Switzerland has recently announced the suspension of the Most Favoured Nation (MFN) clause in its Double Tax Avoidance Agreement (DTAA) with India, effective from January 1, 2025.

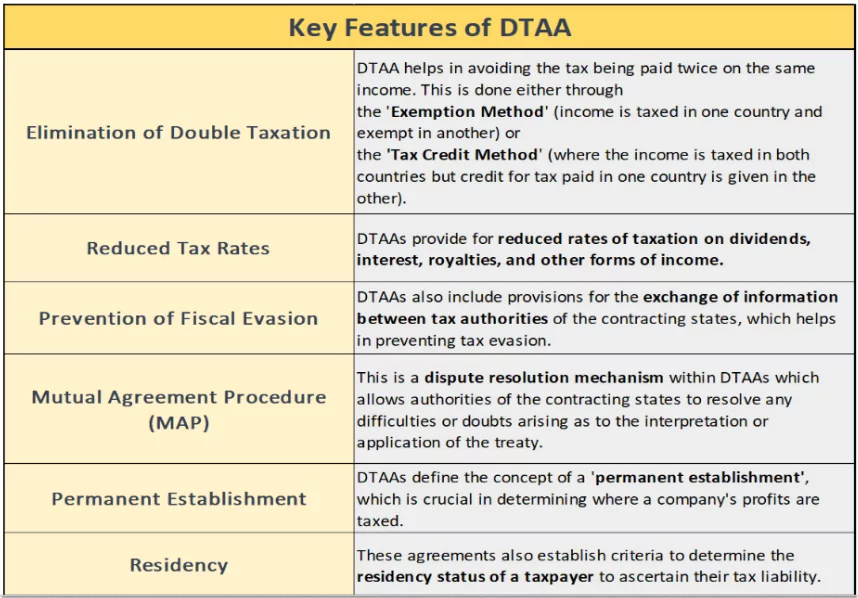

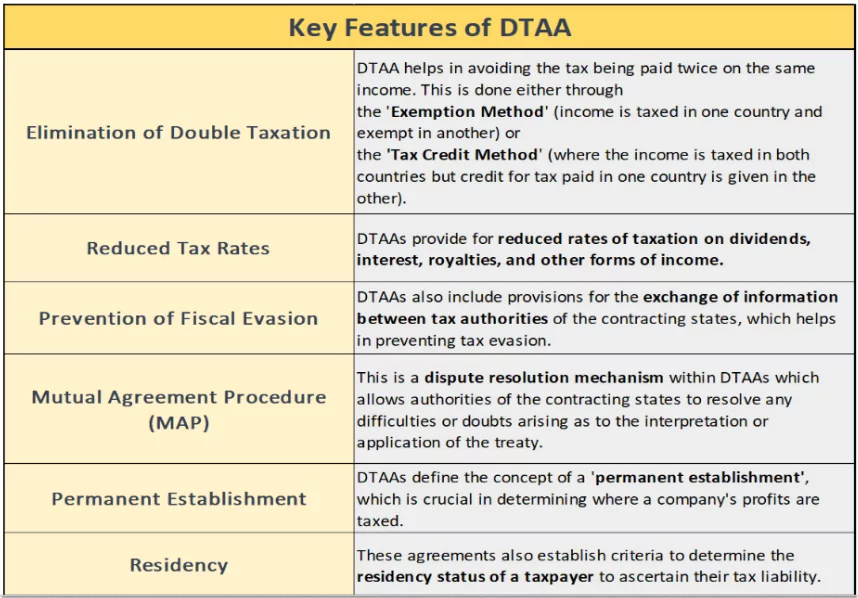

About Double Tax Avoidance Agreement (DTAA)

- A DTAA is a tax treaty signed between two or more countries to prevent double taxation for taxpayers who reside in one country and earn income in another.

- Application: The agreement applies when a taxpayer resides in one country but earns income in another country.

- Purpose: To ensure that taxpayers are not subject to double taxation on the same income.

- Types of DTAAs:

-

- Comprehensive DTAAs: These cover all possible sources of income between the two countries.

- Limited DTAAs: These focus on specific areas of income, such as income from shipping, air transport, inheritance, or dividends.

About the Most Favoured Nation (MFN) Clause

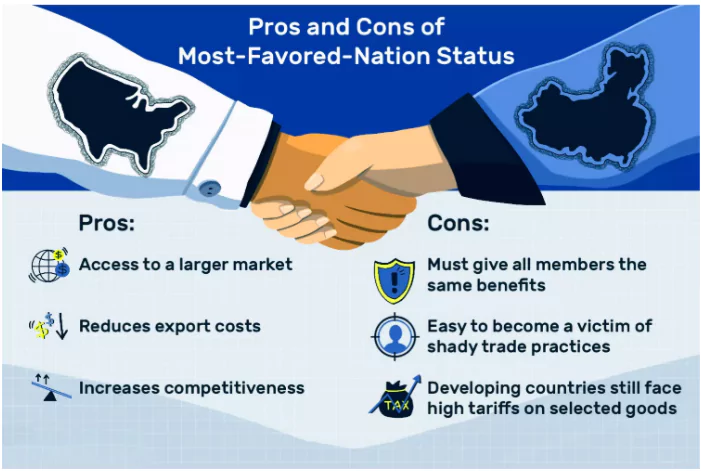

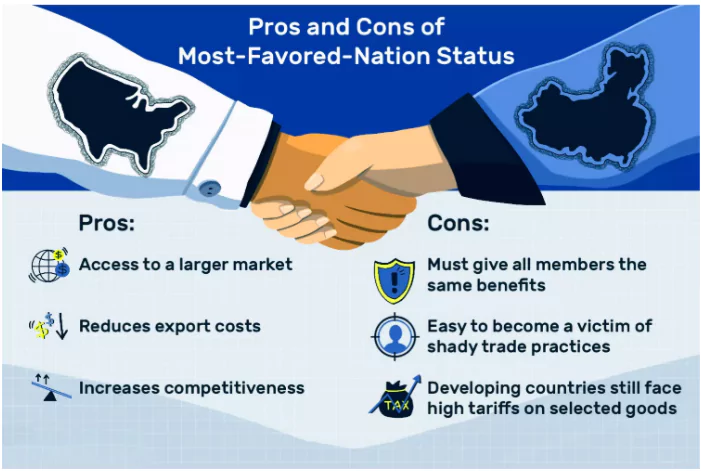

- Definition: The MFN clause ensures that trade between countries is non-discriminatory. It mandates that a country must offer the same trade terms to all its trading partners.

- WTO Rules:

- Under World Trade Organization (WTO) regulations, member countries cannot discriminate among trade partners.

- If any special trade benefits are granted to one trade partner, they must be extended to all WTO members.

- Exceptions: While the MFN clause is a fundamental principle of the WTO, there are exceptions for:

- trade blocs like the USMCA and the European Union, which are allowed to discriminate against imports from outside the bloc;

- trade barriers in response to unfair competition;

- trade preferences extended to developing countries; and

- trade in services, on a limited basis.

- For example, the United States denies MFN status to Cuba and North Korea due to geopolitical and policy reasons.

Check Out UPSC CSE Books From PW Store

Impact of Removal of MFN Status in the India-Switzerland Double Taxation Avoidance Agreement (DTAA)

- Increased Tax Burden on Indian Entities in Switzerland: The removal of the MFN status may lead to a higher tax burden on dividend income for Indian companies operating in Switzerland.

- Potential Renegotiation of DTAA: The suspension of the MFN clause has prompted discussions on renegotiating the India-Switzerland DTAA.

- The renegotiation will likely address changes required due to Switzerland’s obligations under the European Free Trade Association (EFTA) pact.

- Impact on Bilateral Trade Relations: The removal of MFN status could create uncertainties in India-Switzerland trade relations, potentially affecting business confidence.

- It might lead to a reassessment of trade policies between the two countries.

- Alignment with the EFTA Trade Pact: The renegotiation of the DTAA is expected to align India’s tax framework with the broader terms of the EFTA trade deal, which includes Switzerland, Norway, Iceland, and Liechtenstein.

- Implications for EFTA Free Trade Agreement: The MFN suspension highlights the need to resolve tax-related issues before the India-EFTA Free Trade Agreement comes into force.

- This agreement is projected to bring USD 100 billion in investments from EFTA member countries to India over the next 15 years.

- Legal and Judicial Precedents: Switzerland cited a 2023 Indian Supreme Court ruling related to Nestlé as a basis for suspending the MFN clause. This suggests a need for India to address legal interpretations that could impact international agreements.

- Broader Economic Impact: The removal of MFN status may lead to a reassessment of India’s treaties with other countries, especially in the context of evolving global trade dynamics and investments.

![]() 14 Dec 2024

14 Dec 2024