Context

Madhabi Puri Buch, Chairperson of the Securities & Exchange Board of India (SEBI), stated that Real Estate Investment Trusts (REITs), Infrastructure Investment Trusts (INVITs), and Municipal Bonds are promising investment areas.

Understanding REITs, INVITs, and Muni Bonds: Opportunities in Real Estate and Infrastructure Investment

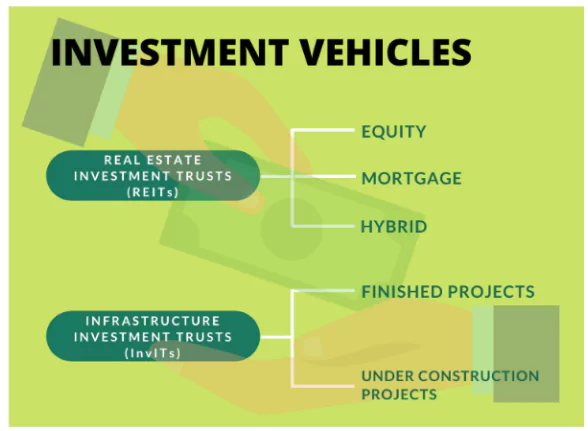

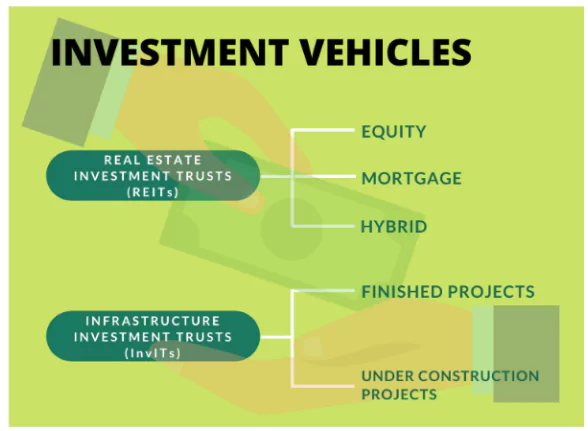

- REITs: These are companies that own and operate in income generating real estate.

- InvITs are similar to mutual funds. It permits developers to generate income from infrastructure assets.

- Both Reits and Invits offer investors the opportunity to invest in these assets without direct ownership.

- Muni Bonds: A municipal bond, also known as a muni bond, is a form of debt security issued by municipal corporations or related entities in India.

The Significance of REITs, INVITs, and Muni Bonds: Features, Benefits, and Examples

| Features |

REITs |

InviTs |

| Assets Type |

It is real estate properties |

It is infrastructure asset |

| Investment |

Investments are done on income generating real estate properties. |

Investments are done on operational infrastructure assets. |

| Risk |

This investment is less risky |

This investment has moderate to high risk |

| Generation of Income |

Properties Are leased and then Rents are collected on it. |

Small investment on infrastructure generates return in the form of dividends at the end. |

| Example |

Healthpeak Properties (PEAK): It develops real estate for healthcare discovery and delivery. |

Road, power generators, airports are examples of InviTs |

These assets are backed by governance elements and the disclosure elements which provide comfort and confidence to retail investors

REITs

- Lower Risk: Investors can participate in real estate without taking high levels of risk associated with direct investments.

- Liquidity and Market Performance: REITs are publicly traded just like stocks which makes it more liquid.

- Diversification of risk; REITs invest in various types of real estate such as apartment buildings, hospitals, shopping centers, hotels and commercials.

-

- Diversification of investment helps in reducing risks across different sectors.

Benefits and Advantages of INVITs for Investors and Developers:

- Lower Risk: Investors can participate in infrastructure projects without taking high levels of risk associated with direct investments.

- Reduced Capital Requirement: Investors can enter these sectors without significant capital typically required for direct investments.

- Easy Fundraising: Developers can easily raise funds through REITs and InvITs, particularly helpful for securing last-minute funding or when banks are cautious about lending.

- Asset Monetization: Developers can monetize a portion or the entirety of their projects through REITs and InvITs, helping to reduce assets on their balance sheets and enabling them to take on new projects.

Exploring the Benefits of Muni Bonds:

- Transparency: Renowned agencies like CRISIL rate the bonds issued to the public, providing investors with clear information about how reliable the investment is.

- Tax Benefits: In India, municipal bonds don’t have taxes if investors follow specific rules. Also, the interest earned from these bonds is not taxed.

- Minimal Risk: These bonds are issued by municipal authorities, which means they carry minimal risk for investors.

Challenges and Risks of REITs and INVITs and Muni Bonds

- REITs: REITs are influenced by shifts in the market, which in turn can affect stock prices.

- Economic downturns or changes in the real estate market can also affect how well REITs perform.

- INVITs: INVITs invest money into projects like building roads, power plants, and pipelines.

- These investment risks can include delays in construction, changes in regulations, and difficulties in running the projects due to shortage of funds. .

- Muni Bonds:

- Credit Risk: Municipal bonds provide investors with regular interest payments; however, there exists a slight risk of default if governments encounter financial challenges.

- Liquidity Risk: Municipal bonds may exhibit limited liquidity in the secondary market, potentially posing challenges for investors looking to buy or sell these bonds quickly.

Conclusion

Overall, REITs, InvITs, and Municipal Bonds present appealing growth prospects owing to their stable income, potential for asset value appreciation, tax advantages, and role in infrastructure development.

These are valuable assets in diversified investment portfolios for the Indian economy.

News Source: Thehindu

![]() 14 Mar 2024

14 Mar 2024