RBI has kept the repo rate unchanged at 5.50% with a neutral stance. As part of the MPC statement Reserve Bank of India (RBI) four key measures aimed at enhancing the resilience and competitiveness of India’s banking sector.

- Aim: To enhance credit flow, strengthen banking resilience, simplify regulations, and promote the internationalisation of the Indian Rupee.

- Timing of the Announcement: These announcements come amid global trade tensions, tariff uncertainties, and geopolitical volatility that affect commodity and currency movements. Despite global headwinds, India’s growth outlook remains strong, supported by domestic consumption, public investment, and stable inflation.

Understanding RBI’s Policy Rates and Stance

- Monetary Policy Stance

- Accommodative: RBI focuses on stimulating growth by lowering rates and ensuring liquidity.

- Neutral: RBI balances both growth and inflation—ready to move either way as conditions change.

- Hawkish: RBI prioritises controlling inflation, often by raising rates or reducing liquidity.

- Repo Rate (5.5%): The rate at which the RBI lends short-term funds to commercial banks against government securities.

- It is the main policy rate used to signal the direction of monetary policy.

- Standing Deposit Facility (SDF) – 5.25%: The rate at which banks park surplus funds with the RBI without collateral.

- It acts as the floor of the policy corridor, absorbing excess liquidity.

- Marginal Standing Facility (MSF) – 5.75%: The rate at which banks borrow overnight funds from the RBI when facing liquidity shortages.

- It serves as the upper limit of the policy corridor.

- Bank Rate (5.75%): The rate at which the RBI lends long-term funds to banks.

- It moves in line with the MSF and indicates the overall lending cost for banks.

- Policy Corridor: The range between the SDF (lower bound) and the MSF (upper bound), with the Repo Rate in the middle.

|

Key Takeaways of RBI MPC Meeting 2025–26

- Policy decision – Repo rate unchanged: The MPC unanimously voted to keep the repo rate steady at 5.5 percent, with the SDF at 5.25 percent and the MSF and Bank Rate at 5.75 percent.

- The stance remains neutral.

- Inflation Outlook: RBI has lowered its CPI inflation forecast for FY 2025–26 to 2.6%, down from 3.1%.

- Reason: This drop is because of GST rate cuts, cheaper food prices, and healthy foodgrain stocks.

- GST rationalisation has helped cool prices and simplify taxes, benefiting consumers and businesses alike. However, new U.S. tariffs on Indian exports (as high as 50%) could hurt external demand and slow export growth.

Global Agencies Reaffirm Growth: Several global agencies have maintained India’s strong economic growth prospects, highlighting the country’s resilience amid global uncertainties.

- IMF (FY26: 6.4%), Fitch (FY26: 6.9%, FY27: 6.3%), S&P Global (FY26: 6.5%), United Nations (FY26: 6.3%, FY27: 6.4%), and OECD (FY26: 6.7%)

|

- Growth Projections: India’s GDP growth forecast for FY26 has been raised to 6.8%, up from 6.5%

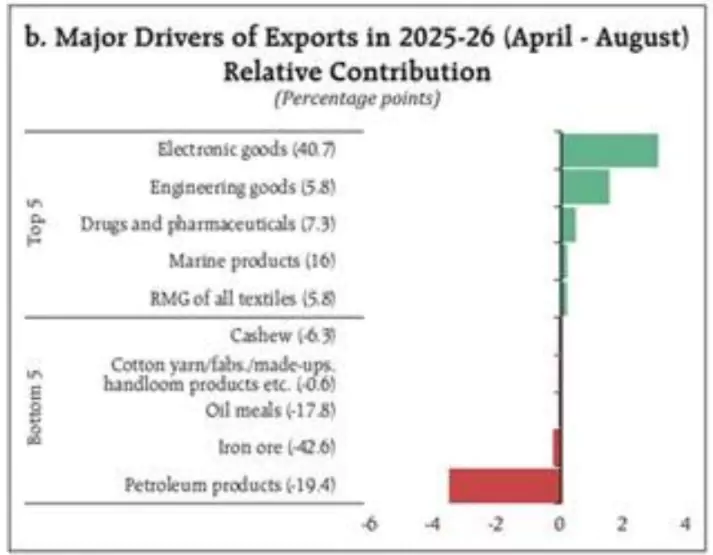

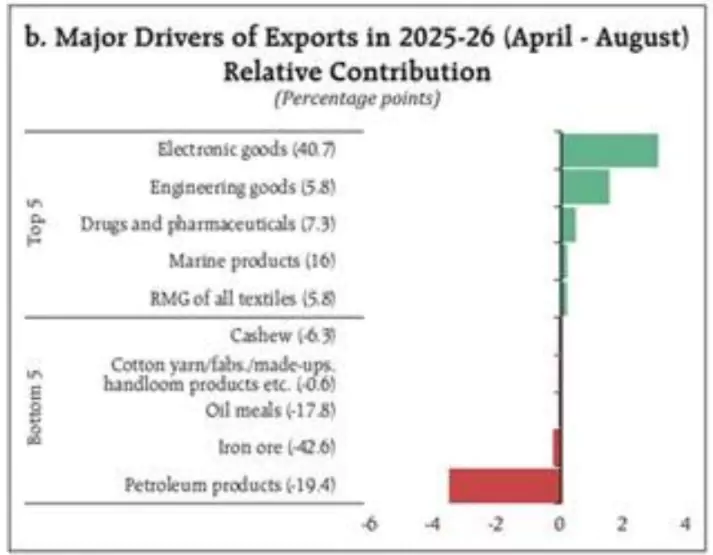

Global Demand Steady: India’s current account deficit fell sharply to 0.2% of GDP in Q1 FY26, helped by strong services exports and record remittances of US$35.3 billion.

Global Demand Steady: India’s current account deficit fell sharply to 0.2% of GDP in Q1 FY26, helped by strong services exports and record remittances of US$35.3 billion.-

- Despite global trade uncertainties, exports grew 2.5% and imports 2.1% (April–August 2025), with services exports showing double-digit growth.

- Foreign Direct Investment (FDI) stayed strong at US$37.7 billion, reflecting investor confidence

- Major inflows from: Singapore, the US, Mauritius, UAE, and the Netherlands.

- Net Foreign Direct Investment (FDI) inflows hit a 38-month high in July

- Forex reserves stand at USD 700.2 billion, enough to cover over 11 months of imports which is a strong buffer against shocks.

- Stability of Rupee: The rupee has remained largely stable, but it still moves up and down at times because of changes in the global economy, trade tensions, and oil price fluctuations.

- Liquidity and Transmission: Liquidity in the banking system has been comfortable, with a daily surplus of ₹2.1 lakh crore since August.

- RBI expects liquidity to improve further after the 75-basis-point Cash Reserve Ratio (CRR) cut and government spending in the coming months.

| Transmission: The process through which RBI’s policy rate changes influence interest rates charged by banks on loans and deposits. |

-

- Interest rate transmission: The way policy rate changes affect lending rates has been visible:

- New loan rates have fallen by 58 bps (0.58%).

- Deposit rates are lower by 106 bps (1.06%).

| Capital Adequacy Ratio (CAR): The amount of capital a bank holds as a cushion against losses. Higher CAR means a safer bank. |

- Financial Stability: India’s financial system (Banks and NBFC) continues to be stable and well-capitalised.

- Banks: Capital adequacy ratio stood at 17.5%, and gross NPAs (bad loans) fell to 2.22% — their lowest level in a decade.

- NBFCs (Non-Banking Financial Companies): Capital ratios were healthy at 25.7%, with low NPAs at 2.23%.

| Steps to Strengthen the System Under 5 Broad Category

A. RBI Measures for Banks (Banking Reforms)

B. Measures to Ease Credit Flow (Easier Loans)

C. Ease of Doing Business (Simplified Regulations

D. Simplified Forex and External Borrowing Rules

E. Consumer-Oriented Reforms (For Everyday Banking)

F. Strengthening the Rupee (Internationalisation Measures) |

- Additional measures – 22 Steps to Strengthen the System: Alongside rate decisions, RBI unveiled 22 major reforms to modernise banking and simplify regulation.

4 RBI Measures for Banks (Banking Reforms)

1. Implementation of Expected Credit Loss (ECL) Framework: The RBI will introduce the Expected Credit Loss (ECL) provisioning system for all Scheduled Commercial Banks (excluding SFBs, PBs, and RRBs) and All India Financial Institutions (AIFIs) from April 1, 2027, with a transition period until March 31, 2031.

- Impact: This aligns India with global IFRS norms and encourages early recognition of loan stress, improving transparency and financial resilience.

Expected Credit Loss (ECL) Framework

- A forward-looking way for banks to estimate loan losses before they actually occur.

- Replaces the old “incurred loss” model where banks need to provide for losses that have occurred/incurred.

- Helps banks spot stress early, maintain healthier balance sheets, and protect depositors.

- Banks classify financial assets (primarily loans, including irrevocable loan commitments, and investments classified as held-to-maturity or available-for-sale) into three categories:

- Stage 1: Financial assets that have not had a significant increase in credit risk or with low credit risk at the reporting date.

- Stage 2: Financial instruments that have had a significant increase in credit risk but don’t have objective evidence of impairment.

- Stage 3: Financial assets that have objective evidence of impairment at the reporting date

|

2. Removal of Restriction on Bank: Banks will now have the flexibility to determine which services are carried out by themselves or by group entities.

- Impact: This move encourages strategic decision-making by bank boards, reduces regulatory micromanagement, and allows banks to tailor their business models to market needs.

3. Introduction of Risk-Based Deposit Insurance Premium: The RBI will replace the flat-rate premium charged by the Deposit Insurance and Credit Guarantee Corporation (DICGC) with a risk-based premium system.

- DICGC has been operating the deposit insurance scheme since 1962 on a flat rate premium basis.

- Impact: Banks with better risk management and sound governance will pay lower premiums, incentivising stability and protecting depositors’ money.

4. Revised Basel III Capital Adequacy Norms: The Basel III framework under the Standardised Approach for Credit Risk will be implemented from April 2027.

- Impact: It reduces overall capital requirements, especially for sectors such as MSMEs and housing, enabling banks to free up capital for additional lending and improve credit availability.

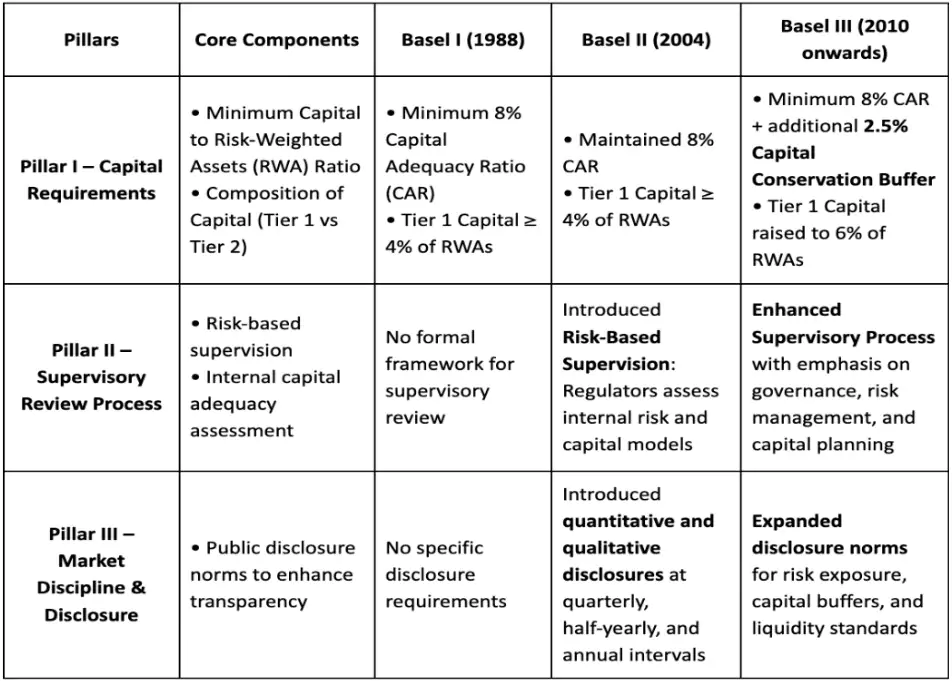

About Basel III and the Basel III Endgame

- Basel III: It is a set of global banking regulations developed by the Basel Committee on Banking Supervision (BCBS) after the 2008 financial crisis.

- Its aim is to make banks stronger, more transparent, and better prepared to handle financial shocks.

- Basel III Endgame: Refers to the final phase of Basel III reforms, announced in 2023, and to be implemented globally from 2025–2028.

- It focuses on making banks’ capital calculations more risk-sensitive and comparable across countries.

- The Endgame increases capital requirements for large banks – Globally Systemically Important Banks (G-SIBs) by around 20–25%.

- Goal: To improve banking system resilience, ensure consistent supervision, and reduce systemic risks that led to the 2008 crisis.

- Why Basel Norms Matter: They ensure that banks always hold enough capital to absorb unexpected losses and protect depositors.

- These norms strengthen financial stability, improve corporate governance, and reduce the chance of bank failures.

- Important Terminologies

- Risk weighed Assets (RWA): RWA is linked to the minimum amount of capital that banks must have relative to bank’s risk from its lending activities.

- The more the risk, the more the capital needed to protect depositors.

- Tier I capital (Core Capital): It include paid up share capital, stocks and disclosed reserve.

- Tier II capital (Supplementary Capital): It includes all other capital e.g. Undisclosed reserve, revaluation reserves, general provisions and loss reserves.

- Capital to Risk (Weighted) Assets Ratio: CAR is a percentage that measures a bank’s financial health by comparing its capital to its risk-weighted assets.

- Key Features of Basel I, II and III Compared

|

Major Challenges in the Indian Banking Sector

- Liquidity Stress in the Banking System: India’s banks are facing tight liquidity despite RBI’s measures like Open Market Operations (OMOs), as regulatory requirements such as the Liquidity Coverage Ratio (LCR) limit their ability to release funds.

- This restricts credit flow to MSMEs and retail borrowers, suggesting the need for CRR and LCR reforms to free up liquidity and support broad-based lending.

- Rising Stress in Unsecured Retail Loans: The sharp rise in unsecured personal loans such as credit cards, consumer durable finance, and small-ticket personal loans has increased default risks.

- According to RBI’s Financial Stability Report (FSR), Private sector banks accounted for 52.6 per cent of gross non-performing assets (NPAs) in unsecured retail loans during the year ended March 2025

- This trend poses a risk of household over-leverage, especially in the backdrop of stagnant real income growth.

| Portfolio at Risk (PAR) measures the portion of a lender’s (bank or NBFC) total loan portfolio that is at risk of default i.e., loans where payments are overdue beyond a specific number of days. |

- Distress in the Microfinance Sector: The microfinance segment, which caters to low-income and rural borrowers, is witnessing repayment stress due to rising household indebtedness and climate-related livelihood shocks.

- Data from CRIF High Mark shows that PAR (Portfolio at Risk) in the 31-180 days overdue bucket has gone up to 6.2 per cent during FY2025 as against 2.1 per cent in the same period of last year.

- PAR (Portfolio at Risk) in the 180 days plus bucket has jumped from 1.6 per cent to 5.1 per cent during the fiscal.

- Governance and Compliance Gaps: Governance weaknesses persist, especially in urban cooperative banks (UCBs) and smaller PSBs.

- The Reserve Bank of India (RBI) imposed penalties totalling ₹54.78 crore on 353 regulated entities (REs) during the financial year 2024–25 for various contraventions of statutory provisions and regulatory directions

- Rising Defaults in Gold Loans: Once considered a safe segment, gold loans have shown signs of strain.

- NPAs in gold loans rose by 30% to ₹6,696 crore in June 2024 from ₹5,149 crore in March 2024 (RBI data).

- Technological and Cybersecurity Risks: With rapid digitisation, banks are increasingly vulnerable to cyberattacks and data breaches.

- In the first half of 2024, India’s financial sector saw a 175% surge in phishing attacks compared to same period in 2023

- Limited cybersecurity preparedness and shortage of skilled manpower remain key vulnerabilities.

Way Forward

- Solving the Liquidity problem: RBI could explore innovative tools like Long-Term Repo Operations (LTROs), forex buy-sell swaps, and dynamic liquidity requirements to ensure funds reach productive sectors.

- Reforms should aim to make liquidity support broad-based and inclusive, ensuring MSMEs and small borrowers also benefit from India’s monetary easing.

- Strengthen Risk Management for Unsecured Retail Lending: Promote the use of AI-based credit risk analytics and alternative data scoring models to assess borrower repayment capacity.

- RBI can set exposure caps on unsecured retail loans as a share of total credit to prevent over-lending cycles.

- Stabilise the Microfinance Sector and Reduce PAR (Portfolio at Risk) Levels: Expand credit counselling and financial literacy programs to discourage over-borrowing in rural areas.

- Promote geographical diversification of MFI portfolios to avoid concentration risk in high-delinquency states (e.g., Bihar, West Bengal).

- Encourage MFIs to adopt risk-based pricing and strengthen borrower verification through a shared MFI credit registry under CRIF High Mark.

- Introduce climate-risk-adjusted lending frameworks, especially for agrarian regions facing income volatility.

- Contain Household Indebtedness and Promote Responsible Borrowing: Mandate clearer disclosure norms for personal loans and credit card products to improve borrower awareness.

- Strengthen Monitoring of Gold-Backed Loans: Ensure periodic revaluation of pledged gold collateral, especially when gold prices fluctuate sharply.

- Impose Loan-to-Value (LTV) discipline to prevent over-lending during bull markets.Recently, RBI raised gold lending LTV to 85% for loans under ₹2.5 lakh from 75%

- Improve Governance and Compliance Standards: Implement a fit-and-proper criterion for directors of cooperative and regional banks.

- Strengthen RBI’s supervisory capacity through technology-driven audits and real-time compliance dashboards.

- Encourage mergers and consolidation among weak cooperative banks to improve efficiency and governance.

- Promote Long-Term Structural Reforms: Encourage capital infusion in PSBs through market-linked disinvestment to enhance autonomy and efficiency.

- Deepen the corporate bond market to reduce reliance on banks for large-scale funding.

- Align Indian banking practices with Basel III Endgame norms through phased digital compliance and data infrastructure upgrades.

![]() 6 Oct 2025

6 Oct 2025

Global Demand Steady: India’s current account deficit fell sharply to 0.2% of GDP in Q1 FY26, helped by strong services exports and record remittances of US$35.3 billion.

Global Demand Steady: India’s current account deficit fell sharply to 0.2% of GDP in Q1 FY26, helped by strong services exports and record remittances of US$35.3 billion.