The Reserve Bank of India (RBI) has eased norms for opening Special Rupee Vostro Accounts (SRVAs) to promote rupee-based trade settlements and internationalisation of the Indian Rupee.

RBI’s Recent Steps for Internationalisation of the Rupee

- Removal of Prior Approval Requirement: The RBI has removed the need for Authorised Dealer (AD) banks to seek prior approval before opening SRVAs for their overseas correspondent banks.

What is SRVA Mechanism ?

- The SRVA framework, introduced in July 2022, allows exporters and importers to invoice and settle trade in Indian Rupees through designated vostro accounts.

- Under the previous framework, AD banks were required to obtain prior permission from the Foreign Exchange Department, RBI Central Office, Mumbai, before opening SRVAs.

- Now there is no need for prior approval.

|

- Adherence to other regulations : The RBI has clarified that banks must continue to comply with all existing regulations, including the Foreign Exchange Management Act (FEMA) and Know Your Customer (KYC) requirements.

- Faster Operation: By removing approval delays, the RBI aims to accelerate the operationalisation of SRVAs, thereby enabling quicker settlement of international trade in Indian Rupees.

- Impact on Bilateral Trade: This policy change supports the RBI’s broader goal of reducing reliance on hard currencies like the US dollar in cross-border transactions.

What is Internationalisation of the Rupee ?

Case Study: Internationalisation of Currencies

Chinese Yuan (Renminbi – RMB)

- In 2009, China began allowing cross-border trade settlement in RMB to reduce dependence on the US dollar.

- Gradual steps included bilateral currency swap agreements, offshore RMB hubs, and inclusion in the IMF’s SDR basket in 2016 (10.92% weight).

- The RMB share of global SWIFT payments rose to 3.5% in April 2025, up from 2% in 2023.

Japanese Yen

- It gained importance in the 1980s with Japan’s economic rise.

- Strategies

- Liberalised financial markets in the 1980s.

- Promoted yen-denominated bonds (“Samurai bonds”) for foreign issuers.

- It is actively used in East Asia for trade invoicing.

- Currently the Japanese yen is the third-most traded currency in the foreign exchange market, after the United States dollar and the euro.

|

- Internationalisation of a currency is a process that involves the use of a currency for more and more cross-border transactions.

- For the rupee, it means that more international payments start taking place in the Indian currency.

Why do we need Internationalisation?

- Use for Trade Invoicing: As per the Economic Survey 2023, Rupees increasing use for trade invoicing is a prerequisite for it to be considered as an international currency.

- The Rupee’s turnover has to rise or equal the share of non-US, non-Euro currencies in global forex turnover i.e. 4 percent, for it to be regarded as an international currency.

- The US dollar accounts for 88 percent of global forex turnover, and is the dominant vehicle currency, while the Rupee accounts for just 1.6 per cent as per The BIS Triennial Central Bank Survey 2022.

- Opening up: An opening up of the currency settlement and a strong currency swap and forex market involving promoting the rupee for current account transactions and foreign trade between resident and non-resident Indians.

- Full Convertibility of Currency: To make the rupee more international, it will also have to open it for capital accounts too fully and have a restriction-free cross-border transfer of funds

- The rupee is fully convertible in the current account, but partially in the capital account.

Benefits of Internationalisation of Rupee

- Protect against currency volatility: Increasing use of Rupee in international trade transactions will reduce the currency risk of Indian businesses by protecting them against currency volatility.

- Strengthen the Indian Rupee: As more and more transactions are happening with Indian Rupees, The demand of Rupees will increase, appreciating its value and help to lower currency conversion costs.

- Maintaining Forex Reserve: It will reduce India’s need to hold huge foreign currency reserves which is at a record high of $642.63 billion as of March 2024 making India more insulated from external shocks.

- Bargaining voice: More is the usage of Rupee in international transactions more will be India’s bargaining power in international markets

India’s Efforts for Internationalisation of the Rupee

- Policy Push: The government has urged the RBI to make the rupee more globally accessible, aligning with India’s projected rise in global growth share from 16% to 18% by 2028.

- Bilateral Currency Settlement Initiatives: India has initiated rupee-based trade settlements with partners like the UAE and Singapore, including the first-ever crude oil payment to the UAE in rupees.

- Example: India pays for gold imports from the UAE in rupees, and the UAE uses these rupees to buy Indian gems and jewellery.

- Expansion of Special Rupee Vostro Accounts (SRVAs): The RBI has approved 123 correspondent banks from 30 trading partner countries to open 156 SRVAs with 26 Indian banks to promote bilateral trade in local currencies, a junior trade minister told Parliament earlier this year.

- Current Account Convertibility: The rupee is fully convertible in the current account, facilitating trade in goods and services, though capital account convertibility remains partial.

Achievements So Far

- Breakthrough in Oil Trade Payments: India’s rupee payment for UAE crude imports marked a milestone in reducing dollar dependency for a commodity where 80% of Indian demand is met through imports.

- Currency Risk Reduction for Businesses: Internationalisation efforts help Indian exporters and importers reduce exposure to foreign exchange volatility, lowering transaction costs.

- Strengthened Foreign Exchange Position: Despite gradual steps, India’s foreign exchange reserves stand at around 700 Billion USD (as of June, 2025), offering a buffer for expanding rupee trade globally.

Challenges in Internationalisation of the Indian Rupee

- Policy Control Limits: Internationalisation could constrain the RBI’s ability to control money supply and interest rates, as both residents and non-residents can freely trade rupee-denominated instruments.

- Convertibility & Market Depth: Effective internationalisation requires lifting restrictions on currency trading, implying near-full capital account convertibility while ensuring deep domestic financial markets to absorb external shocks.

- India has not allowed full capital account convertibility.

- Rupee Surplus Risk: India’s $57 billion trade deficit with Russia in FY2024 risks leaving Moscow with a surplus of over $40 billion in rupees, which it finds undesirable without market access to spend them.

- Operational & Sanction Hurdles: Indian private banks avoid rupee settlement with Russia due to sanction fears, while exporters face procedural hurdles from the absence of Standard Operating Procedures (SOPs) for such transactions.

- Chinese Yuan Edge: India has less than 5 % share in global export as compared to China’s share of around 12 % providing yuan an edge over rupee.

- For example, Yuan’s dominance in Russia, where 95% of China-Russia trade occurs in yuan , reduced the demand for rupee settlements.

Measures in Pipeline to Boost Internationalization Efforts:

- Easing Regulations for INR accounts for Non-Residents: The Foreign Exchange Management (Deposit) Regulations concerning rupee accounts for non-residents are being reviewed in consultation to let,

- Persons Resident Outside India (PROIs) to open rupee accounts outside the country,

- Facilitate Rupee lending by Indian banks to PROIs

- Enable foreign direct investment and foreign portfolio investment through special non-resident rupee and special rupee vostro accounts.

- Extension of Structured Financial Messaging System (SFMS): India will extend its SFMS through a global SFMS hub to other countries for cross-border payment messaging in local currencies.

- It will help India in reducing dependence on other major trading currencies and may help in foreign exchange management.

- GIFT city push: As per RBI , GIFT city encourages the trading of FCY (foreign currency)-INR pairs for different international currencies.

- Other Measures Include : A review of the IFSC (International Financial Services Centre) regulations under the Foreign Exchange Management Act (FEMA), a review of compounding proceedings rules under the FEMA, ratio rationalization of the Liberalised Remittance Scheme and rationalization of inward remittance schemes

- Inward remittance schemes include the Money Transfer Service Scheme and the Rupee Drawing Arrangement.

|

Way Forward for Internationalisation of the Indian Rupee

- Gradual Move Towards Full Capital Account Convertibility: A calibrated approach to easing capital account restrictions, while ensuring robust domestic financial markets, is essential to absorb external shocks from increased currency flows.

- Expanding Global Payment Integration: Strengthen cross-border adoption of Indian payment systems like RTGS, NEFT, and UPI, and secure inclusion of the rupee in the Continuous Linked Settlement (CLS) framework for safer foreign currency settlements.

- Currently, UPI is live in over 7 countries, including key markets such as UAE, Singapore, Bhutan,etc allowing Indians to make payments internationally.

- Currency Swap and Local Currency Settlement Mechanisms: Increase bilateral currency swap agreements and Local Currency Settlement (LCS) arrangements to stabilise the rupee, reduce transaction costs, and mitigate currency risk for businesses.

- For example, India and the UAE laid the groundwork for a Local Currency Settlement System.

- Securing Inclusion in the IMF SDR Basket: Work towards meeting criteria for adding the Indian Rupee to the IMF’s Special Drawing Rights basket, enhancing its status as a global reserve currency.

- Strengthening Domestic Financial Markets: Harmonise KYC norms across regulators to ease foreign investor access, extend onshore inter-bank INR market hours to match offshore trading, and push for inclusion of Indian government bonds in global indices to attract stable foreign capital.

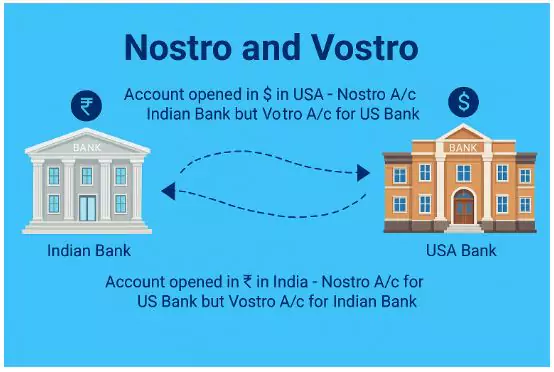

| Vostro Vs Nostro Account

|

| Aspect |

Vostro Account |

Nostro Account |

| Definition |

An account that a domestic bank holds for a foreign bank in the domestic currency. |

An account that a domestic bank holds in a foreign bank in the foreign currency. |

| Purpose |

Enables foreign banks to operate and settle transactions in the domestic market. |

Facilitates domestic banks’ foreign currency transactions and simplifies international trade settlements. |

| Example |

US bank (Citibank) holds an INR account with SBI in India, this is SBI’s Vostro account. |

SBI holds a USD account with Citibank in the US, this is SBI’s Nostro account. |

Conclusion

RBI’s easing of SRVA norms aims to promote rupee-based trade settlements, reduce dollar dependency, and advance rupee internationalisation, strengthening India’s trade position, currency stability, and global financial integration while addressing associated policy and operational challenges.

![]() 13 Aug 2025

13 Aug 2025