Answer:

| Approach:

Introduction:

- Introduce the Constitution (One Hundred and First Amendment) Act, 2016, which implemented the Goods and Services Tax (GST) in India, aiming to remove the cascading effect of taxes and create a common national market for goods and services.

Body

- Divide the body into three main sections.

- Salient features of the amendment.

- Efficacy of GST in achieving objectives.

- Concerns and challenges.

Conclusion

- Conclude, emphasizing the need for continued improvement and simplification of the GST system to enhance its overall effectiveness.

|

Introduction:

The Constitution (One Hundred and First Amendment) Act, 2016, introduced the Goods and Services Tax (GST) in India, a comprehensive indirect tax system aimed at streamlining the taxation process and creating a common national market for goods and services.

Body:

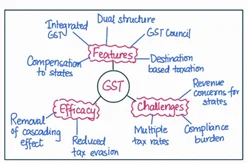

The amendment’s salient features include:

- Dual GST structure: This includes Central GST (CGST) and State GST (SGST) or Union Territory GST (UTGST) depending on the transaction type.

- Integrated GST (IGST): For inter-state transactions and imports, the Integrated GST is levied and administered by the Central Government.

- Destination-based taxation: The GST is a destination-based tax system, meaning that the tax revenue is collected by the state where the goods or services are consumed, rather than the state where they are produced.

- GST Council: The amendment establishes the GST Council, a constitutional body comprising representatives from the Central Government and all States/Union Territories.

- Compensation to states: To address potential revenue losses for states, the amendment provides for compensation payments for a period of five years from the implementation of GST.

The efficacy of the GST in removing the cascading effect of taxes and providing a common national market for goods and services can be assessed as follows:

- Removal of cascading effect: By subsuming multiple indirect taxes, such as excise duty, service tax, and value-added tax, into a single tax, the GST has significantly reduced the cascading effect of taxes, leading to a more transparent and simplified tax structure.

- Enhanced compliance and reduced tax evasion: The GST’s comprehensive input tax credit system incentivizes businesses to ensure compliance and reduces opportunities for tax evasion.

- Facilitating a common market: By harmonizing tax rates and eliminating state-level barriers, the GST has facilitated the creation of a common national market, making it easier for businesses to trade across state borders and improving economic efficiency.

However, there are some concerns and challenges:

- Multiple tax rates: The GST system still has several tax rates, which can create confusion and complexity for businesses.

- Compliance burden: Small and medium-sized enterprises (SMEs) may face challenges in complying with the GST’s digital filing requirements and navigating the tax system.

- Revenue concerns for states: Some states may experience revenue losses despite the compensation mechanism, as they lose the autonomy to levy their taxes.

Conclusion:

Addressing the challenges faced by businesses and states, and further simplifying the tax structure, can enhance the overall efficacy of the GST system.