![]() 10 Feb 2024

10 Feb 2024

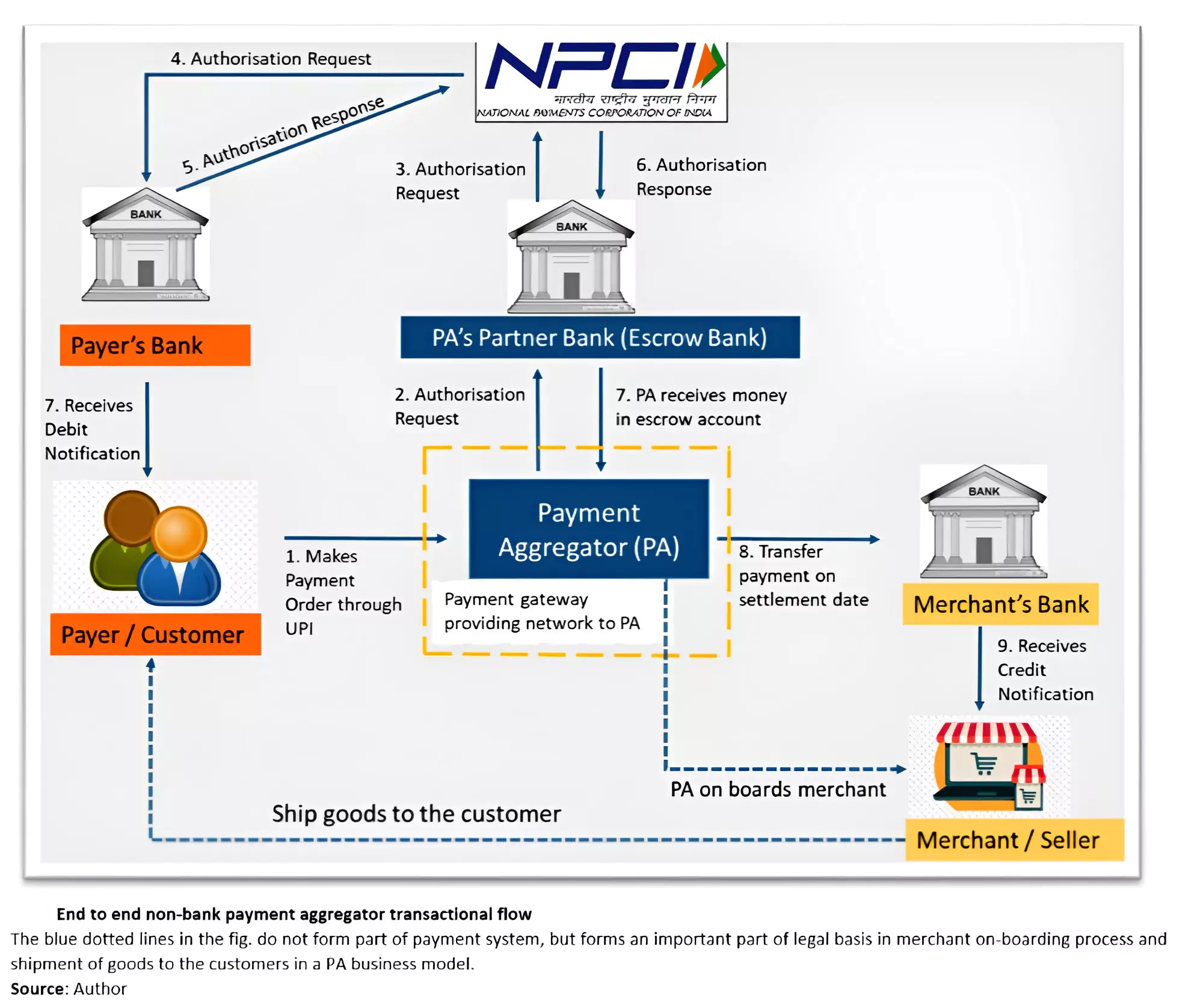

Several Startups have recently obtained regulatory approval from RBI to operate as payment aggregators.

News Source : Business Standard

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>