Recently, the Reserve Bank of India (RBI) has released the Report on Currency and Finance (RCF) for the year 2023-24.

What is the ” Report on Currency and Finance” (RCF)?

- About: RCF is an annual publication of the RBI. The report covers various aspects of the Indian economy and financial system.

About Digitalization

- Digitalization is the process of using digital technologies to transform various aspects of the economy and society.

- It can enable greater efficiency, innovation, inclusion and empowerment of citizens and businesses.

|

- Theme and Focus: Each edition of the report is centered around a specific theme that addresses contemporary economic issues and forward-looking strategies

- The theme of Report on Currency and Finance 2023–24 is ‘“India’s Digital Revolution”

- Aim: The report provides a comprehensive analysis of the Indian economy, including growth trends, inflation, fiscal policy, and external sector developments.

- It offers insights into the macroeconomic environment and the impact of global events on the domestic economy.

- The report has five chapters, each addressing various aspects of India’s digital revolution.

- Chapter I: India’s Digital Revolution: Opportunities and Challenges

- Chapter II: Digitalisation and Financial Innovation

- Chapter III: Digitalisation and Payment Revolution in India

- Chapter IV: Open Economy Digitalisation: Challenges and Opportunities

- Chapter V: Digitalisation – Tackling Emerging Risks and Challenges

Enroll now for UPSC Online Course

History of India’s Digitalisation:

- Phase I: Digital Awakening (1950s-1980s)

- Early Perception: Computers were viewed mainly as tools for saving labor, facing restrictions due to fears of unemployment.

- Shift in the 1980s: Significant shift towards computerisation in banking, guided by various committees (e.g., Committee on Mechanisation in the Banking Industry, 1984).

- Technological Advances: Introduction of electronic data processing, ATMs, credit cards, BANKNET3, and MICR-based systems. Transition from standalone computers to LANs and core banking platforms.

- Phase II: Liberalisation and the InfoTech Boom (1990s)

-

- Telecom Advancements: Establishment of the Centre for Development of Telematics (C-DOT) and industry associations like NASSCOM.

- Capital Market Reforms: SEBI recognition, National Stock Exchange (NSE) establishment, shift to dematerialisation of securities.

- Banking Modernisation: Recommendations of the Narasimham Committees led to the launch of the Indian Financial Network (INFINET) and adoption of internet banking.

- Competition and IT Solutions: Public sector banks embraced IT solutions due to rising competition and customer expectations.

- Growth of IT and Telecom Industries: Driven by supportive policies from central and state governments.

- Phase III: Building the Institutional and Legal Framework (2000-2016)

- Legal Recognition: Information Technology Act of 2000 provided legal recognition to electronic transactions.

- Digital Payment Systems: Introduction of RTGS in 2004, NEFT in 2005, and the Payment and Settlement Systems Act of 2007.

- NPCI and UPI: Establishment of NPCI in 2008 and launch of UPI in 2016.

- Government Initiatives: Aadhaar project (2009), National Telecom Policy (2012), Direct Benefit Transfer scheme (2013), and Pradhan Mantri Jan-Dhan Yojana (2014).

- Digital India and Startup India Missions: Launched to enhance digital infrastructure and innovation.

- Debt Management: Development of G-sec market through platforms like Negotiated Dealing System – Order Matching (NDS-OM) and the Retail Direct Scheme in 2021.

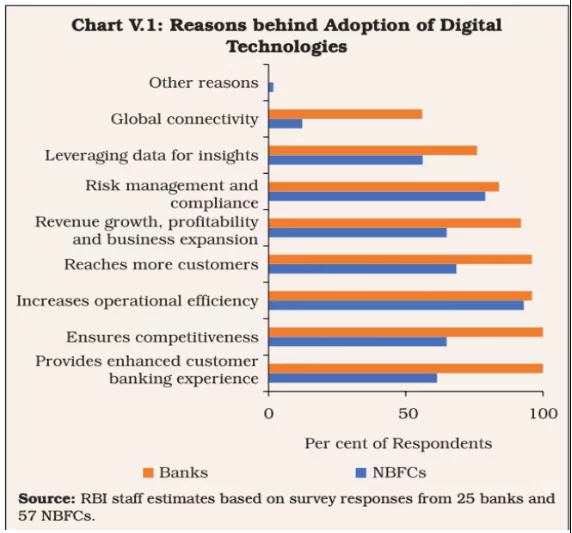

Reasons behind Adoption of Digital Technologies

|

- Phase IV: Digital Financial Innovation at Centre Stage (2017 onwards)

- Robust Digital Infrastructure: By 2017, India positioned as a leader in large-scale payment systems.

- It has planned to increase the domestic usage of digital payments and phased implementation of Central Bank Digital Currency (e – Rupee).

- Financial Innovations: Availability of round-the-clock payment systems (RTGS, NEFT), offline payments, feature phone payments, conversational payments.

- CBDC Pilots and Initiatives: Launch of Central Bank Digital Currency pilots, Regulatory Sandbox (2019), Reserve Bank Innovation Hub (2021), and Public Tech Platform for Frictionless Credit (2023).

- Internationalisation of Payment Systems: Enabling cross-border transfers and enhancing India’s soft power. The plan is to participate in payment systems linkage projects across countries – bilateral and multilateral.

Check Out UPSC CSE Books From PW Store

Opportunities For India

- Economic Growth: Digital technologies are driving economic growth, enhancing consumer welfare, and raising living standards

- Current contribution to GDP: The report estimates that the digital economy currently accounts for a tenth of India’s GDP.

- Potential contribution to GDP: Based on growth rates observed over the past decade, it is poised to constitute a fifth of India’s GDP by 2026.

- Financial Inclusion: The digital revolution, particularly through financial technology (FinTech) and India Stack, is expanding the ambit of financial inclusion across time and space .

- Penetration: With internet penetration reaching 55% in 2023, the country has witnessed an increase of 199 million internet users over the past three years.

- Affordability: India’s cost per gigabyte (GB) of data is the lowest globally, averaging ₹13.32 (US$ 0.16) per GB.

- Consumption: This affordability has contributed to India having one of the highest mobile data consumption rates in the world, with an average per-user, per-month mobile data consumption of 24.1 GB in 2023.

- Smartphone Users: The nation boasts about 750 million smartphone users, a number expected to reach approximately one billion by 2026

- Accessibility & DBT: Digitalisation in finance is paving the way for next-generation banking; improving access to financial services at affordable costs; and enhancing the impact of direct benefit transfers by effective targeting of beneficiaries in a cost-efficient manner.

- Innovation and Entrepreneurship: Digital technologies democratize innovation and entrepreneurship by being cost-effective and scalable .

- Smartphone Manufacturer: India is also on track to become the second-largest smartphone manufacturer within the next five years.

- Startup Ecosystem: Furthermore, India has the world’s third-largest startup ecosystem, with over 1.4 lakh startups and more than 100 unicorns.

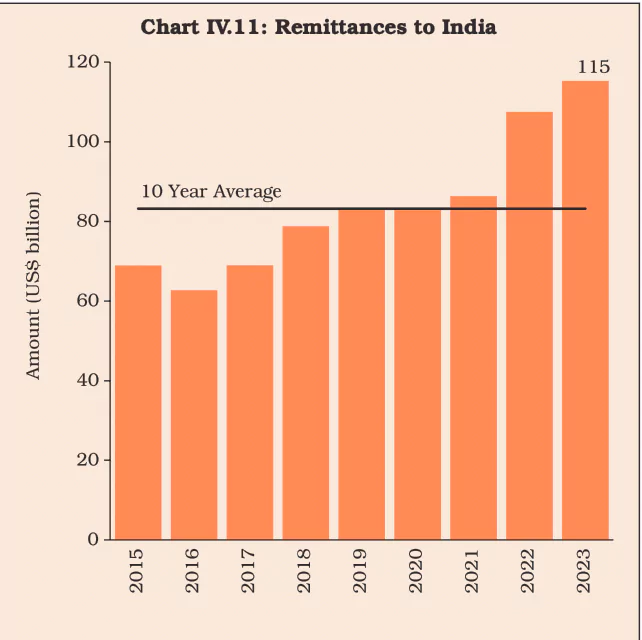

Digital Remittances: Reducing the cost of remittances and achieving Sustainable Development Goals (SDGs) by 2030.

Digital Remittances: Reducing the cost of remittances and achieving Sustainable Development Goals (SDGs) by 2030.

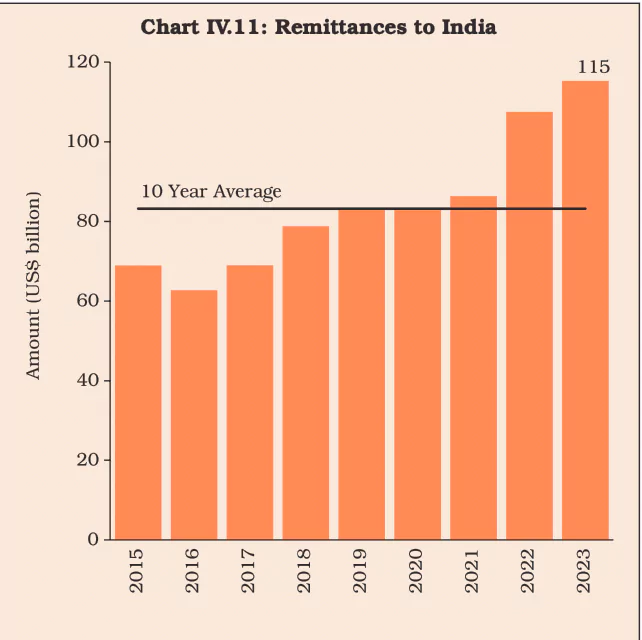

- Boost to Remittances: Digitalisation in international payment systems has the potential to reduce the cost of receiving remittances, thereby leading to higher remittances and income or savings for the recipients.

- International Payment Systems: Reducing foreign exchange risks and managing global liquidity through digital international payment systems.

- RBI joined Project Nexus, a multilateral international initiative to enable instant cross-border retail payments by interlinking domestic Fast Payments System (FPS).

- As part of the project, the country’s Unified Payments Interface (UPI) and FPSs of Malaysia, the Philippines, Singapore and Thailand will be interlinked through Nexus.

- Singapore PayNow : Country’s real-time retail payment system Unified Payments Interface (UPI) and its equivalent network in Singapore PayNow got integrated, to enable faster remittances between the two countries at a competitive rate.

- Central Bank of UAE (CBUAE): The RBI and the Central Bank of UAE (CBUAE) had also signed a memorandum of understanding (MoU) for cooperation for interlinking UPI of India with Instant Payment Platform (IPP) of UAE.

- UPI and Digital Payments: Unified Payments Interface (UPI) and other digital payment systems are revolutionizing the payment landscape, enhancing financial inclusion and reducing transaction costs.

Data: UPI has seen a tenfold increase in volume over the past four years, increasing from 12.5 billion transactions in 2019-20 to 131 billion transactions in 2023-24 – 80 per cent of all digital payment volumes.

Data: UPI has seen a tenfold increase in volume over the past four years, increasing from 12.5 billion transactions in 2019-20 to 131 billion transactions in 2023-24 – 80 per cent of all digital payment volumes. - Currently, the UPI is recording nearly 14 billion transactions a month, buoyed by 424 million unique users in June 2024.

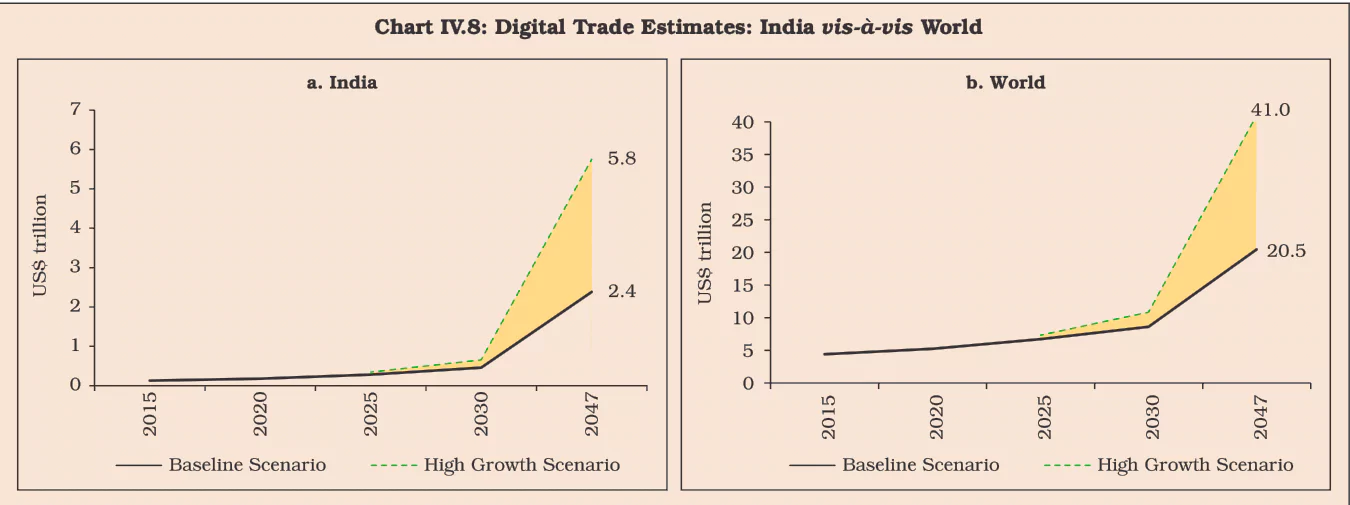

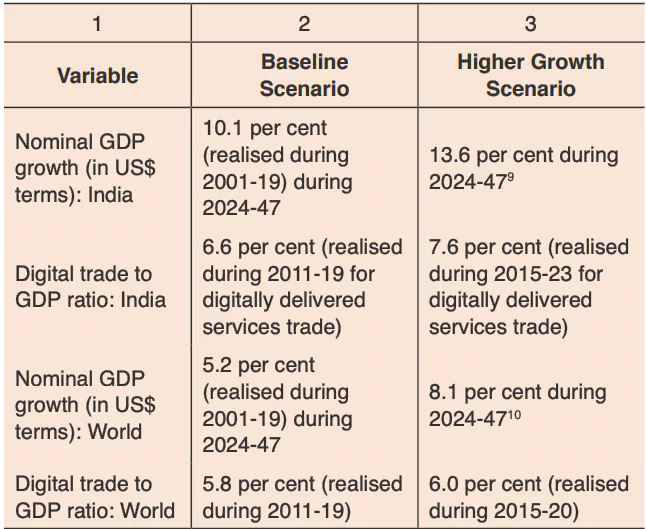

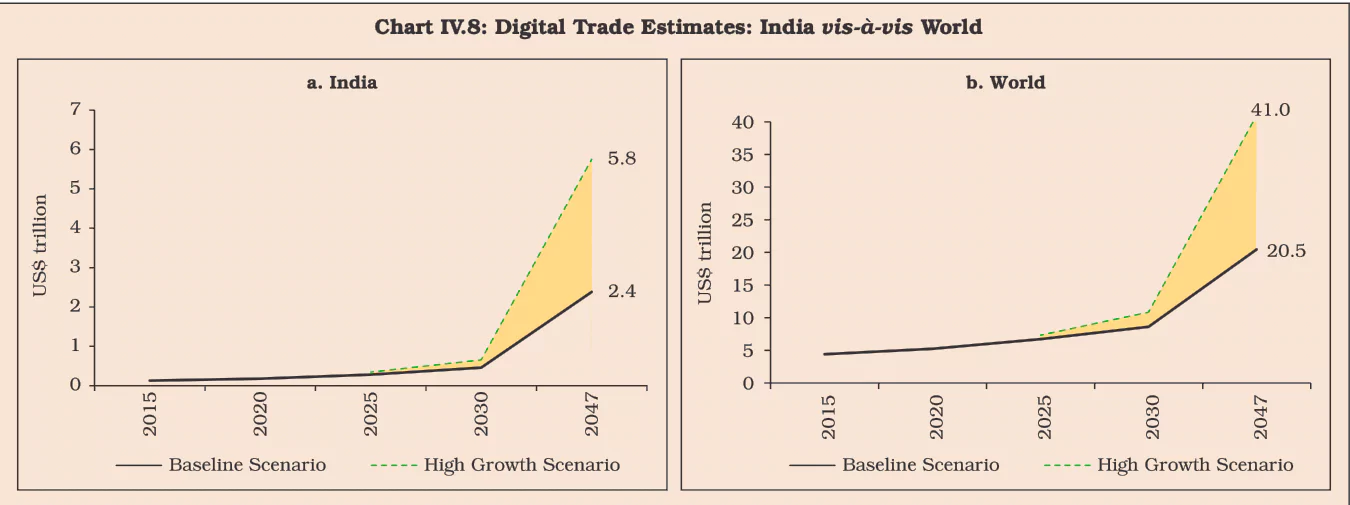

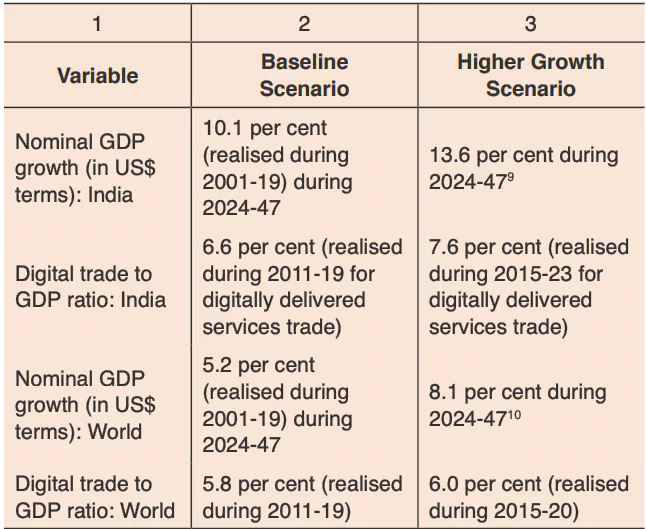

- Boost to Indian Trade: Digitalisation can provide a strong boost to India’s external trade in goods and services, given the country’s relative comparative advantage in modern services exports, which are not conditional upon the geographical proximity of the trading partners.

- Digital Foreign Direct Investment (FDI): Attracting digital FDI through availability of e-payment services, policy support for digital businesses, development of local digital skills, and ensuring data security.

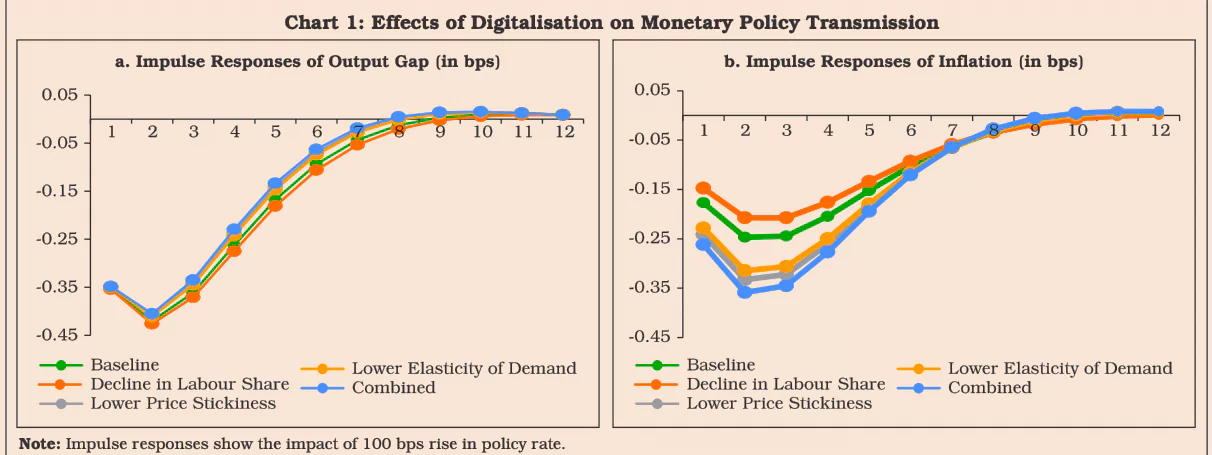

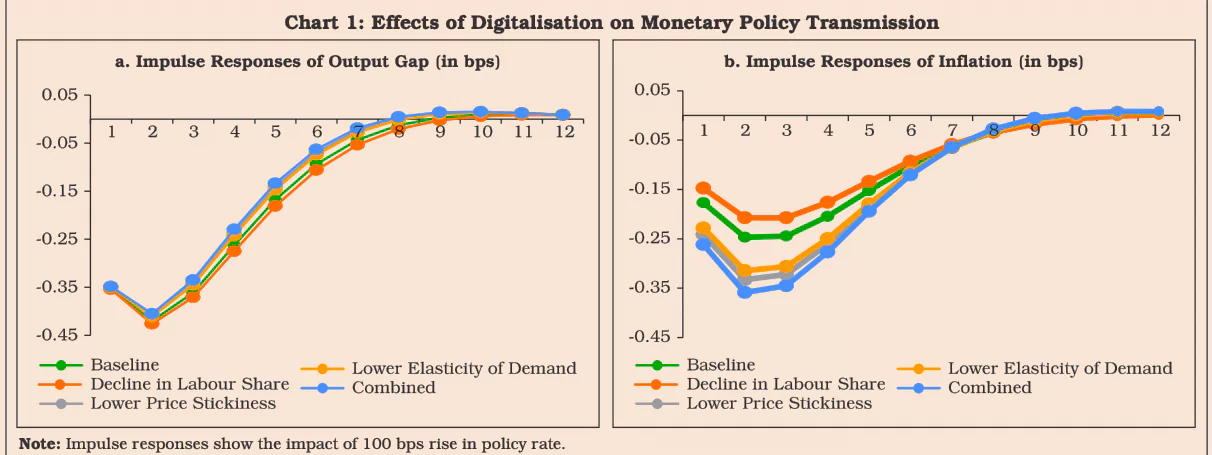

- Monetary Policy: Digitalisation can make monetary policy more effective in controlling inflation by reducing costs and changing demand elasticity .

Challenges in India’s Digital Revolution

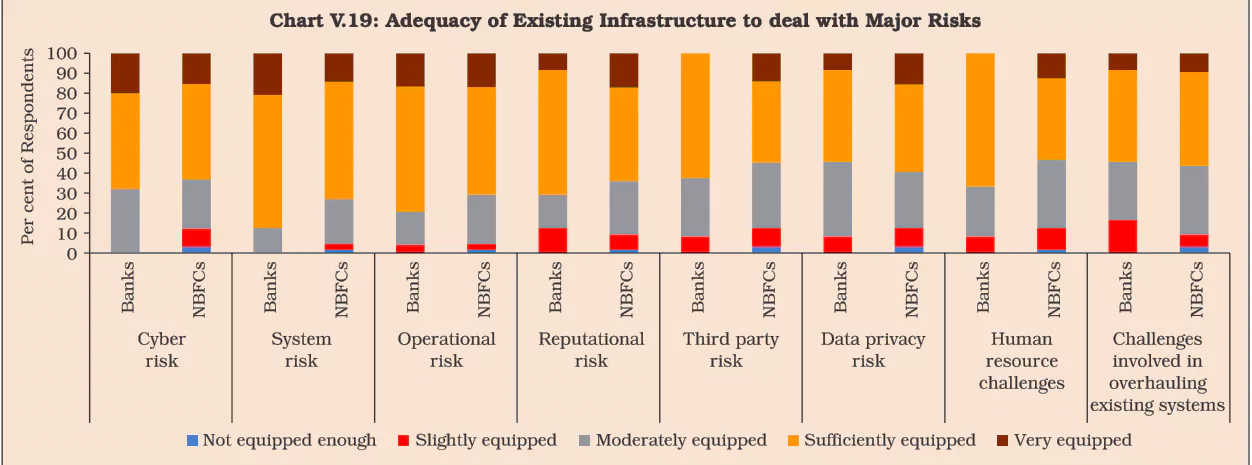

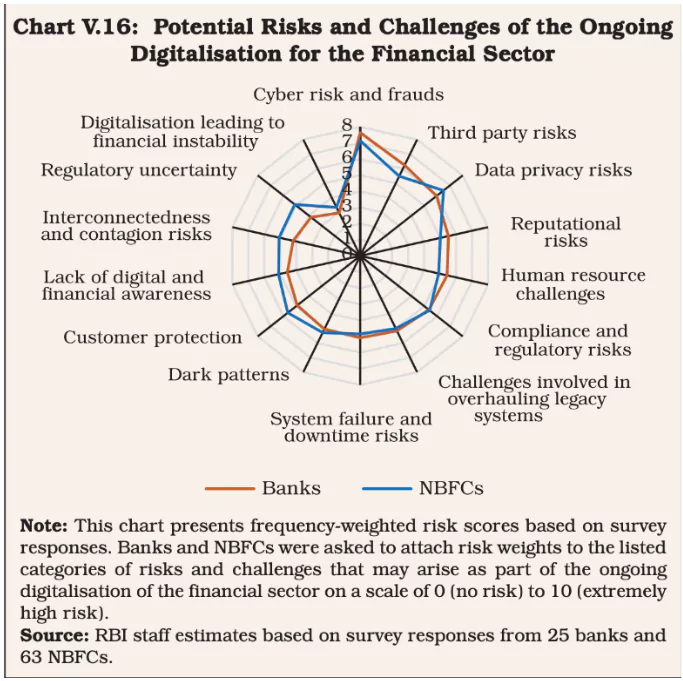

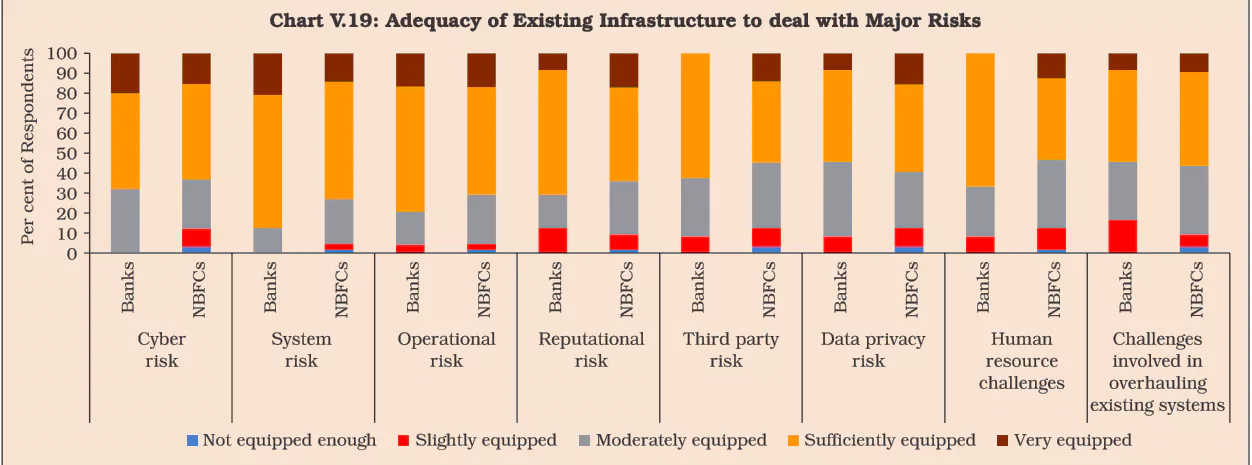

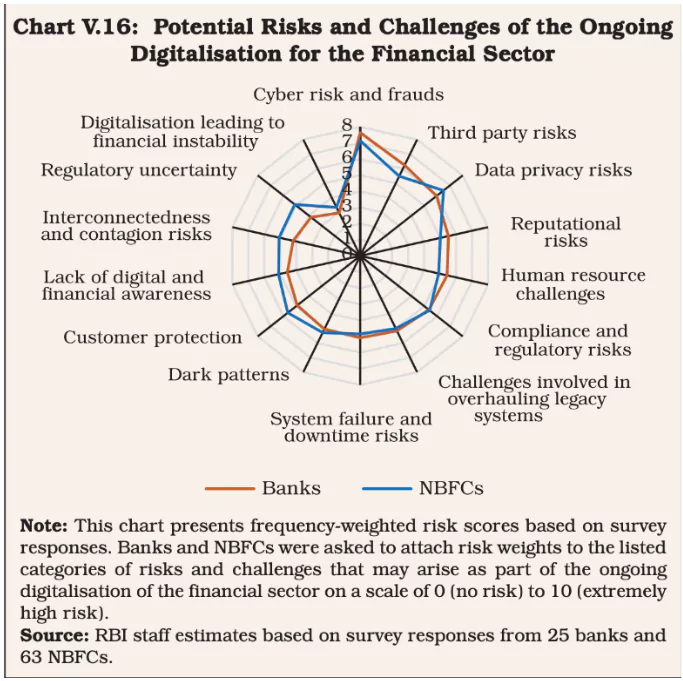

- Cybersecurity: Addressing the rising threat of cyber-attacks and ensuring robust cybersecurity measures.

- Numbers: Average cost of data breaches in India has risen to $2.18 million in 2023, a 28% increase since 2020.

- Globally, the cost of cybercrime is expected to reach $13.82 trillion by 2028, up from $8.15 trillion in 2023.

- The most common cyberattacks in India include phishing (22%) and stolen or compromised credentials (16%).

- Impulsive spending & Herd behaviour: While improving accessibility and convenience of financial services for customers, digitalisation raises concerns related to impulsive spending, &herd behaviour

- Tracking financial trends and choices: Digital platforms enable quick dissemination of financial trends and choices, allowing information about investments, spending habits, and financial products to spread rapidly across social networks

- Herd Behaviour: When customers observe large groups engaging in certain financial activities, such as mass buying or selling of stocks during a market frenzy, they are more likely to follow the crowd.

- “Dark patterns”: The report highlights the rise of “invisible risks” or “dark patterns,” where consumers are tricked into making decisions detrimental to their interests

- Monetary Policy Impact: Monetary policy impact could be dampened if digitalisation leads to shifting of credit supply from banks to less-regulated / unregulated nonbanks, or by offsetting reductions in bank deposits

- The hyper-diversification of financial services: It may lead to a “barbell”–like financial structure, where dominant multi-product players could pose systemic risks.

- Impact on Labour Markets: The digital revolution is reshaping labour markets, impacting workforce composition, job quality, and skill requirements.

- The report emphasises the challenges of upskilling and reskilling the labour force to meet the demands of digital technologies.

- Emerging Regulatory Challenges: Regulators face the challenge of staying ahead of the financial innovation curve while balancing complex trade-offs.

- The report stresses the need for regulations to set boundaries to prevent the irrational exuberance of participants.

- Concerns: It include the loosening of entry barriers, which could lead to fintech lending being promoted on weak business models with inadequate cyberinfrastructure.

- Additionally, BigTech companies have the potential to become “too big to fail,” dominating markets and posing systemic risks.

- Policy Coordination: Ensuring policy coordination at the international level to standardize digital trade regulations and support global digitalisation efforts .

- Infrastructure and Awareness: Ensuring the development of robust payment infrastructure and increasing awareness among consumers and merchants .

- Adequate infrastructure is essential to support the growing digital economy and ensure widespread access .

- Balancing Regulation and Innovation: Ensuring effective regulation while fostering financial innovations in a safe ecosystem is critical .

Check Out UPSC NCERT Textbooks From PW Store

Government Initiatives in Digitalization as Mentioned in the Report

- Digital Personal Data Protection Act, 2023:

- AIM: Aims to ensure comprehensive data protection.

- Establishes the Data Protection Board of India.

- Enforces measures to handle personal data breaches and impose penalties .

- Consumer Protection (e-Commerce) Rules, 2020:

- Designed to prevent unfair trade practices in e-commerce .

- Key Provisions:

- Mandates transparent returns, refund, exchange, warranty, delivery, and shipment policies.

- Requires disclosure of seller information and addresses consumer grievances effectively

- Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021:

- Focuses on holding digital platforms accountable for their content and user safety .

- Mandates mechanisms for timely redressal of grievances and ensures transparency in content moderation .

- Udyam:

- Objective: To simplify the process for Micro, Small, and Medium Enterprises (MSMEs) to access government schemes and benefits.

- Key Features:

- Online and paperless registration process.

- Provides MSMEs with a unique identification number to avail various benefits and subsidies

- Digital Infrastructure for Knowledge Sharing (Diksha):

- Objective: To enable collaborative learning and teaching, generating customizable content.

- As of July 15, 2024, there are 1.71 crore registered users on DIKSHA .

- Digital Public Goods (DPG):

- Objective: To ensure availability of assets like software codes and documentation required for the successful deployment of digital public infrastructure.

- Key Features:

- Supports financial inclusion, transparency, and efficiency.

- Examples include Aadhaar, UPI, and DigiLocker

- Direct Benefit Transfer (DBT):

- Objective: To transfer subsidies directly to the bank accounts of beneficiaries, reducing leakage and delays.

- Key Features:

- Ensures targeted delivery of subsidies.

- Enhances transparency and efficiency in welfare schemes

- Uses digital payment systems to reduce delays and leakages in government transfers.

- NITI for States DPI Platform:

- Objective: To assist states in leveraging digital public infrastructure for improved governance.

- Key Features:

- Provides tools and frameworks for states to develop their digital infrastructure.

- Promotes inter-state collaboration and sharing of best practices

- The knowledge products on the platform span 10 sectors

|

Way Forward

- Cybersecurity and Data Privacy: As digital transactions increase, cybersecurity and data privacy become major concerns .

- Cross-border digital trade policies would play a crucial role in harnessing new opportunities, building trust, and facilitating coordination on regulatory aspects like data security and cybersecurity.

- Regulatory and supervisory frameworks must scale up and become more sophisticated to balance financial stability, customer protection, and competition while fostering financial innovations

- Robust regulatory framework: The report provides evidence supporting the role of a robust regulatory framework in enhancing confidence in digital products.

- Call for robust model-based lending: The RBI report stresses the importance of employing robust, regularly tested algorithms in model-based lending by banks and non-banking financial companies (NBFCs) to ensure the integrity and stability of financial systems.

- Promoting Digital Literacy: Increasing awareness and adoption of digital payment systems through targeted educational initiatives .

- Proactive Risk Mitigation: Adopting a proactive approach to mitigate digital risks while fostering innovation in the financial sector .

- International Collaboration: Strengthening international collaboration on digital trade policies and infrastructure development .

- Developing Local Skills: Enhancing local digital skills to support the growing digital economy and attract foreign digital investments .

- Policy Initiatives: Implementing policy measures to facilitate safe and efficient adoption of financial innovations while safeguarding the financial system .

- Strengthening policy support for digital payment systems and promoting digital literacy to boost adoption rates .

Enroll now for UPSC Online Classes

Conclusion

The “Report on Currency and Finance 2024” underscores India’s significant strides in digitalization, transforming the financial landscape and fostering economic growth. Despite opportunities like enhanced financial inclusion and operational efficiencies, challenges such as cybersecurity, data privacy, and regulatory complexities remain. The way forward involves strengthening infrastructure, regulatory frameworks, and international collaborations to sustain and enhance the digital economy’s benefits

![]() 30 Jul 2024

30 Jul 2024

Digital Remittances: Reducing the cost of remittances and achieving Sustainable Development Goals (SDGs) by 2030.

Digital Remittances: Reducing the cost of remittances and achieving Sustainable Development Goals (SDGs) by 2030.

Data: UPI has seen a tenfold increase in volume over the past four years, increasing from 12.5 billion transactions in 2019-20 to 131 billion transactions in 2023-24 – 80 per cent of all digital payment volumes.

Data: UPI has seen a tenfold increase in volume over the past four years, increasing from 12.5 billion transactions in 2019-20 to 131 billion transactions in 2023-24 – 80 per cent of all digital payment volumes.