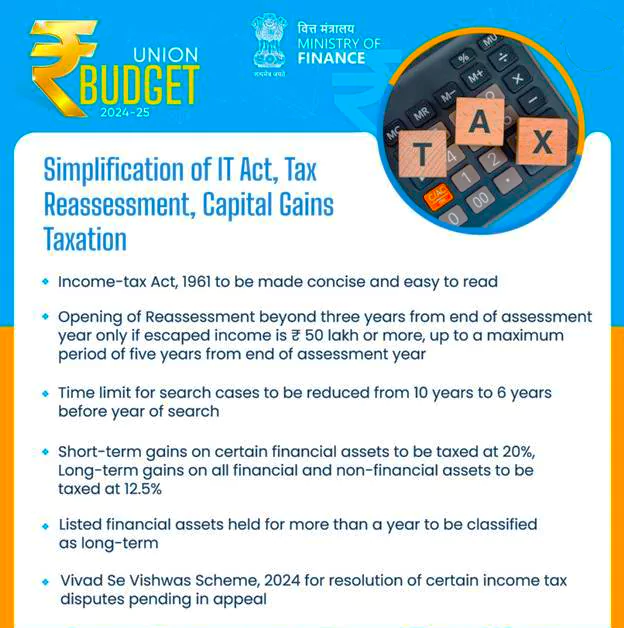

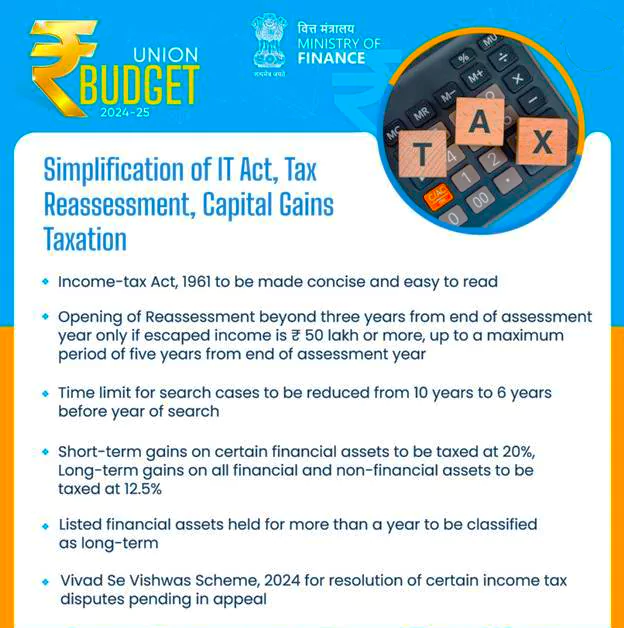

A number of Tax Simplification Measures have been proposed in the Union Budget of 2024-2025 including,

- A comprehensive review of the Income Tax Act 1961 in the next six months to make it concise and lucid and provide tax certainty and reduce disputes and litigation.

- Decriminalization: Late payment of tax deducted at source (TDS) and the Vivaad Se Vishwas Scheme 2024 for settling direct tax disputes.

- A simplified tax regime for charities and a tweak in limits for reassessments to reduce disputes.

- Digitalisation: It was announced that all the remaining services including rectification and order giving effect to appellate orders will also be digitized and made paper-less over the next two years.

Decriminalization Measures

- The Budget has proposed to decriminalize several provisions under the Income Tax Act 1961 such as,

- Non-reporting of movable assets up to Rs 20 lakh: Not reporting small foreign assets like the ESOPs (employee stock ownership plans) and investment in social security schemes and other movable assets abroad has a penal consequences under the Black Money Act

- Delayed TDS Payment: It is proposed to decriminalize late payment of TDS, if the payment is made before the time prescribed for filing the TDS statement.

- Immunity: A proposed legislative change to provide for immunity to benamidar or any person other than the beneficial owner who turns approver against the beneficial owner under the Benami Transactions (Prohibition) Act, 1988.

Enroll now for UPSC Online Classes

Provisions for Reassessment and Search Provisions

- Reassessment procedures: Time limits for reassessment are proposed to be reduced from ten years to five years along with rationalization of the procedure for reassessment.

- The Reassessment window is proposed to start three years after the end of the assessment year up to a maximum period of five years from the end of the assessment year only if the escaped income is Rs 50 lakh or more

- In Search Cases: A time limit of six years before the year of search, as against the existing time limit of ten years, is proposed to reduce tax uncertainty and disputes.

Tax Deducted at Source

- It is a specific amount that is deducted at source by the payer themselves and remitted to the government on behalf of the receiver as a form of advance Income Tax.

- A TDS deduction is made on certain payment like salary, commission, rent, interest, professional fees, etc.

- The rates are set on the basis of the age bracket and income of different individuals.

|

Tweaks in TDS Rates Structure

- Reduced: Transactions including payment of insurance commission, payment in respect of life insurance policy, commission on sale of lottery tickets, payment of commission or brokerage, payment of rent by certain individuals or HUF will now attract 2 per cent TDS from the previous 5 per cent rate effective from October 1.

- The TDS rate on e-commerce operators has been proposed to be reduced from 1 per cent to 0.1 per cent.

- The 20 per cent TDS rate on repurchase of units by mutual funds or UTI was withdrawn

Dispute Resolution

- The Budget has proposed to increase the monetary limits for filing appeals related to direct taxes, excise and service tax in tax tribunals, high courts and the Supreme Court to Rs 60 lakh, Rs 2 crore and Rs 5 crore, respectively from the current limit of Rs 50 lakh, Rs 1 crore and Rs 2 crore, respectively.

- The government also plans to bring in a new version of the dispute resolution scheme, Vivad se Vishwas 2.0, to provide a mechanism of settlement of direct tax disputes with an aim to reduce litigation.

Simplifying Tax Regime for Charities

- It is proposed to merge trusts, funds or institutions to be transited to the second regime in a gradual manner for exemption from the current first regime (which will now be sunset) and also provide for rationalization of filing of applications and the timelines for registration and approval of certain benefits to charitable trusts and institutions

- At present, the Income Tax Act has two main regimes for trusts or funds or institutions to claim exemption.

Check Out UPSC NCERT Textbooks From PW Store

Deepening the Tax Base

- Security Transactions Tax on futures and options of securities is proposed to be increased to 0.02 per cent and 0.1 per cent respectively.

- Taxing of income received on buy back of shares has been proposed as a measure of equity

Tax Base:

- A tax base is the total value of all assets, properties, individual income, and corporate income in a certain area or jurisdiction that can be taxed by a taxing authority, usually a government. It is used to calculate tax liabilities.

- Tax liabilities: It is the portion of the tax base that is collected, and they come in many forms, including income, property, capital gains, and sales taxes.

- Tax Liability = Tax Base x Tax Rate

|

![]() 27 Jul 2024

27 Jul 2024