Context

Recently, the Reserve Bank of India’s (RBI’s) latest Monetary Policy Report (included in its April Bulletin) has given primacy to “extreme weather events” and “climate shocks”.

Reserve Bank of India’s (RBI’s) Path to Green Economy: Sustainable Investment and Net Zero Goals

Beginning with its July 2022 discussion paper on ‘climate risk and sustainable finance’, the RBI has made incremental progress to address the transition to a green economy.

The European Central Bank has aided the formulation of a green taxonomy for the entire Eurozone’s economic value chain.

- The EU green taxonomy is a complex system to classify which parts of the economy may be marketed as sustainable investments. It includes economic activities, as well as detailed environmental criteria that each economic activity must meet to earn a green label.

Enroll now for UPSC Online Course

Crucial Insights of the Reserve Bank of India’s (RBI’s) latest Monetary Policy Report

- Climate & Economic Stability: The “extreme weather events” and “climate shocks” are affecting not only food inflation but also likely having a broader impact on the natural rate of interest, thereby influencing the economy’s financial stability.

Monetary Policy:

- It is the macroeconomic policy laid down by the Central Bank (RBI), involving management of money supply and interest rate.

|

-

- The report said global average temperatures are rising, with an accompanying increase in extreme weather events, and the economic and social impact is becoming increasingly evident.

- The report warns that ‘if inflation hysteria gets entrenched, it may lead to a de-anchoring of inflation expectations, and the undermining of the RBI’s credibility would warrant higher interest rates to curb inflation, leading to greater output loss’.

- Maximum Economic Output: Natural, or neutral, rate of interest refers to the central bank’s monetary policy lever allowing it to maintain maximum economic output, while keeping a check on inflation.

| The natural rate refers to the short-term real interest rate that would prevail in the absence of business cycle shocks, with output at potential, saving equating investment and stable inflation. |

-

- The report warns that the “long-term (economic) output” could be lower by around 9% by 2050 in the absence of any climate mitigation policies.

- New-Keynesian Model: The report mentions a “New-Keynesian model that incorporates a physical climate risk damage function” being used to estimate the “counterfactual macroeconomic impact of climate change vis-à-vis a no climate change scenario”.

About Green Taxonomy

Green Taxonomy is defined as a framework to assess the sustainability credentials and possible ranking of an economic activity.

- Need: In recent decades, the challenges of a rapidly warming planet and other aspects of environmental degradation have motivated a call for all actors in society, including the financial sector, to take responsibility for environmental sustainability.

- Aim: To help financial actors and others determine which investments can be labeled “green” for their jurisdiction.

- Significance: The support for making informed decisions on environmentally friendly investments can encourage the undertaking of projects and activities that help scale up environmentally sustainable economic development and contribute to specific environmental objectives.

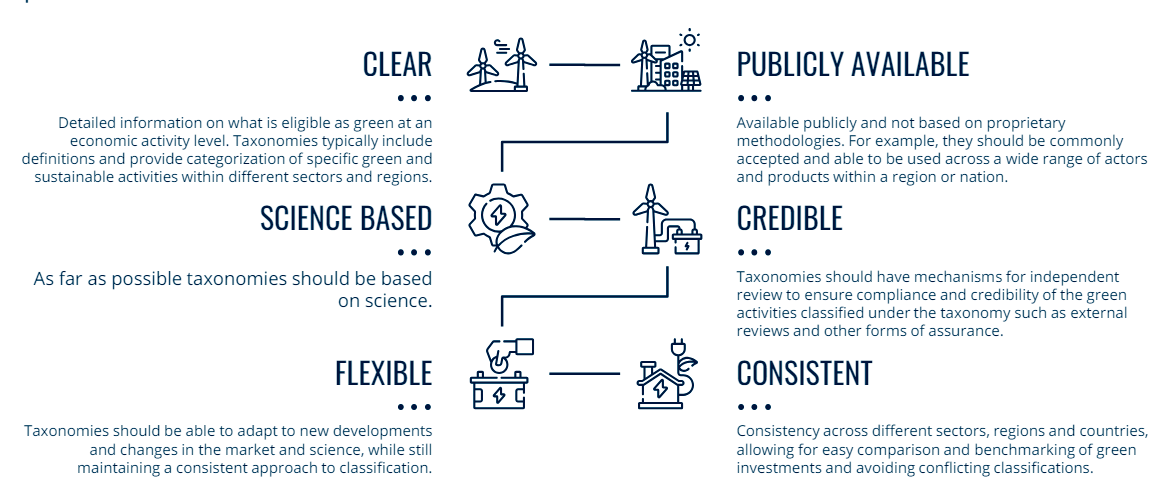

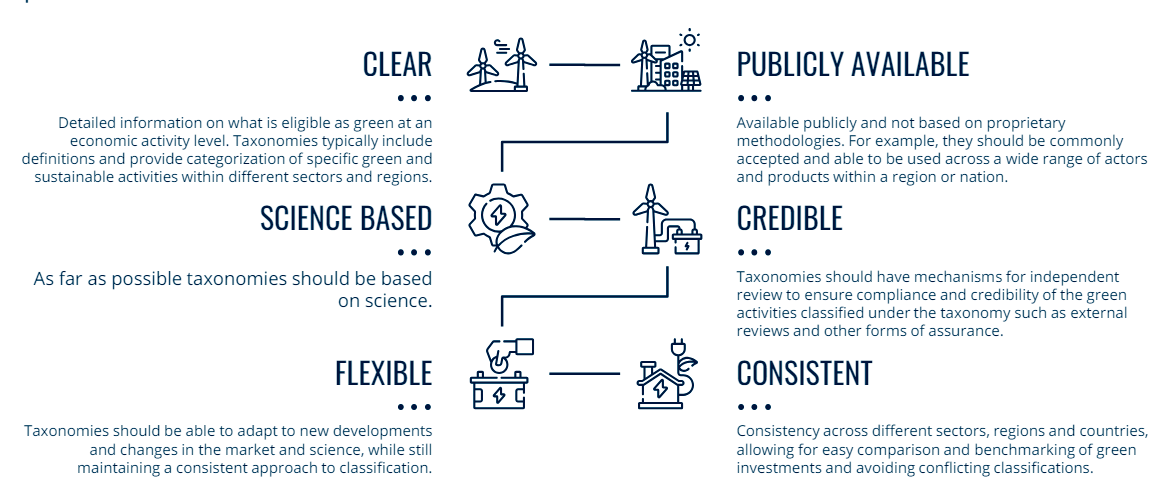

Principles of a Green Taxonomy: The World Bank Group recommends the principles and methodology for developing a taxonomy of environmentally sustainable activities.

- Multipronged Impact: A green taxonomy should be developed in a way that has a multipronged impact on green finance.

- Environmental Objectives: The green taxonomy should focus on India’s most pressing environmental challenges – climate change mitigation and adaptation, pollution prevention and control, resource efficiency, conservation of natural resources, and ecosystem/biodiversity conservation.

- These are serious challenges in sectors such as energy, manufacturing, transport, agriculture, waste, and buildings. The green taxonomy may thus focus on these sectors to maximise the positive environmental outcomes expected to be generated from it.

- In India, as opposed to quantitative technical screening criteria, there is a need to include a pre-specified set of sustainable agricultural and livestock farming practices.

- Standard Criteria: The green taxonomy must be anchored in Nationally Determined Contributions, key national plans and policies for environmental action, and national norms and standards.

- The Indian green taxonomy must rely on pollution standards set by the Central Pollution Control Board (CPCB) under the Ministry of Environment, Forests & Climate Change (MOEF&CC), water consumption norms set by the MOEF&CC and Ministry of Jal Shakti, and the Environmental Impact Assessment (EIA) protocol defined by the MOEF&CC.

- The monetary valuation of ecosystem services may also be used for assessing ecosystem and biodiversity losses.

- Innovative: Such green taxonomy provides the freedom to choose between alternative pathways to green transition and prevents it from being redundant amidst technological innovations.

- India must use the latest climate science for its technical screening criteria relating to GHG emission thresholds. The criteria should be consistent with 1.5°C rather than 2°C.

- India must establish its own screening criteria for determining eligibility for green finance.

In Harmony with International Standards: Existing Indian standards may be revised to be at par with international benchmarks within the scope provided by domestic circumstances.

In Harmony with International Standards: Existing Indian standards may be revised to be at par with international benchmarks within the scope provided by domestic circumstances. - Alignment of Tracking of Green Finance & Disclosure Norms: There is a need for tracking climate/green finance through transparent and well-defined disclosures and reporting.

- Regulators such as the RBI and Securities and Exchange Board of India (SEBI) should mandate financial market participants to delineate the environmental goals met.

- The Ministry of Corporate Affairs must mandate companies to enlist the environmental objectives achieved by economic activities.

- Regular Reviews & Updates: There is a need for timely updates to incorporate changes in development levels, technology, policy, standards and environmental conditions.

Enroll now for UPSC Online Classes

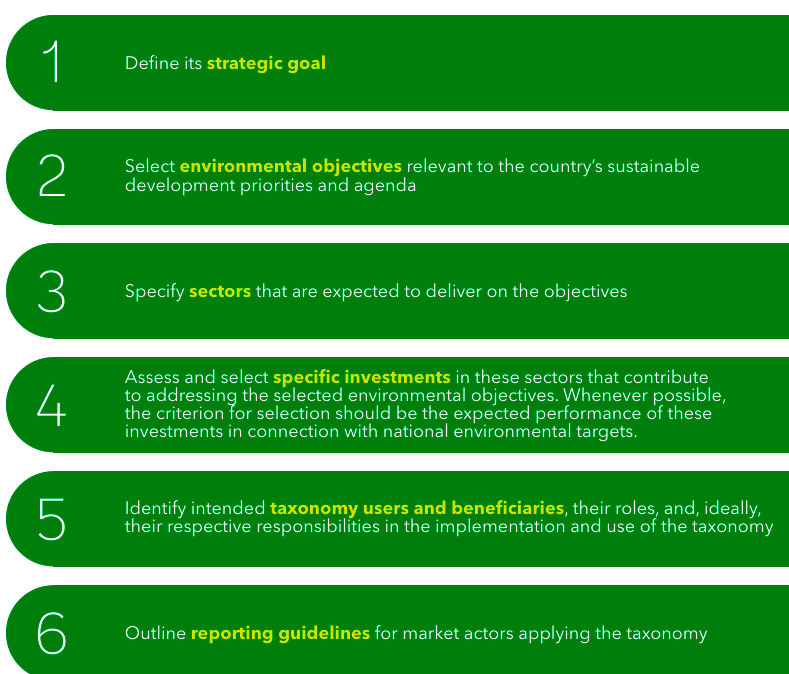

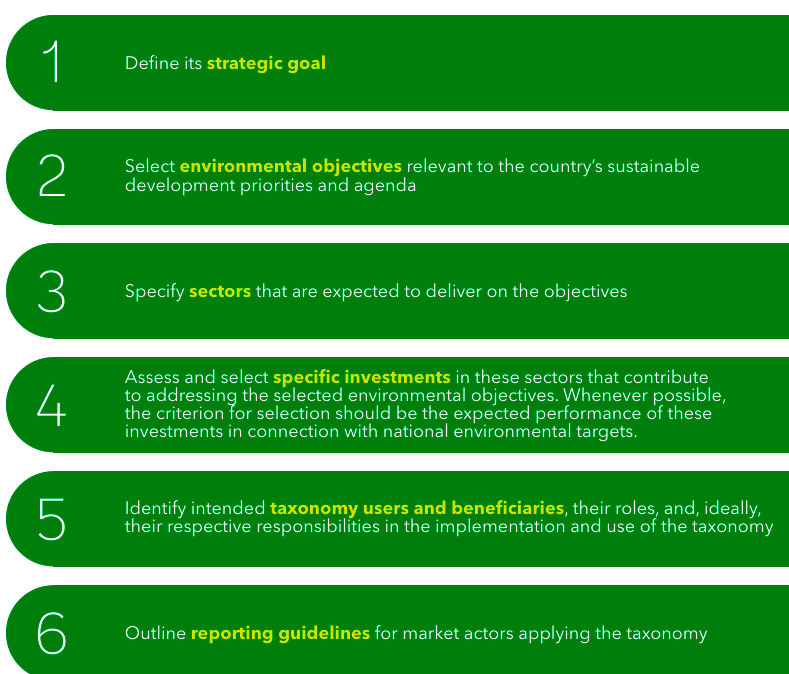

Actions Suggested to Define the Contents of a Green Taxonomy

Need for a Well-defined Green Taxonomy

- Information: Reduce the incidence of information asymmetry.

- Interpretations: Rule out plural interpretations of green finance.

- Risk Minimisation: Minimise the risk of greenwashing.

- Transparent Understanding: Provide a transparent understanding of the environmental footprint of economic activities underlying investments.

- Investors-Friendly: Provide the guidance and confidence sought by investors in making environmentally conscious investment decisions.

- Visibility: Provide visibility to capital-starved green sectors, allowing them to attract requisite investments away from renewable energy (which currently accounts for 80% of green finance in India).

- Management & Monitoring: It can be the standard for Financial Institutions (FIs) and companies in managing and monitoring the environmental quotient of their financial profile while allowing regulators like SEBI and RBI to oversee these entities by mandating disclosures that align with the taxonomy.

- Standardisation: It can facilitate standardisation of data collection, reporting, and impact measurement methodology involved in the construction of Environmental, Social & Governance (ESG) indices.

- Tracking Measurement: It can also be the government’s barometer for tracking the compatibility of environmental outcomes with the vision of global net-zero, while showing the way to appropriate corrections in the case of deviations.

RBI’s Efforts Towards Green Economy

- RBI’s Approach: The RBI has made incremental progress to address the transition to a green economy since its July 2022 discussion paper on climate risk and sustainable finance.

- Green Methods: The RBI has issued ₹16,000 crore worth of Sovereign Green Bonds and expanded the resource pool by allowing Foreign Institutional Investors to participate in future green government securities.Actions that need to be Taken:

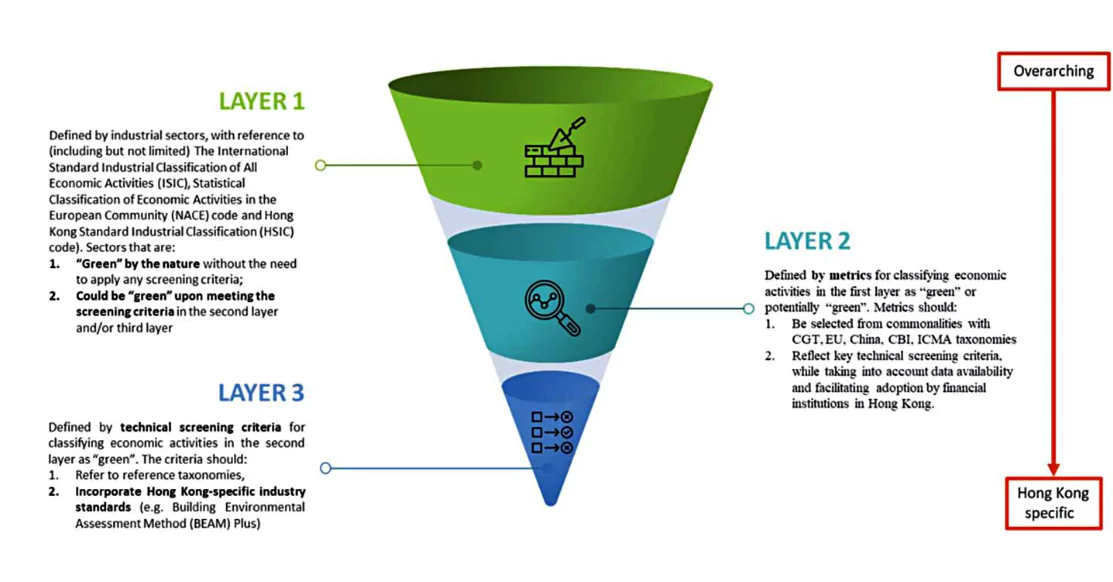

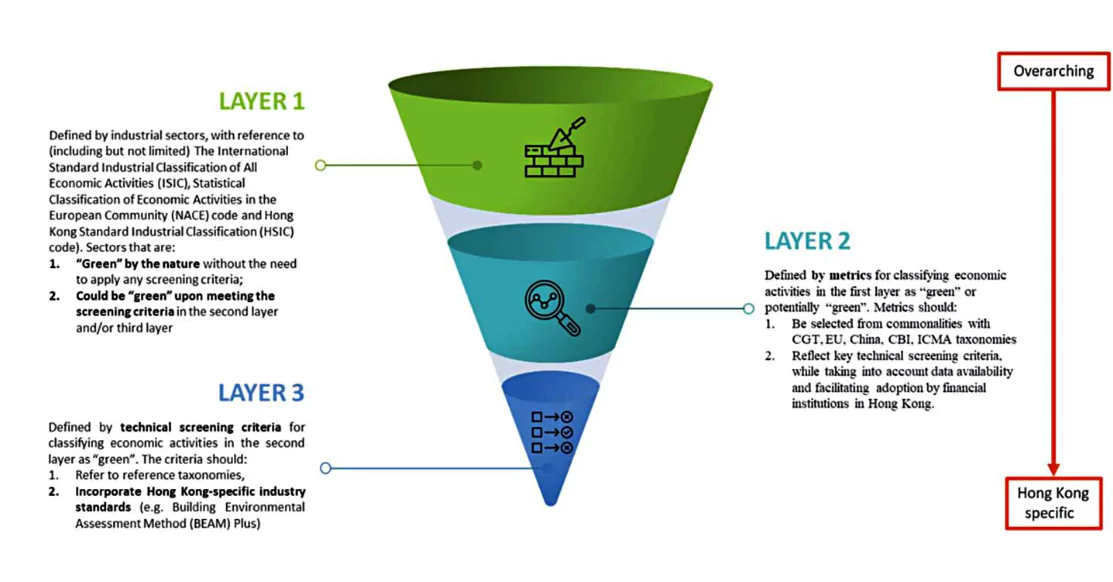

- Layer Green Taxonomy: The RBI and the Finance Ministry could take inspiration from the developing world, especially the ASEAN region, where a layered green taxonomy as a living document keeps getting updated with sectoral views of possible sustainable trajectories.

- Comprehensive Assessment: The RBI must undertake a thorough-going assessment on the quantitative and qualitative impact on economic and financial stability due to climate change.

- Inclusiveness: It must encourage administrative consultation to begin populating a layered green taxonomy that is reflective of India’s fragmented developmental trajectories.

- Mitigation of Risks: The effort should be to mitigate the transitional risks to the financial system as the economy moves towards a sustainable future.

Sovereign Green Bonds (SGrBs) in India:

- Refers: These are a kind of government debt that specifically funds projects attempting to accelerate India’s transition to a low carbon economy.

- High Adoption: Central banks and governments the world over are encouraging financial institutions to embrace greeniums to hasten the transition to a greener future.

- However, SGrBs yield lower interest than conventional G-Secs, and the amount foregone by a bank by investing in them is called a greenium.

- Issued Earlier in India: The RBI had issued SGrBs worth ₹16,000 crore in two tranches in January and February last year with maturities in 2028 and 2033.

- Classification under Statutory Liquidity Ratio (SLR): Moreover, these green Government -Securities (G-Secs) were classified under the SLR.

- SLR is a liquidity rate fixed by the RBI that financial institutions must maintain with themselves before they lend to their customers.

|

Framework for Green Taxonomy: Aligning Regulations and Investments for Sustainable Growth

- Clear Definition: A green taxonomy definition should be developed in accordance with a country’s existing environmental targets, laws, standards, and labeling schemes.

- Technological Advancement: All times, the focus should be on providing a technically sound justification for the activities and investments considered green.

- This logic is aligned with international practices, such as the EU taxonomy.

- Addressal to Cross-environmental & Social Risk: The green taxonomy may include a section describing the national or, if relevant, the sectoral frameworks for addressing the potential for transferring risk from one environmental objective to another or to different population groups.

- Risk Mitigation Schemes: These are anchored in existing national standards, policies, or regulations and will inform users about how these potential risks are addressed.

- It is advisable to provide relevant references and links to such national and sectoral regulations.

- Adequate Investments: The taxonomy should have the stature of an official guideline or policy for filtering such investments in both the public and private sectors.

- It has been experienced that for a taxonomy to be effective, it is important to connect it with existing and potential new incentives (such as fiscal incentives, soft credit lines, guarantees, and so on) that promote and support environmentally sound activities, including low-carbon and climate-resilient development.

- Examples: Lowering capital requirements for sustainable financial products, setting regulatory quotas (minimum annual targets for the disbursement of green finance), and lowering refinancing rates, among others, based on solid market research.

- Learning from International Experience:

- China: Mandatory green credit guidelines issued by the China Banking and Insurance Regulatory Commission (CBIRC) and the People’s Bank of China (PBOC) have led to increases in green loans to projects offering energy savings or emission reductions.

- Bangladesh: Green loan portfolios of Bangladeshi banks also increased significantly after the central bank set a minimum annual target for green financing for banks and other financial institutions.

Enroll now for UPSC Online Course

Conclusion

A well-defined and structured green taxonomy can support better-informed and more efficient decision making and response to investment opportunities that contribute to achieving national environmental objectives. It will influence India’s ambitious green transition and the introduction of a national taxonomy will display India’s aspiration of ramping up its contribution to the global net-zero vision.

Also Read: FIIs To Invest In Its Green Bonds In India

![]() 29 Apr 2024

29 Apr 2024

In Harmony with International Standards: Existing Indian standards may be revised to be at par with international benchmarks within the scope provided by domestic circumstances.

In Harmony with International Standards: Existing Indian standards may be revised to be at par with international benchmarks within the scope provided by domestic circumstances.