Context

India received overseas inflows totaling ₹3.33 lakh crore, equivalent to $40.4 billion, in equities, debt, and hybrid instruments combined during the current financial year, marking a record high.

Surge in FPI Flows into India This Fiscal Year

- Investment Trend: This figure represents a 25% increase compared to the previous peak of ₹2.67 lakh crore achieved in FY21.

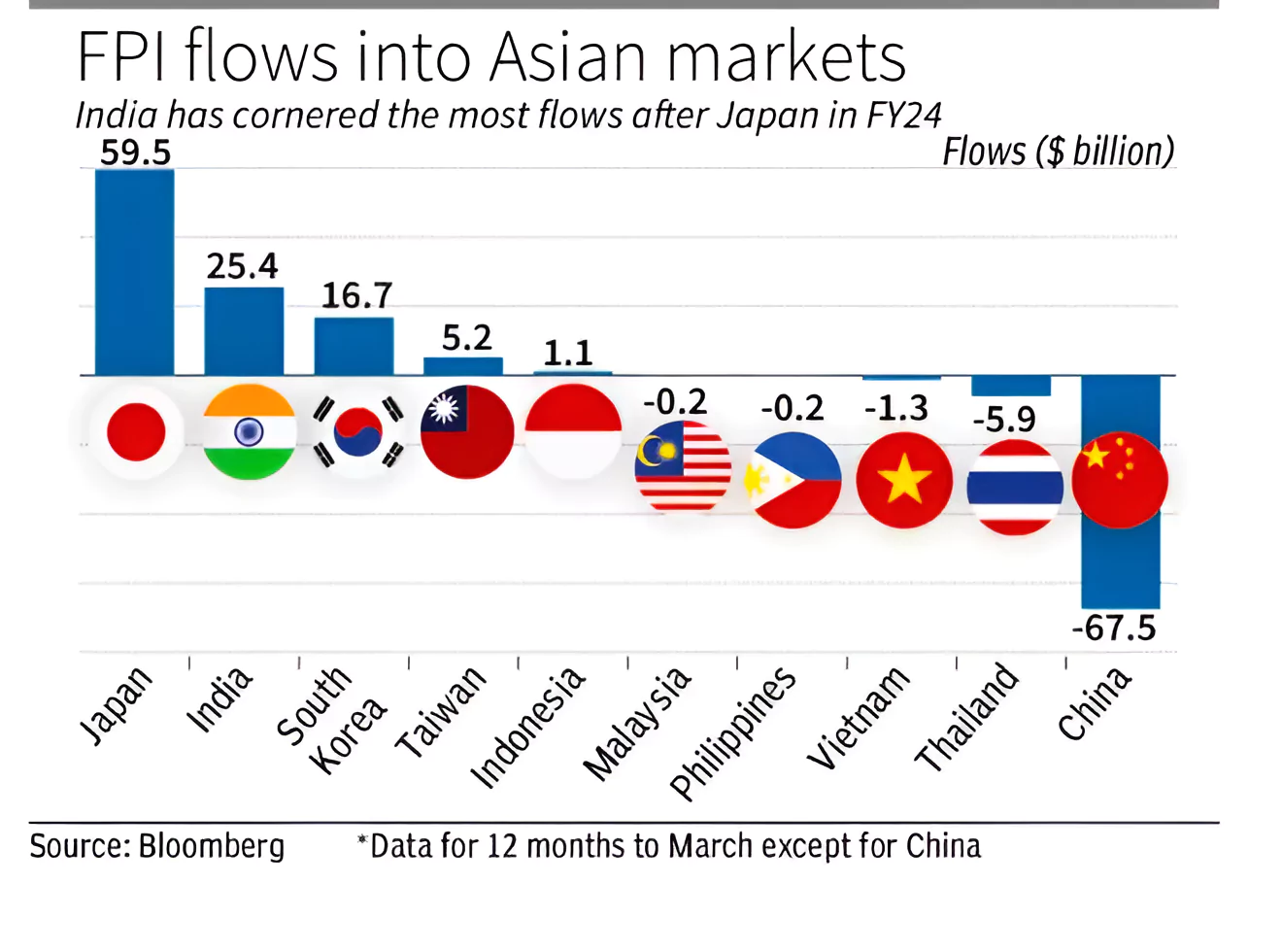

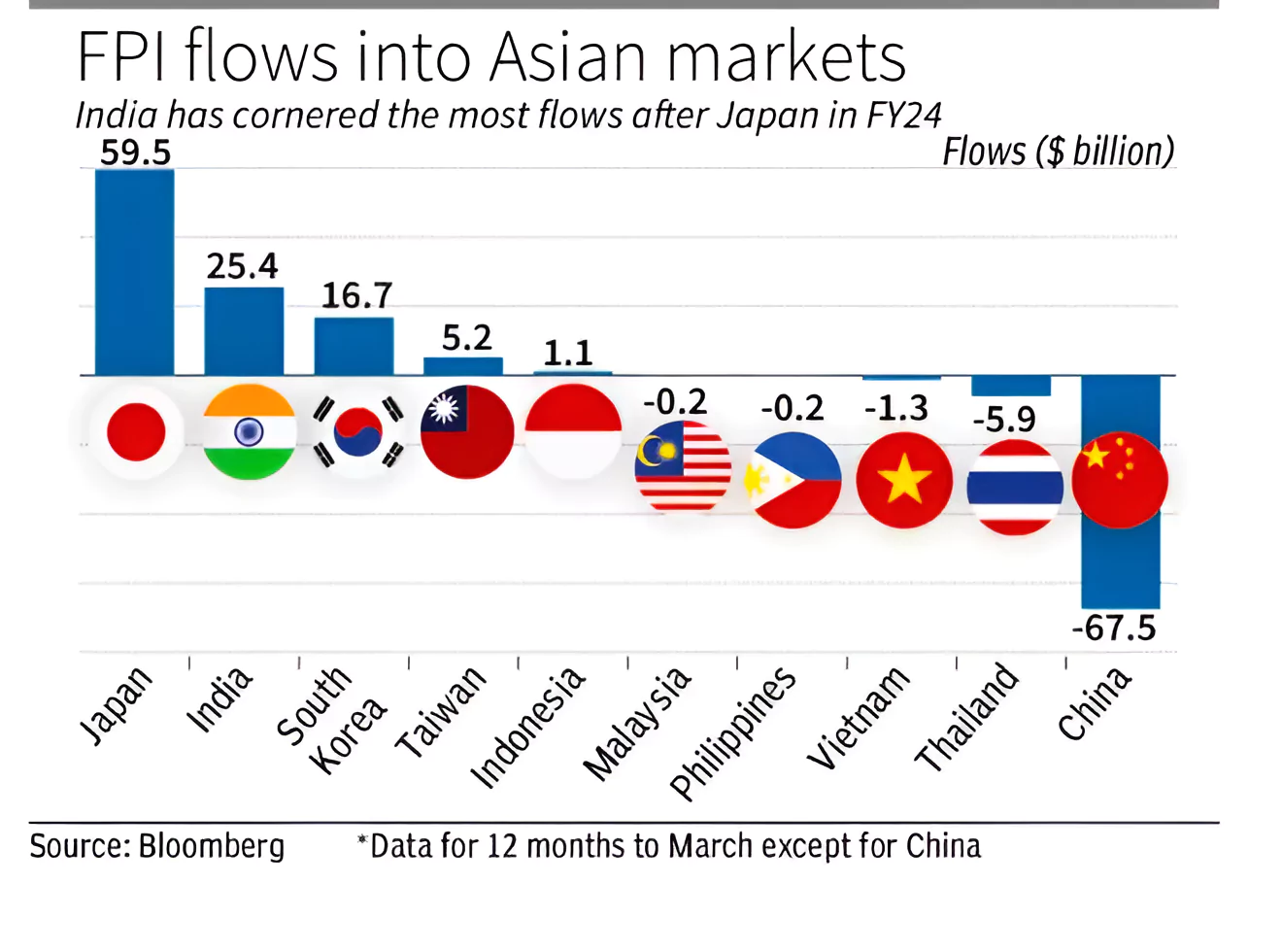

- China, on the other hand, saw outflows of over $67 billion in the 12 months to December.

- According to reports, emerging market investors in the US are increasingly favouring exchange-traded funds that avoid exposure to China.

- Investment in Indian Debt: Foreign Portfolio Investors (FPIs) have allocated $14.4 billion towards Indian debt, surpassing investments made in all years except FY15 and FY18.

- Investment in Equity flows: Equity flows stood at over $25 billion, more than flows received by all other Asian markets except Japan, which received $59.5 billion.

- Investment in hybrid instruments: $1.5 billion of FPI funds have been directed towards hybrid instruments.

- Rising Interest in government bonds: Investors have shown increased interest in government bonds since September of the previous year, anticipating India’s potential inclusion in global bond indices.

- Driving factors: The flows have largely been driven by the performance of our economy which has done well despite geopolitical conflicts, Covid, and rate action by the US Fed.

- The PLI schemes and the China plus one story had helped the cause of Indian manufacturing.

- The massive investment in infrastructure modernisation is helping companies in the materials, real estate and construction space.

- Banks now have cleaner balance sheets with low NPAs which augurs well for the economy as a whole.

- Steady growth in debt investment: An interesting feature of the foreign portfolio investment in India this fiscal is the steady growth in debt investment in sharp contrast to the volatile equity investment.

About FPI: Foreign Portfolio Investment

- About: FPI consists of securities and other financial assets held by investors in another country. It does not provide the investor with direct ownership of a company’s assets and is relatively liquid depending on the volatility of the market.

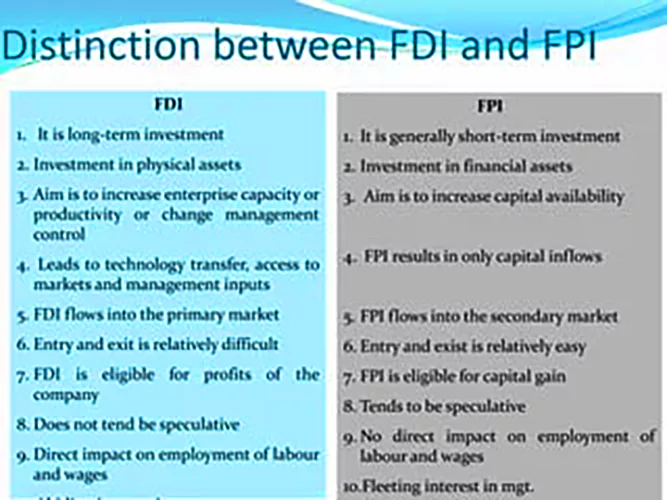

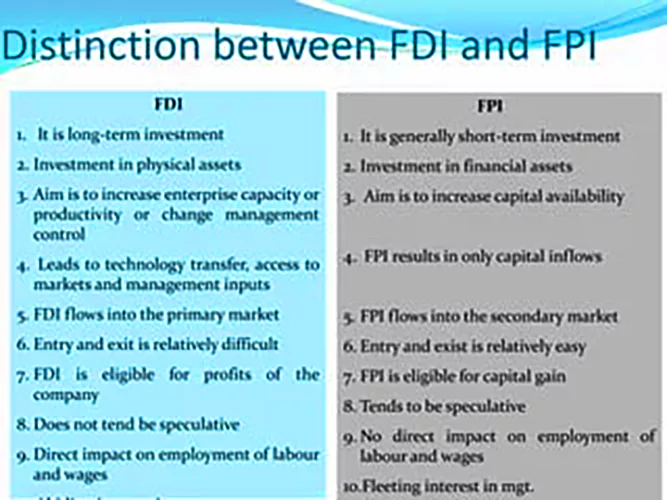

- Along with foreign direct investment (FDI), FPI is one of the common ways to invest in an overseas economy. FDI and FPI are both important sources of funding for most economies.

- FPI Holdings: It can include stocks, ADRs, GDRs, bonds, mutual funds, and exchange traded funds.

- Part of BOP: On a more macro level, foreign portfolio investment is part of a country’s capital account and shown on its balance of payments (BOP).

- The BOP measures the amount of money flowing from one country to other countries over one monetary year.

- Passive ownership: Unlike FDI, FPI consists of passive ownership i.e., investors have no control over ventures or direct ownership of property or a stake in a company.

- With FPI, an investor does not actively manage the investments.

- In contrast, FDI lets an investor purchase a direct business interest in a foreign country.

Benefits of FPI (Foreign Portfolio Investment)

- Liquidity: FPI is more liquid than FDI and offers the investor a chance for a quicker return on his money—or a quicker exit.

- Feasible for Retail Investors: Foreign portfolio investments are more suited to the average retail investor.

- FDI is more the province of institutional investors, ultra-high-net-worth individuals, and companies. However, these large investors may also use.

- More Marketable: Since the FPI investments are financial assets, not the property or a direct stake in a company, they are inherently more marketable.

Difference Between Debt and Equity Investments

- About: Debt market instruments (like bonds) are loans, while equity market instruments (like stocks) are ownership in a company.

- Returns: Debt instruments pay interest to investors, while equities provide dividends or capital gains.

- Risk Profile: Debt instruments are generally considered safer as they offer fixed returns and have a higher claim on assets during liquidation, unlike equities.

Also Read: India Is The 2nd Largest Recipient Of Foreign Flows In 2023

![]() 30 Mar 2024

30 Mar 2024