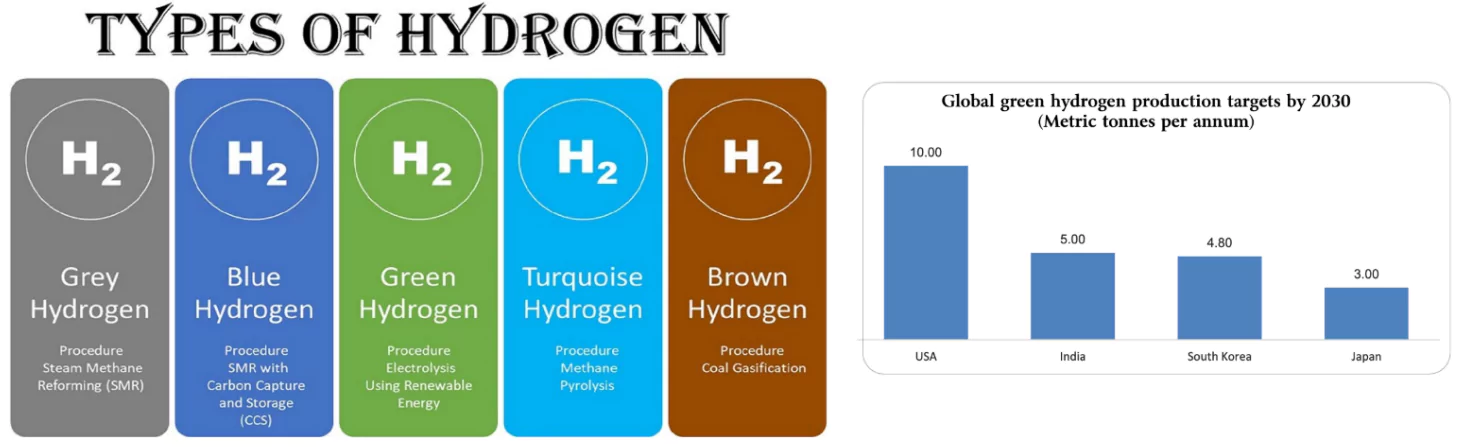

India targets 5 million metric tonnes (MMT) of green hydrogen production annually by 2030 to decarbonize industries and achieve net-zero emissions by 2070, but financing challenges pose significant hurdles.

- Based on a recent analysis by BloombergNEF, India is on track to meet only 10% of its stated goal.

- High Production Costs: Green hydrogen costs $5.30–$6.70/kg, significantly higher than grey/blue hydrogen ($1.90–$2.40/kg).

- Market Deadlock: Green hydrogen prices can drop with scaled production, but scaling requires viable economics and reduced costs.

Enroll now for UPSC Online Course

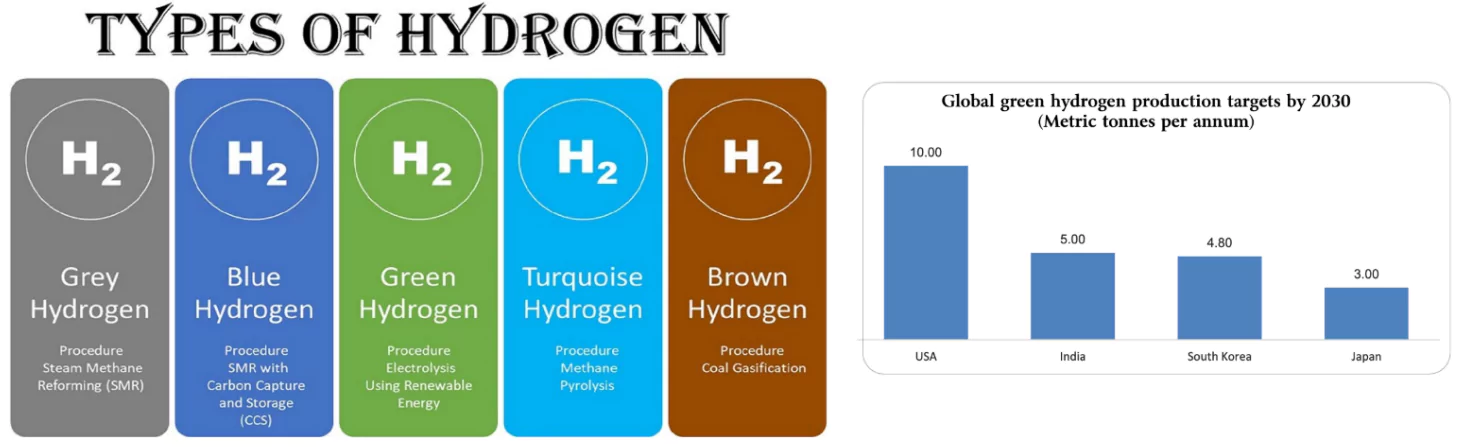

About Green Hydrogen

- The Ministry of New and Renewable Energy (MNRE) has defined green hydrogen as hydrogen produced to emit no more than 2 kg of carbon dioxide per kg of such hydrogen.

- Currently, producing 1 kg of ‘grey hydrogen,’ as it is known, emits 9 kg of carbon dioxide.

How is Green Hydrogen Produced?

- Green hydrogen production relies on electrolysis, a process in which water (H₂O) is split into hydrogen (H₂) and oxygen (O₂) by applying an electric current through an electrolyzer using renewable energy, while grey hydrogen requires carbon combustion.

- Key factors in its production include:

-

- Electrolyzers: Devices that split water molecules into hydrogen and oxygen.

- Renewable Energy Sources: Solar, wind, and hydropower provide the necessary electricity for electrolysis, ensuring zero carbon emissions.

- Water Resources: Sufficient water supply is required, as one ton of hydrogen production needs approximately nine tons of water.

|

Significance of Green Hydrogen

- Zero Carbon Emissions: Green hydrogen is produced using renewable energy sources, emitting only water vapor as a byproduct, unlike fossil fuels that release large amounts of CO₂.

- Example: Replacing 1 kg of grey hydrogen (emits 9 kg CO₂) with green hydrogen can reduce significant carbon emissions in sectors like refining and ammonia production.

- Versatility Across Sectors: Green hydrogen can replace fossil fuels in hard-to-abate sectors like steel, cement, fertilizers, shipping, and aviation.

- Example: The steel industry, a major fossil fuel consumer, can adopt green hydrogen to produce green steel, reducing emissions by up to 90% compared to traditional methods.

- Use in Agricultural Sector: Green hydrogen can decarbonize the agriculture sector by replacing natural gas-derived grey hydrogen in fertilizer production, reducing carbon emissions significantly.

- Example: Green hydrogen can produce ammonia, a key fertilizer component, while ensuring sustainability and reducing dependency on fossil fuels.

- Energy Independence and Security: Reduces reliance on imported fossil fuels, enhancing energy security for countries with abundant renewable resources.

- Example: India, with an annual energy import bill of $185 billion, aims to save ₹1 lakh crore by 2030 through green hydrogen adoption under the National Green Hydrogen Mission.

- Sustainable Transport Solutions: Green hydrogen powers fuel cells in heavy-duty vehicles, ships, and trains, providing a clean alternative to diesel and natural gas.

- Example: Japan’s development of hydrogen-powered trains and India’s pilot hydrogen-fueled buses by NTPC in Leh and Noida.

- Long-term Energy Storage: Hydrogen allows renewable energy storage for long durations, overcoming the intermittency of solar and wind power, unlike fossil fuels that are finite.

- Example: Hydrogen storage solutions are being tested to stabilize grids in Europe and the U.S., ensuring reliable energy during high demand periods.

- Potential for Global Trade and Export: Countries with renewable energy surplus can produce green hydrogen for export, creating economic opportunities and reducing global dependence on fossil fuels.

- Example: Australia-Japan’s Hydrogen Energy Supply Chain project aims to export green hydrogen to meet Japan’s decarbonization targets.

Green Hydrogen vs. Fossil Fuels

| Feature |

Green Hydrogen |

Coal |

Natural Gas |

Petroleum Products |

| Production |

Electrolysis of water using renewable energy |

Mining |

Extraction from natural gas fields |

Oil drilling and refining |

| Environmental Impact |

Zero carbon emissions during production |

High carbon emissions |

Moderate carbon emissions |

High carbon emissions |

| Cost |

Currently more expensive than other fuels |

Relatively inexpensive |

More expensive than coal, but cheaper than green hydrogen |

More expensive than coal and natural gas |

| Energy Density |

High |

Low |

Medium |

High |

| Storage and Transportation |

Can be stored and transported in various ways, including pipelines and tanks |

Can be stored in stockpiles |

Can be stored in underground reservoirs and transported via pipelines |

Can be stored in tanks and transported via pipelines and tankers |

Check Out UPSC CSE Books From PW Store

India’s Potential for Green Hydrogen Production

- Abundant Renewable Energy Resources:

- India’s solar energy potential: 748 GW (gigawatts) at full capacity; current installed solar capacity stands at 73.32 GW (December 2023).

- Wind energy potential: Significant untapped resources in states like Tamil Nadu, Gujarat, and Maharashtra.

- Gujarat’s RE projects linked to green hydrogen hubs; Rajasthan’s solar potential for electrolyzer-driven hydrogen production.

- Favorable Geographic Conditions: Vast land availability in states like Rajasthan and Gujarat for renewable energy parks.

- Bhadla Solar Park in Rajasthan, a prime renewable energy hub, could support green hydrogen production.

- High Domestic Demand for Hydrogen: India currently produces 6.5 million metric tonnes (MMT) of hydrogen annually, mostly grey hydrogen, for industries like fertilizers, refining, and steel.

- Green hydrogen can replace grey hydrogen in these sectors, reducing 50 MMT of CO₂ emissions annually by 2030.

- NTPC and Oil India blending green hydrogen in PNG and fuel networks in Gujarat and Madhya Pradesh.

- Cost-Competitive Production Potential: By leveraging economies of scale and declining renewable energy costs, India aims to reduce green hydrogen production costs to $1 per kg by 2030.

- Solar Energy Corporation of India (SECI) has achieved low renewable electricity tariffs at INR 2.6/kWh, which is crucial for affordable green hydrogen.

- Policy Support and Investments: National Green Hydrogen Mission: ₹19,744 crore outlay to establish India as a global hub for green hydrogen.

- Target: 5 MMT annual green hydrogen production and 125 GW renewable energy capacity by 2030.

- The Adani Group is investing $9 billion in the first phase of its green hydrogen venture in Gujarat’s Kutch district.

- Strategic Location for Exports: Proximity to key hydrogen-importing countries like Japan, South Korea, and Europe.

- Ongoing trade discussions for green hydrogen exports under partnerships like the India Hydrogen Alliance (IH2A).

- Potential forex savings of ₹1 lakh crore by reducing fossil fuel imports and earning from exports.

- Technological and Industrial Ecosystem: Growing electrolyzer manufacturing capacity with initiatives like the SIGHT programme under the Green Hydrogen Mission.

- Pilot projects in mobility and steel sectors showcasing feasibility.

- Green steel pilot project in Odisha leveraging green hydrogen to decarbonize steel production.

Challenges to Green Hydrogen Production

- High Cost of Producing Green Hydrogen: The cost of producing green hydrogen depends on two critical factors which make the production of green hydrogen expensive:

- Levelised Cost of Electricity (LCOE): It is the average cost of generating renewable electricity over a project’s lifetime.

- A higher LCOE directly increases green hydrogen production costs, as renewable electricity is the primary input for its production.

- Currently, there is a substantial disparity between green hydrogen production costs ($5.30–$6.70 per kg) and traditional grey/blue hydrogen production costs ($1.90–$2.40 per kg).

- Electrolyzer Costs: Electrolyzers are devices used to split water into hydrogen and oxygen through electrolysis.

- These systems rely on advanced technology, but due to relatively low demand, the cost of electrolyzers remains high.

- Alkaline electrolyzers cost approximately $500–$1,400 per kilowatt (kW).

- Proton Exchange Membrane (PEM) systems are even more expensive, ranging from $1,100 to $1,800 per kW.

- High Borrowing Costs: The cost of capital, particularly in developing markets like India, is often high.

- This issue arises because such investments are perceived as riskier due to uncertainties surrounding demand.

- This perception leads to higher borrowing costs, reflected in an increased weighted average cost of capital (WACC).

- Studies show that a rise in WACC from 10% to 20% can increase the cost of hydrogen by up to 73%.

- Since investment costs contribute 50–80% of the LCOE in renewable energy projects, even a small increase in WACC can significantly drive up production costs.

- Infrastructure Limitations: Lack of pipelines, storage facilities, and hydrogen refueling stations for transport and industrial use.

- Currently, India has only a couple of operational hydrogen filling stations, in Faridabad and Gurugram, insufficient for scaling adoption.

- Energy and Water Demand: Electrolyzers consume 9 liters of water per kg of hydrogen, creating challenges in water-scarce regions.

- Dependence on freshwater resources limits scalability, making seawater electrolysis an underdeveloped alternative.

- Storage and Transportation Challenges: Hydrogen is highly flammable and requires high-pressure tanks or cryogenic temperatures for storage and transport.

- Liquid hydrogen storage requires temperatures below −252.8°C, which involves expensive cryogenic infrastructure.

- Lack of Standardization and Certification: Absence of harmonized global standards for hydrogen production, carbon intensity, and safety protocols.

- Divergent definitions of “green hydrogen” allow biomass-based hydrogen, which still emits some carbon, to qualify.

- Dependence on Fossil Fuels in Energy Grid: Risk of using coal-dominated grids for electrolyzer operation when renewable energy is unavailable (e.g., at night).

- India’s grid relies on 70% coal-based electricity, which undermines the carbon neutrality of green hydrogen projects.

- Nascent Technology and Workforce Skills: Need for R&D in efficient, low-cost electrolyzers and non-freshwater-based production methods.

- Workforce skill gap in hydrogen production, storage, and infrastructure development.

- The ministry of skill development and education (MSDE) estimates a demand for 2.83 lakh jobs in production and storage, along with 11,000 roles in electrolyser manufacturing by 2030 for green hydrogen production units.

- Competing Renewable Energy Needs: Diversion of renewable energy from grid decarbonization to green hydrogen production could slow progress toward overall energy transition goals.

- India’s 2030 green hydrogen plan requires 125 GW of additional RE capacity, over and above the 500 GW target under the Paris Agreement.

Check Out UPSC NCERT Textbooks From PW Store

Government Initiatives for Green Hydrogen Production in India

- National Green Hydrogen Mission (2023):

- Objective: Make India a global hub for green hydrogen production, use, and export.

- Key Targets:

- 5 MMT annual green hydrogen production by 2030.

- Add 125 GW renewable energy capacity for hydrogen production.

- Save ₹1 lakh crore in fossil fuel imports and reduce 50 MMT CO₂ emissions annually.

- Sub Schemes under the NGHM:

- Strategic Interventions for Green Hydrogen Transition Programme (SIGHT): It aims to support 4GW of domestic electrolyser manufacturing capacity and assist production of 1 million tonnes of green hydrogen by 2030.

- Green Hydrogen Hubs: States and regions capable of supporting large scale production and/or utilization of hydrogen will be identified and developed as Green Hydrogen Hubs.

- Green hydrogen projects planned in Gujarat, Odisha, and Tamil Nadu.

- Green Hydrogen Policy (2022):

- Waiver of interstate transmission charges for 25 years for projects commissioned by December 31, 2030.

- Open access policy: Ensures availability of renewable energy for hydrogen production.

- Land Allocation: Support for establishing renewable energy parks.

- Pilot Projects:

- Mobility and Industry: Hydrogen buses in Leh and Noida; green steel initiatives in Odisha.

- Budget allocation of ₹1,466 crore for pilot projects, including mobility and shipping.

- Exemption of Taxes and Duties: Special provisions for green hydrogen projects located in Special Economic Zones (SEZs).

- Electricity (Promoting Renewable Energy through Green Energy Open Access) Rules, 2022: These facilitate renewable energy supply through open access for green hydrogen production.

- ISTS waiver of Green Hydrogen: The government has exempted inter-state transmission charges for 25 years for producers of green hydrogen and green ammonia for projects commissioned before December 31, 2030.

- Research and Development (R&D): ₹400 crore allocated for R&D under the National Green Hydrogen Mission.

- Focus on indigenous electrolyzer technology and non-freshwater-based hydrogen production methods.

- Production-Linked Incentive (PLI) Scheme: Incentives for manufacturing green hydrogen equipment like electrolyzers under the government’s broader PLI framework.

- International Collaborations:

- Partnerships with countries like Japan, Germany, and Australia for technology transfer, trade agreements, and joint projects.

- Example: Cooperation agreements with Japan for green hydrogen trade and supply chain development.

Global Strategies for Green Hydrogen Financing and Production

Incentive-Based Financing Models

- U.S. Inflation Reduction Act (IRA): Offers tax credits up to $3/kg for green hydrogen production. Provides long-term certainty for investors and accelerates deployment of electrolyzers and renewable energy projects.

Development of Hydrogen Hubs

- Australia’s Hydrogen Energy Supply Chain (HESC): Establishes hydrogen hubs connected to renewable energy sources. Focus on export-oriented production to Japan.

International Partnerships and Trade Agreements

- EU Hydrogen Alliance: Aims to produce 10 million tonnes of green hydrogen annually by 2030 and import 10 million tonnes. Focus on standardizing green hydrogen certification for global trade.

Blended and Innovative Financing Mechanisms

- EU Innovation Fund: Supports green hydrogen projects through grants and co-financing. Prioritizes scaling innovative technologies in hydrogen production.

- Equipment Leasing Models: Europe uses leasing mechanisms for electrolyzers to reduce capital expenditure. Shifts upfront costs into manageable operational expenses.

Carbon Pricing and Penalty Mechanisms

- EU Emissions Trading System (ETS): Penalizes carbon-intensive industries and encourages green hydrogen adoption through carbon pricing mechanisms.

|

Way Forward for Green Hydrogen in India

- Comprehensive Policy Framework: Develop a comprehensive policy framework extending beyond production incentives to address financing barriers.

- Introduce long-term hydrogen purchase agreements and partial loan guarantees to reduce investor uncertainty.

- Establish “regulatory sandboxes” to experiment with new business models safely and efficiently, drawing from fintech innovations.

What is a Regulatory Sandbox (RS)?

- It refers to a live testing environment where new products, services, processes, and business models may be deployed, on a limited set of users, for a specified period of time, with certain relaxations as per the provisions of the Telecommunication Act 2023.

- Purpose: The sandbox allows the regulator, the innovators, the service providers and the customers to conduct field tests and collect evidence on the benefits and risks of new product innovations, while carefully monitoring and containing their risks.

|

Enroll now for UPSC Online Classes

- Innovative Financing Mechanisms: Indian banks should adopt non-traditional financing structures tailored to hydrogen’s unique challenges, such as uncertain demand and long project timelines.

- Modular project financing could allow phased scaling of facilities, reducing upfront capital requirements.

- “Anchor-plus” financing models can secure base capacity investments from industrial customers, with flexible instruments financing additional capacity.

- Equipment leasing for electrolyzers can transform prohibitive upfront costs into manageable operational expenses, replicating the success of solar and wind sectors.

- Focus on Pilot Projects and Cost-Effective Business Models: Launch early projects in industrial hubs that integrate financial structuring and demonstrate cost-viable business models.

- Emphasize delivering green hydrogen at competitive prices for industries like steel and ammonia production.

- Infrastructure Development: Establish hydrogen hubs with integrated production, storage, and distribution systems.

- Develop pipelines, refueling stations, and other logistics to facilitate large-scale adoption.

- Establish localised industrial clusters in states like Odisha, Maharashtra, and Gujarat to promote regional self-sustaining hydrogen corridors.

- Promote R&D and Skill Development: Invest in indigenous technologies for electrolyzers and alternative hydrogen production methods.

- Launch training programs to build a skilled workforce for hydrogen production and infrastructure management.

- Encourage International Collaboration: Forge partnerships with key importing countries like Japan and the EU for technology transfer, market access, and export facilitation.

- Carbon Pricing and Disincentives for Fossil Fuels: Introduce carbon pricing mechanisms to make green hydrogen competitive and phase out grey hydrogen in industrial sectors.

Conclusion

Green hydrogen is a transformative solution to achieve India’s net-zero targets, decarbonize industries, and ensure energy independence. By addressing cost barriers, enhancing infrastructure, and leveraging global collaborations, India can emerge as a leader in the global green hydrogen economy.

![]() 19 Dec 2024

19 Dec 2024