![]() 28 Feb 2025

28 Feb 2025

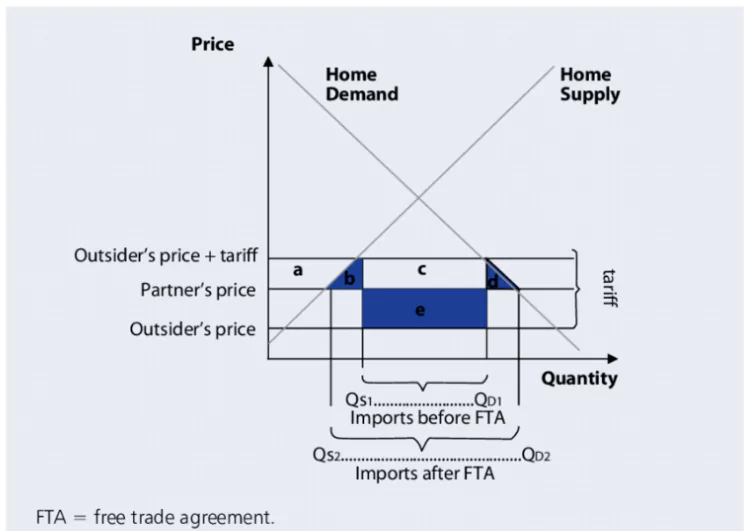

India has signed 13 Free Trade Agreements (FTAs) and six preferential trade pacts to boost exports and ensure better market access for Indian industries.

India’s Exports to UK (FY24): $12.9 billion

India’s Exports to UK (FY24): $12.9 billion

Types of Trade Agreements

Types of Trade Agreements| Pros (Benefits) | Cons (Disadvantages) |

| Market Expansion: Zero-duty access to partner countries help exporters to reach new markets and increase sales. | Unemployment: Domestic industries may struggle to compete with foreign counterparts, leading to job losses within the country. |

| Enhanced Competitiveness: Provides domestic companies with the same competitive advantages as those from other FTA member countries. | Industry Relocation: Large-scale industries may relocate to countries with less stringent environmental and labor regulations, potentially causing issues like child labor and pollution. |

| Protection of Sensitive Industries: Inclusion of negative and exclusion lists to safeguard sensitive domestic industries from tariff reductions. | Increased Dependency on Global Markets: Over-reliance on global markets can leave a nation vulnerable during times of crisis, such as wars or natural disasters, requiring costly rebuilding of domestic industries. |

| Trade Safeguard Measures: Implementation of anti-dumping duties and other safeguard mechanisms to protect domestic industries from import surges. |

<div class="new-fform">

</div>