Answer:

| Approach:

Introduction

- Briefly introduce the concept of Financial Emergency as per the Indian Constitution.

Body

- Discuss the circumstances under which a Financial Emergency can be proclaimed by the President and the consequences that follow when such a declaration remains in force.

Conclusion

- Summarize the importance of understanding Financial Emergency provisions and their implications on the functioning of the government and the economy.

|

Introduction:

Financial Emergency, as per Article 360 of the Indian Constitution, is one of the three types of emergencies that the President of India can proclaim. It has never been imposed in the history of independent India. It aims to address situations where the country’s financial stability or credit is threatened.

Body:

Circumstances for Proclaiming Financial Emergency:

As per Article 360, the President of India can proclaim a Financial Emergency if they are satisfied that the financial stability or the credit of India or any part thereof is threatened.

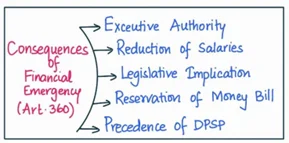

Consequences of Financial Emergency:

- Executive authority: The executive authority of the Center extends to directing any state to observe canons of financial propriety, and the President may give any other necessary direction to the state.

- Reduction of salaries: The President has the authority to reduce the salaries and allowances of all Central and State government employees, including judges of the Supreme Court and High Courts.

- Legislative implications: All Money Bills and other financial bills passed by the State Legislature are subject to the consideration of the President. The President can also direct the reduction of salaries and allowances of the Members of Parliament (MPs) and Members of the Legislative Assembly (MLAs).

- Reservation of money bills: During a Financial Emergency, the President can also reserve any financial bill passed by the state legislature for their consideration.

- Suspension of Fundamental Rights: Though not explicitly mentioned in the Constitution, the enforcement of Directive Principles of State Policy (DPSP) may take precedence over the Fundamental Rights during a Financial Emergency.

Conclusion:

Understanding the provisions of Financial Emergency and their implications is crucial for comprehending the constitutional framework for addressing financial crises in India. While a Financial Emergency has never been imposed in India’s history, its potential consequences can have far-reaching impacts on the functioning of the government and the economy. The President’s powers during a Financial Emergency are aimed at restoring financial stability and creditworthiness, albeit at the cost of temporarily curtailing certain rights and privileges of government officials and the public.