Answer:

| Approach:

Introduction:

- Give a brief background of GST

Body

- Mention the rationale behind GST

- Mention reasons for delay in its rollout

Conclusion

- Conclude saying that GST makes the Indian economy future ready.

|

Introduction:

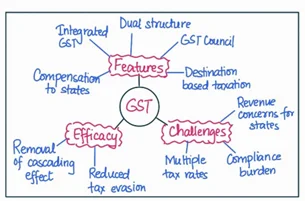

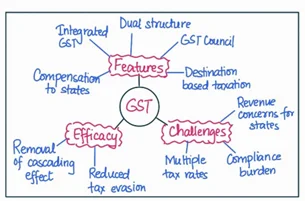

Goods and Services Tax (GST) is an indirect, comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST replaced a host of indirect taxes being levied by the central and state governments, which has changed the taxation landscape.

Body:

Rationale behind GST:

- Different taxation rates: There is a lack of uniformity between tax rates of different states, which impedes the creation of a national market of goods.

- Cascading effect: Multiple taxes result in cascading effect and hence, put a higher burden on businessmen and end customers. This makes the business less profitable.

- Goods and services are now integrated: With technological development, it is sometimes difficult to separate goods and services from a product for the purpose of taxation.

- ‘One nation One tax’ would improve ease of doing business for taxpayers. It would bring in transparency, promote inter-State trade, ensure timely compliance and ultimately reduce the tax burden for the common man.

Thus, Goods and services tax was proposed to subsume all indirect taxes at central and state level, with two uniform rates, viz central GST and State GST.

The reasons for delay in its rollout were:

- States taxation powers lost: States are unhappy that their powers for independent taxation have been curtailed. This is more so because the economic position of different states is vastly different while GST imposes uniformity. The State’s power to initiate a new social welfare scheme will be severely strained under a GST regime.

- GST is a destination-based tax: Producer states tend to lose out on tax revenues. For instance, Gujarat & Tamil Nādu are few states who are likely to lose their revenue if state sales tax is abolished. On the other hand, consumer states like Kerala are likely to see an increase in their revenue.

- Tax compensation: The states feared that the states are going to see loss of revenue on account of GST. The centre thus had to assure the states that it’d compensate for their losses for 5 years. But it took a lot of consultation and effort to reach this agreement.

- Fiscal Federalism: The GST bill needs Constitutional Amendments for redrawing the tax structure and how the centre and states cooperate. This requires a different level of political negotiation which has led to delays.

- Technicalities: Like arriving at a revenue neutral rate for the levy and a minimum threshold value, beyond which a supply of goods or services would attract GST; agreeing on model legislation to be adopted by states to implement GST.

Conclusion:

GST has been a significant reform which eliminates cascading of taxes and reduces transactional and operational costs, thereby enhancing the ease of doing business and catalyzing the “Make in India” campaign. There have been concerns, but the system continues to evolve. Therefore, GST is going to be a game changer for our economic growth and employment generation in the long run.