![]() 22 Jan 2024

22 Jan 2024

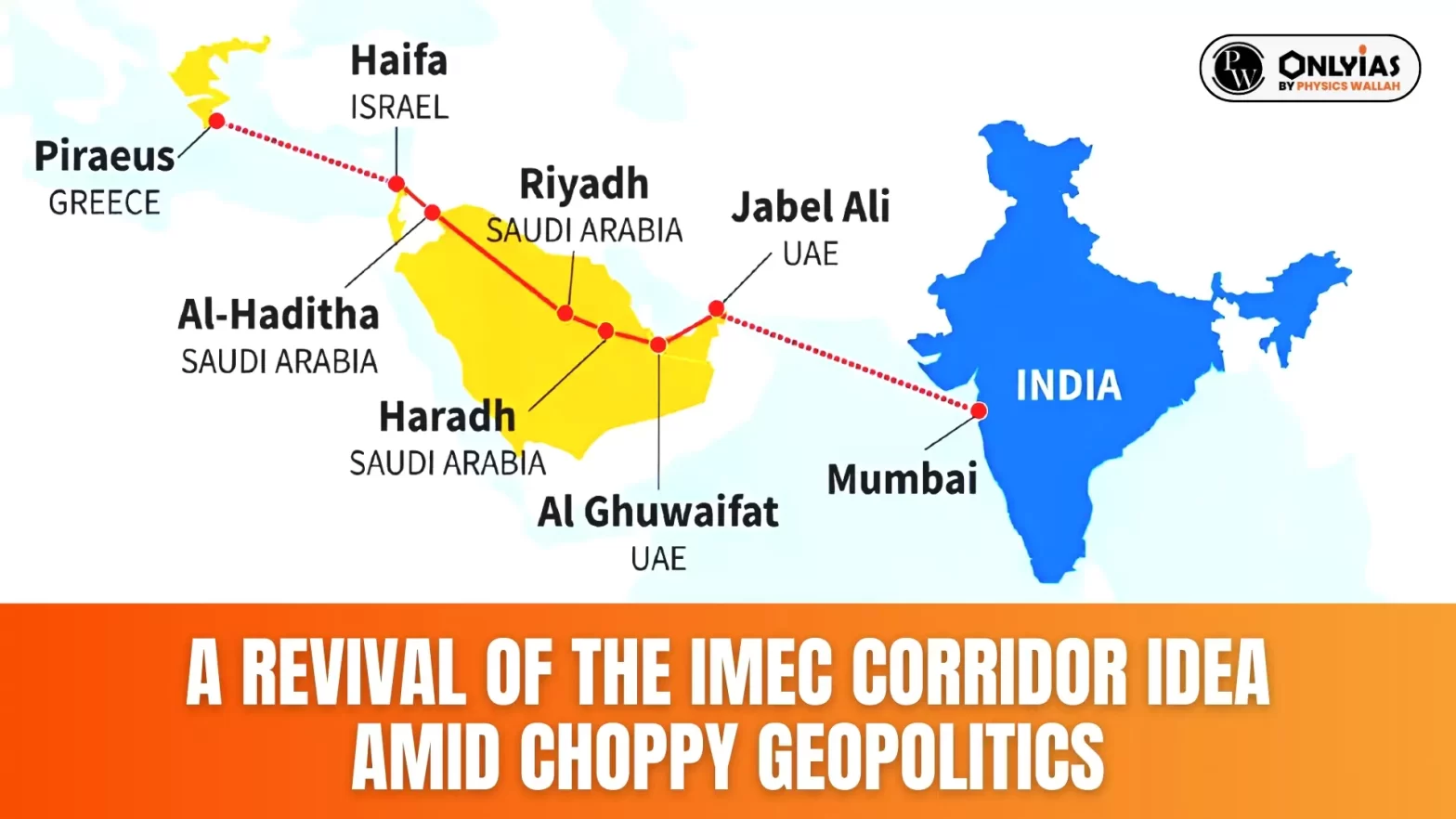

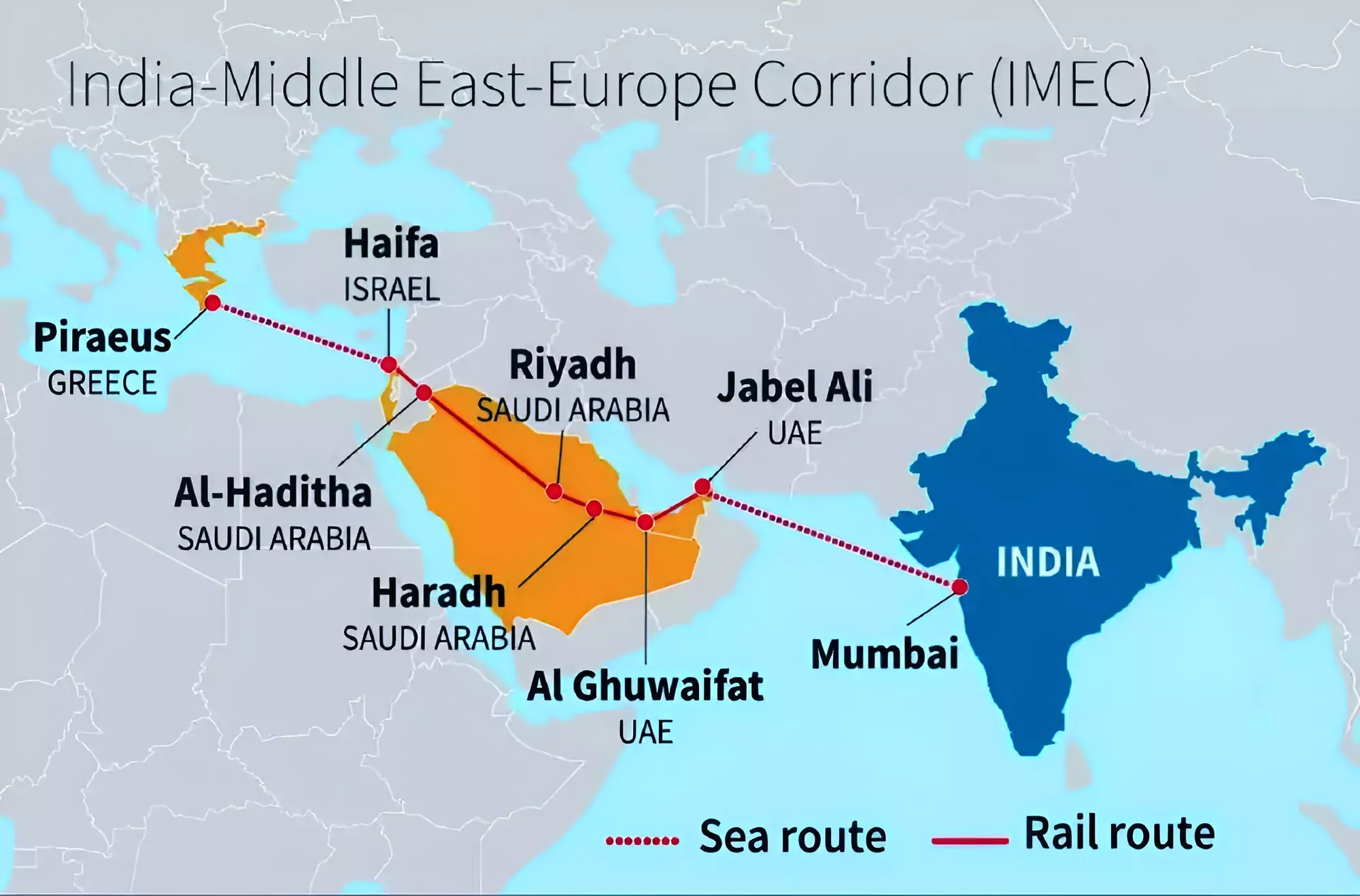

This editorial is based on the news “A revival of the IMEC Corridor idea amid choppy geopolitics” which was published in The Hindu. The recent Yemen conflict is highlighting the significance of India-Middle East-Europe Economic Corridor or IMEC Corridor as an alternative to the Suez Canal.

| Relevancy for Prelims: IMEC Corridor: India-Middle East-Europe Economic Corridor, Major Ports In India, Red Sea Crisis, Houthi Attacks, Israel-Hamas Conflict.

Relevancy for Mains: India-Middle East-Europe Economic Corridor- Significance, Challenges and Way Forward. |

|---|

IMEC Corridor

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

<div class="new-fform">

</div>