![]() 26 Mar 2024

26 Mar 2024

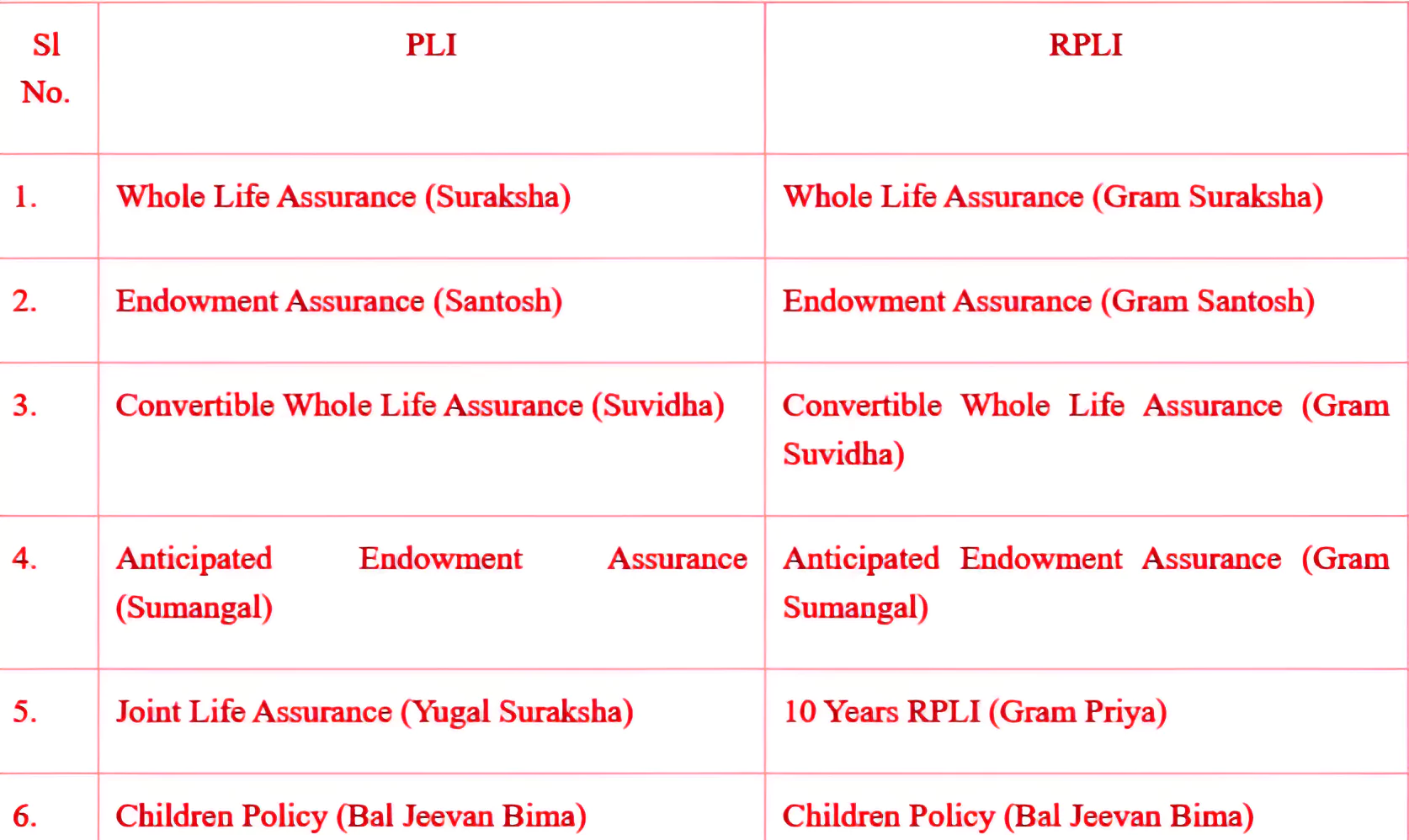

Recently, the Central Government has approved a simple reversionary bonus for the Postal Life Insurance Scheme and Rural Postal Life Insurance Scheme for fiscal year 2024-25 without changing the rate.

However, a period of consecutive 5 years should not have passed from the date of first unpaid premium.

However, a period of consecutive 5 years should not have passed from the date of first unpaid premium.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>