Context:

The Indian stock market has become the 4th largest globally, surpassing Hong Kong.

Indian Stock Market Became 4th Largest Stock Market, Surpassing Hongkong

- Indian stock market value: $4.33 trillion (₹366 lakh crore)

- Hong Kong’s total market value: $4.29 trillion

- The Top 3 stock markets in the world are the US, China, and Japan.

Factors Contributing to India’s 4th Largest Stock Market

- Impact of Hong Kong’s Market Decline: The decline in Hong Kong’s stock market due to the weakening appeal of China as an investment destination has helped India emerge as the world’s largest stock market.

- Strong Corporate Performance: Many Indian companies, especially in sectors like IT, pharmaceuticals, and renewable energy, are experiencing higher growth and profitability.

- This has helped in attracting investor interest and boosted market capitalization.

- Technological Upgradation: Technological advancements such as online trading platforms and mobile apps have made access to the stock market easy. It has helped in increasing the investor base and facilitated efficient transactions.

- India’s Alternative to China: Economic slowdown and geopolitical uncertainties make China less attractive to investors. However, India’s stable and promising economic environment, coupled with recent reforms has made India a favorable alternative.

Implications of Indian Stock Market Surpassing Hong Kong

- Geopolitical Impact:

- Geopolitical Shift in Power Dynamics: India’s growing influence in the financial world signals its increasing economic and political strength, possibly challenging China’s dominance.

- Enhanced Soft Power: A rising stock market can attract foreign investment which can improve India’s reputation as a stable and appealing investment destination.

- Potential for Cooperation: A stronger Indian economy could encourage deeper economic and strategic cooperation with other regional players like the Quad countries to counterbalance China’s influence.

- Geo-economic Consequences:

- Diversification of Investments: India’s larger market provides more investment options, reducing dependence on the Chinese market and lessening risks linked to its slowdown.

- Rise of the Indian Rupee: Increased foreign investment could elevate the value of the Indian rupee, making it a more significant regional currency and possibly challenging the dominance of the US dollar.

- Growth of Financial Hubs: A larger and more dynamic Indian stock market could transform cities like Mumbai into major financial hubs in the region, attracting capital and expertise.

Challenges and Uncertainties

- Sustaining Growth:

- India must maintain robust economic growth and implement effective financial regulations to retain its position as a top market.

- Domestic Challenges:

- Issues like income inequality and social unrest might hinder India’s economic potential and limit its global impact.

- China’s Reaction:

- China may respond to India’s rise through economic or political measures, creating uncertainties in the regional dynamics.

What is the Stock Market?

- Definition: It is a marketplace where publicly listed companies’ stocks (Equities or Shares) are bought and sold.

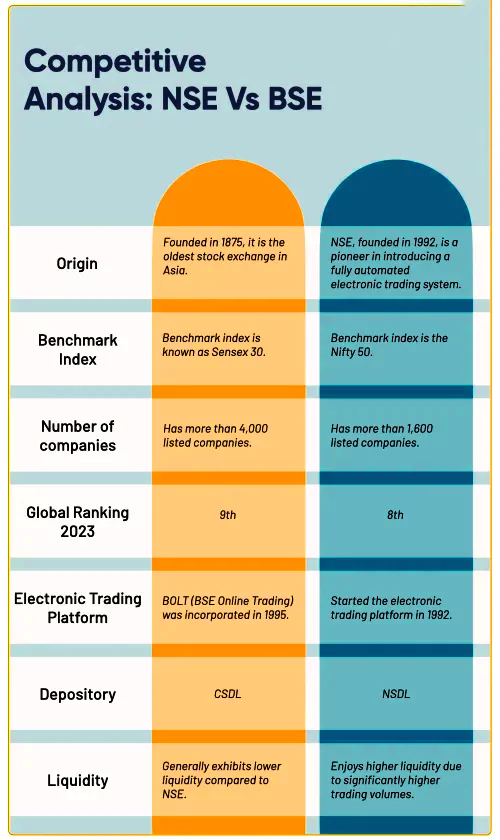

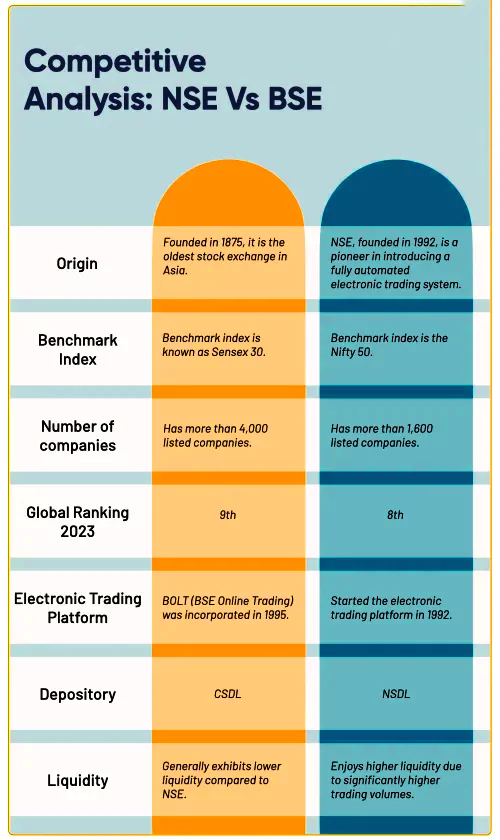

- There are two primary stock exchanges:

- The Bombay Stock Exchange (BSE): It is the oldest stock exchange

- The National Stock Exchange (NSE).

- These stock exchanges have their benchmark indices:

- The SENSEX for the BSE

- The NIFTY 50 for the NSE

- These benchmarks track the performance of the top 30 and 50 companies respectively.

- Market Structure:

- Primary Market: Companies release shares to the public through an initial public offering (IPO) to raise funds.

- Secondary Market: Investors buy shares from each other either at the current market price or at a price they both decide on.

- Regulation by: The primary and secondary markets are regulated by SEBI in India.

About Security and Exchange Board of India

- SEBI is a statutory body.

- It was established in 1992.

- It regulates the stock market.

- Its main aim is to save investors’ interest in securities.

|

News Source: Indian Express

![]() 24 Jan 2024

24 Jan 2024