The 54th GST Council met under the Chairpersonship of the Union Minister for Finance & Corporate Affairs in New Delhi.

Key Highlights of 54th GST Council

- Cancer Drugs: The GST rate on cancer drugs namely, Trastuzumab Deruxtecan, Osimertinib and Durvalumab to be reduced from 12% to 5%.

- Metal Scrap: Reverse Charge Mechanism (RCM) to be introduced on supply of metal scrap

- Exemption: GST Council recommends to exempt supply of research and development services by a Government Entity; or a research association, university, college or other institution notified u/s 35 of Income Tax Act using government or private grants.

- GST Council also recommends formation of a Group of Ministers (GoM) to study the future of compensation cess

- Compensation Cess: States are guaranteed compensation for any revenue shortfall below 14% growth (base year 2015-16) for the first five years ending 2022.

- GST compensation is paid out of Compensation Cess every two months by the Centre to states.

- Life and Health Insurance: The Council has set up a Group of Ministers (GoM) to thoroughly review GST issues concerning life and health insurance.

- Launch Of B2C E-Invoicing Pilot: One of the most notable decisions from the 54th GST Council meeting was the launch of a pilot for B2C e-invoicing.

Enroll now for UPSC Online Classes

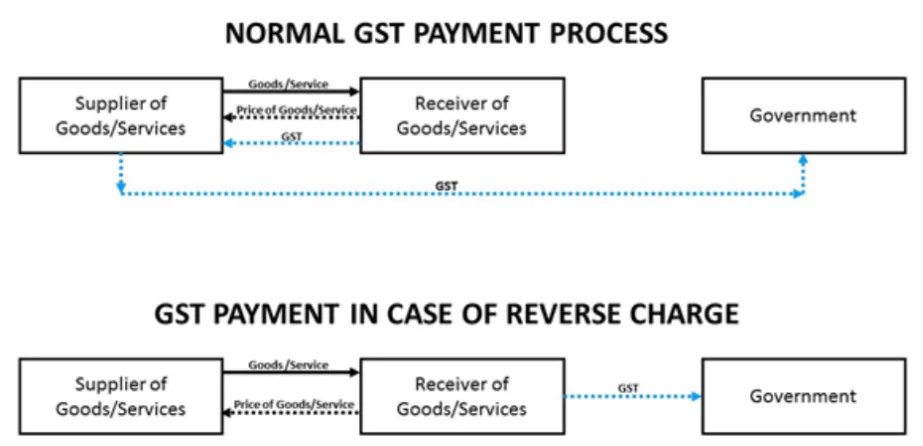

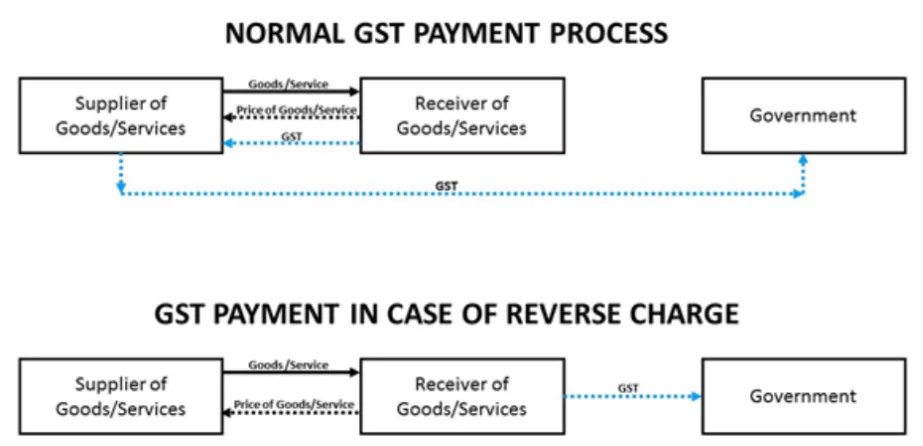

What is Reverse Charge Mechanism?

- Typically: The supplier of goods or services pays the tax on supply.

- Under the reverse charge mechanism: The recipient of goods or services becomes liable to pay the tax, i.e., the chargeability gets reversed.

- Objectives:

- To widen the scope of levy of tax on various unorganised sectors;

- To exempt specific classes of suppliers of goods/services

- To tax the import of services

About GST Council

- About: It is a constitutional body formed under Article 279A(1), enacted by the 101st Constitutional Amendment Act.

- Recommendations: According to Article 279A(4), the GST Council recommends the GST rates for the Union and the States.

- Composition of GST Council (Article 279A(2)): The GST Council brings together representatives from the Centre and the States to oversee the nationwide implementation of GST. Its membership includes:

- Chairperson: Union Finance Minister

- Member: Union Minister of State in charge of Revenue or finance

- Members nominated by each State Government, typically in charge of finance or taxation

- Vice-Chairperson elected from among the Council members (Article 279A(3))

- Decision Making Process: The GST rates are jointly determined by the states and the central government during GST Council meetings.

- The GST Council requires at least half of its total members to be present to conduct a meeting.

- Decisions are made based on a majority of no less than three-fourths of the weighted votes of members present and voting.

- The central government’s vote carries a weight of one-third of the total votes cast, while all states collectively hold the remaining two-thirds weightage.

Check Out UPSC NCERT Textbooks From PW Store

![]() 10 Sep 2024

10 Sep 2024