Context:

This article is based on the news “India Defence exports: A strategic imperative” which was published in the Business Standard. With escalating geopolitical tensions driving the expansion of the defense and aerospace industry, India has a significant opportunity to become a key player in the global Defence Exports market.

Status of India Defence Exports

- Expanding Global Defence Industry: Analysts foresee a rapid expansion of the global defence and aerospace industry, from $750 billion in 2022, to $1.38 trillion by 2030.

- Leading Arms Exporters: The US, Russia, France, China, and Germany account for nearly 77 per cent of global arms exports, according to the SIPRI report.

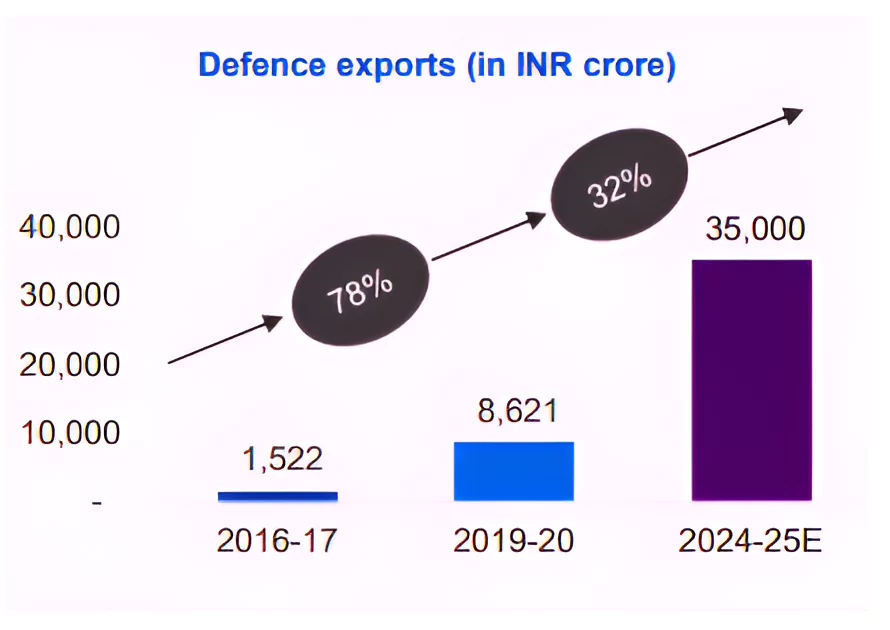

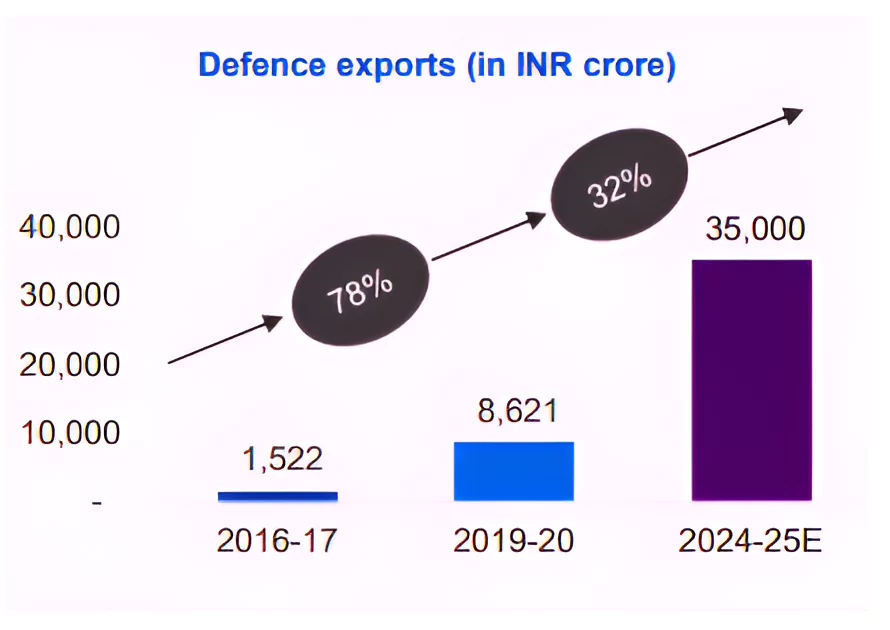

- Surge in India’s Defence Exports: India’s Defence Exports surged from surging from Rs. 686 Crore in FY 2013-14 to nearly Rs. 16,000 Crore in FY 2022-23.

- It has grown 800 percent in five years and reached 85 countries across continents.

- This propelled India into the top 25 defense exporters globally.

- Private Sector Dominance: Nearly 80 percent of the defense export growth is attributable to private industry.

- Items of India’s Defence Exports: Expanding India’s Defence Exports encompass missiles, rockets, torpedoes, artillery-guns, and drones, among others.

- Major Export Destination: India’s private companies and Defence PSUs currently export defence equipment to over 75 countries.

-

- Italy, Maldives, Sri Lanka, Russia, France, Nepal, Mauritius, Sri Lanka, Israel, Egypt, UAE, Bhutan, Ethiopia, Saudi Arabia, Philippines, Poland, Spain and Chile are some of the major export destinations for defence equipment and platforms.

India As a Defence Exporter: What Advantages Will India Gain From Being a Defence Exporter?

- Economics Advantages: Export of defense items not only earns foreign currencies but also substitutes the import of defense products.

- The Atma Nirbhar Bharat initiative which promotes local defense production, has reduced India’s import dependency from 46% of defense spending in 2018-19 to 36.7% by December 2022.

- Integration with Global Defence Supply Chain: The growth of India’s defence industry is integrating them with the global defence supply chain with countries like the USA, France etc.

- Strategic Interdependence: India’s Defence exports create dependencies for maintenance, repair, and future upgrades, linking India technologically with partner nations.

- Enhanced Military Cooperation: Selling defense equipment fosters compatibility, facilitating joint operations, interoperability and broadening military collaboration opportunities.

- Geopolitical Influence and Diplomatic Leverage: India’s Defence relations influence the geopolitical stance of partner countries, enhancing India’s strategic position and diplomatic relations.

- Self-Reliance in Defence: Focusing on indigenisation strengthens India’s defense sector, mitigating vulnerabilities associated with foreign imports and bolstering its role as a key Indo-Pacific power.

| Emergence of US As a Defence Exports Major:

The US which currently dominates the Global Arms supply with around 40% market share, lagged behind Europe in the late 19th century.

- Strategic Shift in Production: In response to changing naval technologies, the US shifted from importing to mandating domestic production of ships and components in the 1880s, laying the groundwork for a private defence industry.

- Government Support: The introduction of the Government Metal Testing programme, amendments allowing direct procurement negotiations, and the promotion of foreign sales by US firms were key policies that transformed the US defence industry.

|

Factors Contributing to the Emergence of India as a Defense Exporter

- Geopolitical Uncertainties: Dependence on foreign suppliers exposes vulnerabilities that India can ill-afford, particularly in times of crisis.

| Which Defence Equipment Does India Export?

The major defence items being exported are Personal Protective items, Offshore Patrol Vessels, ALH Helicopter, SU Avionics, Bharati Radio, Coastal Surveillance Systems, Kavach MoD II Launcher and FCS, Spares for Radar, Electronic Systems and Light Engineering Mechanical Parts, among other. |

-

- India imports nearly 60 percent of its equipment from Russia, which is at war in Ukraine. India is looking at equipment systems in Israel, which is at war in Gaza.

-

External Opportunities

- China’s Export Challenges: A decline in Chinese arms exports due to quality and performance issues, highlighted by operational problems in Myanmar, Nigeria, and Pakistan, opens opportunities for India.

- Myanmar’s grounding of Chinese jets, Nigeria’s return of Chengdu F-7 fighters, and Pakistan’s issue with F-22 frigates highlight the challenges faced by China’s arms industry.

- China’s declining arms exports are marked by a 7.8% drop between 2016 and 2020.

-

Domestic Strengths and Initiatives For India’s Defence Exports

- Expertise in Handling Russian Equipment: India’s capability to service Russian military platforms is recognized globally, increasing its attractiveness to countries with Russian inventories.

- Strategic Geographic Position: The Indo-Pacific region’s growing strategic importance enhances the role of Indian shipyards in servicing US and European naval forces.

- Technological Edge: India’s prowess in software and AI in defense fulfills the requirement of the modern warfare shift towards tech-driven capabilities, attracting global defense OEMs.

-

Government Support and Policy For India Defence Exports

- Innovation for Defence Excellence (IDEX): This initiative has fostered hundreds of startups offering innovative defense technologies, ready for global licensing.

- Defence Production & Export Promotion Policy (DPEPP) envisages an environment that encourages R&D, rewards innovation, creates Indian IP ownership and promotes a robust and self-reliant defense industry.

- Positive Indigenization List: Government has notified four Positive Indigenisation Lists comprising 411 major weapon platforms and systems with an embargo on their import from defined timelines.

- India;s Defence Exports Steering Committee: It is a body that is playing a significant role in coordinating and promoting the export of defense products from India.

-

Infrastructure and Innovation For India Defence Exports

-

- Private Sector and Startup Engagement: Encouraging private sector participation and streamlining export permissions to minimize delays can significantly contribute to the growth of the defense sector.

- Export Facilitation Measures: Implementing an online system for export inquiries, open general export licenses, and recognizing Defence Exports as a performance measure for defense attaches abroad can promote Defence Exports.

- Financial and Promotional Support: Liberal defense lines of credit and the repositioning of DefExpo and Aero India as global showcases for Indian defense innovations have also played crucial roles.

- Defence Industrial Corridors: Two defense industrial corridors are being established in Uttar Pradesh and Tamil Nadu, and intends to increase indigenization of defense products and increase exports.

Challenges To India’s Defence Export Growth

- Regulatory and Bureaucratic Hurdles: Bureaucratic resistance and outdated practices, especially by institutions like the DRDO, block private sector integration into defense manufacturing and deter innovation.

- Project Delays: Delays in crucial defense projects and cost overruns due to such delays hamper the growth prospect of the defense sector.

-

- As per the reports of the Ministry of Defence, 23 of 55 DRDO’s ‘mission mode’ projects have been delayed.

- The CAG said that DRDO couldn’t stick to the original time frame in 119 out of 178 projects.

- Funding and Investment Shortfalls: Insufficient funding for R&D and lack of attractive investment mechanisms for private investors is a challenge to the growth of defense export growth.

- Gross Expenditure on Research and Development (GERD) of prominent defense exporting countries are Israel (4.8%), South Korea (4.5%), USA (~3%), China (2.6%) and France (~2.5%), whereas India’s GERD is only 0.65%.

- Infrastructural Deficit: It increases India’s logistics costs thus reducing the country’s cost competitiveness and efficiency in the defense sector.

Way Forward To India Defence Exports

- Simplify rules for government-to-government sales: The government should actively promote Defence Exports by simplifying rules for government-to-government sales, to ease procurement by foreign governments from Indian firms.

- Framework for International Sales: Beyond specific agreements like with the US, India needs a broader framework similar to the US’s foreign military framework to facilitate easier international transactions.

- Defense Lines of Credit (LOC): Allowing empanelled defense firms to include defense LOC in their proposals could be considered. Interest rates for defense LOC need to be reduced.

- Innovation and Technology Licensing: With IDEX startups developing sought-after innovative technologies, a licensing framework that protects national interests and supports startups is critical.

- Integrating Defense and Education Sector: To boost defense innovation, India needs to integrate academia industry and R&D labs into its ecosystem to develop advanced technology. There is also a need for curriculum updates and offer appealing career paths to students and researchers.

- Establishment of Think Tank: The Government should consider creation of a think tank under the Department of Defence with national and international experts in S&T, war-gaming, policy formation etc. to dynamically update defense roadmap as per world requirement.

Conclusion

India’s Defence Exports enhance global standing position and improve strategic relations with allied nations, presenting a vital agenda for government prioritization.

Also Read: Project 75i

![]() 17 Feb 2024

17 Feb 2024