Context:

This editorial is based on the news “Parliament Budget Session Live Updates: Day after interim Budget, INDIA party leaders to chalk out joint strategy” which was published in the Indian Express. Recently, the Finance Minister of India presented an interim budget 2024-25 in the Parliament.

Enroll now for UPSC Online Course

What is Interim Budget?

- There is no constitutional provision for an interim budget. However, it has become a common practice for outgoing governments ahead of polls.

- A Short Period Budget: During an election year, the finance ministers present an interim Budget that covers the government’s expenses and revenues for a short period. This is till a new government is elected and takes charge.

- Released: The presentation of an interim budget follows the same schedule as the Union budget would in a regular financial year.

What Can Be Included in Interim Budget?

- The interim Budget includes estimates for the government’s expenditure, revenue, fiscal deficit, financial performance and projections for just a few months.

Enroll now for UPSC Online Classes

What Cannot Be Included in Interim Budget?

- No major policy announcements that can burden the next government can be presented in the interim Budget.

About Full Budget

- A Financial Year Budget: The Union Budget is the annual financial statement with the estimated costs and expenses of the government for the following financial year.

- Released: After the Lok Sabha elections, the new government presents a full budget.

Enroll now for UPSC online coaching

Highlights of Interim Budget 2024

- Economic growth: It has picked up and the average real income of people increased by 50%.

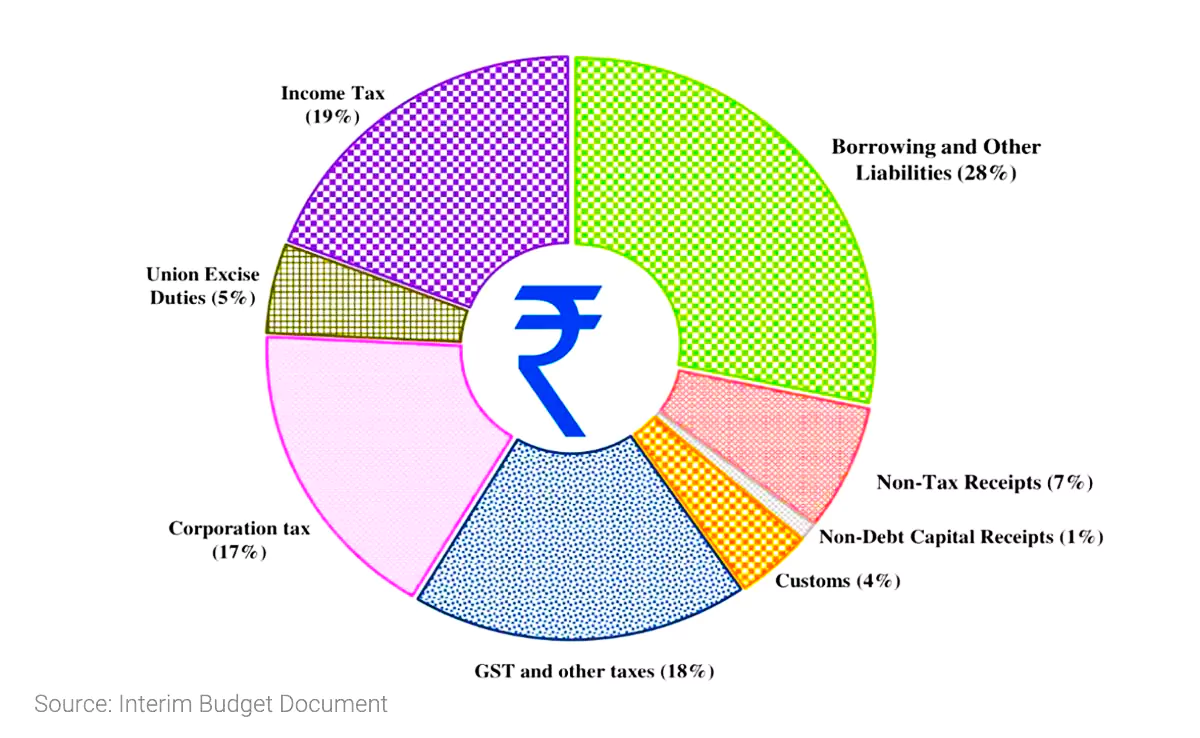

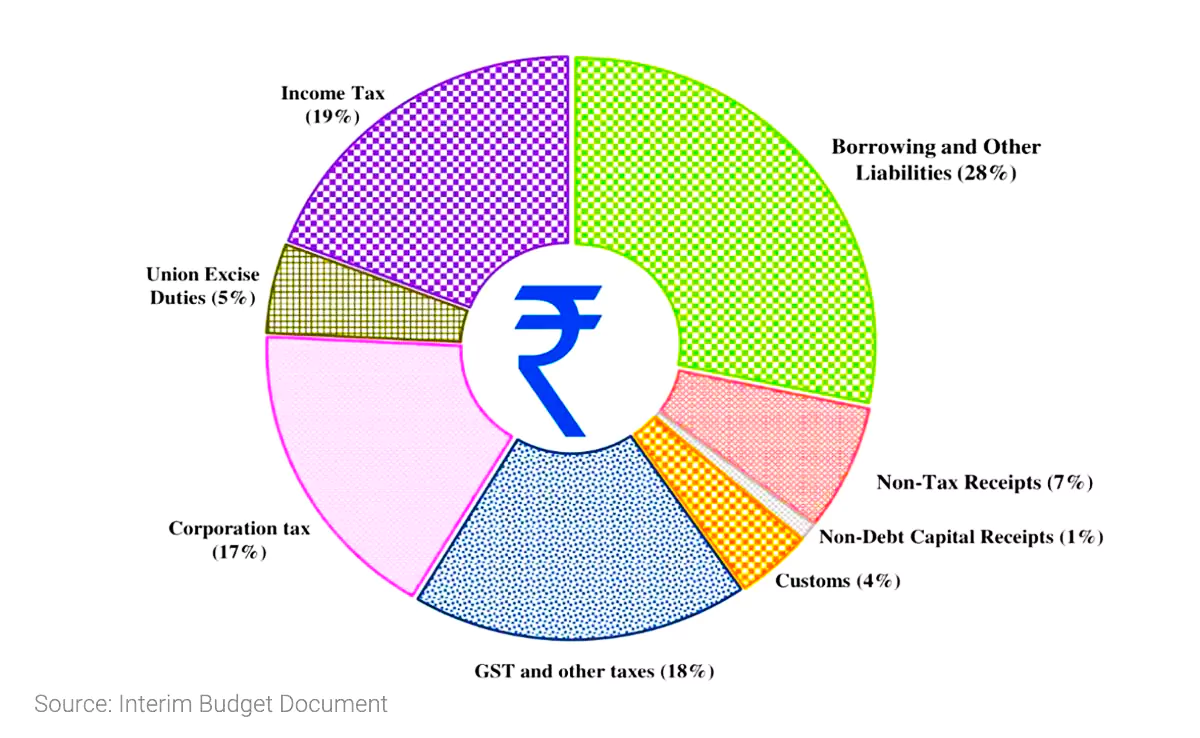

- On Borrowings: The Government borrowings on a gross and net basis for 2024-25, at Rs. 14.13 lakh crore and Rs. 11.75 lakh crore, respectively, lower than 2023-24.

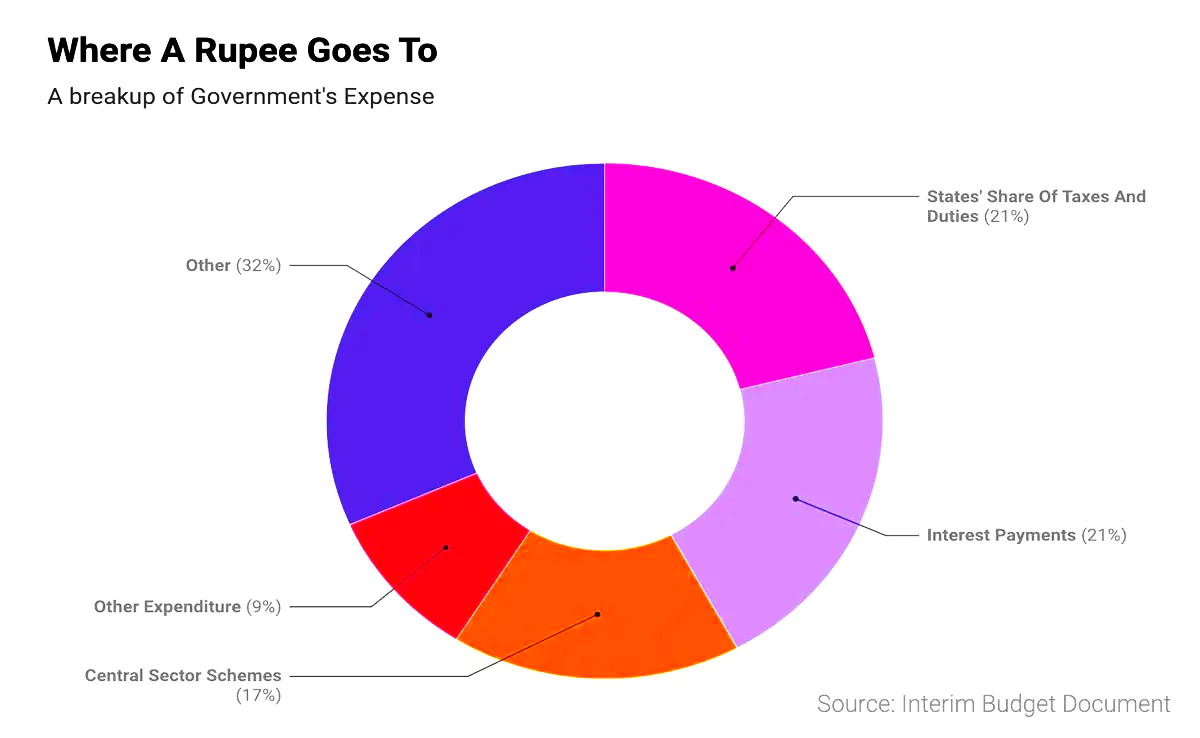

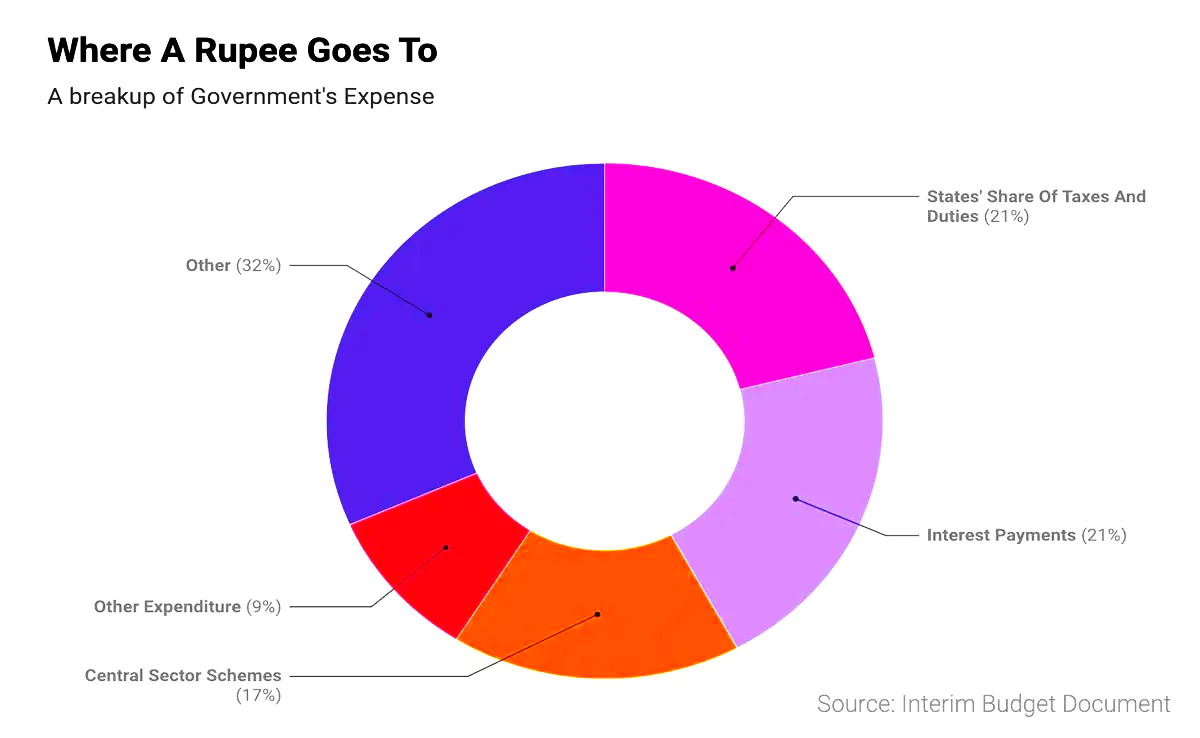

- On Expenditure: Spends on capital expenditure have been increased to ₹11.11 lakh crore for Interim Budget 2024-25.

- On Inflation: Inflation has moderated and is within the target band (2%-6%).

- On Fiscal Deficit: Reduce fiscal deficit to 4.5% in 2025-26.

- On Tax Rates: The Government proposed to maintain the same tax rates for direct and indirect taxes, including import duties.

- On GST Collection: Average monthly Gross GST collections doubled to 1.66 lakh crore in FY24.

- Positive sentiment about GST: 94% industry leaders view transition to GST as largely positive 80% of respondents feel GST has led to supply-chain optimisation.

- Welfare for Poor: The Government pulled 25 crore people out of poverty in ten years and provided free food for 80 crore people through various schemes.

- Direct Benefit Transfers (DBT): DBT of Rs. 34 lakh crore through PM Jan Dhan Yojana accounts has led to savings of ₹2.7 lakh crore.

-

Interim Budget 2024 For Support Self-Sufficiency:

-

- For Artisans: The PM Vishwakarma Yojana scheme provides end-to-end support to artisans.

- For Street Vendors: The government provided credit assistance to 78 lakh street vendors under the PM-SVANidhi scheme.

-

Interim Budget 2024 For Women

Enroll now for UPSC Online Course

-

Interim Budget 2024 For Upskilling and Reskilling

- Over 1.4 crore youth were trained under the Skill India Mission.

- 43 crore loans sanctioned under PM Mudra Yojana.

- Expansion of the ‘Lakhpati Didi’ scheme to empower rural women and boost the rural economy.

-

On Trade & Growth

-

Interim Budget 2024 For Tourism and Investment Promotion

- Comprehensive development of tourist centers and infrastructure projects to boost domestic tourism. Projects for port connectivity, tourism infrastructure, and amenities will be taken up including islands, Lakshadweep.

- Foreign Direct Investment (FDI) inflows marked a significant increase, with continued efforts to attract more foreign investment.

Enroll now for UPSC Online Classes

-

Interim Budget 2024 For Development & Support

- Development Mantra: Comprehensive development of all- Sabka Saath, Sabka Vikas, and Sabka Vishwas

- 3Ds: Trinity of demography, democracy and diversity, backed by ‘Sabka Prayas’

- Affordable Houses: The Government will subsidize the construction of 30 million affordable houses in rural areas.

- Health: The Centre will encourage cervical cancer vaccination and combine maternal and child health care schemes into one comprehensive programme.

- The Ayushman Bharat scheme will be expanded to all ASHA workers, Anganwadi workers and helpers.

-

Interim Budget 2024 For Farmers & Agriculture:

- PM KISAN: Direct financial assistance to 11.8 crore farmers under PM-KISAN.

- PM Fasal Bima Yojana: Crop Insurance to 4 crore farmers under PM Fasal Bima Yojana.

- e- NAM: Integration 1,361 mandis under e- NAM, supporting trading volume of 23 lakh crore.

- Nano DAP: Government to encourage ‘Nano DAP’ for various crops and to expand its use for all agro-climatic zones.

- Dairy Farmers: It will also formulate policies to support dairy farmers and defeat Foot and Mouth Disease.

- Oilseeds: The government will formulate a strategy to achieve AtmaNirbharta (self-reliance) for oilseeds. This will cover research for high-yielding varieties, procurement, value addition and crop insurance.

- Fishermen: A new department “Matsya Sampada” to be set up to address the needs of fishermen.

Enroll now for UPSC online coaching

-

Interim Budget 2024 For Connectivity

- 40,000 normal rail bogies will be converted to Vande Bharat standards.

- Government to enhance safety, convenience and safety of passengers.

- Government to focus on metros in a bid to provide transit-oriented development.

- Promotion of urban transformation via Metro rail and NaMo Bharat.

- Implementation of 3 major railway corridor programmes under PM Gati Shakti to improve logistics efficiency and reduce cost.

- Expansion of existing airports and comprehensive development of new airports under UDAN scheme.

-

Interim Budget 2024 For Environment

- Net Zero by 2070: The Government has announced several schemes.

- Renewable Energy: Funding to harness offshore wind energy generation for an initial capacity of 1 Giga Watt, procuring biomass aggregation machinery and expanding the e-vehicle sector by encouraging more manufacturing and charging infrastructure.

- Rooftop solarization: 1 crore households will be enabled to obtain up to 300 units of free electricity per month.

- Viability gap funding for wind energy

- Setting up of coal gasification and liquefaction capacity

- Phased mandatory blending of CNG, PNG and compressed biogas

- Future Outlook and ‘Viksit Bharat’ Vision By 2047: The budget sets the foundation for the vision of a ‘Viksit Bharat’ (Developed India) by 2047, focusing on demographic, democratic, and diversity strengths.

- Kartavya Kaal: Commitment to national development with new inspirations and resolutions, termed as ‘Kartavya Kaal’ (Era of Duty).

Enroll now for UPSC Online Course

Conclusion

The Interim Budget 2024-25 reflects the government’s continued focus on inclusive growth, economic stability, strategic global positioning, sector-specific developments, environmental sustainability, and tax reforms, with an overarching vision towards a developed India by 2047.

![]() 1 Feb 2024

1 Feb 2024

Fuel: The Government will pay more attention to developing the East to fuel India’s growth.

Fuel: The Government will pay more attention to developing the East to fuel India’s growth.