The 16th Finance Commission, chaired by Dr. Arvind Panagariya, submitted its report for 2026–27 to 2030–31, tabled in Parliament on 1 February 2026 alongside the Union Budget.

- The Government accepted its key recommendation to retain States’ 41% share in Central Taxes.

About Finance Commission

- Constitutional Body: The Finance Commission is a constitutional body under Article 280 of the Indian Constitution.

- Appointing Authority: The President of India constitutes a Finance Commission every fifth year or at such a time that is considered necessary.

- Composition: The Finance commission composition consists of a chairman and four other members.

- Tenure: For the duration specified in Presidential order. The Commission is reconstituted typically every five years and usually takes a couple of years to make its recommendations.

- Members are eligible for reappointment.

- Qualifications: The Parliament has been authorized by the constitution to determine the qualifications of the members and the manner in which they are to be appointed.

- Specifications: Based on these powers, the Parliament has given the following specifications for appointing the members.

- The chairman must have experience in public affairs while the other four members should be selected from amongst the following criteria:

- A High Court judge or one qualified to become one

- An individual having specialised knowledge of finance and accounts of the government

- A person who possesses experience in financial matters and administration

- A person who has special knowledge of economics

- Powers: Based on the Code of Civil Procedure 1908, the Finance Commission of India has all the powers of a Civil Court.

- Evidence Demand: The commission has powers to call witnesses, and ask for the production of a public document or record from any office or court.

- Mandates:

- Tax Distribution: Distributing shares of net proceeds of tax between the Union and the States and the allocation between the States of the respective shares of such proceeds.

- The Centre, however, is not legally bound to implement the suggestions made by the Finance Commission.

- Rules for Grants-in-Aid: The rules that govern grant-in-aid to the states by the Centre from Consolidated Fund of India.

- Tax Devolution at State Level: Augmenting the consolidated fund of the state to supply resources to panchayats and municipalities based on recommendations of the State Finance Commission.

- Miscellaneous Matter: Any other matter referred by the President to the Commission in the interests of sound finance.

- Submit Report: A report is submitted to the President, who lays it before both houses of the Parliament. The report is followed by an explanatory memorandum on the actions taken on its recommendations.

About the Distribution of Funds by the Finance Commission

The Finance Commission decides what proportion of the Centre’s net tax revenue goes to the States overall (vertical devolution) and how this share for the States is distributed among various States (horizontal devolution).

- Horizontal Devolution: This devolution of funds between States is usually decided based on a formula created by the Commission that takes into account a State’s population, fertility level, income level, geography, etc.

- Vertical Devolution: This devolution of funds however, is not based on any such objective formula.

- Nevertheless, the last few Finance Commissions have recommended greater vertical devolution of tax revenues to States.

- Additional Aid: The Centre may also aid States through additional grants for certain schemes that are jointly funded by the Centre and the States.

- For Local Bodies: The 16th Financial Commission is also expected to recommend ways to augment the revenues of local bodies such as panchayats and municipalities.

- As of 2015, only about 3% of public spending in India happened at the local body level, as compared to other countries such as China where over half of public spending happened at the level of the local bodies.

Key Recommendations by the 16th Finance Commission

- Overview and Share of Central Taxes: The Commission recommended that the share of states in the divisible pool of central taxes should remain at 41%, which is the same as the previous commission.

- The divisible pool is calculated by taking the gross tax revenue and excluding the cost of collection, cesses, and surcharges.

Key Terms:

- Gross State Domestic Product (GSDP) measures the total value of final goods and services produced within a state in a year. It reflects a state’s economic size and fiscal capacity and is a key benchmark for devolution formulas and deficit limits.

- Off-Budget Borrowings are liabilities raised by governments through public sector entities or special vehicles that do not appear in the official budget, allowing expenditure without increasing the reported fiscal deficit. They mask true debt levels, weaken transparency, and pose long-term fiscal risks.

|

- Criteria for Devolution: The Commission updated the formula used to determine each state’s individual share of taxes by assigning weights to various parameters:

- Income Distance (42.5%): This measures the difference between a state’s per capita GSDP and the average of the top three large states.

- Population (17.5%): This is determined based on the state’s share of the national population as per the 2011 Census.

| Criteria for Horizontal Devolution |

| Criteria |

15th FC (2021-26) |

16th FC (2026-31) |

| Income Distance |

45% |

42.5% |

| Population (2011) |

15% |

17.5% |

| Demographic Performance |

12.5% |

10% |

| Area |

15% |

10% |

| Forest |

10% |

10% |

| Contribution to GDP |

– |

10% |

| Tax and Fiscal Efforts |

2.5% |

– |

-

- Contribution to GDP (10%): A new parameter that replaces “tax and fiscal efforts”; it is calculated using the square root of a state’s GSDP.

- Demographic Performance (10%): This has been redefined to account for population growth between 1971 and 2011.

- Area (10%) and Forest (10%): These weights reward states based on their geographic size and their share in overall and increasing forest area.

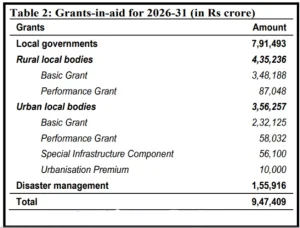

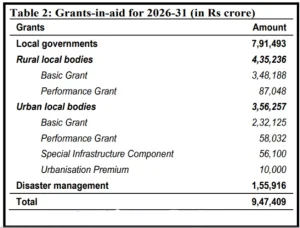

- Grants-in-Aid: Total grants-in-aid recommended for the five-year period amount to Rs 9.47 lakh crore:

- Local Government Grants: A total of Rs 7.91 lakh crore is allocated for rural (RLB) and urban (ULB) local bodies.

Entry-Level Criteria: Local bodies must fulfill conditions such as audited accounts, constitutional constitution, and the timely setup of State Finance Commissions to receive funds.

Entry-Level Criteria: Local bodies must fulfill conditions such as audited accounts, constitutional constitution, and the timely setup of State Finance Commissions to receive funds.- Grant Structure: Grants are divided into Basic Grants (80%) and Performance-Based Grants (20%).

- Disaster Management: A corpus of Rs 1,55,916 crore (Centre’s share) has been recommended for relief and management funds.

- Discontinued Grants: The 16th FC has stopped revenue deficit grants, sector-specific grants, and state-specific grants.

- Fiscal Roadmap and Sector Reforms:

- Fiscal Deficit Targets: The Commission recommends the Centre reduce its fiscal deficit to 3.5% of GDP by 2030-31, while States should maintain a limit of 3% of GSDP.

- Debt Trajectory: The combined debt of the central and state governments is projected to fall from 77.3% of GDP in 2026-27 to 73.1% by 2030-31.

- Off-Budget Borrowings: The report demands a strict end to off-budget borrowings, requiring all such debts to be brought onto official budgets.

- Subsidy Rationalization: States should review unconditional cash transfers and implement clear exclusion criteria to ensure effective targeting.

- Public Sector Enterprises: The Commission recommended the closure of 308 inactive SPSEs and the formulation of a disinvestment policy.

- Power Sector: States are encouraged to privatize electricity distribution companies (DISCOMS) to improve efficiency.

- Conditionality of DISCOM Reform: States are permitted to utilize Special Assistance for Capital Investment only after the completion of DISCOM privatisation, making fiscal support strictly reform-contingent.

Inter-state Impact Analysis

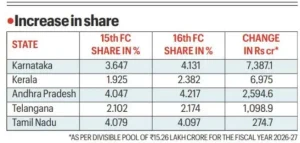

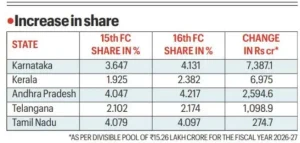

- Relative Gainers: High-performing states such as Karnataka (share rising to 4.13% from 3.65%), Kerala (rising to 2.38% from 1.93%), and Gujarat (rising to 3.76% from 3.48%) have seen relative increases in their tax shares.

- Performance Incentive: These gains are largely attributed to the introduction of the Contribution to GDP (10%) weightage, which rewards states for their share in the national economy.

- Relative Decline: Conversely, some northern and low-income states have seen a slight relative decline in their percentage shares, such as Bihar (falling to 9.95% from 10.06%) and Uttar Pradesh (falling to 17.62% from 17.94%).

- Equity Balance: Despite these shifts, the Income Distance parameter remains the highest weight (42.5%) to ensure that the fiscal needs of lower-income states are still substantially supported.

Significance of the Recommendations

- Rewarding Economic Efficiency: By introducing Contribution to GDP (10%) and removing “Tax Effort,” the commission has signaled a shift toward rewarding states that drive national growth.

- This particularly benefits industrialized states like Maharashtra, Gujarat, and Tamil Nadu.

- Urban-Centric Growth: The massive 230% increase in grants for Urban Local Bodies (ULBs)—reaching ₹3.56 lakh crore—recognizes that India’s future economic growth is rooted in its cities.

- Demographic Fairness: The redefined Demographic Performance criterion (using 1971–2011 growth) addresses the long-standing grievance of Southern states.

- It ensures they are not penalized for their success in population control and family planning.

- Environmental Stewardship: By including open forests and rewarding the increase in forest cover, the report incentivizes states to actively participate in India’s net-zero and climate goals.

- Forest-linked devolution also complements India’s international climate commitments under the Paris Agreement by internalising ecological costs at the state level.

- Fiscal Transparency: The mandate to bring off-budget borrowings (such as those done through state-owned entities) back into the official budget is a landmark step for fiscal honesty and debt sustainability.

- Recalibration of Cooperative Federalism: The recommendations reflect a move toward balancing redistribution (equity) with growth incentives (efficiency).

- Urbanisation Premium & Strategic Expansion: The ₹10,000 crore Urbanisation Premium signals a policy push toward planned urban expansion, addressing challenges of peri-urban governance and infrastructure stress through a Rural to Urban Transition Policy.

- Functional Prioritisation in Grants: The Commission explicitly prioritised sanitation, solid waste management, water supply, and wastewater treatment, aligning 50% of basic local body grants with urban sustainability and SDG targets.

Fiscal Challenges Arising from the 16th Finance Commission Recommendations

- The “Cess and Surcharge” Gap: A major friction point remains as the effective divisible pool has shrunk.

- While the nominal share is 41%, the actual share received by states is closer to 32% because cesses and surcharges are not shared with them.

- Vertical Imbalance: Many states had demanded a share of 50% in central taxes, citing limited revenue-raising powers under the GST regime and rising expenditure on social welfare.

- Rising Revenue Deficits: Despite the 41% devolution, several states continue to face worsening revenue balances, leading to a heavy reliance on market borrowings for daily operations rather than capital assets.

- Populism vs. Development: The “freebie culture” or non-merit subsidies (unconditional cash transfers) poses a risk to long-term fiscal health.

- The Commission noted a lack of standardized accounting for these transfers across states.

- Inter-State Disparities: While the formula tries to balance equity and efficiency, there remains a risk that low-income states like Bihar may see a decline in their relative share compared to high-growth states.

- The GST Context: Post-GST, states’ independent revenue-raising capacity has weakened, making predictable tax devolution and the 41% share critical for maintaining fiscal autonomy.

- Removal of Revenue Deficit Grants: The explicit removal of these grants marks a shift from gap-filling to reform-linked fiscal discipline, potentially increasing pressure on fiscally weaker states to undertake expenditure and subsidy reforms.

- Subsidy Accounting Standardisation: The Commission flagged the absence of uniform definitions and accounting standards for subsidies, noting that many states misclassify them as assistance or grants, thereby obscuring true fiscal liabilities.

Way Forward

- Reforming the Divisible Pool: There is a growing need to cap cesses and surcharges or include them in the divisible pool to restore the spirit of cooperative federalism.

- Structural Subsidy Reforms: States should implement “Sunset Clauses” for subsidy schemes and adopt the Commission’s suggested exclusion criteria to ensure that welfare reaches only the intended beneficiaries.

- Sunset Clauses are provisions that set an automatic expiry date for a law, scheme, regulation, or fiscal incentive unless it is explicitly reviewed and renewed.

- They are used to prevent policy inertia, ensure accountability, and align interventions with changing economic and governance needs.

- Empowering the Third Tier: States must move beyond treating local bodies as implementers and instead devolve actual taxation powers to Panchayats and Municipalities to reduce their dependence on central grants.

- Power Sector Turnaround: The recommended privatization of DISCOMs should be treated as a priority.

- Creating Special Purpose Vehicles (SPVs) to warehouse old debt can help clear the path for private investment.

- Fiscal Consolidation: Both the Centre (target 3.5%) and States (target 3.0%) must strictly adhere to fiscal deficit paths to ensure that India’s combined debt-to-GDP ratio declines as projected.

- Empowering SFCs: Beyond central transfers, it is essential to strengthen State Finance Commissions (SFCs) through strict timelines and data support to ensure effective fiscal decentralization.

- Subsidy & PSE Reform: States must adopt uniform accounting for transfers and implement a disinvestment policy for inactive Public Sector Enterprises (PSEs) to free up fiscal space for capital creation.

Conclusion

The 16th Finance Commission balances economic efficiency with equity by rewarding growth-contributing states while supporting vulnerable ones. By mandating fiscal transparency and structural reforms, it provides a strategic roadmap for India to achieve long-term debt sustainability and cooperative federalism.

16th Finance Commission

![]() 4 Feb 2026

4 Feb 2026

Entry-Level Criteria: Local bodies must fulfill conditions such as audited accounts, constitutional constitution, and the timely setup of State Finance Commissions to receive funds.

Entry-Level Criteria: Local bodies must fulfill conditions such as audited accounts, constitutional constitution, and the timely setup of State Finance Commissions to receive funds.