Context: In a research paper recently published by RBI officials, they have claimed that the risk of stagflation in India has further lowered to 1%, compared to 3% in August.

Risk of Stagflation in India: Data, Methods, and Risk Factors

- Empirical Data: The officials used two methods to conclude, both of which indicated a decline in stagflation risk.

- First method: Stagflation risk was assessed based on phases of lower economic growth coinciding with high inflation.

- Second Method: ‘At-risk’ frameworks were used i.e., “Inflation at Risk” (IaR) and “Growth at Risk” (GaR) were determined by employing quantile regression to assess the likelihood of stagflation.

- Factors: As per the research, Supply Side shocks, such as spikes in commodity prices along with tighter financial conditions and relatively higher depreciation of the Indian currency are the major determinants of stagflation risk in India.

- Why the fear: Higher commodity prices globally and the appreciation of the U.S. dollar post-pandemic raised stagflation concerns.

- Risk: Government-regulated fertilizer prices and weak pass-through of crude oil prices to the domestic market have limited the predictive power for stagflation.

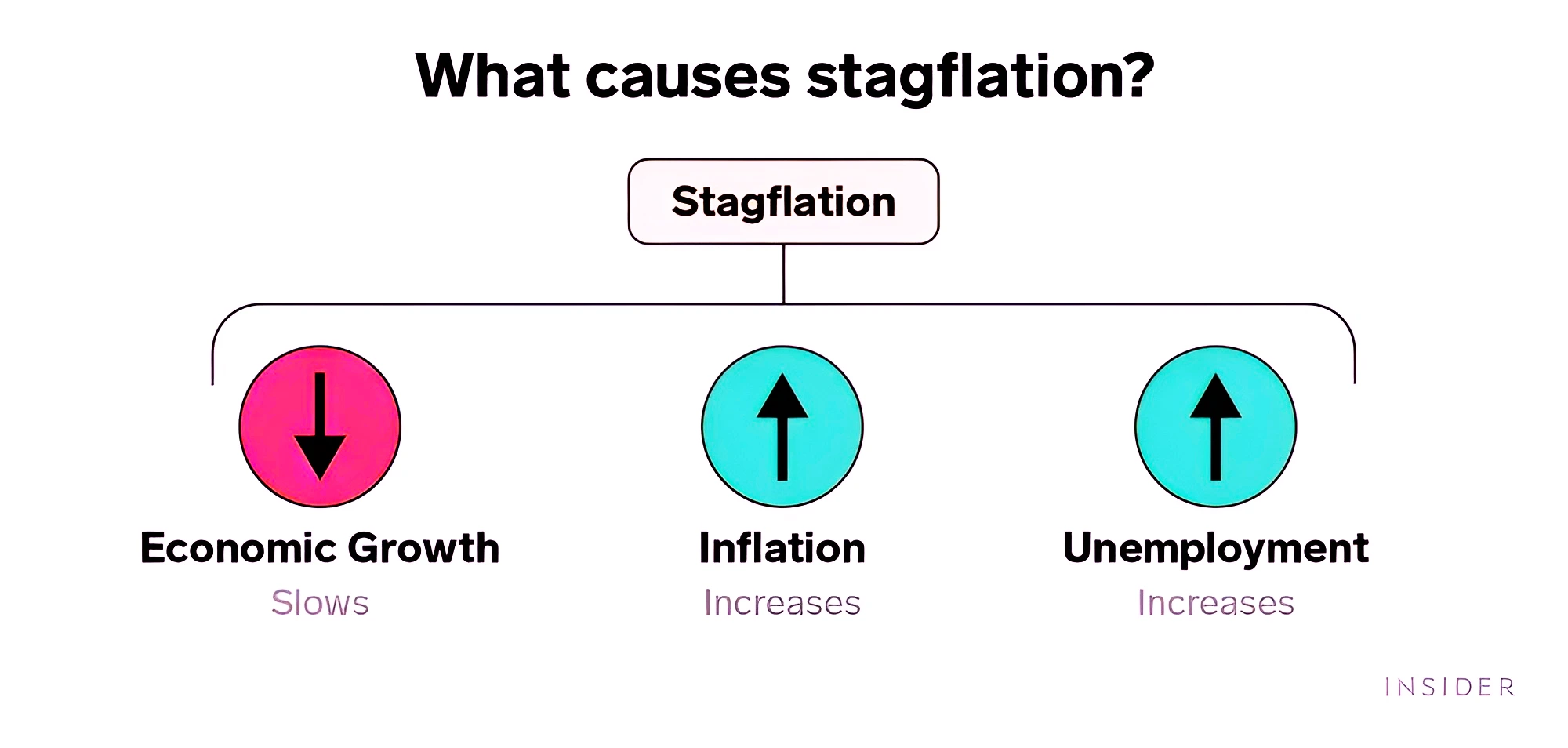

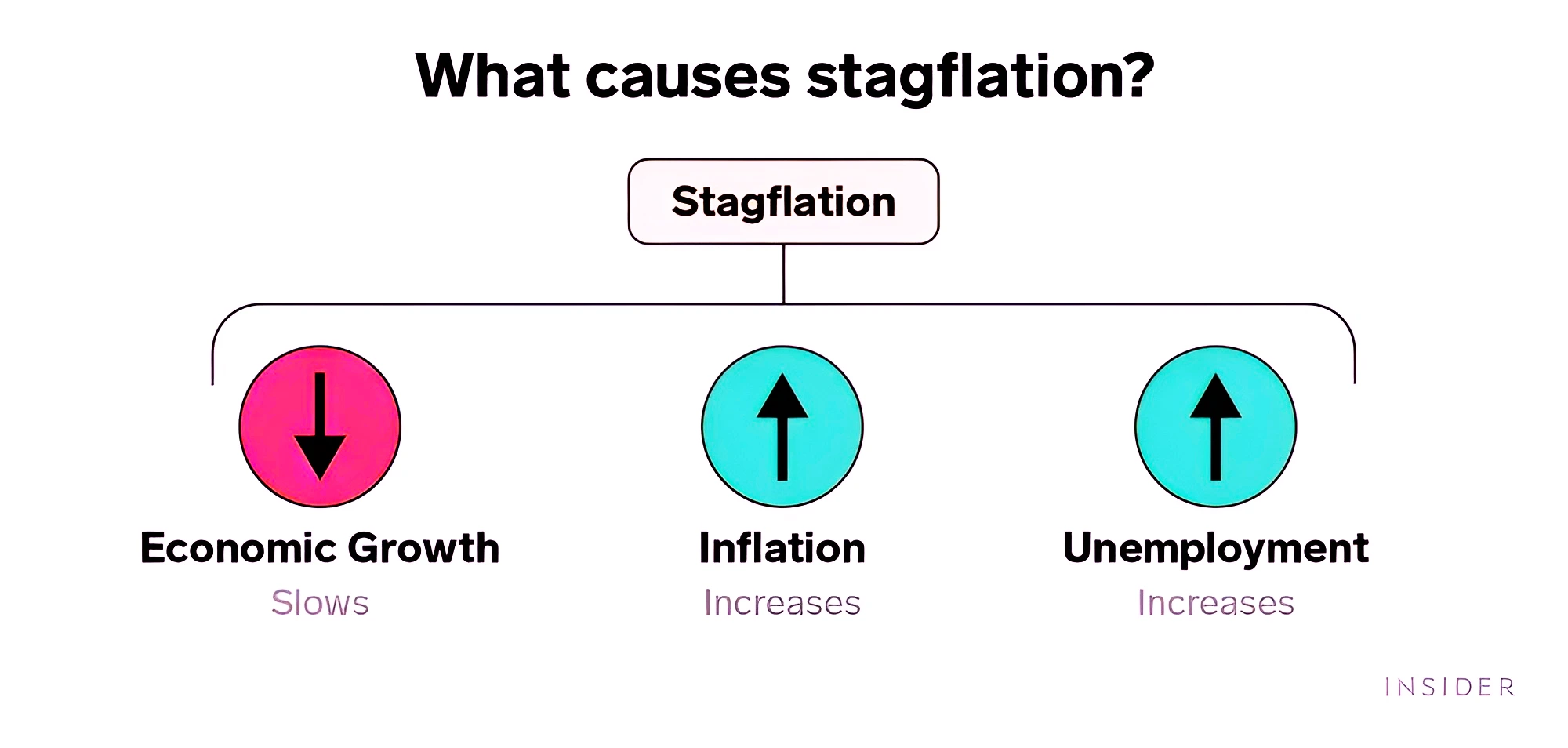

What is Stagflation?

- Definition: Stagflation refers to a situation where there is a simultaneous increase in prices along with a stagnation in the economy.

- The high unemployment due to a slow and stagnated economy coupled with high prices makes it a difficult condition to get out of through traditional monetary or fiscal policies.

- Challenge: Contrary to the popular understanding, when the economy slows, the demand reduces and price falls.

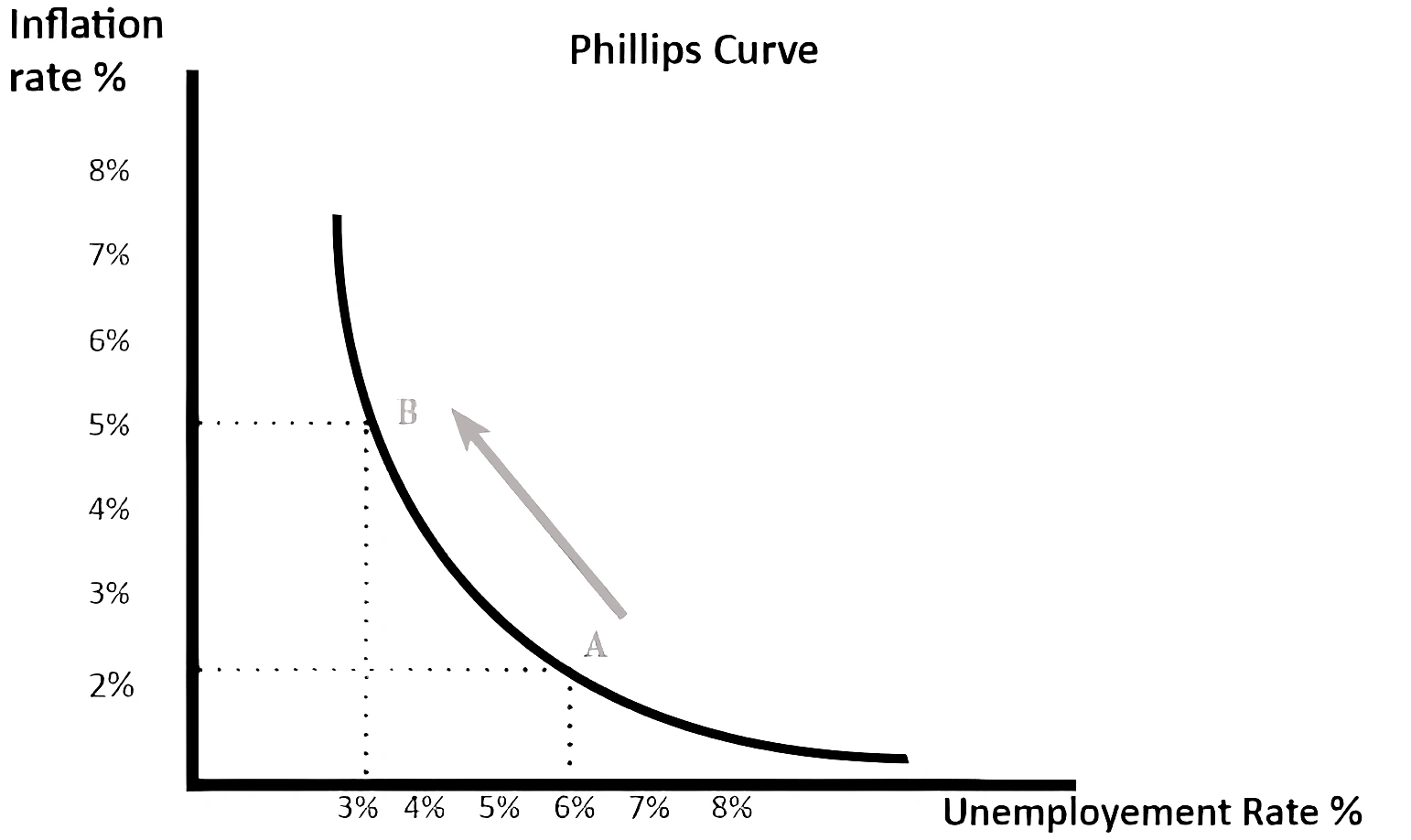

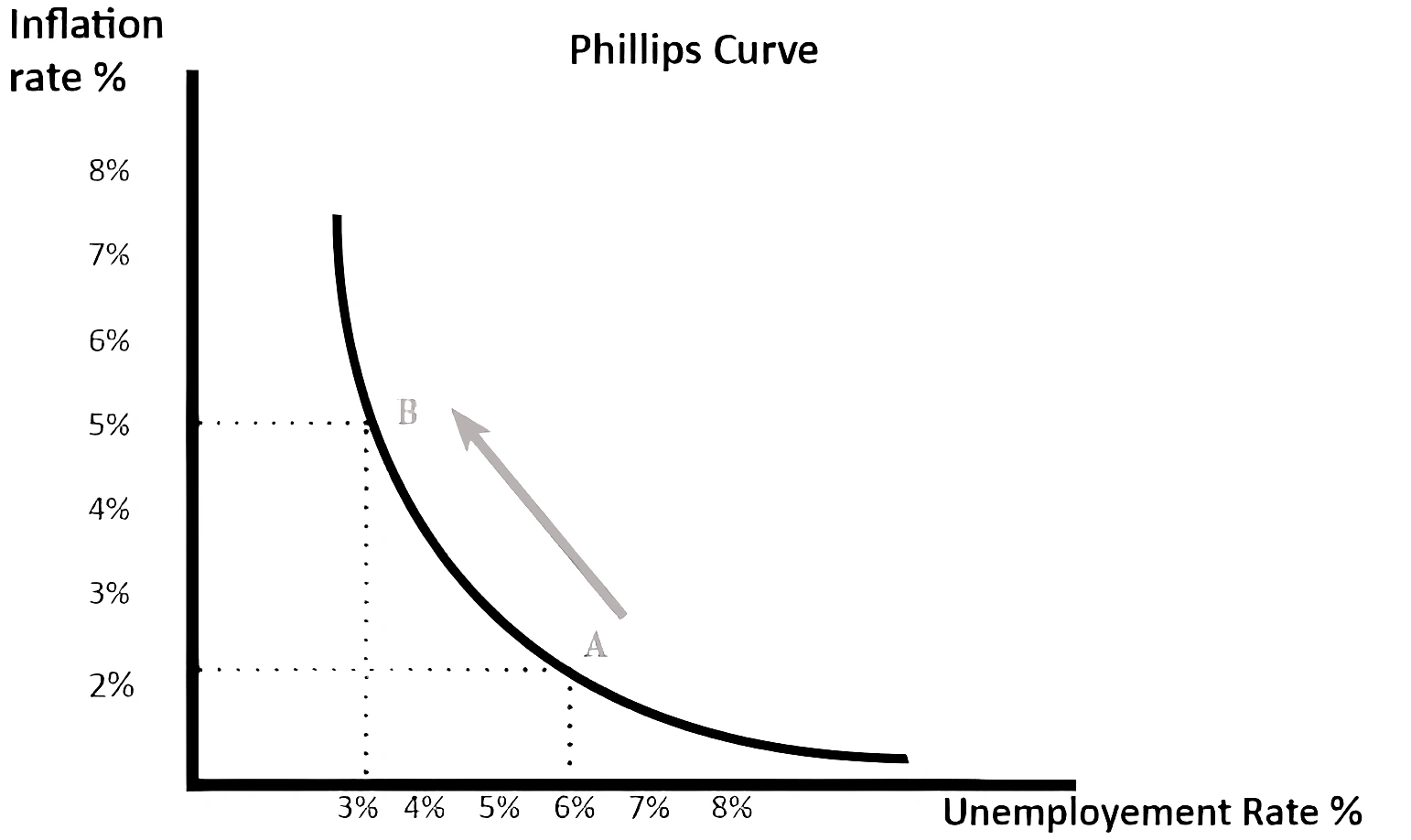

- It also belies the prediction of Phillips Curve, which claims that with high inflation, there should be low unemployment.

- The Phillips Curve shows the inverse relationship between the rate of inflation and unemployment.

Causes:

Causes: -

- Supply-side shock: Sharply rising oil prices, Supply Chain Disruption

- Poor economic policies: Too-high government spending or too-low interest rates.

- Demand Pull Inflation: Strong Demand coupled with low capital investment, can result in stagnant growth leading to stagflation.

- Poor Monetary Policy: When cheap money policy is coupled with a stagnant economy.

- Therefore, to avoid stagflation, steps like fiscal stimulus and structural reforms are essential to make sure that production capacity and the demand in the economy are matched.

Must Read: RBI Monetary Policy Committee’s Status Quo on Repo Rates and Policy Stance

Source: The Hindu

![]() 26 Dec 2023

26 Dec 2023

Causes:

Causes: