Context

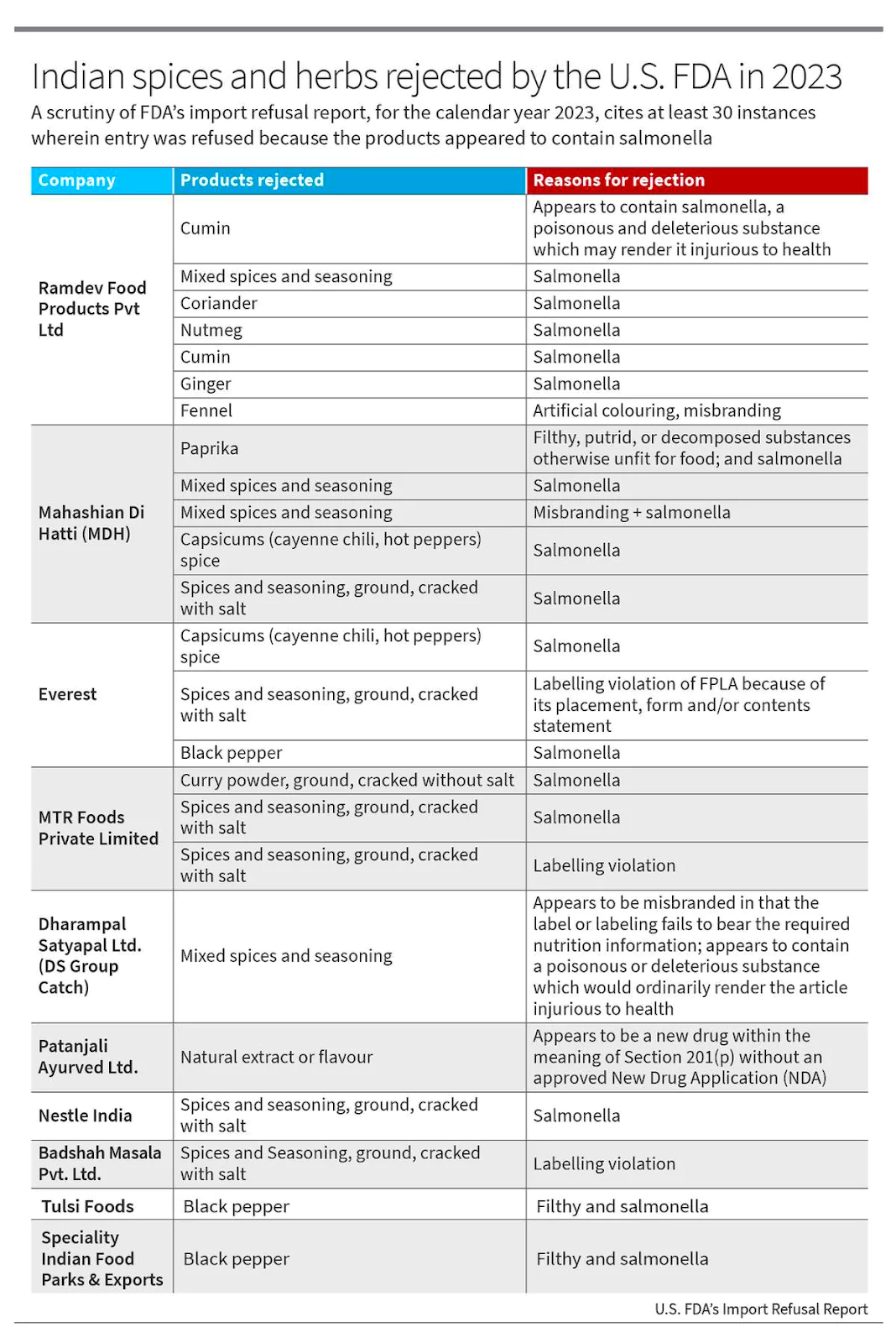

Recently, there has been a notable rise in the rejection of Indian spice shipments in various countries.

Indian Spices Face Global Rejections Amid Contamination Concerns and Regulatory Scrutiny

In the past six months, about one-third of Mahashian Di Hatti (MDH) Pvt Ltd’s spice shipments to the US were turned away due to salmonella contamination.

- Hong Kong’s Action: Hong Kong’s Centre for Food Safety suspended the sale of three MDH spice blends (Madras curry powder, Sambhar masala and curry powder masala) and Everest fish curry masala.

- Singapore and Hong Kong Suspensions: Both have suspended the sale of several products from both MDH and Everest Food Products Pvt Ltd due to alleged detection of a cancer-causing pesticide (ethylene oxide) in their products.

- Investigation on Contamination: Various countries (including Singapore, Hong Kong and the U.S.) have announced an investigation into possible contamination of spice mixes sold by top Indian brands.

-

- The complaints cite the presence of ethylene oxide, a toxic chemical used as a food stabilizer, beyond permissible limits.

- The international scrutiny has also raised a demand for the Food Safety and Standards Authority of India to ensure stringent quality checks on spices and curry powders sold in domestic markets.

- Controversies also arose for protein drinks, fruit juices, health drinks and imported Nestle baby products, drawing attention to regulatory lapses and heightening health concerns.

- Consumers are increasingly questioning the safety and quality of trusted brands.

Enroll now for UPSC Online Course

India’s Response to Spice Contamination:

- Spice Board of India Initiatives: It has initiated mandatory testing of products shipped abroad and is reportedly working with exporters to identify the root cause of contamination.

- Inspection: Thorough inspections at exporter facilities are also underway to ensure adherence with regulatory standards.

- Preventing Measures: Preventing ethylene oxide (EtO) contamination by voluntary testing of EtO during raw and final stages; EtO treated products to be stored separately; to identify EtO as a hazard and incorporate critical control points in hazard analysis.

- FSSAI Action: The FSSAI has directed state regulators to collect samples of major spice brands, including MDH and Everest, to test for the presence of EtO.

- It also plans to carry out a nationwide surveillance in 2024-25, for fruit and vegetables, salmonella in fish products, spice and culinary herbs, fortified rice and milk and milk products.

About Indian Spices

- Spices are defined as plant derived substances that add flavor to any dish.

- Spices are primarily used as food flavoring (cloves, black pepper) or to create variety. They are also used in perfume cosmetics (Saffron, sandalwood) and incense (cinnamon, styrax). At various periods, many spices were used in herbal medicine.

History & Evolution of Indian Spices

- Ancient Origins: The use of spices in India can be traced back to ancient times (as far back as the Indus Valley Civilization) and used for culinary and medicinal purposes.

- Trade Routes: India has a strategic location on ancient trade routes, including the Silk Route, facilitated the exchange of spices and relations with other civilizations.

- Ayurvedic Influence: Many spices were believed to possess medicinal properties and were used to treat various ailments.

- Arab and Persian Influence: During the medieval period, they played a significant role in further disseminating Indian spices to the West, which then flourished and became luxury commodities in Europe.

- European Influence: In the 15th century, European powers, particularly the Portuguese, Dutch, and later the British, sought direct access to India’s spice-producing regions, which led to the exploration and establishment of maritime trade routes, contributing to the Age of Exploration.

- Colonial Powers: European colonial powers aimed to control the spice trade, leading to the establishment of trading posts and colonies in India.

-

- Competition for dominance in spice-producing regions was fierce among the Portuguese, Dutch, and British.

- Monopoly of the British East India Company (EIC):

- The British EIC played a significant role in monopolizing the spice trade by controlling spice production, distribution, and trade routes.

- The British introduced large-scale spice plantations, particularly in Kerala and Karnataka, focusing on spices like black pepper, cardamom, and cinnamon for export.

- Post-Independence:

- India continued to be a major player in the global spice market.

- India is known for producing a wide variety of spices due to its diverse climate and geography.

- Example: Spices like black pepper, cardamom, cinnamon, cloves, turmeric, cumin, etc.

- Global Influence: The use of Indian spices is widespread in international markets and cooking.

Spices Market of India

- Status: India is the world’s biggest exporter, producer and consumer of spices, and its domestic market for the products was valued at $10.44 billion in 2022.

- India produces 75 varieties out of 109 varieties, listed by the International Organization for Standardization (ISO).

About International Organization for Standardization (ISO):

- It is an international standard development organization composed of representatives from the national standards organizations of member countries.

- ISO officially came into existence in 1947.

|

- Export: The top three importers of India’s curry powders and mixtures, in the fiscal year 2022-23, include the U.S. (₹196.2 crore), U.A.E (₹170.6 crore) and U.K. (₹124.9 crore).

- These are followed by Saudi Arabia, Australia, Bangladesh, Oman, Canada, Qatar and Nigeria.

- Overall, China, U.S. U.A.E, Bangladesh and Thailand are the top importers of all spices and spice mixes originating from India.

Beyond MDH and Everest, other major manufacturers include Madhusudan Masala, NHC Foods and consumer giants Tata Consumer Products and ITC.

Beyond MDH and Everest, other major manufacturers include Madhusudan Masala, NHC Foods and consumer giants Tata Consumer Products and ITC.

- Major Exported Spices:

- Pepper, cardamom, chilli, ginger, turmeric, coriander, cumin, celery, fennel, fenugreek, garlic, nutmeg & mace, curry powder, spice oils and oleoresins.

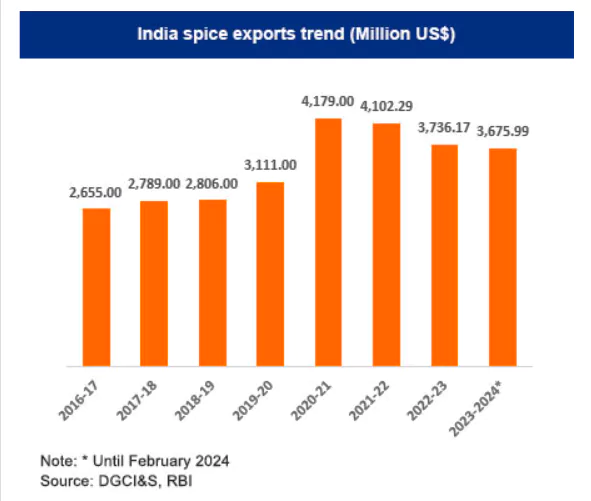

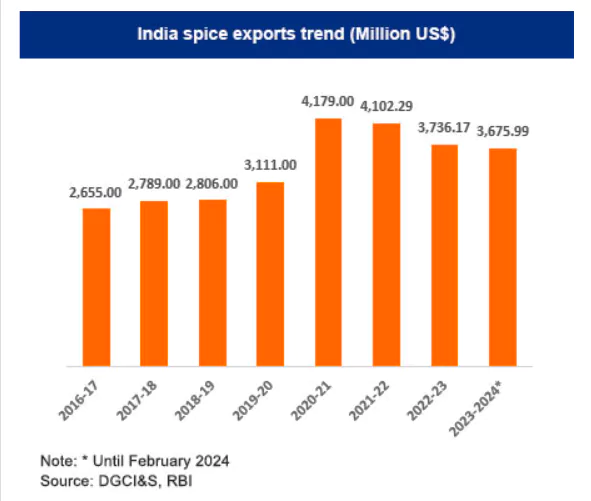

- Statistics for 2023 and 2024

- In 2023, India’s exports for spices were around US$ 3.73 billion.

- In 2023- 2024 (till feb), India’s exports for spices were around US$ 3.67 billion.

- Largest Spices Producing Indian States:

- Madhya Pradesh, Rajasthan, Gujarat, Andhra Pradesh, Telangana, Karnataka, Maharashtra, Assam, Orissa, Uttar Pradesh, West Bengal, Tamil Nadu and Kerala.

Enroll now for UPSC Online Classes

Government Initiatives for Growth of Spices Production in India

- Export Development & Promotion: This was an initiative of the Spices Board of India to promote spices of Indian brand, set up infrastructure in spice growing centers and to support exporters to use advanced technology and upgrade the existing technology.

Spices Board of India:

- Establishment: It is the statutory organization constituted on 26th February 1987, under the Spices Board Act 1986.

- It was formed with the merger of the erstwhile Cardamom Board and Spices Export Promotion Council.

- Headquarter: Kochi.

- Mandate: Spices Board (Ministry of Commerce and Industry, Government of India) is the flagship organization for the development and worldwide promotion of Indian spices.

- The Board is an international link between the Indian exporters and the importers abroad.

|

- Setting up of Spices Parks: The board started establishing eight crop-specific Spices Parks in key production areas and market hubs.

- Objective:

- To help farmers in getting better prices and wide market access for their crops.

- To create a comprehensive system for spice cultivation, post harvesting, processing, value edition, and storage of spices.

- Spice Complex Sikkim: An initiative to help farmers and other stakeholders in the state by providing financial assistance for facilitating and demonstrating common processing and value addition in spices.

- Establishment of Codex Committee on Spices and Culinary Herbs (CCSCH): It is a subsidiary body of the Codex Alimentarius Commission, which is a joint initiative of the Food and Agriculture Organization (FAO) and the World Health Organization (WHO).

- The Codex Alimentarius Commission is responsible for setting international food standards to ensure the safety, quality, and fairness of food trade.

- India has been a member since 1964.

Significance of Indian Spices

- Economic Growth:

-

- Export: India is one of the world’s largest spice exporters, and its spices are in high demand globally. India exports its spices to more than 150 countries, with the US, China, Vietnam, UAE, and Malaysia being some of the largest markets.

- Employment: The spices sector provides livelihoods to millions of farmers, traders, and laborers involved in its cultivation, processing and marketing.

- Value Addition: India has moved up the value chain from exporting raw spices to offering value-added products like spice oils, oleoresins, culinary pastes, and ready-to-use spice mixes, among others.

- Cultural Significance:

- Cultural Heritage: Spices have a rich cultural heritage in India. They have been an integral part of Indian culture for centuries, used not only in cuisine but also in traditional medicine, rituals, etc.

- Health Benefits: Turmeric is valued for its anti-inflammatory properties, and ginger is used to aid digestion.

- Spice Blends: Spice blends like garam masala and curry powder are at the heart of Indian cooking and are carefully crafted combinations of spices that lend distinctive flavors to dishes.

- Regional Variations: Spices play a central role in defining regional cuisines and adding depth to local flavors.

Challenges faced by the Indian Spices Sector

- Economic Concerns:

- Immediate Risk: Delhi-based think tank Global Trade Research Initiative (GTRI) said that nearly $700 million worth of exports are at stack due to regulatory actions in critical markets.

- China’s Impact: If China follow Hong Kong, Indian exports could see a “dramatic downturn”. This could affect exports valued at $2.17 billion – about 51.1% of the country’s global spice exports.

- EU’s Influence: It could further worsen if the European Union, which it states, “regularly rejects Indian spice consignments over quality issues”, follows suit.

- Total Potential Losses: The impact could be an additional $2.5 billion, bringing the total potential losses to 58.8% of global exports.

- Quality & Standard Maintenance: One of the major challenges in the spices sector is maintaining high-quality standards and meeting the stringent pesticide residue norms of importing countries.

- Food Safety Concerns: Food safety is a paramount concern for consumers worldwide, particularly in developed nations where stringent regulations ensure product safety. Indian spice exporters encounter challenges in assuring consumers of the safety and hygiene of their products.

- More than seven in 10 Indians are worried about the quality and safety of the spices they consume, according to a recent Local Circles survey that documented responses from 12,300 people across 293 districts.

- Almost 36% of them “had no confidence” that the FSSAI had the capacity or willingness to uphold its mandate.

- Traceability and Transparency: The fragmented nature of India’s spice supply chain presents challenges in achieving full traceability and transparency. Lack of standardized documentation, inadequate record-keeping practices, and informal trade channels hinder Indian exporters’ ability to provide verifiable traceability data.

- The absent accountability and consequences often mean enforcement agencies fail to penalize unscrupulous food operators, which fuels the issue.

- Under Section 59 of the FSS Act, food businesses found guilty of selling, storing or manufacturing sub-standard foods can be penalized with a ₹3 lakh penalty and a three-month jail term.

- Tariffs & Trade Barriers: Tariffs and trade barriers imposed by developed countries pose significant obstacles for Indian spice exporters. Despite being a major producer and exporter of spices, India faces stiff competition from other exporting nations.

- Price Volatility & Competition: The global spice market is highly competitive and Indian exporters often face challenges related to price volatility, influenced by factors such as crop yield, weather conditions, and currency fluctuations.

- Operational and Logistic Barriers: Many companies struggle to trace ingredients, especially raw agricultural commodities, due to the lack of standardised recordkeeping and intentional food fraud.

This prevents manufacturers from assessing potential risks, compromising the safety of the entire food supply chain.

This prevents manufacturers from assessing potential risks, compromising the safety of the entire food supply chain. - At least 10 States/Union Territories lack government or private notified food testing labs, as mandated under the FSS Act.

- Societal Impact: In the event of potential losses, farmers of such crops too could find themselves at the receiving end. Such instances will burden the farmer.

- Health Concerns:

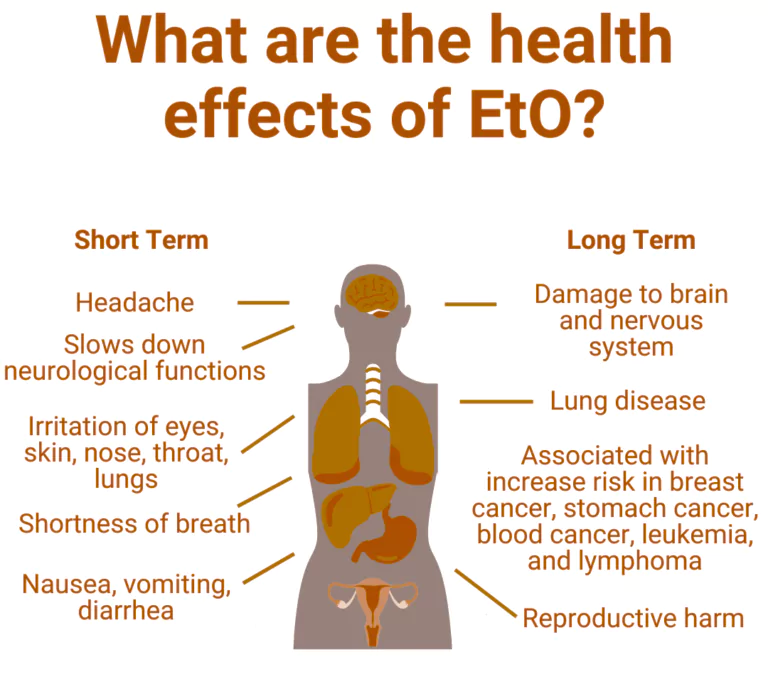

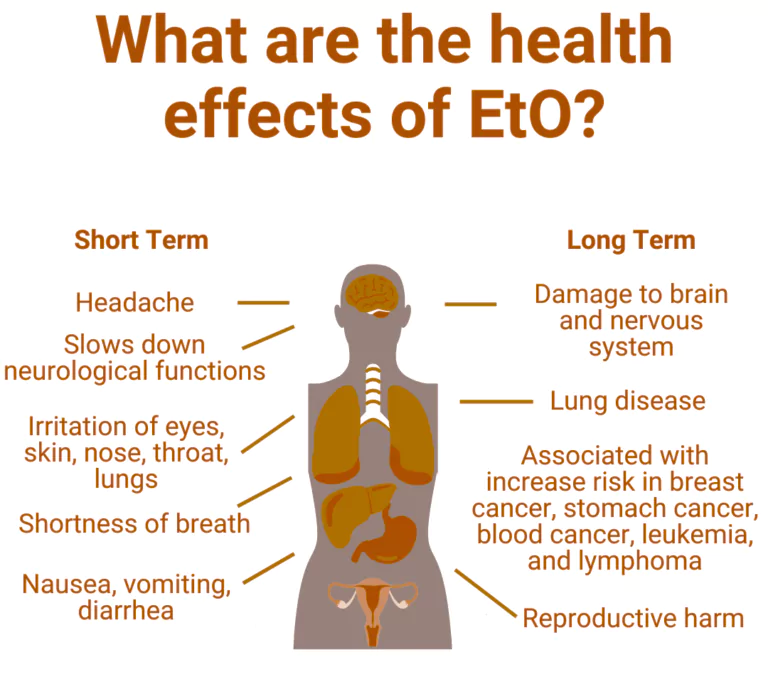

- MDH and Everest’s spice mixes allegedly contain high levels of a prohibited pesticide called ethylene oxide (EtO).

- The European Food Safety Authority (EFSA) has banned the use of EtO and earlier flagged EtO contamination in Indian spices.

- The improper and excessive use of EtO may leave behind residues, causing toxic and even carcinogenic compounds to form, thus contaminating the product.

- Long-term exposure to ethylene oxide is associated with cancers including lymphoma and leukaemia.

About Ethylene Oxide (EtO):

EtO is a colourless, flammable and a remarkable gas that was originally intended for sterilising medical devices.

- It is used as a chemical in industrial settings, agriculture, and as a sterilising agent in food products, including spices, dried vegetables and other commodities.

- The chemical provides life to the spice industry as it reduces microbial contamination, and in turn, extends products’ shelf life and makes their storage safe.

- The International Agency for Research on Cancer (IARC) classifies the ethylene oxide (chemical) as a Group 1 carcinogen.

|

Way Forward to Indian Spices Sector

- Good Agricultural Practices (GAP) & Organic Cultivation: To address quality and standard issues, there is a need to focus on GAP and organic cultivation for spices.

- Good Agricultural Practices: It requires production of good quality spices by adopting good agricultural practices, using the correct quantity of water, soil, improved variety of seeds, fertilizer, approved pesticide, and the right crop pattern.

- Use of sanitary practices at harvesting, storage, and transportation also help to avoid cross-contamination at these stages.

- Technologies like cold plasma, pulsed light sterilisation, and high-pressure processing are innovative non-chemical methods that can effectively reduce microbial load without leaving harmful residues.

- Strict Regulations & Safety Checks: To address the arising mistrust around FSSAI, there is a need for stricter regulatory measures and transparency in food production and safety industry standards.

- There should be a commitment to proactive monitoring and enforcement, rather than reactive responses to individual incidents.

- There is a need to regularly update food safety standards to align with global practices, and improve information flow to food industries so that they better comply with regulations.

- Adopt Alternatives to Ethylene Oxide in Food Processing: Exploring safer chemical alternatives that have similar antimicrobial properties without carcinogenic risks is crucial.

- Substances such as ozone, hydrogen peroxide, or heat treatments could serve as potential replacements for ethylene oxide in certain applications.

- Adequate Investment: By prioritizing investments in quality infrastructure, implementing stringent food safety measures, enhancing traceability and transparency, and aligning with market trends, Indian spice exporters can overcome these hurdles and unlock the vast potential of developed markets for India’s rich array of spices.

- To support and achieve $ 10 billion exports by FY 2027, Indian spices should be the torchbearer for agro products to boost the prominence of ‘Brand India’ worldwide and require an annual growth rate of 19.5%.

- Sustainability: As global awareness about environmental issues and sustainability grows, there is an opportunity for India to expand its share in the organic spices market.

- There is a need to implement sustainable farming practices that can also help preserve biodiversity and reduce environmental impact.

- Market Diversification: Exploring new markets and creating demand for lesser-known spices is required and could help in reducing dependence on traditional markets.

Enroll now for UPSC Online Course

Also Read: FSSAI Investigates Spice Mix Safety Amid Ethylene Oxide

![]() 3 May 2024

3 May 2024

Beyond MDH and Everest, other major manufacturers include Madhusudan Masala, NHC Foods and consumer giants Tata Consumer Products and ITC.

Beyond MDH and Everest, other major manufacturers include Madhusudan Masala, NHC Foods and consumer giants Tata Consumer Products and ITC. This prevents manufacturers from assessing potential risks, compromising the safety of the entire food supply chain.

This prevents manufacturers from assessing potential risks, compromising the safety of the entire food supply chain.