Context: This article is based on the news “Mining for critical minerals: what is the auction process, and why is it important?” which was published in the Indian Express. India has recently launched the first tranche of auctions for critical and strategic minerals worth around ₹45,000 crore.

| Relevancy for Prelims: Mineral and Energy Resources, Critical Minerals, Rare earth elements, Mines, and Minerals (Development & Regulation) Amendment Act, 2023, and Mineral Security Partnership (MSP).

Relevancy for Mains: Mining For Critical Minerals: How is the auction process conducted, Significance of Critical Mineral Mining, and challenges in assuring resilient critical minerals supply chains. |

Government Initiates Auction Process for Critical Minerals

- The bidding process began after the government declared 30 minerals as “critical”, and amended the Mines and Minerals (Development And Regulation) Act to allow commercial mining of lithium and a few other minerals.

- The bid for each block will be awarded on the highest percentage of mineral dispatch value quoted by the bidder.

- After the ongoing auction is over, the process of auctioning a second tranche of critical mineral blocks is expected to begin.

- It is currently unclear if this second tranche includes new lithium reserves in Rajasthan and Jharkhand.

Mines and Minerals (Development & Regulation) Amendment Act, 2023:

- Lifting ban: The amendment lifts the ban on commercial mining of six critical minerals which are Lithium, beryllium, titanium, niobium, tantalum and zirconium.

- Critical minerals: The government declared 30 minerals as critical for the country, including the above six minerals.

- Monetising assets: The amendment allows the Central government to auction these minerals while the royalty will go to the states.

Know more about the Mines and Minerals (Development and Regulation) Amendment Bill, 2023, here. |

What are the critical minerals?

- Critical Minerals: These are minerals that are essential for clean energy, economic development, and national security.

- These are essential for the advancement of many sectors, including high-tech electronics, telecommunications, transport, and defense.

- Identified Critical Minerals: The Expert Committee under the Ministry of Mines has identified a set of 30 critical minerals for India.

- These are Antimony, Beryllium, Bismuth, Cobalt, Copper, Gallium, Germanium, Graphite, Hafnium, Indium, Lithium, Molybdenum, Niobium, Nickel, PGE, Phosphorous, Potash, REE, Rhenium, Silicon, Strontium, Tantalum, Tellurium, Tin, Titanium, Tungsten, Vanadium, Zirconium, Selenium, and Cadmium.

- Lithium Reserves: India’s first official lithium was found in the Salal Haimna block of Reasi district of Jammu and Kashmir, which has been auctioned.

- Katghora block in Chhattisgarh is also on auction, which consists of lithium and rare earth elements (REE).

How is the auction process conducted for critical minerals in India?

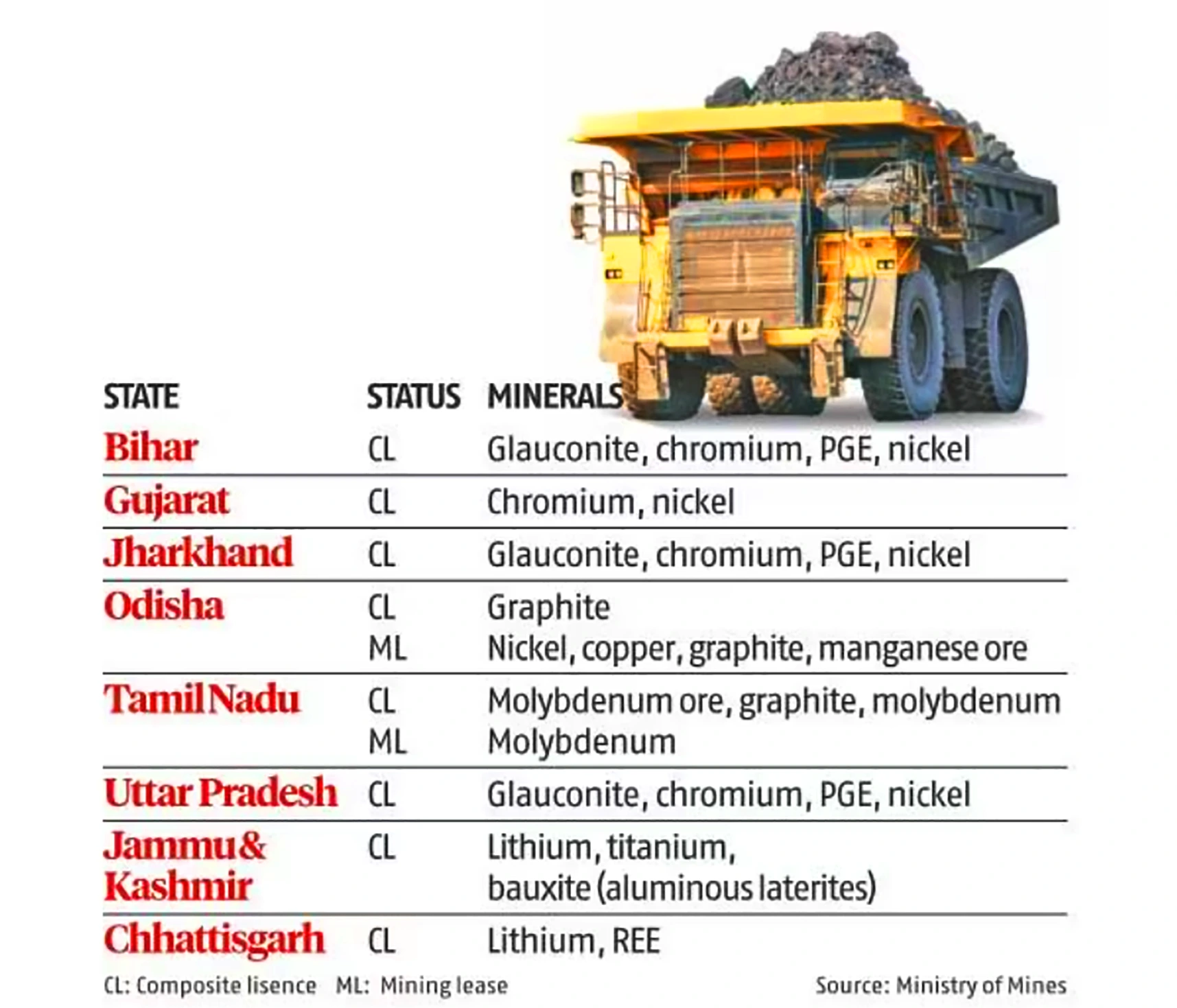

- Minerals in Auction: Around 20 mineral blocks covering lithium and REE (rare earth elements), nickel, copper, chromium, phosphorite, potash, glauconite, graphite, manganese, and molybdenum were put under the auction.

- Location: The blocks are located across 8 States, namely Odisha, Jharkhand, Uttar Pradesh, Bihar, Chhattisgarh, Tamil Nadu, Gujarat, and Jammu & Kashmir.

- Duration: The entire auction process will be completed within 103 days from the date of launch of the auction. Further, the Government is committed to bringing more critical mineral blocks to auction in a phased manner.

- Types of Agreement: Of the 20 blocks, 16 are Composite Licences (CL) blocks, while 4 are Mining Leases (ML).

- Mining Lease: It allows mining for specified minerals and conducts other activities associated with mining or promoting the activity of mining. Under ML, once the license is granted, the licensee can begin mining operations after obtaining the requisite clearances.

- Composite Licence: It means the prospecting licence-cum-mining lease which is a two-stage concession granted to undertake prospecting operations followed by mining operations in a seamless manner. CL allows the licensee to conduct further geological exploration of the area to ascertain evidence of mineral contents.

- Exploration Period Under CL: The Licensee can make an application to the relevant state government to convert their CL to an ML to begin mining operations pending requisite clearances.

- The licensee has 3-5 years to complete the prescribed level of exploration, failing which the licence will be withdrawn.

- Clearances Required: Out of the total concession area of 7,197 hectares (for all 20 blocks), 17% of the area is forest land with status.

- Once granted a licence, the licensee will have to obtain 15 approvals and clearances including forest clearance, environmental clearance, Gram Sabha consent, etc. before beginning operations.

What is the Significance of Critical Mineral Mining for India?

- Boost Atma Nirbhar Bharat: Critical minerals are fundamental to the manufacturing sector, and their availability is crucial for economic growth with industries heavily relying on these minerals for the production of components and technologies. Once the mining is operational, it will help to cut down imports of these minerals and ensure to fulfillment of the vision of Aatmanirbhar Bharat and further development of strategic sectors.

- Ensuring Critical Mineral Security: As India and the world at large are focusing on expanding renewable energy capacity, the demand for certain critical minerals is expected to rise.

- Further, India has set up KABIL or the Khanij Bidesh India Limited to ensure the mineral security of the nation.

- Reducing Dependency on Imports: India is 100% reliant on imports for its lithium and nickel demand and around 93% for copper. Developing domestic mining capabilities can help reduce this dependency, making the country more self-reliant and resilient to global market fluctuations.

- In August 2023, India imported 2,145 tonnes of lithium carbonate and lithium oxide at a total cost of Rs 732 crore.

- India also imported 32,000 tonnes of unwrought nickel for Rs 6,549 crore, and 1.2 million tonnes of copper ore for Rs 27,374 crore, in 2022-23.

- National Security: Critical minerals are essential for the defense industry, contributing to the production of advanced weaponry, communication systems, and other strategic technologies.

- Ensuring a domestic supply of these minerals is vital, as dependence on foreign sources may pose risks during times of geopolitical uncertainties.

- Job Creation and Local Development: The mining and processing of critical minerals can contribute to Employment Generation, particularly in regions where these minerals are available, further providing opportunities for infrastructure development.

- Environmental Sustainability:

- Critical minerals are crucial for the transition to a clean energy. They help in reducing the reliance on fossil fuels and consequently greenhouse gas emissions.

- 500GW of renewable energy capacity target by 2030 necessitates these minerals.

- Green technologies like solar panels, wind turbines, batteries, and electric vehicles rely heavily on critical minerals.

- International Cooperation: International cooperation is crucial for diversifying import sources and securing supply chains.

- India’s membership in the Mineral Security Partnership (MSP) in June 2023 (MSP) strengthens its position and provides a platform to advocate for developing countries. Joining them is a strategic move.

Estimated Reserves:

- Lithium Reserve: The blocks of lithium reserves in J&K and Chhattisgarh are up for auction for a CL.

- J&K Block: It has an inferred reserve of a 5.9 million tonne (mt) of bauxite column, which contains more than 3,400 tonnes of lithium metal content and it also contains more than 70,000 tonnes of titanium metal content.

- Chhattisgarh Block: It contains lithium and REEs, but no drilling has been conducted yet to estimate total reserves.

- Nickel Ore Reserves: These have been found in Bihar, Gujarat, and Odisha.

- Odisha Block: An inferred value of 2.05 mt of nickel ore, which amounts to 3,908 tonnes of nickel metal content.

- Bihar and Gujarat Block: No drilling has been conducted.

- Copper Reserves: The Odisha block is the only block among the 20 that contains deposits of copper, amounting to 6.09 mt of copper ore and 28,884 tonnes of copper metal content.

|

What are the challenges India faces in assuring resilient critical minerals supply chains?

Global Challenges:

- China: The dominant player in critical mineral supply chains faces disruptions due to COVID-19 lockdowns, potentially impacting extraction, processing, and exports.

- Russia-Ukraine War: Russia is one of the significant producers of nickel, palladium, titanium sponge metal, and the rare earth element scandium. Ukraine is one of the major producers of titanium.

- Disruptions in production and supply of critical minerals like nickel, palladium, titanium, and rare earth elements due to the war.

- Geopolitical Shifts: A strategic partnership between China and Russia could further affect critical mineral supply chains, especially as developed countries form rival alliances.

- For example: the Minerals Security Partnership (MSP) and G7’s Sustainable Critical Minerals Alliance.

- Increased Demand: Transition to renewable energy and electric vehicles requires more minerals like copper, lithium, cobalt, and rare earth elements, exceeding current global production.

Domestic Challenges:

- Limited Domestic Reserves: India lacks sufficient reserves of many critical minerals, necessitating reliance on imports.

- However, India does not have in significant amounts, the reserves of nickel, cobalt, molybdenum, rare earth elements, neodymium, and indium, and the country’s requirement of copper and silver are higher than its current reserves.

- High Demand: India’s growing economy and ambitious green energy goals place high demands on critical mineral resources.

Way Forward:

- Increasing Mineral Exploration: Conducting thorough assessments to identify and quantify critical mineral deposits across the country, investing in advanced geological surveys and exploration of technologies to locate potential reserves is crucial.

- For instance, as per the Geographical Survey of India’s (GSI) field season 2023-24 report, lithium exploration projects are underway in at least three states, including Korba district in Chhattisgarh, South Garo Hills and East Garo Hills in Meghalaya, and Jammu, Ramban, Resai, Rajouri and Udhampur in Jammu and Kashmir.

- Investment Promotion: Create a conducive investment environment by offering incentives, tax breaks, and streamlined regulatory processes to attract domestic and foreign investment in critical mineral mining projects.

- Further, facilitate public-private partnerships to share the risks and rewards of critical mineral exploration and production.

- The government specified new royalty rates for critical minerals by matching global benchmarks to attract investment in mining.

- Environmental and Social Responsibility: Minimize the ecological impact of mining activities while implementing community engagement programs to address the concerns of local communities and ensure that the benefits of mining are shared equitably.

- Technology Adoption: Embrace and invest in advanced technologies such as automation, artificial intelligence, and robotics to improve efficiency, reduce costs, and enhance safety in mining operations.

- National Strategy:

- Develop a comprehensive national strategy for critical minerals, aiming for self-reliance in these resources.

- Address environmental concerns and protect affected communities through sustainable mining practices.

- International Cooperation: India must actively engage in bilateral and plurilateral arrangements for building assured and resilient critical mineral supply chains.

- Collaboration with countries like Australia and Canada can leverage their advanced exploration technologies and expertise, leading to faster and more efficient resource discovery.

Conclusion:

The auction process for critical minerals in India, marked by the Mines and Minerals (Development & Regulation) Amendment Act, 2023, is a crucial step towards reducing import dependency.

![]() 7 Dec 2023

7 Dec 2023