It has been seven years since the introduction of the goods and services tax (GST) on July 1, 2017.

- GST was introduced by aiming to unify an array of traditional state and central indirect taxes under a single umbrella system.

53rd GST Council Met

- Recently, the 53rd Goods and Services Tax (GST) Council met and approved several measures to ease compliance for small businesses, railway services etc. and also agreed to reconvene in August 2024 to discuss restructuring the multiple tax rates under the seven-year GST.

Enroll now for UPSC Online Course

About the Goods and Services Tax (GST)

Goods and Services Tax (GST) is one of the biggest economic and taxation reforms undertaken in India.

- Aim: To streamline the taxation structure in the country and replace a gamut of indirect taxes with a singular GST to simplify the taxation procedure.

- Refers: GST is essentially a consumption tax and is levied at the final consumption point. The principle used in GST taxation is the Destination Principle.

- It is levied on the value addition and provides set offs.

- It avoids the cascading effect or tax on tax which increases the tax burden on the end consumer.

- It is collected on goods and services at each point of sale in the supply line.

- Slabs for Tax Collection: 0%, 5%, 12%, 18%, and 28%

- Background and Evolution of GST in India:

- Proposed by: The idea of a nationwide GST in India was first proposed by the Kelkar Task Force on Indirect taxes in 2000.

- Introduction in the Parliament: After years of deliberation and negotiations between the Central and State Governments, the Constitution (122nd Amendment) Bill, 2014, was introduced in the Parliament to do away with multiple indirect taxes and to have a ‘One Nation One Tax’ system.

- Passed in the Parliament: The Constitution (122nd Amendment) Bill was passed as the Constitution (101st Amendment) Act in 2016 and the GST was introduced and enforced across the country on 1st July 2017.

Establishment of GST Council: The 2016 Constitutional amendment creates a GST Council consisting of the Union Finance Minister and representatives from all states to implement GST.

Establishment of GST Council: The 2016 Constitutional amendment creates a GST Council consisting of the Union Finance Minister and representatives from all states to implement GST.

- For assisting the GST Council, the office of the GST Council Secretariat was also established.

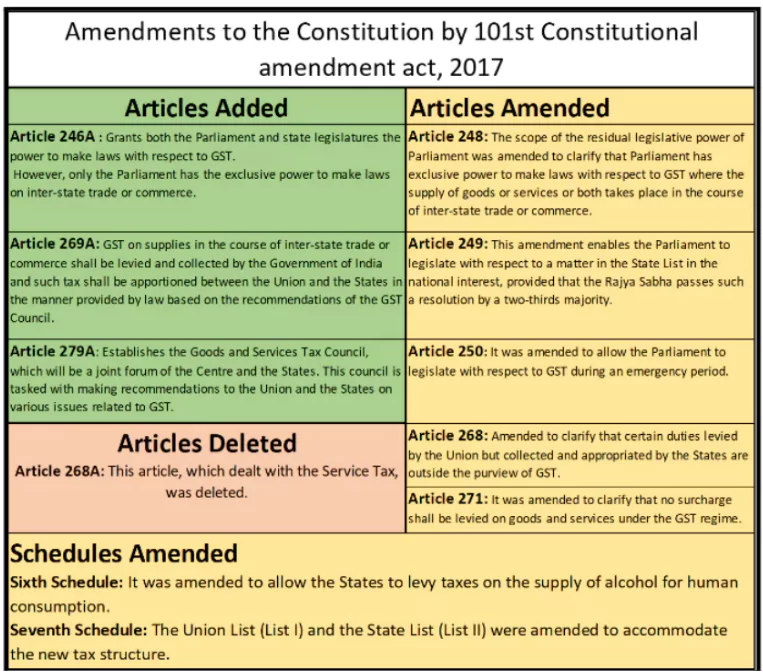

Constitutional Framework for Goods and Services Tax (GST)

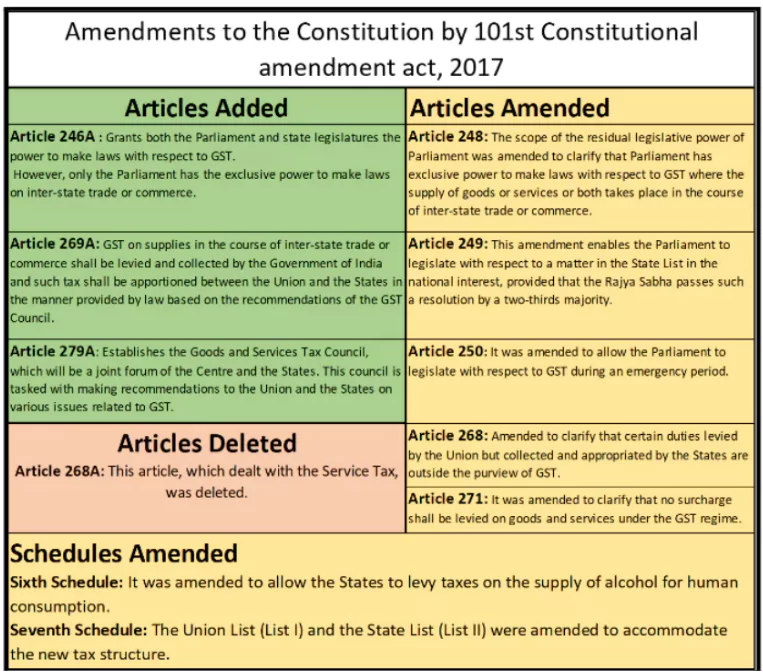

101st Constitution Amendment Act: The Goods and Services Tax bill was passed in India in 2016.

- Article 246A: Both the Parliament and the State Legislatures will have concurrent powers to make laws related to GST.

- However, the Parliament will retain exclusive power to legislate in the case of inter-state trade of goods and services.

- Article 269A: In the case of inter-state trade where GST is levied and collected by the Union Government, the tax revenue proceeds to be apportioned by the Centre between the centre and states in a manner as may be provided by the Parliament by law on the recommendations of the GST Council.

- Article 279A: It empowers the President of India to constitute the GST Council and defines its composition and functioning.

Need of Goods and Services Tax (GST) in India

The implementation of Goods and Services Tax (GST) has brought about a fundamental shift based on the principles of value-added tax and applies to the supply of goods and services across the nation. It brought uniformity in the tax structure across India, eliminating the cascading effect of taxes.

- Input Tax Credit: This set-off system has been the fabric of GST, a far cry from the erstwhile tax regime that led to a cascade of taxes. The GST regime has all but eliminated the cascading effect of taxes by enabling taxpayers to claim input tax credit (ITC) seamlessly.

- Robust Settlement Mechanism: A central agency is needed that can act as a clearing-house to verify the claims and inform respective governments to transfer the funds.

- Competitive Prices: GST eliminates all other taxes of an indirect nature, and this will effectively mean that the tax amount paid by end consumers will be reduced.

- And lower the prices, the more will be demand for that product, which will result in more consumption and will benefit the entities.

- Increase in Revenue: GST is easy to understand, and a simple tax structure will bring more taxpayers and in return, it will increase the revenue for the Indian government.

Achievements of Goods and Services Tax (GST) in the last 7 years

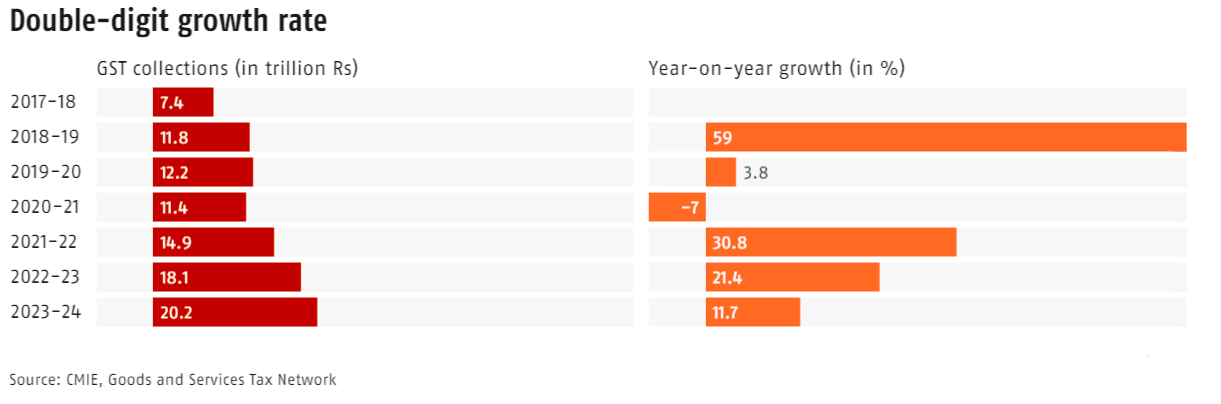

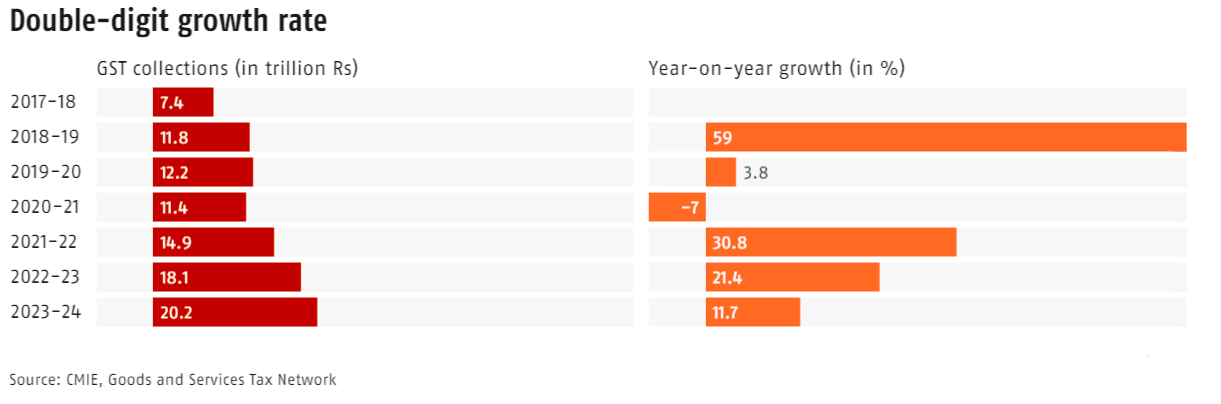

Goods and Services Tax (GST) has overhauled the indirect tax landscape leading to buoyant GST collections exceeding INR 20.14 trillion in FY 2023-24. This robust performance signifies India’s economic resilience and paves the way for the next phase of GST reforms.

- High Tax Revenue: Besides standardising most tax rates across the country, GST has delivered gains in terms of higher tax revenues.

- Monthly collections under the regime have doubled to average over Rs 1.8 lakh crore over the last three months, compared with Rs 89,884 crore in the first year of implementation.

GST revenue peaked at a record high of Rs 20.2 trillion in 2023-24 (FY24). Growth remains above 10%, although slower than before, according to data from the Centre for Monitoring Indian Economy.

GST revenue peaked at a record high of Rs 20.2 trillion in 2023-24 (FY24). Growth remains above 10%, although slower than before, according to data from the Centre for Monitoring Indian Economy.- In the latest FY24 figures, GST collections were equivalent to 3.25% of GDP, up from 3.08% in 2018-19.

- GST buoyancy declined from 1.6 in FY22 to 1.3 in FY24.

- A higher GST buoyancy indicates that GST receipts grew faster than nominal GDP.

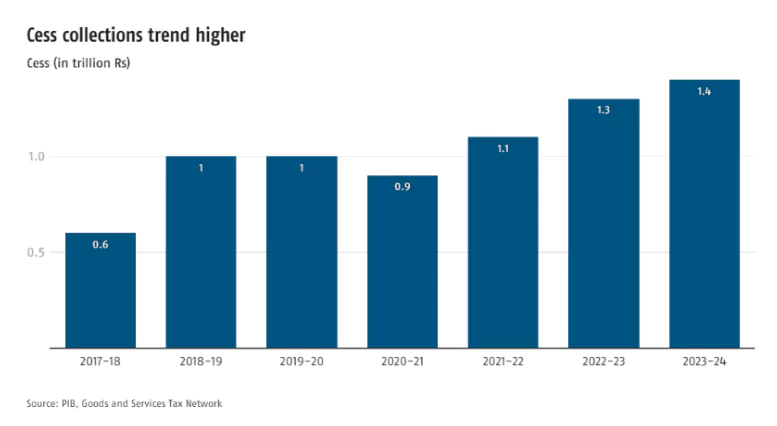

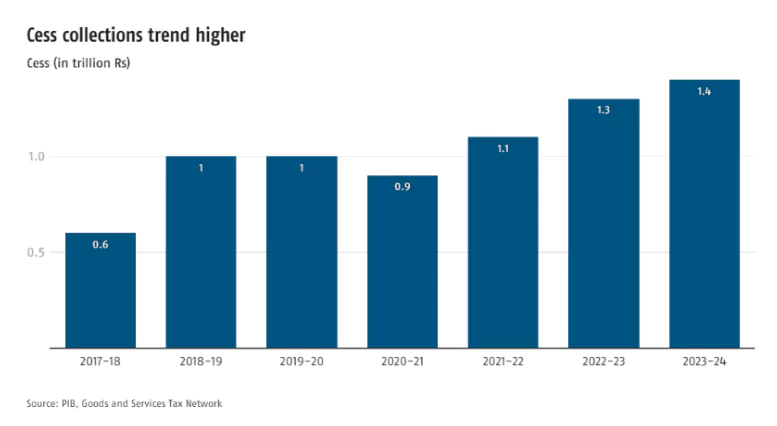

- Rising E-way Bill Generation & High Cess Collection:

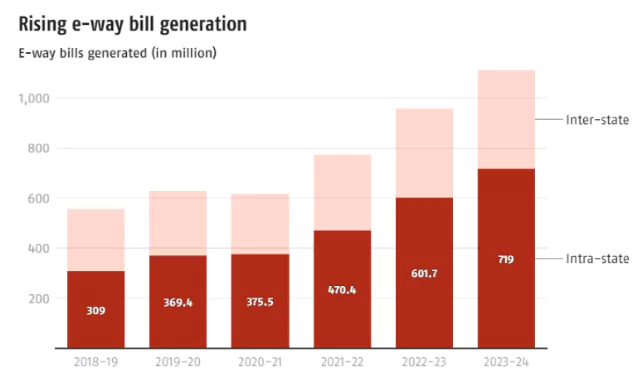

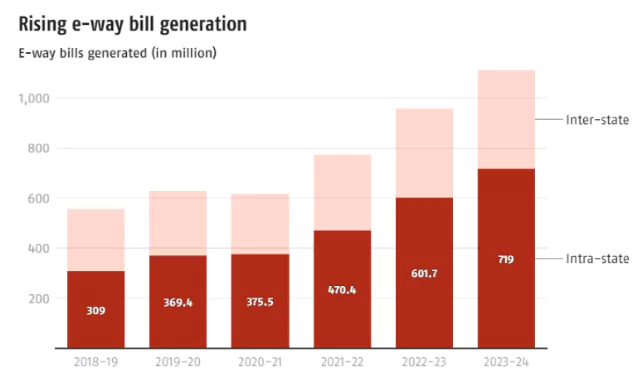

Electronic way (e-way) bills were introduced on April 1, 2018. Since then, the number of e-way bills generated has considerably increased both intrastate and interstate, with a sharper rise in intrastate transactions.

Electronic way (e-way) bills were introduced on April 1, 2018. Since then, the number of e-way bills generated has considerably increased both intrastate and interstate, with a sharper rise in intrastate transactions. - Cess collections have consistently exceeded Rs 1 trillion since 2021-22 (FY22) and continue to rise.

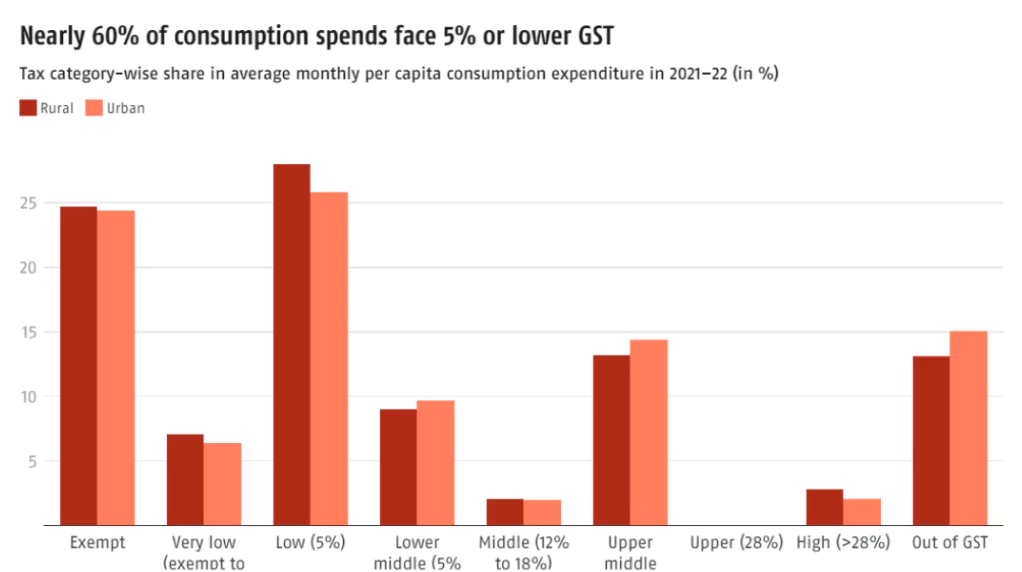

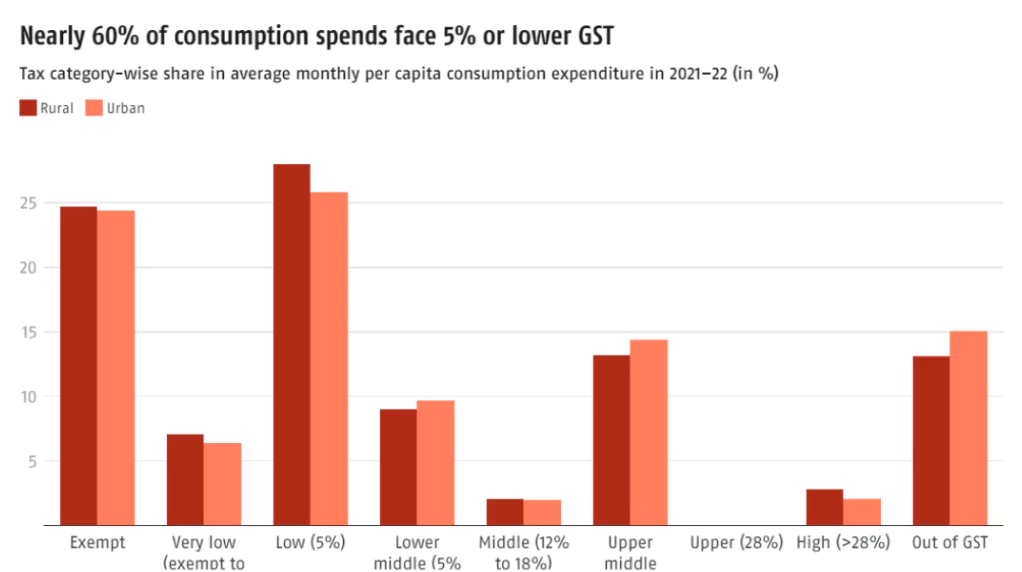

- Favourable to Consumers: A recent study suggests that most consumer items face low or no GST taxes at all.

- Less than 3% of consumption items attract the highest tax rate of 28%.

- Rise in Taxpayers: The number of registered taxpayers has risen to 1.46 crore from 65 lakh in 2017.

- Average monthly GST revenues soared from around ₹90,000 crore in 2017-18, to about ₹1.90 lakh crore in 2024-25.

Progress in Digital Infrastructure: GST has been in consonance with the clarion call for a ‘Digital India.’ The tax system is nearly fully digital, making it ready for the future.

Progress in Digital Infrastructure: GST has been in consonance with the clarion call for a ‘Digital India.’ The tax system is nearly fully digital, making it ready for the future.

- Technology was harnessed from the get go, starting with registration to all compliances and filings being done online via the GST Network (GSTN) portal.

- GSTN simplified the processes of registration, tax payments, and filing returns for taxpayers.

- Enhancement in Compliance: GSTN has made compliance easier for businesses and tax authorities, equipping them with data analytics to detect and prevent tax evasion.

- Automation of tasks such as e-waybills, e-invoicing, and monthly returns has transformed tax compliance.

- Benefits for MSMEs: Measures like quarterly returns and relaxed GSTR-9C requirements have encouraged MSMEs to register under GST, leading to an increase in the taxpayer base.

- GST has facilitated improved access to credit for MSMEs, which has accelerated their growth.

- Unified Market and Competitiveness: GST has introduced a unified system, established a common market, and eliminated tax cascading, and enhanced the competitiveness of Indian businesses.

- GST has removed entry taxes and checkpoints at state borders, this has ensured smooth movement of goods, faster transit times, and reduced logistics costs for businesses.

Check Out UPSC CSE Books From PW Store

Concerns that Need to be Taken Care Of

It cannot be said that the GST and and associated all laws are flawless, but the volume of changes reveals an intent to improvise and improve the law so that it evolves in response to shifting circumstances.

- Products Exempted from GST: Petroleum products have not been kept under the GST regime.

- Complexities: The GST law is still evolving, leading to various disputes on various issues due to unfamiliarity and divergent positions.

- Tax Frauds: Combating tax fraud remained a priority, with measures in place to ensure compliance and eliminate such fraudulent businesses.

- Litigation and Dispute Resolution: Seven years since the tax rollout, India still does not have an operational GST Appellate Tribunal (GSTAT).

- The absence of this mechanism has led to a backlog of litigation and burdened our high courts.

Digitalization: The digital matching of ITC was not operationalized in the initial years of GST, and so the shift from provisional availability to invoice-level reconciliation (Form GSTR-2A/2B) has been challenging and a difficult change for taxpayers.

Digitalization: The digital matching of ITC was not operationalized in the initial years of GST, and so the shift from provisional availability to invoice-level reconciliation (Form GSTR-2A/2B) has been challenging and a difficult change for taxpayers. -

- Unfortunately, this resulted in an avoidable avalanche of mismatch notices that forms the bulk of today’s GST-related litigation in India.

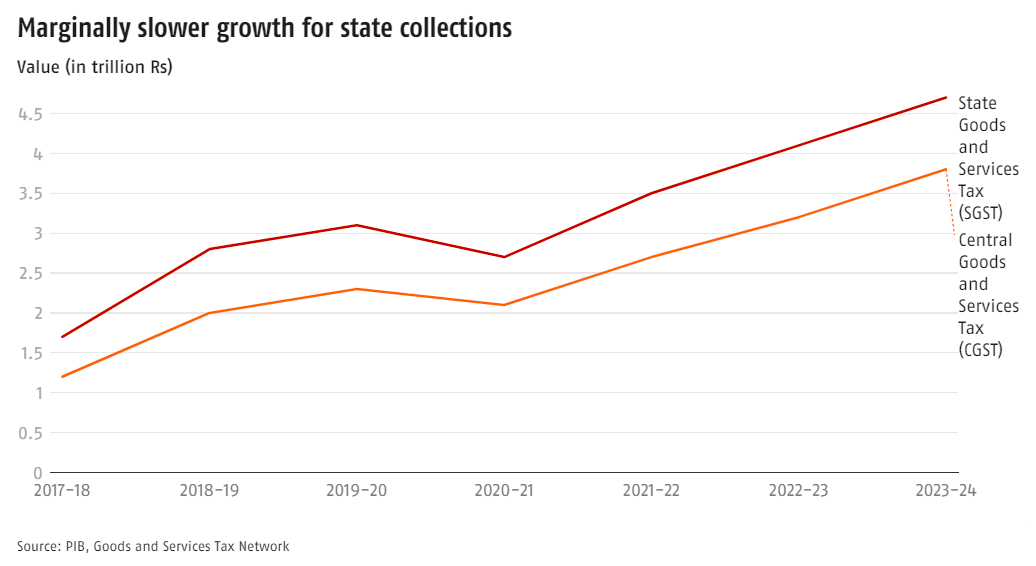

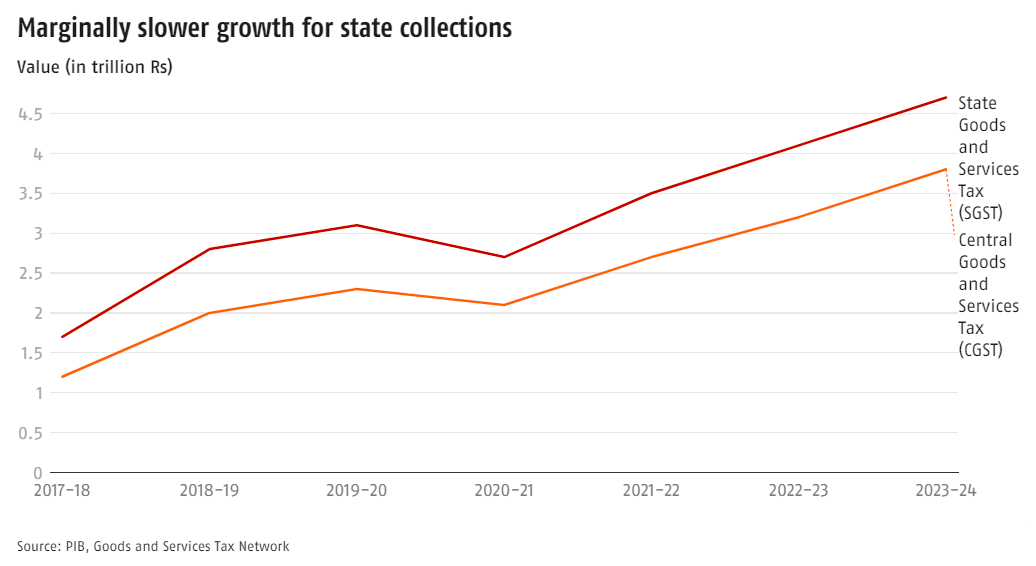

- Prevalence of Disparities on GST Collection: Both central GST (CGST) and state GST (SGST) continue to see year-on-year growth, albeit at slightly different rates. State collections have grown marginally slower than central collections.

- According to an analysis, Maharashtra, Karnataka, and Uttar Pradesh report among the highest state-wise collections. However, adjusting for population, other states perform better, indicating differing consumption patterns and spending abilities.

Way Forward

To achieve the objective of becoming a US $30-35 trillion economy by 2047, India needs to take various steps regarding Goods and Services Tax (GST).

- Establishment of a National Advance Ruling Authority: It is required as it could ensure uniform interpretation of the law across India and can reduce uncertainty and minimise disputes.

- Effective Dispute Resolution: A functional Goods and Services Tax Appellate Tribunal (GSTAT) could reduce the burden on High Courts.

- This can lead to faster and more efficient dispute resolution for businesses.

- Clarification on GST Complexities: Time has come to reintroduce FAQs associated with specific sectors and could provide clear guidance and reduce complexities.

- Clarification on taxation of online gaming activities, transactions involving cryptocurrency, etc. is also required.

- Integration of Exempted Products into GST: The need of the hour is to look at the tax base to not only bring in all commodities i.e. petroleum products, electricity, land and alcohol within the realm of GST but also look at the large number of exemptions to minimise cascading.

- Centre-State Cooperation: The time has come to look at centre-state cooperation at all levels to provide ease of doing business by reducing the multiplicity of audits, scrutiny and investigations being carried out on large corporates across the country, by setting up centralised or joint or coordinated Audits.

- Establishment of a Permanent Secretariat: To provide the much needed research and analysis on an ongoing basis to provide the structural changes and sectoral alignments on issues like inverted duties, interpretational inconsistencies, and procedural problems on a proactive basis.

- Other Actions: Some aspects of the tax credit system require a relook so as to keep a cascading effect of taxes at bay.

- The GST Council should revisit the blockage of ITC on construction-related expenditure, especially, given how the creation of infrastructure or any other immovable apparatus can generate taxable revenue.

- Actions should be taken to empower and enhance the consumption patterns and spending abilities of all states of India to achieve best of their potential.

- Retrospective application of rates/clarifications should be strictly avoided.

Enroll now for UPSC Online Classes

Conclusion

GST Council’s pro-assessee approach and GSTN’s digitised platform shows India’s commitment towards ensuring ease of doing business and this needs to continue and keep GST as ‘Good and Simple Tax’.

- It is time to develop a vision for the future of GST to provide the much-needed impetus to the business to grow to achieve the objective of becoming a US $30-35 trillion economy by 2047.

GST Council

- GST Council is a constitutional body formed under Article 279A(1), enacted by the 101st Constitutional Amendment Act.

- It is India’s largest and most successful Constitutional body till date.

- Its most of the recommendations emerged by means of a consensus among members, with voting seldom required.

- The Council has ably guided and shaped GST in India.

|

![]() 1 Jul 2024

1 Jul 2024

Establishment of GST Council: The 2016 Constitutional amendment creates a GST Council consisting of the Union Finance Minister and representatives from all states to implement GST.

Establishment of GST Council: The 2016 Constitutional amendment creates a GST Council consisting of the Union Finance Minister and representatives from all states to implement GST.

GST revenue peaked at a record high of Rs 20.2 trillion in 2023-24 (FY24). Growth remains above 10%, although slower than before, according to data from the Centre for Monitoring Indian Economy.

GST revenue peaked at a record high of Rs 20.2 trillion in 2023-24 (FY24). Growth remains above 10%, although slower than before, according to data from the Centre for Monitoring Indian Economy. Electronic way (e-way) bills were introduced on April 1, 2018. Since then, the number of e-way bills generated has considerably increased both intrastate and interstate, with a sharper rise in intrastate transactions.

Electronic way (e-way) bills were introduced on April 1, 2018. Since then, the number of e-way bills generated has considerably increased both intrastate and interstate, with a sharper rise in intrastate transactions.  Progress in Digital Infrastructure: GST has been in consonance with the clarion call for a ‘Digital India.’ The tax system is nearly fully digital, making it ready for the future.

Progress in Digital Infrastructure: GST has been in consonance with the clarion call for a ‘Digital India.’ The tax system is nearly fully digital, making it ready for the future.

Digitalization: The digital matching of ITC was not operationalized in the initial years of GST, and so the shift from provisional availability to invoice-level reconciliation (Form GSTR-2A/2B) has been challenging and a difficult change for taxpayers.

Digitalization: The digital matching of ITC was not operationalized in the initial years of GST, and so the shift from provisional availability to invoice-level reconciliation (Form GSTR-2A/2B) has been challenging and a difficult change for taxpayers.