognition of a recognized political party in cases of non-compliance with the Model Code of Conduct (MCC).

- EC does not have power to deregister a political party, except on three grounds, which were outlined by the top court in case of Indian National Congress Vs Institute of Social Welfare and others (2002).

- The grounds are : registration obtained on fraud and forgery, party ceased to have faith and allegiance to the Constitution, and any other alike ground.

|

Challenges in curtailing Freebie Culture:

- Lack of regulatory powers with ECI: The Election Commission of India (ECI) has stated that it lacks the authority to regulate or penalize political parties for making electoral promises.

- According to the ECI, the offering or distribution of freebies, either before or after an election, falls under the jurisdiction of the respective party.

- No assessment of financial viability of populist policies: Political parties often fail to clarify the funding sources for the promises made in the form of freebies.

- Lack of Information to the Voters: They don’t delve into the financial aspects of freebies, prompting political parties to compete for promising freebies.

Supreme Court response on Freebies:

- The Supreme Court Bench in a recent judgment proposed the constitution of an apex body, to address the issue of freebies and poll promises.

- It will comprise several stakeholders like the Niti Aayog, Law Commission, Finance Commission, Reserve Bank of India and members of ruling party and opposition parties,

- The reference is a shift from the court’s own stand in the S. Subramaniam Balaji vs Tamil Nadu judgment of 2013.

S. Subramaniam Balaji vs Tamil Nadu judgment of 2013.

- The court had held that making promises in election manifestos does not amount to a ‘corrupt practice’ under Section 123 of the Representation of People Act (RP).

|

Way Forward:

- Responsibility of voters: Voters need to be vigilant and inquire about the financial implications of the populist policies.

- Empowering the ECI with greater authority: Statutory provisions as a backup or warnings on the use of funds are needed.

Model Manifesto: The ECI needs to prepare a Model Manifesto to be followed by all political parties.

Model Manifesto: The ECI needs to prepare a Model Manifesto to be followed by all political parties.

- ECI could bring in certain measures under the MCC to introduce a responsible way of making promises to the public.

- Voters need to decide whether an election campaign is credible and whether the promises and the freebies are in their interest.

- Fixing limit of welfare schemes: Fixing spending of 1% of GSDP or 1% of state own tax collections or state revenue expenditure would help to implement welfare schemes properly.

- Distinction between freebies and welfare measures: There has to be a distinction between the offer of ornaments, television sets, consumer electronics free of cost and real welfarist offers.

- Tracking social sector budgetary allocations: Prioritizing higher resource allocation to welfare schemes is needed.

- India’s spending on health and education, at 4.7%, lags behind that of other developing countries, such as sub-Saharan Africa, which spends 7%.

- Role of Finance Commission: It should consider the state’s debt burden during state allocations, and assess whether the state’s economy can sustain the financial impact of freebies over the long term.

- A committee should be formed comprising constitutional bodies, such as the Law Commission of India, to put down a proposal on how to deal with the issue.

News Source: Business Standard

![]() 11 Sep 2023

11 Sep 2023

State Finance: A Risk Analysis’, a report released by the RBI in June 2022, stated that the slowdown in state revenues and increasing subsidy burden have added to the state government’s debt.

State Finance: A Risk Analysis’, a report released by the RBI in June 2022, stated that the slowdown in state revenues and increasing subsidy burden have added to the state government’s debt.  Model Manifesto: The ECI needs to prepare a Model Manifesto to be followed by all political parties.

Model Manifesto: The ECI needs to prepare a Model Manifesto to be followed by all political parties.