India has introduced a comprehensive legal framework for Virtual Digital Assets.

In its recently introduced Income Tax Bill, 2025 aligning the country’s tax structure with global precedents.

Virtual Digital Assets as Property and Capital Assets

- Section 92 (5)(f)): The Income Tax Bill, 2025 has explicitly termed VDAs as property under this section aligning India with global practices,

- Digital assets are either classified as securities (like in the U.S.) or property (like in the U.K., Australia, and New Zealand).

- Section 76(1): The section classifies VDAs as capital assets, ensuring these transactions are subject to standard asset taxation principles, preventing their misuse as unregulated financial instruments.

- Any short/long term gains arising from their sale, transfer, or exchange will be taxed under Capital Gains Tax provisions.

- Example: If an individual purchases Bitcoin at ₹10 lakh and sells it for ₹20 lakh, the ₹10 lakh profit will be subject to capital gains tax.

- VDA Transfers: The bill imposes a flat 30% tax on income from VDA transfers with no deductions for expenditure or allowance (other than the cost of acquisition) being allowed unlike traditional capital assets.

- No Deduction: Expenses related to mining, transaction fees, platform commissions, and gas fees cannot be deducted when calculating taxable income.

- Example: If an investor buys Ethereum for ₹5 lakh and sells it for ₹7 lakh, the ₹2 lakh profit is taxed at a flat 30% with no relief for transaction costs.

- Section 393: A 1% TDS (Tax Deducted at Source) on transfers of VDAs is also imposed even in peer-to-peer (P2P) transactions to track large crypto transactions.

- The threshold for TDS exemption is ₹50,000 for small traders and ₹10,000 for others.

- Section 301: VDAs are also included in undisclosed income taxation and asset seizure regulations. VDAs can be classified as undisclosed income and taxed accordingly if an individual fails to report VDA holdings in their tax filings.

- Section 524(1): It allows tax authorities to seize VDAs during investigations or tax raids, similar to how cash, gold, or real estate is confiscated in cases of tax evasion.

- It aims to ensure that crypto-assets do not remain a shadow asset class, immune from regulatory oversight.

- Section 509: Any entity which deals in crypto assets (exchanges, wallet providers, and even individual traders) are required to report transactions in a prescribed format.

- Aim: To mandate compliance from platforms facilitating crypto trades, making it harder to launder money through digital assets.

- Inclusion in Annual Information Statements (AIS): The bill also mandates that VDAs be included in Annual Information Statements (AIS), ensuring that all crypto transactions are automatically recorded in taxpayers’ financial profiles.

- Significance of the Move:

- To ensure that VDAs do not exist in a legal grey area.

- India gains the ability to tax, regulate, and seize crypto assets when necessary, preventing their misuse for illicit financial activities by defining them as property.

- Aligning its tax structure with international legal standards.

- Example: The United States SEC classifies many crypto assets as securities, bringing them under financial market regulations.

- Challenges:

- Policy Framework: There is a lack of a clear and comprehensive regulatory framework for VDAs integrating financial regulations, consumer rights, and technological advancements.

- Ancillary Areas: Such as investor protection, market regulation, enforcement mechanisms, and a lack of standard guidelines also need to be addressed beyond taxonomy and taxation

- Discouraging Taxation: The tax treatment of flat 30% without provisions for deductions is quite harsh which can discourage investments in VDAs and hamper its development.

- Example: The Virtual Assets Regulatory Authority (VARA) of UAE allows businesses and individuals to hold and trade VDAs under regulated conditions, with 0% personal income tax on gains in certain cases.

About Virtual Digital Assets

- Virtual Digital Assets refer to any digital representation of value that can be digitally traded, transferred or used for payment. It does not include digital representation of fiat currencies.

- It includes any information, code, number or token not being Indian or foreign currency, and generated through cryptographic means or others.

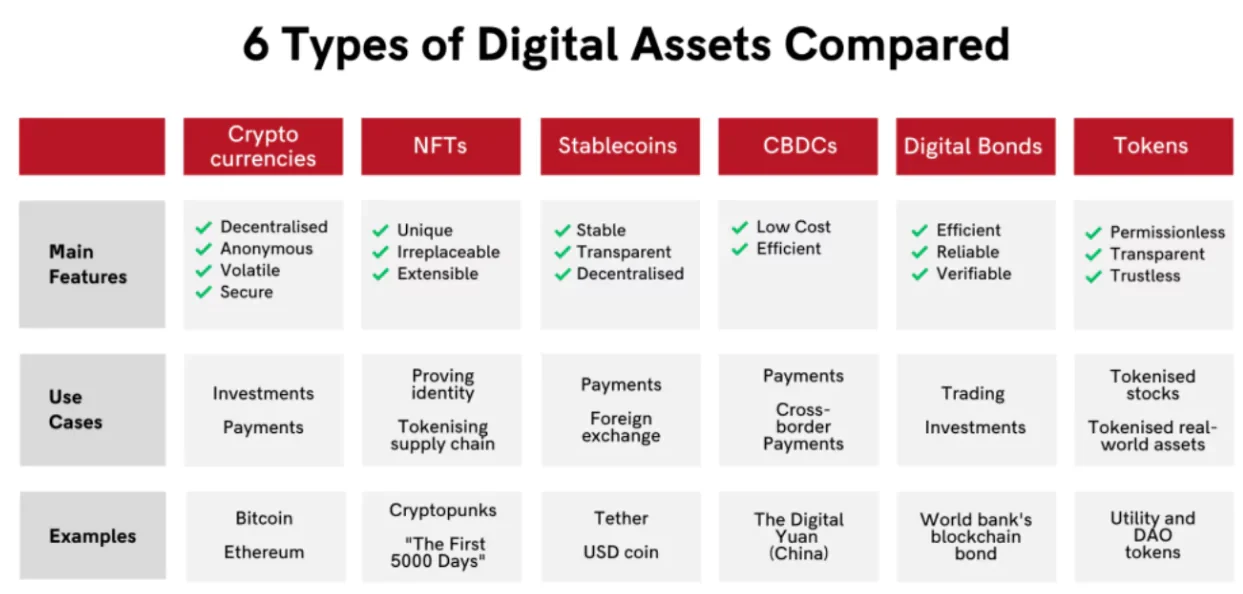

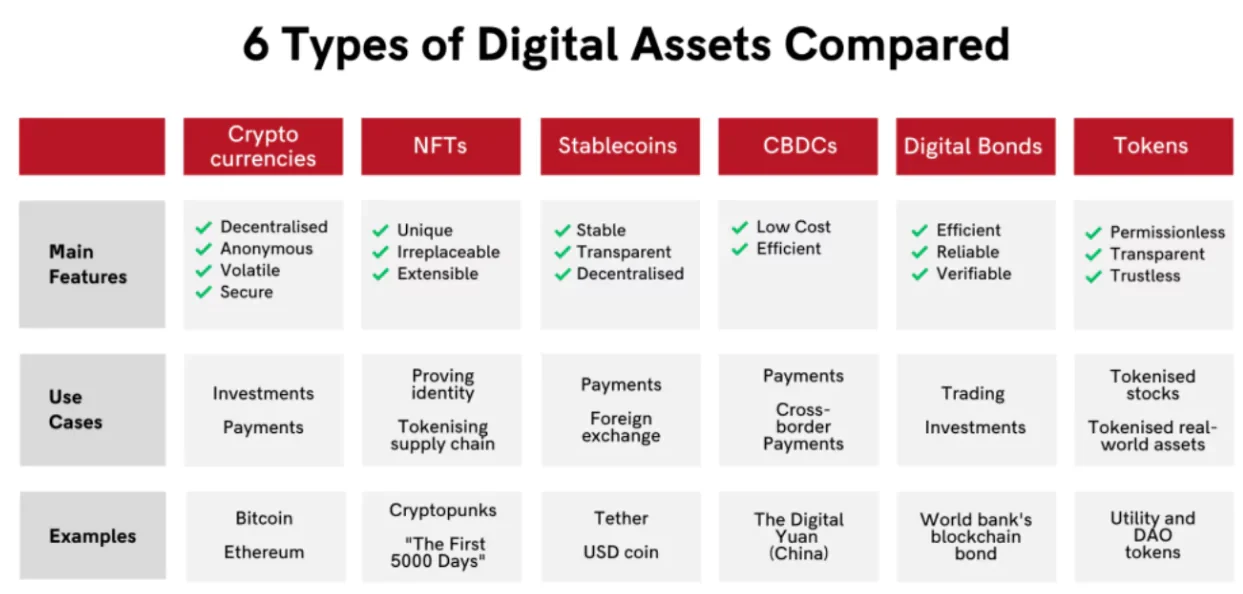

- Types:

- Crypto Assets: Digital currencies that use cryptography for security and control the creation of new units, enabling secure and decentralized transactions.

- Usage: It can be used for, Investments; Payments and creating a coin to fund a project

- Examples: Bitcoin, Ethereum, Litecoin

- Stablecoins: A type of cryptocurrency designed for price stability. Its prices are linked to fiat currencies, commodities or other crypto assets.

- Usage: Payments; Foreign exchange; Cross-border payments and transfers

- Example: Tether or USD Coin.

- Non-fungible tokens (NFTs): It is a token which represents ownership of a unique digital item (art, a government ID, music, videos, or even real estate etc). An NFT certifies that the holder owns the underlying digital asset and can sell, trade or redeem it.

- Usage: Proving your identity and granting access (to either a virtual or physical space); Tokenizing supply chain to track inventory movement and ownership; Ownership of virtual items (games, avatars, virtual land)

- Decentralized Finance (DeFi): It is a range of financial applications built on blockchain technology that aim to provide decentralized and permissionless access to financial services.

- Usage: Enable users to access financial services without traditional intermediaries, such as banks or financial institutions.

- Examples: Lending platforms, borrowing platforms, and decentralized exchanges.

- Security Tokens: Digital assets that meet the definition of a security or financial investment, like stocks and bonds.

- Usage: Tokenized versions of stocks (equity) and bonds; Tokenized versions of real world assets (real estate, property, plant, and

- Central Bank Digital Currency (CBDC): It is a digital currency sanctioned by central banks and is linked to the value of the issuing nation’s official fiat currency.

- Usage: It enables faster and more efficient payments, increasing financial inclusion, and enhancing monetary policy tools for central banks.

- Example: The Digital Yuan of People’s Bank of China

- Virtual Digital Assets V/S Digital Currency: A Digital currency has to be issued by the central bank of a country only even if it is a crypto.

- All the other virtual assets , also private cryptocurrencies are referred to as Virtual Digital assets.

![]() 4 Mar 2025

4 Mar 2025