Retail inflation (CPI ) hit a nine-month high of 5.49% in September, up from 3.65% in August, driven by rising food prices.

Key Highlights of the Inflation

- Food Inflation: The Consumer Food Price Index (CFPI) surged to 9.24%, with rural food inflation at 9.08% and urban at 9.56%.

- Housing and Electricity Inflation: Housing inflation rose to 2.78% in September, while the All India Electricity index showed a 5.45% inflation rate.

- Factors Behind Inflation Rise: High base effect and adverse weather conditions contributed to the inflation increase in September.

- Decline in Specific Categories: Inflation fell for pulses, spices, meat and fish, and sugar and confectionery in September.

Enroll now for UPSC Online Classes

About Inflation

- Inflation refers to the rise in the prices of most goods and services of daily or common use, such as food, clothing, housing, recreation, transport, consumer staples, etc.

- It measures the average price change in a basket of commodities and services over time.

- Inflation is indicative of the decrease in the purchasing power of a unit of a country’s currency. This is measured in percentage.

- Importance: A certain level of inflation is required in the economy to ensure that expenditure is promoted and hoarding money through savings is demotivated.

Types of Inflation

- Stagflation: Stagflation is a unique combination of high inflation and stagnant economic growth, accompanied by high unemployment.

- Headline Inflation: Headline Inflation is a measure of the total inflation within an economy, including commodities such as food and energy prices (e.g., oil and gas), which tend to be much more volatile and prone to inflationary spikes.

- Wholesale Price Index (WPI) in India is known as headline inflation.

- Core Inflation: Core inflation is the change in the costs of goods and services, but it does not include those from the food and energy sectors.

- This measure of inflation excludes these items because their prices are much more volatile.

- Disinflation: Disinflation refers to a decrease in the rate of inflation, meaning prices are still rising but at a slower pace.

How is Inflation measured?

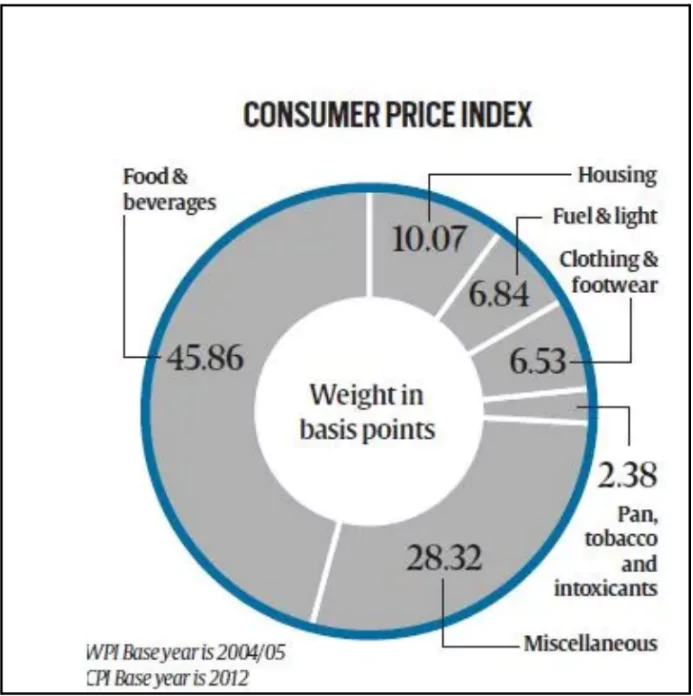

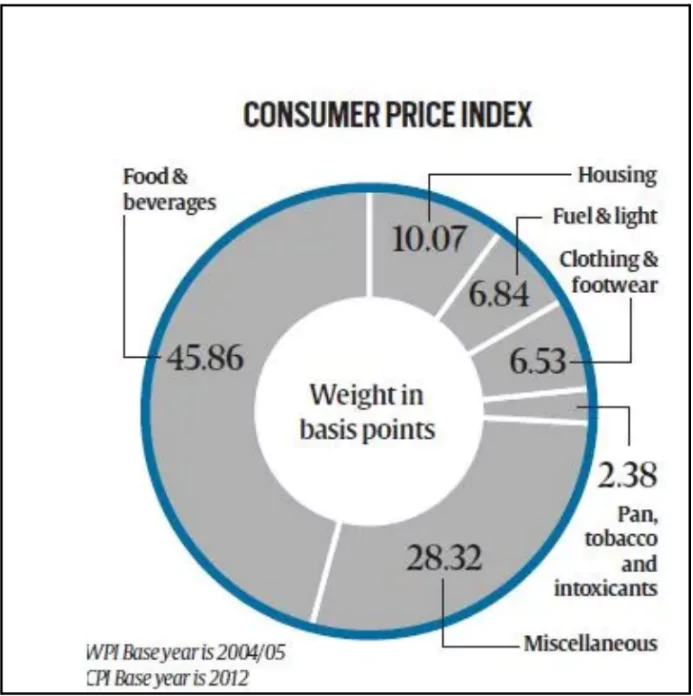

In India, inflation is primarily measured by two main indices WPI (Wholesale Price Index) and CPI (Consumer Price Index), which measure wholesale and retail-level price changes, respectively.

About Consumer Price Index (CPI) – Retail Inflation

- CPI Measures the change in the retail prices of goods and services with reference to a base year.

Compiled by: National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).

Compiled by: National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).- Types of CPI:

- CPI for Industrial Workers (CPI-IW)

- Compiled by the Labor Bureau.

- Base year: 2016.

- CPI for Rural Laborers and Agricultural Laborers (CPI-AL & CPI-RL)

- Compiled by the Labor Bureau.

- Base year: 1986-87.

- New CPI (Rural, Urban, and Combined):

- Base year: 2012.

- Compiled and published by the Central Statistical Organisation (CSO) for all-India levels.

Consumer Food Price Index (CFPI)

- CFPI: It is a sub-component of CPI, measuring changes in retail prices of food items consumed by the population.

- Focus: Tracks price changes of food staples such as cereals, vegetables, fruits, dairy, meat, etc.

- Compiled by: Central Statistics Office (CSO), MoSPI (from May 2014), now under NSO (formed in 2019).

- Base year: 2012.

- Methodology: Calculated monthly, using the same methodology as CPI.

Check Out UPSC NCERT Textbooks From PW Store

Wholesale Price Index (WPI)

- WPI : It measures the average change in wholesale prices before the retail level.

- Coverage: It covers only goods, excluding services.

- Compiled by: Office of Economic Advisor, Ministry of Commerce and Industry (on a monthly basis).

- Base year: 2011-12.

- Weightage: Weights assigned to commodities are based on production value adjusted for net imports.

![]() 15 Oct 2024

15 Oct 2024

Compiled by: National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).

Compiled by: National Statistics Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).