Context: Recently, a G20 independent expert group released its report on strengthening Multilateral Development Banks (MDBs).

| Probable Question:

Q. What are the key challenges that have prompted the need for reform in Multilateral Development Banks (MDBs), and what specific measures are being considered to address these challenges and improve their operations? |

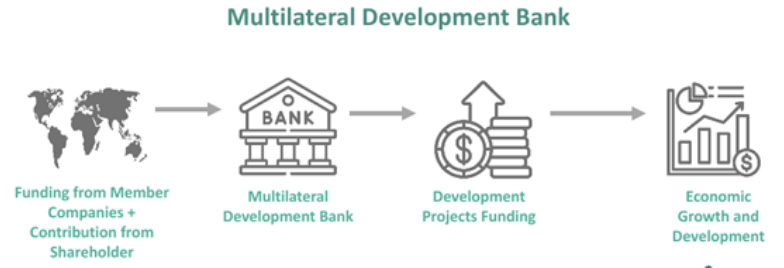

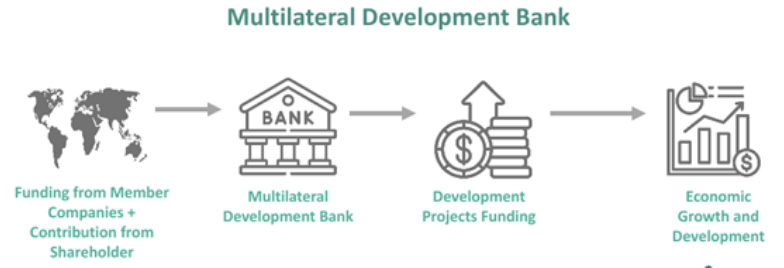

About Multilateral Development Bank (MDB):

- It is an international financial institution chartered by two or more countries for the purpose of encouraging economic development in poorer nations.

- They originated in the aftermath of World War II to rebuild war-ravaged nations and stabilize the global financial system.

Examples of MDBs

- World Bank

- European Investment Bank

- Asian Development Bank

- Asian Infrastructure Investment Bank

- Islamic Development Bank

- Central American Bank for Economic Integration

- New Development Bank

|

- Significance of MDBs

- Support Developing Countries: The MDBs provide financial and technical support to developing countries to help them strengthen economic management and reduce poverty.

- Instrumental Role: During the global financial crisis 2008, the MDBs provided $222 billion in financing, which was critical to global stabilization efforts.

- Building Institutional Capacity: MDBs support member nations in enhancing governance, policy frameworks, and institutional capacity.

- Beyond Political Borders: MDBs are concentrating more and more on solving problems that cut across national borders.

- Support Climate Action: They back programmes aimed at reducing global warming and adapting to it, using renewable energy, safeguarding the environment, preserving biodiversity, and building sustainable infrastructure.

- For Example-The World Bank has approved a five-year loan (for the second phase) to the National Mission for Clean Ganga (NMCG) or Namami Gange Project

- Support Private Sector Participation: By lowering risks, enhancing governance, and promoting public-private partnerships, they contribute to the development of an environment that is favorable for private investment.

Image Source: Brettonwoods Organisation

Image Source: Brettonwoods Organisation

Need for Reforming MDBs:

- One Size Fit Approach: In order to pursue equitable and sustainable development, developing countries have a variety of different and changing needs, and MDBs’ current operational methods and business models are not best suited to address those needs.

- Balancing Traditional Priorities: As MDBs broaden their mandates, there is a concern that traditional priorities like poverty elimination and addressing inequality should not be compromised.

- Not Fit for 21st century: The current institutional and regulatory framework for MDBs is out-of-date and unable to handle the complexity and quick-changing nature of the digital environment.

- Example: New cross border challenges—climate change, pandemics, fragility, migration—require new finance capacity and new approaches.

- Limited Resources: Resources are limited, making it difficult for MDBs to meet the rising demand for development funding.

- The total flow of support from the World Bank and other MDBs to developing countries was $192 billion in 2022, however, it is a third less than the share of developing country GDP attained in 2009 .

- Lack of Private Sector Participation: MDBs encounter difficulties in securing private sector funding for development initiatives.

- Procedural Restrictions: MDBs frequently come under fire for being bogged down in bureaucratic processes, which can impede the implementation of projects and decision-making.

- Restricted Support: Currently, MDBs only mobilize 0.6 dollars in private capital for each dollar they lend on their own account.

Highlight of G20 Expert Group Report on Strengthening Multilateral Development Banks (MDBs)

- About Expert Group: Expert Panel, headed by economists Lawrence Summers and N.K. Singh was commissioned by the Group of 20 nations to propose reforms for MDBs with a focus on increasing funding for sustainable development goals and climate change.

- Expert Group suggested adopting a Triple Mandate:

- Eliminating extreme poverty, boosting shared prosperity, and contributing to global public goods.

- Tripling sustainable lending levels by 2030.

- Creating a third funding mechanism to permit flexible and innovative arrangements to support elements of the MDB agenda.

- Role of G20: G20 should link sustainable lending levels of the MDB system in 2030 to the financial support needed by developing countries to invest to achieve SDG goals.

- G20 should review the adequacy of such lending every three years.

- Infusing Capital: MDB should infuse spending of some $3 trillion per year needed by 2030, of which $1.8 trillion represents additional investments in climate action and $1.2 trillion in additional spending to attain other SDGs (like Health and Education).

- An international development finance system should be designed by providing $500 billion in additional annual official external financing by 2030.

- Global Challenge Funding mechanism of $50 billion: To tap into a coalition of willing donors and non-sovereign investors, to boost investment in Global Public Goods.

- Partnering with Private Player: MDBs should place the mobilization and catalyzation of private capital at the center of their sustainable development strategies,

- They can help governments reduce policy and regulatory risk and align financial product offerings to private capital market gaps.

- There are considerable innovative ways of attracting private capital into sustainable infrastructure, and MDBs must complement, rather than compete with, these efforts.

- All Stakeholder Approach: MDBs, like the International Monetary Fund and World Bank, must work with governments and the private sector to reduce, share and manage risks and thus bring down the cost of capital.

- Ensuring Accountability: MDBs need to fix annual targets and judge performances by the outcomes secured in this altered framework of accountability.

- Implementation of G20 Capital Adequacy Framework: MDBs can optimize their balance sheets and create headroom to lend an additional $80 billion annually.

Other Recommendation to Reform MDBs

- Prioritizing investment: MDBs must prioritize investment in sectors that are critical for development and climate outcomes rather than spreading financing thin across the whole economy.

- Support climate-related objectives: MDBs would help deploy concessional funding to support investment projects on needs-based criteria to incentivize larger climate investments.

- Country Specific Strategies: It must play a critical role in helping countries integrate the need for collective action on regional and global challenges into their strategies.

- MDBs can help countries identify where their existing gaps and investment opportunities.

- Funding should be disbursed to governments based on performance under the agreed country strategy.

- Reforming International Financial Architecture: Make it more inclusive, efficient and equitable and to grant developing countries greater representation and a stronger voice in the governance bodies of these institutions.

- Strengthening of global financial safety nets through precautionary and insurance lines that enable developing economies to cope with crises and exogenous shocks.

- Close coordination between the Bretton Woods Institutions to better respond to the debt restructuring needs of developing countries.

Conclusion

- Making MDBs more relevant for addressing 21st-century challenges would contribute towards enhancing human welfare.

- Deeper integration with multiple stakeholders is crucial.

News Source: Business Standard

![]() 18 Jul 2023

18 Jul 2023

Image Source: Brettonwoods Organisation

Image Source: Brettonwoods Organisation