The Ministry of Finance has finalised the guidelines and funds under the Scheme for Special Assistance to States for Capital Investment 2024-25 and circulated them to the states.

Special Assistance to States Finalized

- Rs 10,000 crore has been finalised for implementing land-related reforms in rural and urban areas.

- Additional Funds:

- Farmers’ Registry: Rs 5,000 crore has been finalised for creating a Farmers Registry with details of six crore farmers and their lands during the financial year 2024-25 (FY25)

- Working Women’s Hostel: Rs. 5,000 crore has been finalised for the construction of working women’s hostels.

- The State Government will provide land for the hostels either free of cost, or the cost of acquiring the land will be borne by them

- Aim: To facilitate higher participation of women in the workforce through the establishment of working women’s hostels in collaboration with industry, and setting up crèches.

- Public-Private Partnership (PPP) model: The operation and maintenance of the hostels will be managed by a private party while the ownership of the hostel would rest with the state government

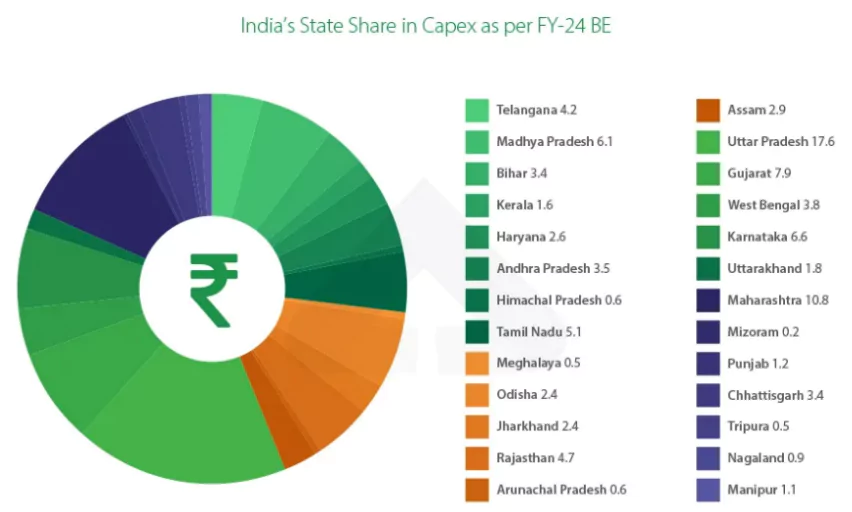

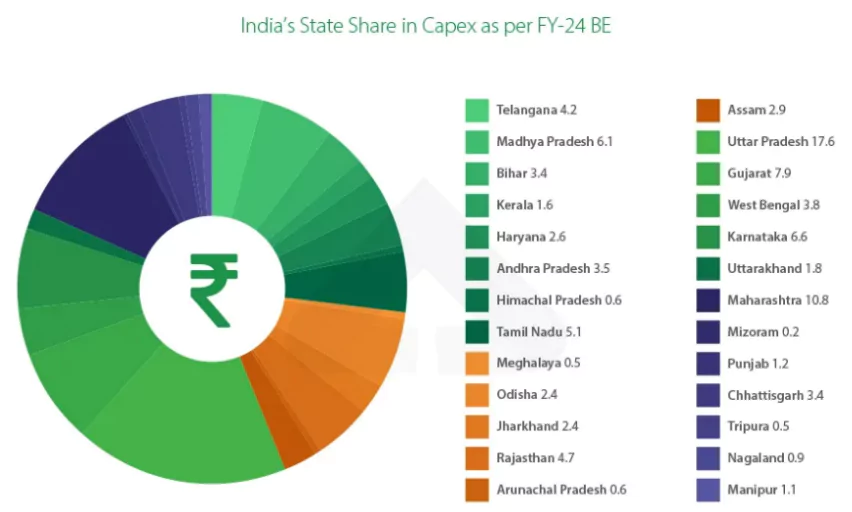

- State Wise Allotment: Uttar Pradesh will receive the highest amount of Rs 382 crore, followed by Madhya Pradesh (Rs 284 crore) and Assam (Rs 226 crore).

- Rs 1,000 crore for the development of the National Capital Region (NCR): It will be divided equally among the three states of Haryana, Uttar Pradesh, and Rajasthan.

- Rs 15,000 crore for states’ shares of Centrally Sponsored Schemes, including Urban and Rural Infrastructure Projects

- Rs 15,000 crore for stimulating industrial growth

- Rs 4,000 crore in incentives for Implementing the SNA Sparsh model for just-in-time release of funds under Centrally Sponsored Schemes

- Rs 25,000 crore as incentives for achieving targets fixed for capital expenditure for 2024-25.

Enroll now for UPSC Online Course

About The Scheme for Special Assistance to States for Capital Investment 2024-25

- The scheme envisages special assistance being provided to the States in the form of a 50-year interest-free loan.

- For the Fiscal Year 2023-24: The Budget Estimate for the scheme was ₹1.30 lakh crore which was later revised to ₹1.05 crore. The scheme was launched for the first time in fiscal year 2020-21 in the wake of COVID-19 Pandemic

- Principle: The scheme is based on the principle of Multiplier Effect, where it is believed that every ₹1 spent as capital expenditure will result in an impact worth ₹3.

- Capital investment Sectors: Projects in Health, education, irrigation, water supply, power, roads, bridges and railways are approved.

- Fiscal Year 2024-25:

- Budget: ₹1.30 lakh crore has been allotted for the year 2024-25

- Mandatory Conditions:

- Correct translation to local language about names and features of centrally sponsored schemes

- Implementing the SNA Sparsh model: Deposit of central share of interest earned in SNA accounts till March 31 in the Consolidated Fund of India.

- Proposed Land Reforms in Rural Areas: States have to include the,

Scheme Part

|

Objective

|

| Part I |

States have been allocated in proportion to their share of central taxes & duties as per the award of the 15th Finance Commission.

- ₹55,000 has been earmarked under this componet

|

| Part-II |

Incentivizing scrapping of government vehicles by providing incentives to States.

- ₹5,000 crore is allotted.

|

| Part-III |

Encouraging reforms in urban planning.

- ₹5,000 crore has been provided for the ‘Development of iconic Tourist Centres’.

|

| Part-IV |

Promoting reforms in urban finance. |

| Part-V |

Increasing housing stock for police personnel in urban areas. |

| Part-VI |

Promoting national integration and the “Make in India” concept through the construction of Unity Malls in each State. |

| Part-VII |

Providing financial assistance for the establishment of libraries with digital infrastructure at the Panchayat and Ward levels. |

-

-

- Assignment of a Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all lands

- Digitisation of Cadastral Maps

- Survey of map sub-divisions according to current ownership

- Establishment of a land registry

- Proposed Land Reforms In Urban Areas:

- Fiscal incentives will be provided for the digitization of land records using GIS mapping

- Establishment of an information technology-based system for property record administration, updating, and tax administration.

Check Out UPSC CSE Books From PW Store

Capital Expenditure In India

- Capital Expenditure is defined as the governmental (central, state, local) spending on the development of physical assets like buildings, machinery, equipment, healthcare facilities, educational institutions, etc.

- It also covers the costs incurred by the government to purchase fixed assets like land and investments that will yield earnings or dividends in the future.

- Capex involves funds spent on the following:

- Purchasing fixed and intangible assets

- Upgrade an existing asset

- Repairing an existing asset

- Repayment of loans

- Capex Loans to States: They are distributed to the states in two major categories,

- Untied: The untied loans would be released to states in two installments under the Scheme for Special Assistance to States for Capital Investment 2024-25

- The first instalment of 66% of the approved amount on meeting the mandatory conditions and the second instalment of 34% will be released on utilization of at least 75% of the amount released in the first installment.

- Tied: It is subject to social reforms and specific development expenditures.

- Example: The Funds provided under specific Centrally Sponsored Schemes and other Schemes.

- Fiscal Year 2023-24: The Centre had spent 85 per cent of the revised capital expenditure estimate of Rs 9.5 lakh crore.

- States: As per the provisional accounts of 25 states, They achieved 84 per cent of the budgeted capital expenditure

These states had budgeted a capital expenditure (capex) programme of Rs 8.37 trillion for FY24. The provisional amount spent was Rs 7.02 trillion.

These states had budgeted a capital expenditure (capex) programme of Rs 8.37 trillion for FY24. The provisional amount spent was Rs 7.02 trillion.- Lowest capex absorption States: These included Nagaland, Chhattisgarh, Punjab, and Mizoram.

- Exception: Four states including Uttar Pradesh, Telangana, Bihar, and Sikkim spent more than the targeted amount

- Fiscal Year 2024-25: Centre’s Capital Expenditure Target were raised by 16.9 per cent for financial year 2024-25 (FY25) to Rs 11.1 trillion over the revised estimates for FY24 In the interim budget.

Factors Influencing India’s States’ Capex Spending

- Public Sector Led: The public sector leads in Capex Expenditure with national and state government spending in double digits and in a wide range of areas

- Underperforming Private sector: Private Investments has increased slowly, in single digits, and that too in concentrated areas like in infrastructure, hospitality and retail, and is yet to surge into other segments.

- Elections: Indian states spend the most on capex when their is an election approaching

- Example: Telangana has met 90 percent of its FY24 capex target. The state held elections to its legislative assembly in November last year

Need For Capital Expenditure

- Planning and Development: it shows the expenditure is planning and development-linked expenditure which may have a positive effect on labor engagement, build up or upgrade infrastructure, and improve the ability to generate more revenue through asset creation.

- Investment Environment: States with healthy capex report cards often host a positive investment environment for the private sector.

- Long Term growth: Capex creates Multiplier Effect thus has a greater impact on long-term growth and productivity than revenue expenditure

- Increase Productivity: Allocating capital for new projects, expanding ventures, or improving technology and infrastructure promotes economic growth by increasing productivity, demand for related industries, and creating job opportunities.

Enroll now for UPSC Online Classes

![]() 22 Aug 2024

22 Aug 2024

These states had budgeted a capital expenditure (capex) programme of Rs 8.37 trillion for FY24. The provisional amount spent was Rs 7.02 trillion.

These states had budgeted a capital expenditure (capex) programme of Rs 8.37 trillion for FY24. The provisional amount spent was Rs 7.02 trillion.