Answer:

| Approach:

Introduction

- Define GST and give a brief background.

Body

- Enumerate the list of taxes subsumed under GST.

- Elaborate on the revenue implications of GST.

Conclusion

- Conclude stating that although not perfect, GST is a step in the right direction for the economic integration of India.

|

Introduction:

Goods and Services Tax (GST) is an indirect, comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST replaced a host of indirect taxes being levied by the central and state governments, which has changed the taxation landscape. The underlying theme was to have a ‘one nation one tax’ which would improve ease of doing business for taxpayers, bring in transparency, ensure timely compliance and ultimately reduce the tax burden for the common man.

Body:

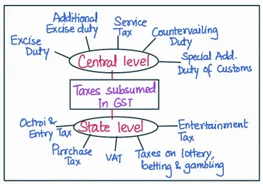

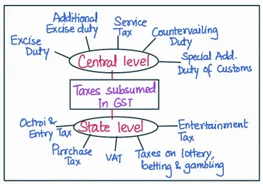

The GST replaced the following taxes:

- At the Central level, the following taxes have been subsumed in the GST:

- Central Excise Duty

- Additional Excise Duty

- Service Tax

- Countervailing Duty

- Special Additional Duty of Customs

- At the State level, the following taxes have been subsumed in the GST:

- State Value Added Tax/Sales Tax,

- Entertainment Tax (other than the tax levied by the local bodies),

- Central Sales Tax (levied by the Centre and collected by the States)

- Octroi and Entry tax

- Purchase Tax

- Luxury tax

- Taxes on lottery, betting and gambling

Revenue implications of GST since July 2017:

- After the initial transitional issues following the roll-out of GST, revenue collection picked up from an annual average of 0.89 lakh crores in 2017-18 to 1.5 lakh crores in 2022-23.

- According to the Economic Survey, though there has been an improvement in tax to GDP ratio over the last few years.

- Increased tax base: Post the introduction of the e-way bill system, collections rose as people e-way bill is easily traceable and is helpful in inter-state business. People filing tax returns also increased. Registration under the old indirect tax regime was 6.4 million. Registration of businesses increased to 11.2 million under GST.

- Reduction in tax evasion: The GST has made it difficult for businesses to evade taxes, as it is a destination-based tax system. The GST has led to increased transparency in transactions and reduced the scope for tax evasion.

- Disparity between states rise: While month-wise gross GST collections have been rising almost consistently over time, collections by or due directly to the States have been quite volatile and have not displayed the same consistent rise.

- Uncertain position of States: The GST revenue accruing to the Central divisible pool is doing better than that received by the States from the State GST (SGST) and Integrated GST (IGST).

- Compensation concern: The shortfall is a problem especially for the States because while their taxation powers will be curtailed, they will be compensated only for five years for any shortfall in tax revenues.

Conclusion:

GST has been a significant reform which eliminates cascading of taxes and reduces transactional and operational costs, thereby enhancing the ease of doing business and catalyzing the “Make in India” campaign. There have been concerns, but the system continues to evolve. Therefore, GST is going to be a game changer for our economic growth and employment generation in the long run.