Part XII of the Indian Constitution, covering Articles 268 to 293, outlines the financial relationship between the Centre and the States. This division ensures both national fiscal needs and State-level autonomy. It meticulously allocates taxing powers and delineates the collection and appropriation of tax proceeds, safeguarding economic unity while allowing for local financial management.

Financial Relations between Centre and States in India

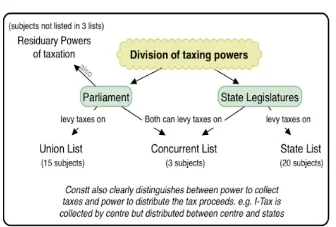

Allocation of Taxing Powers

The Indian Constitution meticulously divides the taxing powers between the Centre and the States, ensuring a balance between national fiscal needs and State-level autonomy.

- Union List: The Parliament holds exclusive authority to levy taxes on subjects enumerated in the Union List, comprising 13 subjects.

- This Centralised approach empowers the Centre to implement national policies seamlessly.

- State List: The State legislatures enjoy exclusive power to impose taxes on subjects listed in the State List, encompassing 18 subjects.

- This decentralised approach grants States the flexibility to tailor their fiscal policies to address the specific needs and priorities of their citizens, promoting local responsibility and autonomy in managing finances.

- Concurrent List: Unlike other legislative matters, the Concurrent List does not include any tax entries.

- This implies that concurrent jurisdiction is not applicable to tax legislation.

- Concurrent Power for GST Legislation: However, the 101st Amendment Act of 2016 introduced an exception by making a special provision for the Goods and Services tax (GST).

- This amendment grants concurrent power to both the Parliament and State legislatures to enact laws governing the GST

- Residual Power of Taxation: The Constitution vests the Parliament with the residual power of taxation, authorising it to impose taxes not enumerated in any of the three lists.

- Under this provision, the Parliament has levied gift tax, wealth tax, and expenditure tax.

- Distinction Between Levy and Collection of Tax: The Indian Constitution establishes a clear distinction between the power to levy and collect a tax and the power to appropriate the proceeds of that tax.

- Example: This distinction is evident in the case of income tax, which is levied and collected by the Central government but its proceeds are shared between the centre and the States.

Enroll now for UPSC Online Course

Restrictions on State Taxing Powers in the Indian Constitution

- Safeguarding Economic Unity: To safeguard the economic unity of the nation and prevent discriminatory taxation practices, the Constitution imposes certain restrictions on the taxing powers of the States:

- Ceiling on Professional Taxes: State legislatures are permitted to levy taxes on professions, trades, callings, and employment.

-

- However, the total amount of such taxes payable by any individual cannot exceed ₹2,500 per annum.

- This restriction aims to prevent excessive taxation that could hinder economic mobility and entrepreneurship.

- Restrictions on Taxes on Goods and Services: State legislatures are prohibited from imposing taxes on the supply of goods or services in two specific scenarios:

- Out-of-State Supplies: Taxes cannot be levied on the supply of goods or services that take place outside the State’s borders.

- This restriction prevents States from imposing taxes on economic activities beyond their jurisdiction.

- Imports and Exports: Taxes cannot be imposed on the supply of goods or services that occur in the course of import or export.

- This restriction safeguards the free movement of goods and services across State boundaries, promoting national economic integration.

- The Parliament holds the authority to formulate the principles for determining when a supply of goods or services falls under the category of out-of-State supplies, imports, or exports.

- This Centralised approach ensures consistency and clarity in the application of tax laws.

- Out-of-State Supplies: Taxes cannot be levied on the supply of goods or services that take place outside the State’s borders.

- Taxation of Electricity: State legislatures can impose taxes on the consumption or sale of electricity. However, this power is subject to certain limitations:

- Central Government Consumption or Sale: Taxes cannot be imposed on electricity that is consumed by the Centre or sold to the Centre.

- This restriction ensures that the operations are not burdened by State taxes.

- Railway-Related Consumption or Sale: Taxes cannot be imposed on electricity that is consumed in the construction, maintenance, or operation of any railway by the Centre or by the concerned railway company, or sold to the Centre or the railway company for the same purpose.

- This restriction protects the smooth functioning of the national railway network.

- Central Government Consumption or Sale: Taxes cannot be imposed on electricity that is consumed by the Centre or sold to the Centre.

- Taxes on Inter-State Water Resources: State legislatures can impose taxes on the consumption, distribution, or sale of water or electricity that is stored, generated, consumed, distributed, or sold by any authority established by Parliament for regulating or developing any inter-State river or river valley.

- However, such laws require the President’s approval to become effective.

- This safeguard ensures that the management of inter-State water resources is not hampered by conflicting tax policies.

Evolution of Tax Distribution in India

The 80th and 101st Amendment Acts: Reshaping Tax Distribution and Introducing GST

- The 80th and 101st Amendment Acts brought about significant changes in the Indian Constitution related to tax distribution between the Central government and States.

- 80th Amendment Act (2000):

- Implemented the recommendations of the 10th Finance Commission, increasing the States’ share of tax revenues.

- Introduction of the ‘Alternative Scheme of Devolution’ : This amendment, known as the ‘Alternative Scheme of Devolution‘, retrospectively came into effect from April 1, 1996, allocating 29% of income from certain Central taxes and duties like Corporation Tax and Customs Duties to the States.

- Constitutional Amendments and Service Tax: Deleted Article 268-A and Entry 92-C from the Union List, which previously governed service tax.

- Introduced by the 88th Amendment Act of 2003, these provisions outlined the levy, collection, and appropriation of service tax by the Central and States.

- 101st Amendment Act (2016): Transformed India’s tax system by introducing the Goods and Services Tax (GST), a comprehensive indirect tax.

- Concurrent Taxing Powers for GST: This amendment granted concurrent taxing powers to both the Parliament and State legislatures for levying GST on the supply of goods and services, replacing various Central and State indirect taxes.

- Objectives of GST: The GST aimed to eliminate tax cascading and create a unified national market.

- Subsumption of Taxes under GST: Facilitated the incorporation of Central and State indirect taxes into the GST framework, including Central Excise Duty, Additional Excise Duties, Service Tax, VAT, Entertainment Tax, Purchase Tax, and Luxury Tax.

Constitutional Arrangements Of Taxation Between The Centre And States

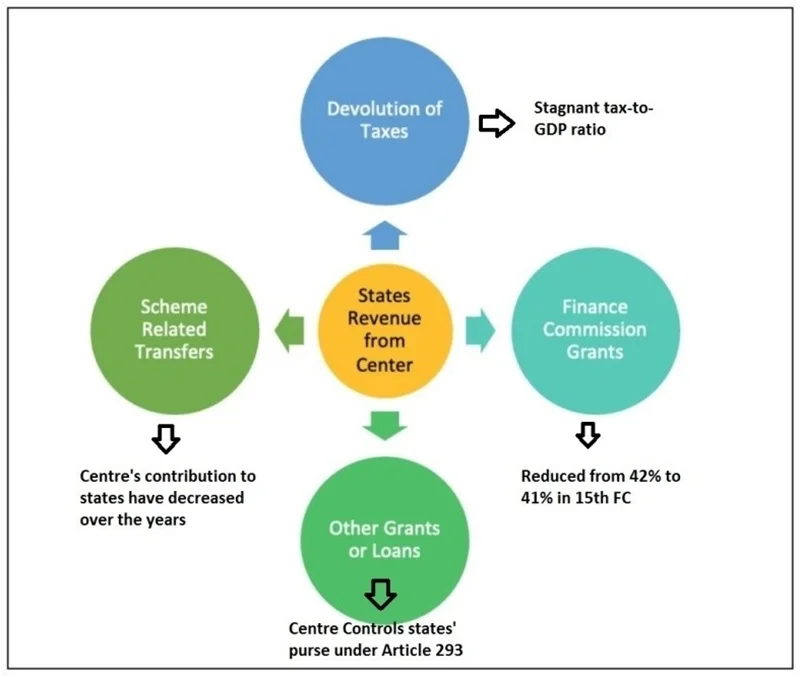

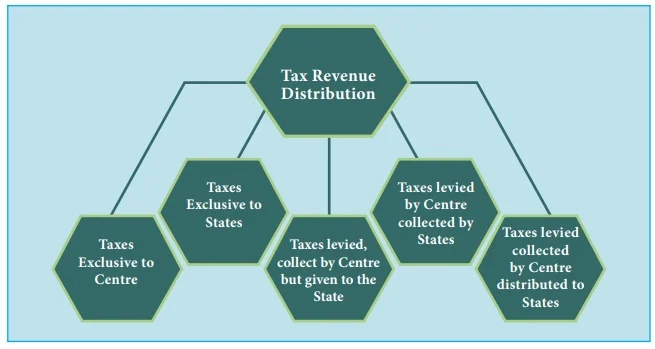

Framework for Tax Revenue Distribution: The Indian Constitution outlines a framework for distributing tax revenues between the Central government and the States.

- This framework ensures that both levels of government have the necessary financial resources to fulfil their respective roles in governing and serving the Indian people effectively.

- Taxes Levied by the Centre but Collected and Appropriated by the States (Article 268)

- These taxes, such as stamp duties, are levied by the Central government but collected and appropriated by the States where they are generated.

- Tax Proceeds to Respective States: The proceeds of these taxes do not form part of the Consolidated Fund but are instead assigned directly to the respective States.

- Examples: This category includes the stamp duties on bills of exchange, cheques, promissory notes, policies of insurance, transfer of shares and others.

- Taxes Levied and Collected by the Centre but Assigned to the States (Article 269)

- This category includes taxes on inter-State trade and commerce, such as taxes on the sale or purchase of goods and consignment taxes.

- These taxes are levied and collected by the Centre, but the net proceeds are assigned to the concerned States according to principles laid down by the Parliament.

- Levy and Collection of Goods and Services Tax (GST) in Inter-State Trade or Commerce (Article 269A)

- The Goods and Services Tax (GST) on inter-State supplies is levied and collected by the Centre.

- Revenues Between Centre and States: However, this tax is divided between the Centre and the States in a manner determined by the Parliament on the recommendations of the GST Council.

- Parliament’s Role: The Parliament is also empowered to define the place of supply and determine when a supply of goods or services takes place in the course of inter-State trade or commerce.

- Taxes Levied and Collected by the Center but Distributed between the Center and the States (Article 270)

- Scope of Taxes and Duties: This category encompasses all taxes and duties listed in the Union List, except for those mentioned in Articles 268, 269, and 269-A (discussed above) and surcharges on taxes and duties referred to in Article 271 (discussed below).

- Distribution of Net Proceeds as Prescribed by the President: The manner of distributing the net proceeds of these taxes and duties is prescribed by the President on the recommendation of the Finance Commission.

- Surcharge on Certain Taxes and Duties for Purposes of the Center (Article 271)

- Authority to Levy Surcharges: The Parliament can levy surcharges on taxes and duties referred to in Articles 269 and 270.

- Allocation of Surcharge Proceeds: The proceeds of these surcharges go exclusively to the Central government, and the States have no share in them.

- Exemption of GST: However, the Goods and Services Tax (GST) is exempted from this surcharge.

- Taxes Levied and Collected and Retained by the States

- These taxes, enumerated in the State List, are levied, collected, and retained by the States.

- Examples: They include taxes on land, agricultural income, mineral rights, electricity consumption, sale of certain goods, professions, trades, callings, and employment, and entertainment and amusements.

Distribution of Non-tax Revenue

| Central Government’s Non-Tax Revenues | State Governments’ Non-Tax Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enroll now for UPSC Online Course

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Conclusion

The financial relationship between the Centre and the States, as outlined in the Indian Constitution, balances national and regional fiscal responsibilities.

- Through a well-defined allocation of taxing powers and revenue distribution, the Constitution promotes both economic integration and autonomy.

- This framework ensures effective governance and resource management, supporting India’s diverse economic landscape

Sign up for the PWOnlyIAS Online Course by Physics Wallah and start your journey to IAS success today!

| Related Articles | |

| Finance Commission | Features of Indian Constitution |

| GST (Goods and Services Tax) Council | State Legislature in India |

GS Foundation

GS Foundation Optional Course

Optional Course Combo Courses

Combo Courses Degree Program

Degree Program