Context

Recently, the Supreme Court has constituted a nine-judge Bench to interpret the Directive Principles of State Policy (DPSP) with respect to ownership and control of material resources.

Redistribution of Wealth and Mumbai ‘Cessed’ Properties Case

The debate surrounding the redistribution of wealth has gained prominence during the ongoing election campaign.

- Cessed Properties Dispute: The case currently before the SC arose out of a challenge to the 1986 amendment to the Maharashtra Housing and Area Development Act, 1976 (MHADA) by owners of ‘cessed’ properties in Mumbai.

Enroll now for UPSC Online Course

About the Maharashtra Housing and Area Development Act, 1976 (MHADA)

Maharashtra Housing and Area Development Act, 1976 (MHADA) was enacted in 1976.

- About: This case was about to address a major problem in the city — old, dilapidated buildings housing (poor) tenants despite becoming increasingly unsafe.

- Outcomes: MHADA imposed a cess on the buildings’ occupants, which would be paid to the Mumbai Building Repair and Reconstruction Board (MBRRB) to oversee repair and restoration projects.

- In 1986, invoking Article 39(b), Section 1A was inserted to MHADA to execute plans for acquiring lands and buildings, in order to transfer them to “needy persons” and the “occupiers of such lands or buildings”.

- The amendment also inserted Chapter VIII-A to the legislation, which contains provisions allowing the state government to acquire cessed buildings (and the land they are built on) if 70% of the occupants make such a request.

Challenge to the Provisions:

- Violation to the Fundamental Rights: The Property Owners’ Association in Mumbai challenged Chapter VIII-A of the MHADA at the Bombay High Court claiming that the provisions violate the property owners’ Right to Equality under Article 14 of the Constitution.

- Judgment by the Court: The court held that laws enacted in furtherance of Article 39 (b) could not be challenged on the grounds that they violated the right to equality, as per Article 31C of the Constitution (“Saving of laws giving effect to certain directive principles”).

Appeal to the Supreme Court:

- In 1992: The Association appealed the decision in the SC in December 1992.

- Focus: In the apex court, the central question became whether “material resources of the community” as per Article 39(b) includes privately owned resources — which would include cessed buildings.

- Ruling: In March 2001, a 5-judge Bench heard the case and referred it to a larger Bench, stating that the views expressed in Sanjeev Coke Manufacturing require reconsideration.

- In February 2002, a 7-judge Bench heard the case and referred the challenge to Chapter VIII-A of the MHADA to a nine-judge Bench — which is now hearing the matter.

|

Redistribution of Wealth

Redistribution of Wealth is the transfer of wealth from one individual to another through a social mechanism such as taxation, charity, or public services.

- It means those earning more pay higher tax.

- Any assistance the Indian government provides to poor people is a form of redistribution.

-

- The tax revenue is used to fund welfare measures, subsidies and direct cash transfers to the needy. State governments levy property tax.

The Inheritance Tax:

- It refers to the tax levied on the value of inheritance received by a beneficiary on the death of a person.

- Inheritance tax, or death taxes, or estate duty as it may be called are all taxes which are paid on the estate of the deceased.

|

-

-

- In the past, India had estate duty (a form of inheritance tax), wealth tax and gift tax. They were abolished as the cost of administering them was more than revenue generated.

- Aim: To bridge the inequality gap between members of a society.

Constitutional Provisions for Wealth Redistribution in India

- The Preamble to the Constitution: It aims to secure all citizens’ social and economic justice, liberty and equality.

- Fundamental Rights: Part III of the Indian Constitution lists down the fundamental rights that guarantee liberty and equality.

- Directive Principles of State Policy (DPSP): Part IV of the Indian Constitution contains the DPSP. Article 39(b) and (c) in Part IV contain principles that are aimed at securing economic justice.

- They provide that ownership and control of material resources of the society should be distributed to serve the common good and that the operation of the economic system does not result in concentration of wealth to the common detriment.

Right to Property in India

- Before Independence: The Constitution originally guaranteed the right to property as a fundamental right under Article 19(1)(f).

- It is provided under Article 31 that the state shall pay compensation in case of acquisition of private property.

- After Independence: The government had to acquire the rights in such estates for carrying out land reforms and construction of public assets.

- Considering the inadequate resources with the government and in order to provide greater flexibility in acquiring land for public welfare, various amendments were carried out curtailing the right to property.

- Exceptions under Articles 31A, 31B and 31C of the Indian Constitution:

- Article 31 A: It was inserted in the Indian Constitution by 1st Amendment Act, 1951. It provided that laws made for acquisition of states etc. shall not be void on the ground that it violated fundamental rights, including right to property.

- Article 31 B: It was inserted in the Indian Constitution by 1st Amendment Act, 1951. It made laws placed under the ninth schedule to be immune from judicial review on the grounds of violation of fundamental rights.

- However, in the IR Coelho case (2007), the Supreme Court stated that protection of Schedule IX will not be available to those laws which violate elements of the basic structure doctrine from April 24, 1973 (date of the judgment of Kesavananda Bharati case).

- Article 31 C: It was inserted in the Indian Constitution by 25th Amendment Act, 1971. It provided primacy to the DPSP under Articles 39 (b) and (c). Laws made to fulfill these principles shall not be void on the ground that it violated fundamental rights, including the right to property.

- A Constitutional & Legal Right: By the 44th Amendment Act, 1978 the right to property as a fundamental right was omitted and made it a constitutional right under Article 300A.

- Any law to acquire private property by the state should be only for a public purpose and provide for adequate compensation.

Enroll now for UPSC Online Classes

- Rulings by the Supreme Court on Right to Property:

- Golak Nath Case (1967): The Supreme Court held that fundamental rights cannot be abridged or diluted to implement DPSP.

- Kesavananda Bharati case (1973): A 13-judge Bench of the Supreme Court upheld the validity of Article 31C but made it subject to judicial review.

- State of Karnataka vs Shri Ranganatha Reddy (1977): This case saw a seven-judge Bench, by a 4:3 majority, holding that privately owned resources did not fall within the ambit of “material resources of the community”.

- However, it was Justice Krishna Iyer’s minority opinion which would become influential in years to come.

- Justice Iyer’s Opinion: Justice Iyer had held that privately owned resources must also be considered material resources of the community.

- To exclude ownership of private resources from the coils of Article 39(b) is to cipherise (make hidden) its very purpose of redistribution the socialist way.

- Sanjeev Coke Manufacturing Company vs Bharat Coking Coal (1983): In this case, the interpretation of Article 39(b) offered by Justice Iyer was affirmed by a 5-judge Bench.

- The court upheld central legislation that nationalised coal mines and their respective coke oven plants relying on what Justice Iyer had ruled.

- Mafatlal Industries Ltd vs Union of India (1996): This case also relied on the interpretation of Article 39(b) offered by Justice Iyer and the Bench in Sanjeev Coke Manufacturing was affirmed by a 9-judge Bench.

- This case held that “the words ‘material resources’ occuring in Article 39 (b) will take in natural or physical resources and also movable or immovable property and it would include all private and public sources of meeting material needs, and not merely confined to public possessions.

- Minerva Mills Case (1980): The Supreme Court ruled that the Constitution exists on a harmonious balance between fundamental rights and DPSP.

Economic Policy of the Indian Government on Wealth Redistribution

- Socialist Model:

- Phase: Indian governments in the first four decades after independence followed a “socialist model” of economy.

- Objective: To reduce inequality and redistribute wealth among the poorer sections who constituted the majority of the population.

- There were many laws made by the Centre and States to acquire land from zamindars and big landlords for public purposes.

- Changes Brought: The economic policies resulted in the nationalization of banking and insurance, extremely high rates of direct taxes (even up to 97%), estate duty on inheritance, tax on wealth etc.

- There were also regulations that placed restrictions on growth of private enterprise like The Monopolies and Restrictive Trade Practices Act, 1969 (MRTP Act).

- Concern: Such measures stifled growth and also resulted in the concealment of income/wealth.

- Taxes like estate duty and wealth tax generated revenue that was much less than the cost incurred in administering them.

- Market-driven Economy:

- Beginning: The nineties saw the country move from a closed economy towards liberalisation, globalisation and privatisation.

- Objective: A new industrial policy was unveiled in July 1991 with the objective of empowering market forces, improving efficiency and rectifying deficiencies in the country’s industrial structure.

- Changes Brought: The MRTP Act was repealed and replaced with the Competition Act, 2002 and income tax rates were reduced considerably.

- Estate duty was abolished in 1985 and wealth tax in 2016.

- Significance: The market driven economy has resulted in additional resources for the government that has helped in bringing people out of abject poverty.

- Concern: This economic system, nonetheless, has also resulted in growing inequality.

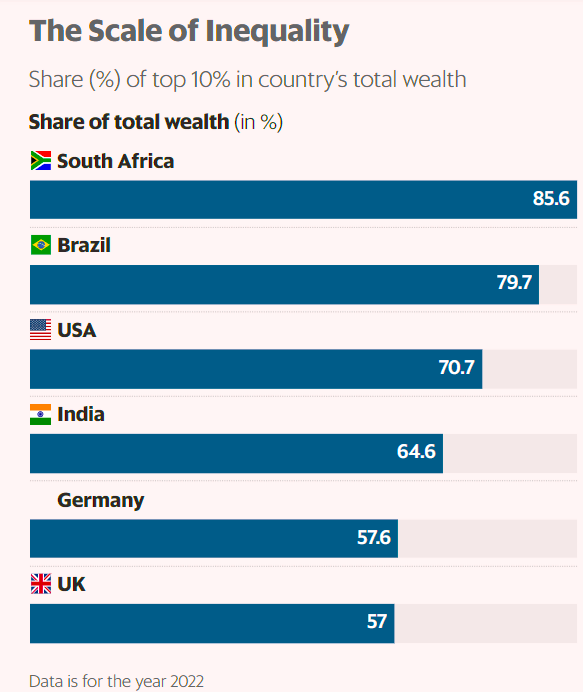

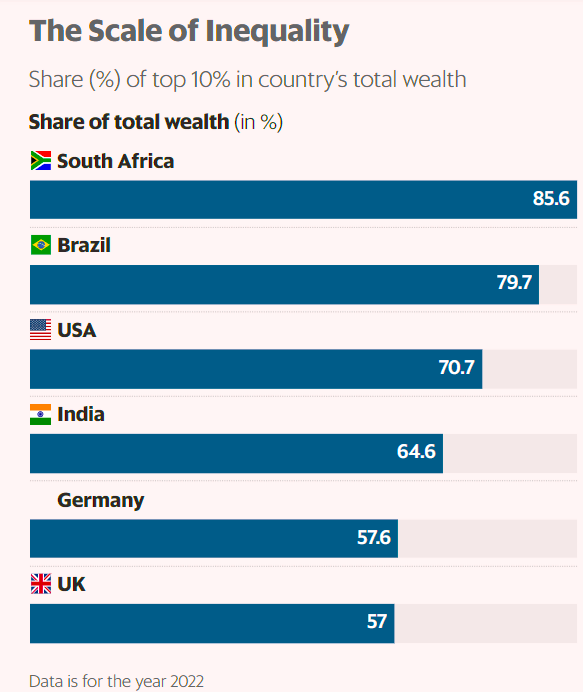

- A report by the World Inequality Lab states that the top 10% of the country’s population have a share of 65% and 57% of the wealth and income respectively as of 2022-23.

Need for Redistribution of Wealth in India

- To Combat Rising Inequality: According to a study published by the World Inequality Lab, the richest 1% of Indians now own as much as 40% of the country’s wealth.

- Inequalities will not close on their own and need specific policy interventions such as a super tax on billionaires and millionaires.

- Also, the wealth of the rich must be taxed.

- Economists such as Thomas Piketty have called for greater redistribution of wealth.

- To Achieve Inclusive Growth: According to a report by the State Bank of India (SBI), India has witnessed a significant fall in inequality over the last decade. The report claims that the Gini coefficient has fallen from 0.472 in 2014-15 to 0.402 in 2022-23.

- A fall of almost 15% in the Gini coefficient indicates a significant reduction in inequality.

- Gini Coefficient: It is a standard measure of inequality that ranges from 0, indicating perfect equality, to 1, indicating perfect inequality.

|

- Provide Opportunities to All: The objectives of income redistribution are to increase economic stability and opportunity for the less wealthy members of society and thus usually include the funding of public services for the welfare of the weaker sections of the society and further led to the inclusive growth.

- By helping equalise inter-generational wealth distribution in the long run, inheritance tax enhances equality of opportunity and social mobility.

- Inheritance tax also increases horizontal equity in the fiscal sphere.

- To Address Social Issues and ensure Social Justice: Property is a scarce resource that needs wise redistribution of wealth enables the government to address social issues like poverty, homelessness, or environmental degradation.

- Redistribution of the wealth and income is in line with the principles of Preamble of the Constitution which strives to ensure social justice.

Challenges to Redistribution of Wealth in India

- Impact on Economy & Growth: Redistribution of wealth will smother innovation and hit productivity eventually causing the economy to slow.

- The excessive taxation and redistribution can stifle economic incentives, discourage investment and entrepreneurship, and undermine economic efficiency and productivity.

- If profits of capitalists are to be taxed to redistribute wealth to the poor, big businesses may escape by moving politically to shift the burden of taxation onto small or medium businesses.

- Alternatively, all businesses may unite to shift the burden of such redistributive taxation onto higher-paid employees’ wages and salaries, and away from business profits.

- Political Resistance: Redistributive policies face resistance from powerful interest groups and vested interests, including wealthy individuals and corporations.

- Politics typically becomes the arena where demonisations and conflicts over redistribution occur.

- Those at risk of being deprived due to redistributions aim either to oppose redistribution or else to escape it. If the opposition is impossible or difficult, escape is the chosen strategy.

- Example: Opposition by the dominant landholding classes to the Land reform policy in India.

- Large Informal Economy: A high informal economy of India makes it challenging to effectively address income inequality for the redistribution of wealth, which is characterized by low wages, lack of job security, and limited access to social protection.

- As per World Economics, the size of India’s informal economy is estimated to be 38.9% which represents approximately $4,228 billion in gross domestic product (GDP) at purchasing power parity (PPP) levels.

- Operational Challenges: India’s institutional capacity to implement redistributive policies effectively is limited by bureaucratic inefficiencies, inadequate infrastructure, and resource constraints such as corruption and leakages in the welfare schemes.

- Existence of Social Inequalities: Recipients of redistributions face parallel political problems of whom to target for contributing to wealth redistribution.

- In India, there are deep-rooted caste, gender, religious, and ethnic inequalities that hinder the effectiveness of redistributive policies, as marginalized groups face barriers in accessing resources and opportunities.

Enroll now for UPSC Online Course

Strategies for Equitable Wealth Distribution and Economic Inclusion

- Responsibility of Government: Growing inequality is a worldwide problem of a liberalized open-market economic system. It is the responsibility of the government to protect the interest of the poorer classes who are most dependent on the state machinery for their livelihood.

- The benefits of growth should reach all sections, especially the marginalized. The policies may vary and need to be framed after adequate debate in line with current economic models.

- Example: Resource based Development Policies.

- Appropriate Inclusion of Inheritance Tax: For redistribution of wealth in India, it needs to be introduced.

- Example: An inheritance tax of 10-15% similar to the Philippines, Taiwan and Thailand could create a financial base of wealth redistribution.

- Strengthening of Institutional Capacity & Governance: They need to be strengthened to ensure the efficient delivery of welfare services and enhance the welfare of the society.

- Consensus before Application: Socio-Political consensus must be created among all associated stakeholders on progressive taxation and welfare programs to address income inequality and promote equitable wealth distribution.

- Need for a Level-playing Field: Social justice demands a level-playing field for all in society. That requires high-quality education and health for all and a generation of productive employment for all.

- For employment generation, education, and health infrastructure, resources are required. These can be obtained via direct taxation of income and wealth.

- Democratize the Decision: Decision about democratizing the distributing wealth is required as it emerges from production. This can be accomplished by democratizing the enterprise. Each worker has one vote, and all basic workplace issues are decided by majority vote after a free and open debate.

- Alternative Approaches: Instead of direct wealth redistribution, expanding access to education, promoting economic growth, and fostering a conducive business environment are required.

- The policies aimed at enhancing human capital, promoting innovation, and reducing barriers to entrepreneurship can generate inclusive prosperity and empower individuals to improve their economic circumstances.

Also Read: Wealth Inequality And The Debate On Wealth Tax

![]() 4 May 2024

4 May 2024